Medical & Scientific Equipment Warranty Report:

The amount of warranty expense reported by these manufacturers has never been lower, but their expense rates have been slowly rising for the past few years after more than a decade of cost reductions. Even though it's last year's data, the importance of low failure rates has never been higher.

It's no understatement to say that the importance of medical and scientific equipment has soared in the past few months as the virus swept the world. Everything from the ventilators to the viral testing machines carry the brand names of U.S.-based manufacturers. And although the personal protective equipment is by its nature disposable, some of those brand names also feature on the company list that follows.

As we do every year around this time, we're taking a look at the warranty expenses of the top warranty providers in the medical and scientific equipment industry. We began with a list of 197 U.S.-based companies that manufacture medical equipment and/or scientific instruments that are offered for sale with product warranties included. Of those 197 companies, the manufacture of medical and scientific equipment was the main line of business of 171, and was a secondary line of business for an additional 26 companies in fields such as semiconductors, telecom equipment, and building materials.

From each company's annual reports and quarterly financial statements, we gathered three essential warranty metrics: the amount of claims paid, the amount of accruals made, and the amount of warranty reserves held. Though this report presents only the calendar-year figures for the past 17 years, we gathered this data quarterly in order to be able to correctly apportion the expenses of companies whose fiscal years differ from the calendar year.

We also gathered data on the amount of capital equipment sold, which in this industry usually involves product revenue minus consumables. Some companies were very good about segmenting their revenue this way; others not so much. Whenever possible, all service, licensing, royalties, and investment revenue was similarly subtracted. The goal was to get as close as possible to just the sale of goods that carry warranties and generate claims costs.

Using the claims and accrual totals alongside these product sales totals, we were able to calculate two additional metrics: warranty claims as a percentage of sales (the claims rate), and warranty accruals as a percentage of sales (the accrual rate). These were measured quarterly, so there are 68 measurements per metric instead of just 17.

Warranty Claims Totals

In years past, we noticed something unusual in the data. There were 24 companies manufacturing medical and products that involved either lasers or X-rays, whose warranty expense rates seemed much higher than the others. In fact, although these 24 companies accounted for only 6% of revenue, they accounted for upwards of 15% of warranty expenses. As we will show, their ratio has only climbed since then.

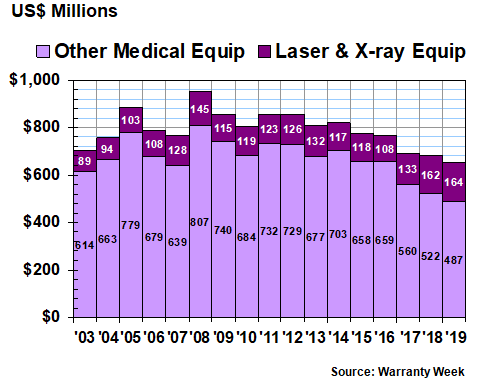

In Figure 1, we are tracking the annual claims cost of the 197 companies, broken into two groups: the 24 whose products make use of lasers or X-rays, and the 173 that do not. Out of their combined total of $651 million in 2019, the laser & X-ray group accounted for 25% of the total, while the others accounted for 75%. It was their respective highest/lowest shares, edging out the 26%/74% ratio seen in 2018, and far exceeding the 16%/84% historical average.

Figure 1

Medical & Scientific Equipment Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2018)

Furthermore, while claims rose slightly last year within the laser/X-ray group, they fell by $35 million or nearly 7% among the companies in the other group. And this is the third year in a row that this has happened, where one group's claims grew while the other group's fell. However, as is obvious from the chart above, claims have generally been declining since 2011, though the peak came in 2008.

Bio-Rad Laboratories Inc., which makes systems used to analyze cells, proteins, antibodies, and infectious diseases, saw one of the largest drops in claims in the industry last year. Its claims total fell from $34 million in 2018 to $11 million in 2019 -- more than a two-thirds decline.

At the other extreme was Insulet Corp., which makes insulin pumps for diabetes patients, saw its claims costs rise from $6.7 million in 2018 to $11 million in 2019 -- more than a two-thirds increase. Not far behind was DexCom Inc., which makes blood glucose monitoring systems. Its annual claims costs rose from $19 million to $32 million.

