Truck Extended Warranty Sales:

New accounting rules require companies to disclose their "service-type warranty" sales. Last year, five of the top U.S.-based truck manufacturers sold more than $1.2 billion worth of extended warranties, a stunning 18% gain over 2017.

Most times, when the topic of vehicle service contracts arises, it's synonymous with the extended warranties sold mostly by auto dealers to consumers. But there's a whole other branch of the industry on the commercial side, where extended warranties are sold by truck manufacturers to their commercial customers.

Fortunately for us, recent changes in U.S. accounting rules have made it mandatory for companies to disclose their sales of what are called "service-type warranties." These are typically optional and separate purchases, sold in addition to the product warranties that are given to the buyer of the product. And for U.S. truck manufacturers, these are typically worth a few hundred million dollars a year.

Commercial Service Contract Definitions

In order to track these commercial service contract sales, we will have to create some simplified language of our own. In the financial statements, the terms tend to resemble insurance industry language, where "premiums" are "recognized" and "amortized." We're going to streamline that a bit, so everyone knows what we're talking about.

The accounting rules for multi-year service-type warranties specify that all the revenue can't be immediately added to the income statement. Instead, it must be put into a special fund, from which it will be gradually added to the income statement. Most times, companies prefer to do this at a set rate. So if it's a four-year contract, they will move one-fourth of it to the income statement each year.

All the while, new contracts are being sold, and that revenue will also be deferred, and added to the income statement over time. So it's somewhat analogous to product warranty, where the additions are called accruals, the subtractions are called claims, and the balance is called the reserve fund. But it's not the same at all. We really don't know anything about the profitability of these commercial service contracts. We have no idea how much they cost in terms of claims. All we know is how much revenue they bring in.

Still, we are going to use a product warranty-like color scheme to keep things simple. In the charts that follow, the revenue raised from the initial sale of these extended warranties will be called "new contract sales," and will be marked in green, as we do with product warranty accruals. Traditionally, these service contracts last for multiple years, and so the money received at the outset is initially set aside as deferred revenue, to be recognized gradually over the life of the contract.

The fund into which this new money is added will be called "deferred revenue," and will be marked in purple. Specifically, with this metric we're measuring the ending balance in this fund for each of the years in question. It's simply a measure of how much money is still hanging around from previous years, waiting to be recognized. And the ending balance for one year will be the beginning balance for the next year.

The amount of revenue recognized each year will be called "earned premium," and will be marked in red. It could also be called amortized or recognized revenue. Either way, this is part of the amount that will come out of the deferred revenue fund and go onto the income statement as service-type warranty revenue. But it's not the amount spent on warranty work. The earned premium is not an expense. Most companies still keep that metric a secret.

In the next five charts, we are going to take a look at the service-type warranty sales of five of the largest commercial truck manufacturers in the U.S. In all cases, we are taking the amount of contract sales, and comparing them to product sales, resulting in a calculation of a percentage of revenue for each.

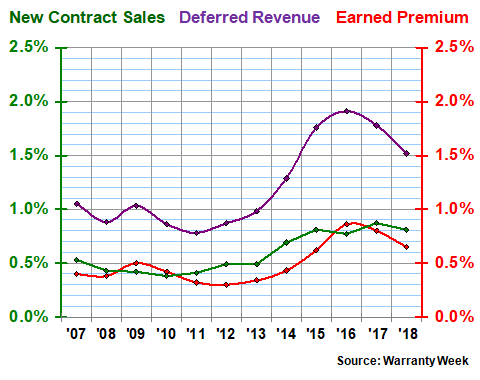

John Deere

In Figure 1, we are looking at the extended warranty metrics of Deere & Company, the agricultural and construction equipment giant founded 181 years ago in Grand Detour, Illinois. Of the three metrics, new contract sales is probably the most important to management, in that it expresses the additional revenue that accompanies the sale of new equipment. The earned premium is more of a trailing indicator, in that it refers to past-year sales. And the deferred revenue metric is simply the mathematical product of the other two.

Figure 1

John Deere Commercial Service Contract Sales

As a Percentage of Product Revenue

(in percent, 2007-2018)

Note that John Deere's new contract sales have been relatively steady at around 0.8% for the past four years. Earned premiums have ranged from 0.7% to 0.9% of product revenue over the same time period. Before that, their averages were closer to 0.5% for the eight years between 2007 and 2014. Therefore, one could conclude that extended warranties have become more important to John Deere customers in recent years, in that they're spending somewhat more on them compared to what they spend on equipment.

