July 28, 2003 |

ISSN 1550-9214 |

Warranty Software:In the automotive market, sooner or later virtually every software package has to interact with warranty data. And why not? Warranty is a $9 billion activity for vehicle manufacturers, with a direct impact on the bottom line. It's also one of the best available measures of a product's quality and reliability, and it could be as useful to the engineers as it already is to the accountants.Should a company buy software to cut the cost of running its warranty program, or should it buy software that raises the quality and reliability of its product line by allowing designers to analyze warranty data? Should a company cut warranty costs by lowering its processing overhead, or should it cut costs by preventing defective products from ever leaving the factory floor?

Specifically within the automotive industry, the warranty process almost always involves a dealership's service department at the front end, so communications almost always involves an external network -- phone, data, fax, email, Web or perhaps even Telex for the old-timers. In the case of the auto importers, communications will also involve a long distance connection back to the factories and design centers in Japan, Korea, or Germany. After all, it is they who end up footing the bill in the end, so of course they'll want to see some details about the claims. Processing, except perhaps where a call-in or fax-based system is still in use, almost always forces the dealership to perform most of the data entry on a terminal or PC. A manufacturer's warranty department, freed from the initial data entry, is frequently still saddled with the task of manually examining and approving the claims. Experts who act like walking and talking business intelligence databases know what to look for, and where to look. The cutting-edge systems in this area could free these warranty experts from their desks, allowing them to get out to the dealerships. The New FrontierAccess and analysis are the new frontiers of warranty claims management. Assuming the warranty records are in an electronic format, who gets access to the database and what kinds of analysis can be performed by the people and departments granted access? The warranty department itself will want to analyze the data to help find ways to cut the cost of handling claims. The production people will want to use warranty data as an early warning system to spot manufacturing problems at their own factory or at the facilities of parts suppliers. The accounting people will want to use warranty data to help them spot claims fraud. Engineers will want to analyze warranty data to see how their designs are faring in the real world, and what they can do in the next generation to improve upon their reliability.

One auto importer used the occasion of planning for TREAD Act compliance to completely rethink the way their warranty data was processed and analyzed. They ended up buying a comprehensive business intelligence solution that not only took care of the TREAD Act compliance but also helped them cut both defects and dealer fraud by packaging warranty data reports for both the auditors and the design engineers. Another software vendor is specifically targeting design engineers, believing that while engineers have access to the latest and greatest in CAD/CAM and simulation software, they lack any access at all to data about the products once they leave the factory. Warranty Data for Engineers

