Top 100 Warranty Providers of 2021:

With all the different industries that issue warranties and the products they cover, it wouldn't be proper to compare one company directly to another. However, we can compare companies to themselves over time, and then rank the biggest changes up or down, which is exactly what we're doing in this week's newsletter, in a series of six top ten charts.

In last week's newsletter, we presented the quarterly and annual totals for warranty expenses, segmented into 18 different industry categories and grouped into three wide sectors: vehicles, electronics, and building trades. This week, we are going to focus on the individual companies: specifically, the 100 largest warranty providers of 2021, ranked by the dollar amount they reported for claims paid during the calendar year.

Every year since 2003 we have gathered four essential metrics from the annual reports and quarterly financial statements of all warranty-issuing U.S.-based manufacturers: the amount of claims paid, the amount of accruals made, the amount of warranty reserves held, and the corresponding revenue totals for products sold. With the claims, accrual, and revenue figures, we have calculated two additional metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

Overall, U.S.-based companies spent $24.1 billion on claims last year, an increase of about 1.4%. Accruals were up 6.8% to $25.8 billion. And warranty reserves set a new record of $50.1 billion by year's end. Sales were up 18%, the claims rate stood at 1.25%, and the average accrual rate was 1.4% of sales.

Ford Motor Company was the largest U.S.-based warranty provider of 2021, based on its payout of $3.95 billion in claims last year (General Motors Co. came in at $3.25 billion; Apple Inc. at $2.62 billion; and HP Inc. at $1.07 billion). Given that the U.S. total was $24.1 billion, these four companies alone represented 45% of that pie.

But rather than dwell on how much they paid, or compare one company against another, what we're going to do this week is compare each of those 100 largest against themselves over time. And then we will look at the size of the changes over the past year, and rank them that way. So what we're spotlighting is the companies with the most volatile warranty metrics, compared to their peers.

For instance, that $3.95 billion represented 2.9% of Ford's product revenue in 2021. In 2020, it spent almost the same amount of money on claims -- $3.92 billion -- but that year its claims total represented 3.6% of its product revenue, because sales were a bit slow. But what we're measuring is the improvement in the company's claims rate from 3.6% to 2.9%, which turns out to be the 28th best out of the 80 claims rate improvements in the top 100 last year. In other words, 27 companies cut their claims rate even faster than Ford.

Changes in Warranty Claims Rates

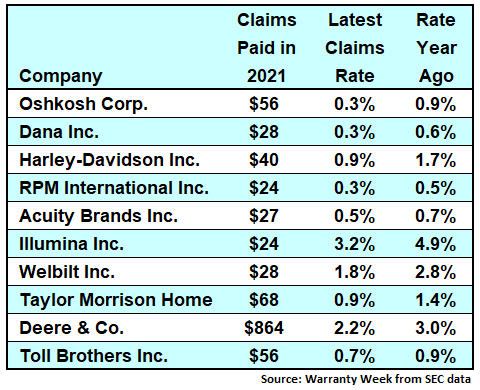

In the charts that follow, all figures are in millions of U.S. dollars and in percent. In Figure 1 we're looking at the top 10 improvements in claims rates last year. And it's some pretty still competition to make this list. For instance, the homebuilder Toll Brothers reduced its claims rate from 0.9% to 0.7% -- by about one-quarter -- but it was only the tenth-best improvement of the year.

At the top of the chart is the truck maker Oshkosh Corp., which cut its claims rate by two-thirds, from 0.9% to only 0.3%. And it also managed to cut its accrual rate from 0.9% to 0.4% (see Figure 3), so it is one of only two companies to achieve that admirable double feat (the other is lighting manufacturer Acuity Brands Inc.).

Figure 1

Top 100 U.S.-based Warranty Providers:

Top Ten Claims Rate Reductions,

Calendar Year 2021 vs. 2020

(claims as a % of product sales)

No other manufacturers besides Oshkosh cut their claims rate by half or better. Acuity cut its claims rate from 0.7% to 0.5% -- or by slightly over a third. But in addition to Acuity Brands, six other companies reduced their claims rates by a third or more: Dana Inc., Harley-Davidson Inc., Illumina Inc., RPM International Inc., Taylor Morrison Home Corp., and Welbilt Inc. And then Deere & Co. and the aforementioned Toll Brothers reduced their claims rates by a little over a quarter since the end of 2020. Congratulations are in order for these 10 best cost-cutters.