Deere's new contract sales topped $270 million in 2018, while it earned $217 million derived from previous-year sales. Its deferred revenue balance at the end of its fiscal year was $506 million. And so, anyone good at math could figure out that its product revenue was $33.35 billion.

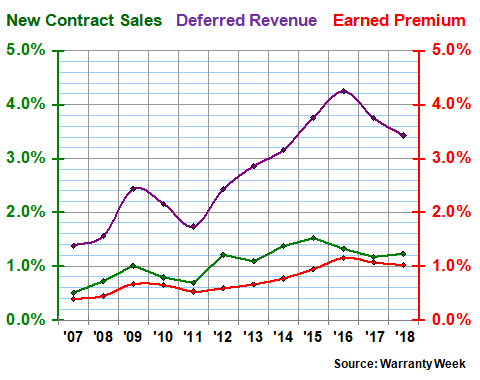

Cummins

As we detailed in a product warranty report back on April 11 of this year, Cummins Inc. has been having some emissions compliance trouble in California for its diesel engines. This has elevated its product warranty expenses considerably. But as can be seen in Figure 2, its extended warranty metrics haven't changed much.

Cummins' new contract sales and earned premium have been relatively steady at around 1.16% of revenue for the past four years. As with Deere, its deferred revenue balance has declined for two years in a row, but again, this is the least-concerning metric of the three.

Figure 2

Cummins Commercial Service Contract Sales

As a Percentage of Product Revenue

(in percent, 2007-2018)

In 2018, new contract sales rose from $240 million to $293 million, while earned premium rose from $219 million to $244 million. But because Cummins' revenue rose more or less proportionally, the red and green lines barely moved.

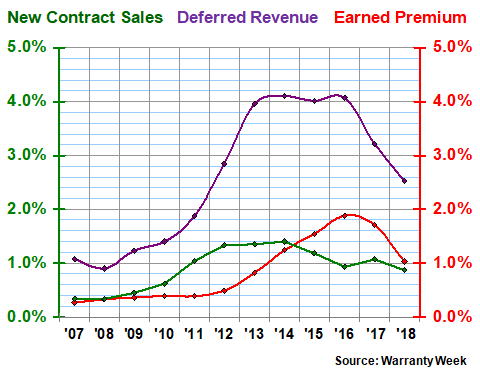

Navistar

Navistar has had its own round of product warranty troubles related to diesel engine emissions. However, those problems are largely behind it now. In its latest fiscal year, product revenue rose from $8.4 billion to $10.1 billion. However, as the lines in Figure 3 suggest, extended warranty sales did not grow last year.

Figure 3

Navistar Commercial Service Contract Sales

As a Percentage of Product Revenue

(in percent, 2007-2018)

We should note that Navistar does not reveal its new contract sales amounts. But since it does disclose its deferred revenue balances and the amount of earned premium, it's a straightforward process to calculate those amounts. Still, we should note that the green line is just a series of Warranty Week estimates.

Nevertheless, we estimate that Navistar's new contract sales fell from $90 million in fiscal 2017 to $88 million in fiscal 2018. Earned premium fell from $144 million to $104 million. And the resulting balance, the amount of deferred revenue, fell from $271 million to $255 million.

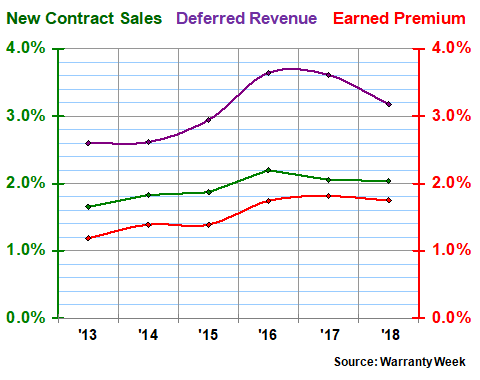

Paccar

Paccar Inc., whose current name derives from the Pacific Car and Foundry Company that was founded in Seattle in 1905, owns the Kenworth and Peterbilt truck brands in the U.S., and both the Leyland Trucks and DAF brands in Europe. However, it did not begin reporting its extended warranty metrics until 2013, so we have only six years of service-type warranty data for them.