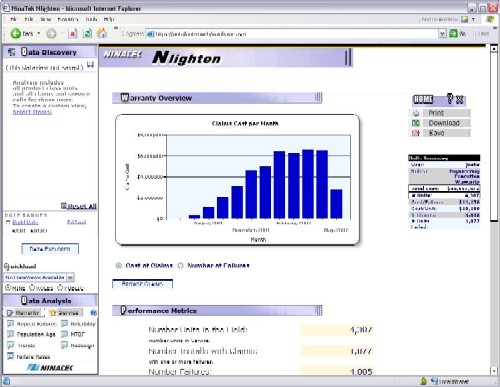

"When we looked at the engineering world, we realized that every nook and cranny was being addressed by technology," Barry said. "But then we started to look at how products perform in the field, after the product ships. And it became obvious, as we spent a lot of time talking to old customers -- we had over 500 manufacturers in our customer database -- that engineering was pretty well blind once the product leaves the factory floor. They don't have a clue as to what's happening out there." So he and his co-founders started NinaTek for the purpose of providing post-sale visibility to engineers. They began developing a product called Nlighten that engineers could use to check on the performance of a product in the field, so necessarily warranty data became one of its primary inputs. But the system also takes as inputs all the production data and the configuration data for each unit, as well as sales and shipment data. "We need to know about every shipment, not just the ones that fail, in order to provide accurate engineering metrics about performance," Barry noted. "We provide the kind of engineering metrics you're used to seeing: mean time between failure computations, reliability analysis, and predictions. So we need access to other data besides just warranty." Not Into Claims ProcessingBy most measures, NinaTek is not a warranty claims management software company. Barry is quite happy to leave the processing of the actual warranty claims to others. He doesn't even want to partner with the companies that make the software. But he most definitely wants access to the data they produce. "There's an automation component associated with claims management," Barry said. "And that's an area that we don't even begin to think about. We're much more interested in the problem of an engineering manager being told that warranty costs have to be cut 10%, because it's having an impact on the bottom line. That's really our focus. Every dollar in warranty is a dollar in lost profits." Barry said he wants to help engineers understand the economic impact of the decisions they make. When they're told to cut warranty expense by 10%, for instance, where do they look? Given the finite number of engineers on staff, which problem do they attack first? To decide, they need to know the current cost of repairs, and which parts and systems produce the biggest shares of those costs. It's not just MTBF. Engineers need to know the actual cost of a failure, in both parts and labor. Then they need to be able to measure the results after their redesigns, to see if they made their 10% quota or not. The Nlighten InterfaceSource: NinaTek Josh Siler, NinaTek's director of technology, explained how an engineer would use Nlighten to determine the economic benefit of different redesigns. "There's a lot of tools that focus on the analyst," he said. "But we wanted to get down to what an engineer needs. So we allow them to go in and select a certain part. Then we give them access to all the magnitude information: they know how much it costs the company, and they know how much it costs in customer downtime." From there, NinaTek gives the engineers the tools they will need to determine cause, for instance which manufacturing plant produces the most failures or which region of the country experiences them the most. Then the question shifts to benefit: how much will it cost to do a redesign, how much will it cost to retool the factory, and, bottom line, how much will be saved over the long run. "That gives them a sense of what their year-over-year ROI is going to be on a change," Siler said. "It also allows managers to objectively compare different engineering changes. So if one guy says 'I need two guys to do an oil pressure sender change,' and another guy says 'I need two guys to fix a fender problem,' the manager can compare which project has a better ROI." The Customer's PerspectiveLuis Novoa is chief engineer with Engineering Design Consultants Ltd., an engineering design and CAD/CAM consultancy headquartered not far from NinaTek in Portland, Oregon. He was with Freightliner LLC for 11 years after starting with DaimlerChrysler AG in 1979. DaimlerChrysler Commercial Vehicles Division subsidiaries Freightliner, Freightliner Custom Chassis Corp., American LaFrance Corp., and Western Star Trucks are all now EDC clients. Novoa said that until he saw how Nlighten can apply warranty data to the design process, most of the software tools he'd looked at seemed to him more like "scorekeeping" tools. They tell you at the end of the game how you won or lost. What Novoa said he prefers, "is a strategic tool, that tells you in the third inning that you better do something or you're going to lose the game in the ninth inning." He said a design engineering department should have on-demand and direct access to warranty data. They shouldn't have to schedule a report generation with the IT department and then wait several hours or even days for its completion. Sometimes they have a hunch or a hot new idea, and they need to check it against the data immediately, before their attention span wanders. Even a reliance on the warranty staff for access may not work out. Design engineers have different priorities than warranty administrators, Novoa said, and this is reflected in the way they're going to browse through the warranty data. An intermediary might lose patience with the frequency and vagueness of the requests. "There is no pattern to it," Novoa said. "For example, if you're designing a front spring, you should look at that point in time to the subject of front springs." Perhaps at first you start looking at leaf spring data, but something you see suggests you should also look at coil spring data. "The moment that you see there's a need to also look at the coil spring data, immediately you can do so." If you're going through an intermediary, however, your sudden change of course might be seen as more of a burden than a burst of inspiration. The first report or two on leaf springs might be expedited as a favor. But the third and fourth? People have their own jobs to do. Novoa says let the engineers tinker with the data by themselves, so neither the IT department nor the warranty staff loses patience with them. "What you need is a tool that allows you to go and search this database on demand, and extract useful information," Novoa said. "You eliminate old problems instead of carrying them forward to the next product generation." This requires data tools aimed at the design engineers, he said, so they can search at their leisure for that "needle in a haystack" relationship in the data. "With any product deficiency, when you go back and look at the history, you find that there were all kinds of opportunities along the way to eliminate this deficiency, and leave it behind. But the reason it wasn't left behind is that the information that existed within the company that suggested there was a deficiency or a problem was scattered in three or four databases in different departments. But it was not visible to the guy who was designing the new product." Six months later, warranty costs confirm that the old problem has carried forward into the new generation. A Motor Vehicle Software Company