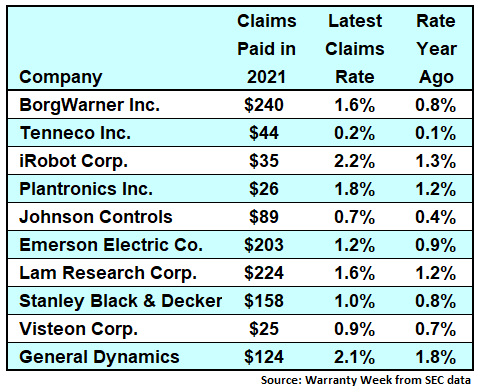

And then there is the opposite direction: the unfortunate companies whose claims rates rose the most last year. Out of the top 100 companies, there were only 20 that saw their claims rates rise at all, primarily because for so many of the other 80, sales rose much faster than claims (overall, claims rose only 1.4% while product sales surged by 18% last year).

We hate to spotlight companies so clearly in pain, but at the top of the list in Figure 2 is auto parts supplier BorgWarner Inc., whose claims cost rose from $86 million in 2020 to $240 million in 2021, and whose claims rate soared from 0.8% to 1.6%.

Figure 2

Top 100 U.S.-based Warranty Providers:

Top Ten Claims Rate Increases,

Calendar Year 2021 vs. 2020

(claims as a % of product sales)

iRobot Corp. and Tenneco Inc. saw their claims rates rise by more than half, and Emerson Electric Co., Johnson Controls International plc, Lam Research Corp., and Plantronics Inc. each saw their claims rates rise by more than a third. Our condolences are noted.

Changes in Warranty Accrual Rates

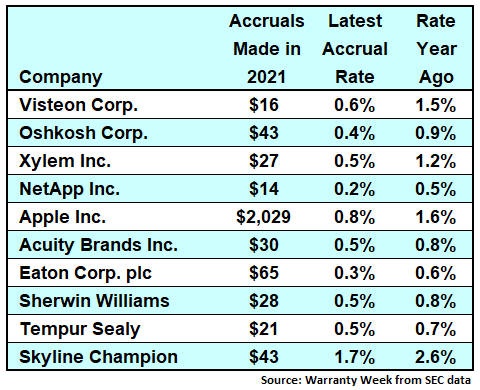

Of the six charts in this week's newsletter, however, the one you really want to see your company name on is the table in Figure 3. This is the list of the ten largest accrual rate reductions out of the top 100 warranty providers.

And once again the competition was stiff. A total of 70 companies reduced their accrual rates last year, while only 29 saw their accrual rates rise (one remained the same).

Visteon Corp. was one of five companies to cut their accrual rate by half or better. But the company also made it onto the Figure 2 list, meaning that not only are two of its warranty metrics headed in opposite directions, but also they are doing so by list-topping proportions. And Visteon was the only company to be pulled like this in massively opposite directions.

The others to cut their accrual rate by half or better were Oshkosh Corp., Xylem Inc., NetApp Inc., and Apple. And though it's not readily obvious, we should note that Apple is one of only a handful of very large warranty providers to make it onto any of these charts -- normally, their warranty metrics change much more slowly.

Figure 3

Top 100 U.S.-based Warranty Providers:

Top Ten Accrual Rate Reductions,

Calendar Year 2021 vs. 2020

(accruals as a % of product sales)

As was previously mentioned, Oshkosh and Acuity Brands were the only two to make both the "good" lists of Figures 1 and 3. iRobot Corp. and Tenneco were the only two to make both the "bad" lists of Figures 2 and 4. And, we should mention, Visteon and Tenneco were the only two to make the maximum possible of three lists, although only iRobot made all three "bad" lists (Visteon made two "good" and one "bad" list).

But there is another school of thought that making any of these lists is not a good thing, because it spotlights companies whose warranty metrics are changing the fastest among their peers, in an industry that prizes stability. And when warranty metrics like these either double or get cut in half, that is not stability. Then again, the investors of all the companies listed in Figures 1 and 3 are no doubt happy to hear that they are among the best warranty cost-cutters of 2021.

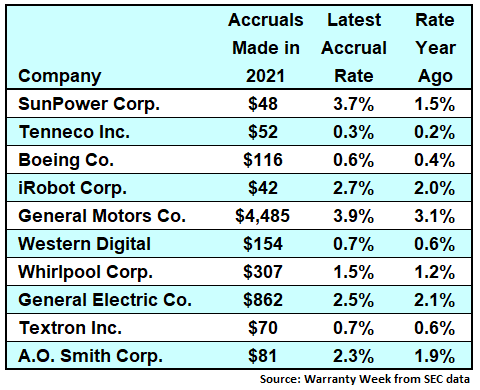

Which brings us to the ten companies listed in Figure 4. These are the companies in the most pain -- the companies whose warranty accruals increased so much faster than sales -- the companies whose accrual rates rose the fastest in 2021, for whatever reason. And as external observers, we frequently have no idea why these rates are rising. We just know that they are.