Others with moderate declines in claims costs included Align Technology Inc., ResMed Inc., and Invacare Corp. Others with moderate increases in claims costs included Varian Medical Systems Inc., Hill-Rom Holdings Inc., and Dentsply Sirona Inc.

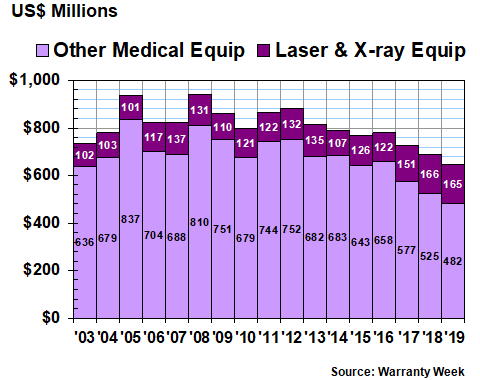

Warranty Accrual Totals

In 2019, warranty accrual totals fell by $44 million in the medical and scientific equipment industry. But almost all the decline was among the larger "other" group -- the decline was only $1.2 million within the laser and X-ray group. And while it was the third straight annual decline among the "other" group, it was the first accrual decline for the laser and X-ray group since 2015-2016. However, as is clear from the data in Figure 2 below, accruals have been declining for most of the past decade, with the exception of a few bumps along the way.

Figure 2

Medical & Scientific Equipment Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2019)

As with claims, the laser and X-ray group accounted for about 25% of the accrual total, despite being responsible for only 6% of the revenue. And again, as with claims, the ratio in 2019 set a new record of 25%/75%, far below the historical 16%/84% average. In fact, back in 2005 the ratio was 11%/89%.

Bio-Rad once again takes the top prize for expense reduction, cutting its accruals total from $32 million in 2018 to $10 million in 2019. On a proportional basis, nobody else came close, though Coherent Inc., Danaher Corp., Invacare, and Illumina Inc. did manage to reduce their accrual totals by about a fifth apiece.

On the upside, DexCom took the top spot, boosting its accruals from $17 million in 2018 to $33 million in 2019. On a proportional basis, Insulet, Dentsply Sirona, and Hill-Rom came close to that, raising their accrual totals by half or more.

Warranty Expense Rates

In and of themselves, the changes in claims and accrual totals don't say much, because for some companies they accompany soaring sales, mergers, or some sort of corporate spin-off or divestment. In other words, if sales double, then it's no problem for accruals to double also. The ratio between them would remain unchanged, as it is supposed to absent any change in product quality, failure rate, or the typical cost of repairs.

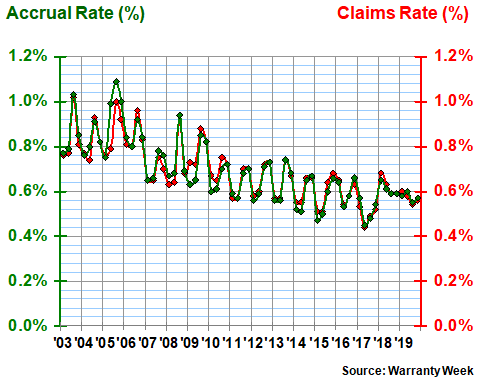

In Figures 3 and 4, what we've done is to take the data from Figures 1 and 2 and recalculate it as a percentage of sales. As was mentioned, wherever possible we subtract out all the non-warranted revenue sources such as service and consumables.

On average -- and this is a very crude average -- over the past 68 quarters the medical and scientific equipment manufacturers have spent about 0.8% of their revenue on warranty claims, and have accrued about 0.8% of their revenue on accruals. The standard deviations for these averages are 0.13% and 0.15%, respectively, which implies moderate amounts of volatility.