"We're a motor vehicle software company," noted Strategic's president John Myers. "Warranty is one of the modules in our packages. It's a core module for us. I mean, we can sell somebody just our warranty package. And certainly the way our system is built, we're able to integrate into our customers' existing applications, because warranty pulls together both the product side as well as the parts side of the business." Among the company's 20 or so clients in the automotive field are AM General Corp. (makers of the Hummer), Harley-Davidson Inc., and Toyota de Puerto Rico. AM General uses Strategic Warranty as part of its dealer communications system. Toyota de Puerto Rico used Strategic Warranty as the basis for a Web-based data entry system for its dealers. Myers said he couldn't really talk about how Harley-Davidson uses the company's warranty software. He said they've been a customer for at least ten years, "but recently, with a new piece of business that we're working with them on, we had to sign a confidentiality agreement." Extensively Modified Over the YearsA source within Harley-Davidson confirmed that the motorcycle manufacturer is using the Strategic Warranty system. "But it is 12 years old," the source added, "and we have changed the code so much here to adapt it to our needs that you wouldn't even recognize it as their system. Nobody thinks of it as their system any more, because it's been modified so much." Myers said he's happy to hear that the package lends itself to such high levels of customization. "Warranty is really an analytical exercise when you sit down and get into it," he said. "Our software tracks warranty claims and payments. It handles product recalls. It does a whole raft of things. But the real strength comes from the end user data analysis that people do on their own. They crawl through the data to see what they can find. Even though we have 50 or 60 different standard analysis reports, a lot of times, it's just people going in and doing some basic data analysis, seeing a pattern, and tracking it down." This is not the typical experience, however. Myers said he suspects that most companies in the automotive industry still view warranty as a cost center that needs to be minimized. They still don't see it as the leading edge of an early warning system that feeds data back into quality reporting, and one that if used properly can fix problems with vehicles long before they ever reach a dealer or are sold to a customer. "We have one customer that captures assembly line information," he said. "But most customers pretty much start quality when it leaves the plant. Every company has its own culture and every segment of industry has its own accepted ways of doing business. In the motor vehicle industry, warranty starts at the dealership." Kia Motors America Inc., the U.S. importing and sales arm of Kia Motors Corp. of Seoul, South Korea, uses the Strategic Vehicle Distribution and Warranty Administration packages as applications for its dealer communications network. But to analyze that data, it also uses a business intelligence and knowledge management system developed by InfoGain Corp. of Los Gatos, California. Subhash Solanki, manager of InfoGain's Solutions Consulting Group, repeated what by now has become a familiar refrain among the companies providing warranty claims analysis systems. "This is not a warranty company. But what InfoGain can be is a warranty solutions provider." Warranty is but one of the many applications of its business intelligence system, he said. "Whatever we can do to support any business process, be it warranty or something else, using technology to make life simpler for people in that process." Working with Existing SystemsInfoGain is leaving the warranty claims processing and communications functions to others to perform. Most of the automakers that Solanki's team works with already have their dealers using warranty claims submission systems running on computer screens and data communications networks to submit claims electronically. So the cost of "paper" work is minimal already. The oldest systems use dumb terminals and mainframes. Some of the newer systems have integrated PCs, client/server computing, and IBM AS/400 hubs. The newest of all are the systems using the Internet, email, Web browsers and possibly Web Services to cut communications and processing costs. Solanki said that while InfoGain will frequently make suggestions concerning how dealer communications and claims processing systems can be improved, what the company is really there to sell is data analysis. When InfoGain meets with a prospective customer in the automotive industry, it asks first for information on how dealers now submit warranty claims, and how the manufacturer processes them. Then InfoGain takes a look at what happens to the data after it's been submitted, collected and processed. Does it get passed on to a product quality group, or to the design engineers? Is it passed on to the parts suppliers? Or is it simply marked "paid," filed away, and forgotten? "We come in and understand that process," he said. Then InfoGain suggests ways the process can be improved, turning the system into not only a clerical timesaver but also a source of insight into how the product fares after it's in the field. They want to improve the efficiency of claims processing, but they also want to be able to use the warranty data for product quality and decision support.