As was mentioned, only 29 of the top 100 warranty providers saw their accrual rates rise at all. Many were saved by rapidly rebounding sales, which rose much faster than projected warranty expenses ever could. But then there are these ten, who ended up on the wrong side of the math.

Take, for instance, A.O. Smith Corp. Sales rose 22%, but warranty accruals rose 45%, and the result was an accrual rate that rose from 1.9% to 2.3%. Or Whirlpool Corp., whose product sales rose 12% but warranty accruals rose 36%, so its accrual rate rose from 1.2% to 1.5%.

And then there were some accrual rates that seemed to rose slowly but actually rose significantly. Tenneco's accrual rate rose from 0.2% to 0.3% in the chart, but that was up by more than half. Actually, the dollar increase -- from $28 million in 2020 to $52 million in 2021 -- was even faster, but a 17% increase in sales took away some of the pain.

Figure 4

Top 100 U.S.-based Warranty Providers:

Top Ten Accrual Rate Increases,

Calendar Year 2021 vs. 2020

(accruals as a % of product sales)

At the top of the chart is the solar energy company SunPower Corp., for an accrual rate that more than doubled, from 1.5% to 3.7%. But the company has actually transformed itself recently by spinning off its manufacturing division into a separate business called Maxeon Solar Technologies Ltd. So in their case, comparing the current company to the company one or two years ago is not a valid analogy. It's not the same company without the manufacturing, and the manufacturing revenue.

GM makes this chart for going from 3.1% of product revenue to 3.9% of revenue with its accrual rate. But it looks worse in dollars: adding $1.08 billion to a $3,40 billion bill. The problem is, however, that product sales rose by only 4.5%, so the additional accruals were made by a company expecting the cost per car to rise.

It was a bit different for Boeing: commercial aviation sales rebounded by +21%, but accruals soared from $65 million to $116 million, so the accrual rate rose by more than half.

The way it's supposed to work, is that accruals rise proportionally to sales, because product quality remains constant, and the accrual rate hardly changes at all. For instance, not on the chart -- in fact not on any chart -- is furniture maker La-Z-Boy Inc. Sales rose 25%, and accruals rose 32%, so the accrual rate remained at 1.2%. Or Deere & Co., whose product sales rose 27% and whose accruals rose 26%, and whose accrual rate remained stuck at 2.7%. The company did, however, see a big drop in claims (see Figure 1).

Changes in Warranty Reserve Balances

Our third warranty metric is the one we don't really know what to do with. Is a rise or fall in the warranty reserve fund balance a good thing, a bad thing, or neither? A rise or fall in claims means more or less warranty work being performed. A rise or fall in the accrual rate means a company is anticipating more or less expense per unit in the future. But a rise or fall in the balance can be good or bad, depending on what causes it.

For instance, there are companies on this list that keep a warranty reserve balance comparable to what they would expect to pay out in claims over eight to ten years. Yet their warranties won't last that long. So if they were to cut their warranty reserve balance, they would simply be rightsizing the fund to match the size of the liabilities they face.

Conversely, there are 31 of these top 100 warranty providers whose year-ending reserve balance wasn't even equal to what they paid out in claims last year. In other words, their reserves wouldn't even last 12 months at current rates of spending. They might do well to increase their reserve balance, even if their accruals currently match their claims, just to thicken the cushion under which their reserve fund operates.

Still, who are we to say whether a given company is over-funding or under-funding their warranty liabilities? All we can do is measure the balance at the end of 2021 and compare it to the balance at the end of 2020. And on that basis, 66 balances went up, 33 went down, and one remained the same.

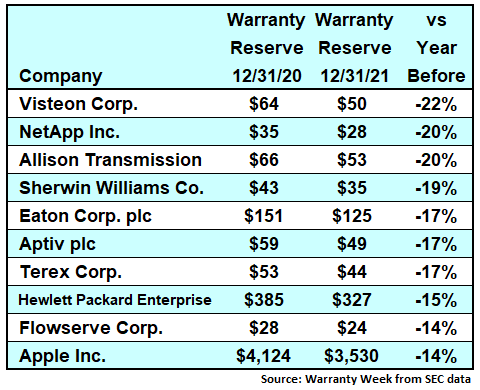

In Figure 5, we're listing the ten proportionally largest balance reductions. Visteon tops this list, for a balance that fell from $64 million to $50 million -- a 22% decrease. And that's the company's third appearance on these charts. Four others -- Apple, Eaton Corp., NetApp, and Sherwin Williams Co. -- also made an appearance on the list in Figure 3, so this is their second appearance of the week.