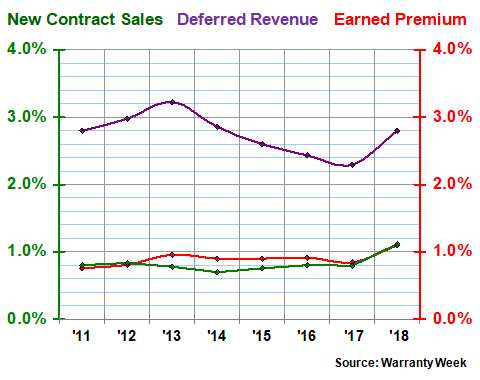

In Figure 4, though, we can see that the company's new contract sales have averaged a little over two percent for the last three years, while earned premium has been just below that level since 2016. Both metrics were a bit lower than that from 2013 to 2015.

Figure 4

Paccar Commercial Service Contract Sales

As a Percentage of Product Revenue

(in percent, 2007-2018)

As with Deere and Cummins, the relative flatness of the red and green lines means that extended warranty sales are more or less keeping up with product sales. Last year, new contract sales rose from $372 million to $448 million. Earned premium rose from $328 million to $385 million. And product sales rose from $18.1 billion to $22.0 billion.

Ingersoll-Rand

Ingersoll-Rand plc is a little different from the others, in that its primary involvement with the trucking industry is its Thermo King subsidiary, which sells cargo refrigeration, freezer, and passenger air conditioning units for all sorts of transportation vehicles such as ships, trains, buses, and trucks. However, the bulk of IR's total revenue is derived from the sale of Trane branded HVAC systems for buildings. Both are part of the climate business unit.

For years, Ingersoll-Rand has been segmenting its revenue into climate and industrial, and also by United States and non-U.S sources. In 2018, however, it added new categories for equipment and services. And since it's the equipment that gets the warranties, that is the revenue metric we're following now. Previously, we had to estimate the deduction for services; now it's explicit in the financial statements.

As can be seen in Figure 5, new contract sales are up, from $101 million in 2017 to $116 million in 2018. Earned premium is up from $107 million to $115 million. But what looks like a huge jump in the deferred revenue balance actually has more to do with the new data for equipment sales being more accurate than our old estimates. The actual balance remained about the same.

Figure 5

Ingersoll-Rand Commercial Service Contract Sales

As a Percentage of Product Revenue

(in percent, 2007-2018)

Of all the companies we're looking at this week, IR has exhibited the most stability in terms of the ratio between extended warranty sales and product sales. Over the eight years of available data, its earned premium has averaged just over one percent of product revenue while its new contract sales have averaged just under that level. But in 2018, both metrics rose to 1.1%.

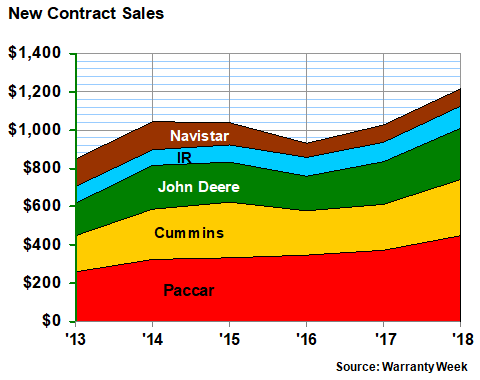

New Contract Sales

We don't have complete information for Paccar from 2007 to 2012, nor for IR from 2007 to 2010. So the data in Figure 6 tracks new extended warranty contract sales from just 2013 to 2018. For the group, sales rose 18% last year to just over $1.2 billion.

Figure 6

Commercial Service Contract Sales

New Contract Sales per Year

(in dollars, 2013-2018)

Of the five companies, Deere, Paccar and Cummins each saw around 21% growth, and IR saw 15% growth. Navistar was down by about 2%.

In terms of annual growth, this is second only to the 23% increase in new contract sales seen from 2013 to 2014. Contract sales actually fell in 2015 and again in 2016, but rose by 6% in 2017. And for all but Navistar, 2018 was a record year for extended warranty sales.

Not the Entire Industry

Keep in mind, though, that this is far from an industry-wide report on commercial extended warranties. First, we have no service contract data from two of the biggest truck manufacturers: Daimler Trucks North America (which owns the Western Star, Detroit Diesel, and Freightliner brands) and Volvo Trucks (which also owns Mack Trucks).

Second, we have no data from any of the truck dealerships and all the independent administrators that also sell commercial service contracts. And even if we did, it would likely also be mixed in with service contracts sold for cars, recreational vehicles, municipal bus fleets, and all sorts of vocational vehicles.