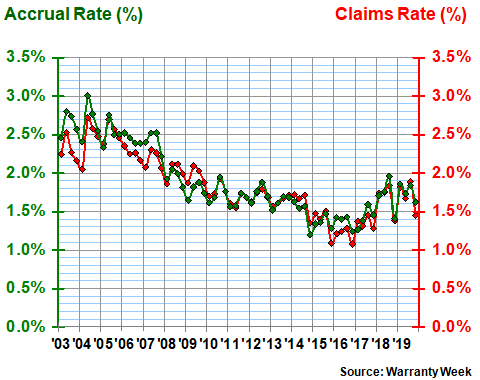

The differences between the laser/X-ray group and the others, however, is wide and obvious. In Figure 3, we're looking at the "other" group, where the average expense rates have both been close to 0.7%. In Figure 4, we're looking at the laser/X-ray group, whose claims rate has averaged 1.8% and whose accrual rate has averaged 1.9%.

Figure 3

Medical & Scientific Equipment Manufacturers

(No Laser or X-ray Equipment Manufacturers)

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2019)

On the one hand, please note in Figure 3 the obvious seasonality to the data, which is said to be linked to the school calendar and the budget cycles of university laboratories in particular. On the other hand, notice that the seasonality has not shown up during the past two years, during which the expense rates have generally fallen (except for the fourth quarter of 2019, when they both rose).

In Figure 4, please note that there is only a minor and only an occasional seasonality to the laser/X-ray data. However, what it has in common with the data in Figure 3 is a generally downward slope to the pair of lines, meaning that expense rates have generally been falling since 2003, with recent rises. But what's different is that here the bottom was in 2015-2016, while in the "other" group the bottom was in 2017.

Figure 4

Medical & Scientific Equipment Manufacturers

(Laser & X-ray Equipment Makers Only)

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2019)

Back in the April 9 newsletter, in Figure 1, we noted that both Coherent and Danaher were among the top claims-rate-reducers in 2019. But that was among only the top warranty providers, each of whom spent $25 million or more on claims last year.

Now that we have widened our view to include 197 medical and scientific equipment companies, we have more to choose from. And indeed, three companies reduced their claims rates by more than either Danaher or Coherent. Bio-Rad cut its claims rate from 1.5% to 0.5%. And Align Technology cut its claims rate from 0.6% to 0.4%, as did ResMed.

At the other extreme, Varian Medical Systems Inc., one of the big X-ray imaging companies, saw its claims rate rise from 2.9% to 4.2%. Hill-Rom, Insulet, and Dentsply Sirona saw their claims rates rise by a quarter or more.

It was much the same story with the annual changes in accrual rates. Bio-Rad topped the accrual rate reductions, and Varian topped the accrual rate increases. Align Technology, Coherent, and ResMed were among the top decliners, and Insulet, Dentsply Sirona, and DexCom were among the top increases.

The main differences were that Hill-Rom cut its accrual rate despite its rising claims rate (opposite directions), and Danaher's accrual rate fell very little despite the big cut in its claims rate. Also, a company called Hologic Inc., which is one of the developers of a coronavirus testing system, saw a big rise in its accrual rate after a moderate rise in its claims rate.

Warranty Reserve Balances

Our final metric is the year-ending balance in the warranty reserve funds of the 197 companies that we're tracking in this industry. For companies whose fiscal years end on a date other than December 31, we used the quarterly balance closest to, but not after, December 31.

For all these companies, warranty reserves have generally been declining since 2009, with 2006 ($889 million) remaining the peak. And 2019 is the new low water mark, with reserves declining a net $1.3 million to just over $627 million. However, once again the two segments of this industry went in different directions. Reserves were up by $544,000 for the laser/X-ray group but were down by $1.8 million for the others.

Figure 5

Medical & Scientific Equipment Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2019)

With this warranty metric, Varian was virtually unchanged. In contrast, Align Technology, Insulet, and Dentsply Sirona each boosted their reserve balance by about a third, while Invacare and Illumina let their balances fall by about a third.

Among the very largest warranty providers in the medical industry, reserves changed relatively little. Varian, which we already mentioned, is the third-largest in terms of reserves. Danaher, which has about one-and-a-half times as much warranty reserves as Varian, saw a 5% decline in its balance in 2019. And Thermo Fisher Scientific Inc., which has about twice as much in reserves as Varian, saw only a one-percent increase.