Before Kia signed with InfoGain, different departments such as warranty, consumer affairs, parts, and product quality each used separate systems. Now it's all on one platform, so for instance a warranty claims manager can take a look at parts data for vehicles that are outside their initial warranty periods, to see if a pattern observed during the initial few years of a product's lifecycle continues into its middle age. Before, it was none of their business unless it was a warranty claim. Was Looking for a TREAD Act SolutionIronically, Kia didn't initially go looking for a new warranty claims processing system, nor was it looking for an improved intra-corporate warranty data sharing system. At first, InfoGain was brought in merely to help the automaker comply with the TREAD Act. Then the talks widened in focus. InfoGain took the approach that TREAD Act Early Warning Reports should be merely an output of a much wider and more comprehensive business intelligence system. Indeed, warranty is just one part of the analysis, as it is just one aspect of the TREAD Act reports. The whole idea of the Act is to put automakers into the business of collecting and analyzing their own parts and service data, looking for patterns and anomalies, then finding and correcting them before the government's own data crunchers spot the same problems. Automakers that merely turn in the sums derived from the columns in a makeshift spreadsheet may still meet the TREAD Act's reporting requirements, but they may not be able to explain what it means to NHTSA. Solanki takes the view that warranty data can be an important early warning indicator not only for NHTSA, but also for the company itself. And the patterns and anomalies in the data do not always spotlight problems with safety or reliability. Sometimes, the data suggests problems with the dealerships themselves -- clerical errors in the most innocent cases and outright claims fraud in the worst cases. He said that as Kia reduces the number of clerical positions due to the increased efficiency of its claims processing system, the company is adding a proportional number of product quality positions in the field. Their job is to interact with Kia's 650 dealers, gathering the kinds of informal and anecdotal data that might not otherwise make it into field reports, and writing more quality information reports for the people back at headquarters. Fraud DetectionThey're also available to visit with dealerships that seem to account for a disproportionate share of claims, based on analyses run back at headquarters. Solanki said fraud detection is a big part of the reason for warranty claims analysis. All this data crunching doesn't just help an automaker build better cars. It also helps them figure out which dealers are faking claims or making unnecessary additional repairs on vehicles in order to inflate the warranty work volume. Having the warranty people freed up from clerical work has allowed Kia to put more people in the field for these investigations. In spite of their aversion to being called warranty software providers, companies such as NinaTek, Strategic Business Systems, and InfoGain are nevertheless part of the warranty food chain. Perhaps they're not doing much work at the processing or dealer communications end of the market. But they most definitely are finding new ways to communicate warranty data within the enterprise, and they most definitely are opening up those databases to new types of analysis by people whose first priority is not always the cost of processing a claim. | ||||||

|

Ideally, the answer is yes to all of the above. In practice, it rarely is so simple. With any warranty claims automation system, tradeoffs are always being made between:

Ideally, the answer is yes to all of the above. In practice, it rarely is so simple. With any warranty claims automation system, tradeoffs are always being made between: There is now another party demanding access to warranty data, namely the U.S. government through the

There is now another party demanding access to warranty data, namely the U.S. government through the

On the opposite coast,

On the opposite coast,  "With Kia, part of our process involves looking at warranty claims history for specific parts," Solanki said. That data is passed back to the factory, where it is used to minimize the chances of that specific part failing in future production. "They've learned through the feedback, through the data that they collect, to improve the quality of the product."

"With Kia, part of our process involves looking at warranty claims history for specific parts," Solanki said. That data is passed back to the factory, where it is used to minimize the chances of that specific part failing in future production. "They've learned through the feedback, through the data that they collect, to improve the quality of the product."