And then there are five companies -- Allison Transmission Holdings Inc., Aptiv plc, Flowserve Corp., Hewlett Packard Enterprise Co., and Terex Corp. -- that are making their first and only appearance in the chart below. What that means to the strength of their warranty program we cannot say.

Figure 5

Top 100 U.S.-based Warranty Providers:

Top Ten Reductions in Reserves Held,

Calendar Year 2021 vs. 2020

(reserves in US$ millions)

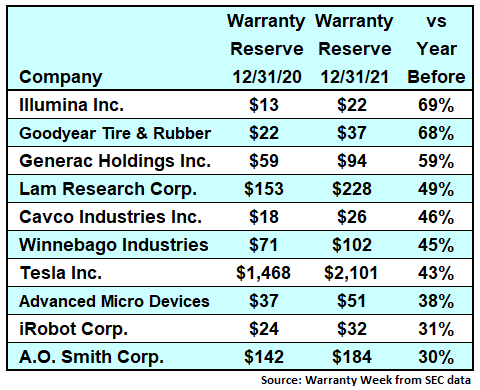

And then in our final chart, we list the ten companies whose warranty reserve fund balances rose the fastest in 2021. And here, iRobot makes its third appearance of the week, while A.O. Smith, Illumina, and Lam Research each make their second showing.

What's perhaps more remarkable are all the companies making their only appearance in Figure 6. For instance, Tesla Inc. increased its warranty reserve balance by $633 million, to $1.47 billion. But its claims and accrual rates barely changed, because those expenses remained proportional to sales. It was the same for Goodyear Tire & Rubber Co. -- claims and accruals kept pace with sales, but reserves rose nevertheless.

Figure 6

Top 100 U.S.-based Warranty Providers:

Top Ten Increases in Reserves Held,

Calendar Year 2021 vs. 2020

(reserves in US$ millions)

For those keeping score at home, only 46 of the top 100 warranty providers made it onto any of these six lists. And 34 of those made just one appearance. That means 54 of the top 100 made exactly zero appearances, because their warranty metrics changed the least, for better or for worse. Among them are not only heavyweights such as HP and Ford, but also worldwide manufacturing powerhouses such as Caterpillar Inc.; Cummins Inc.; and Raytheon Technologies Corp. We celebrate your stability.

By the way, among the top 100 warranty providers are ten companies that publish their warranty expenses only once a year. Goodyear is one of them, and Eaton and Sherwin Williams are two of the others. But let's not forget to mention the other seven: Advanced Micro Devices Inc.; DexCom Inc.; Flowserve Corp.; Fortune Brands Home & Security Inc.; General Electric Co.; Honeywell International Inc.; and Illinois Tool Works Inc.

Also, there are four companies that we suspect belong in the top 100, but they have unilaterally discontinued publishing their warranty expenses, which they did until recently. They are: Advance Auto Parts Inc.; Danaher Corp.; Dentsply Sirona Inc.; and Mohawk Industries Inc. If we ever get an effective enforcer of generally accepted accounting principles in place, perhaps they might check in on those companies to see why they thought the rules were not for them?

Warranty Management Conference Scheduled

These past few years, it sure has been easy to stay home and avoid business travel, what with wars, pandemics, supply chain upheavals, political gridlock, and cancelled flights to be considered. But as the weather gets warmer and those perils begin to recede at least a bit, could it be time to think about attending a warranty conference again?

Next month, the Global Warranty & Service Contract Innovations conference makes its debut in San Diego. It's being put together by Strategic Solutions Network, the same company that assembles the long-running Extended Warranty & Service Contract Innovations conference that's scheduled for October in Nashville.

And while that event later this year is squarely focused on service contracts and extended warranties, this new spring show features a mixture of manufacturers such as Deere, Thermo King, GE Appliances, and Navistar, as well as administrators such as American Home Shield, Clyde, Centricity, and New Leaf. And there's also a focus on commercial service contracts as well as on emerging technologies and new market entrants.

The venue is the Hotel Solamar in San Diego's Gaslamp District, and the dates are April 12 and 13. And as much fun as it can be to zoom all day in sweatpants, those of you yearning to shake a hand, clink a glass, or swap a business card might think about making the trip. See you there, in person!