February 28, 2008 |

|

ISSN 1550-9214 |

Warranty Analytics:The Warranty Chain Management Conference in San Diego next week will feature both a workshop on loss cost analytics aimed at extended warranty providers and a warranty analytics software enhancement aimed at engineers and quality managers.Depending on which end of the warranty business you're in, the term warranty analytics can have very different meanings. If you're selling extended warranties, you'll want to know if the price is right based on the cost of future claims. If you're monitoring product quality, you'll want to tap into warranty data as an early warning of manufacturing problems. Ultimately, somebody in the company is going to want a little bit of both. The early warning systems will have to feed accurate failure rate data to the people calculating extended warranty prices, and will also have to help the auditors decide if enough accruals are being set aside to cover future claims. The loss cost analytic systems that look at extended warranty finances can also help engineers extend their view of a product's lifecycle far beyond the initial warranty period, and can help them detect and correct defects that don't begin to appear until the initial warranty period has ended. Ideally, one system could do both, and indeed some systems do most. But extended warranty analytics and product warranty analytics are aimed at different ends of the business, and appeal to people with different job titles. Different BucketsAnd more practically, they're usually run by different "silos" within the company, in different departments with different reporting structures. One is revenue and the other is expense, even if both are warranty. Attendees to the Warranty Chain Management Conference next week will have a chance to look at analytics packages aimed at both ends of the business. At one exhibition booth, conference sponsor Fulcrum Analytics Inc. will be displaying its eXclaim Intelligent Claims Analyzer package aimed at the extended warranty end of the business (with applications for manufacturer's warranties) while at another booth conference sponsor SAS Institute Inc. will be demonstrating its SAS Warranty Analysis package aimed at the manufacturer's warranty end of the business (with applications for extended warranties). On the afternoon of Tuesday, March 4, Fulcrum's top executives will present a workshop at the conference entitled "Limited Warranty and ESP Program Loss Cost Analytics: How to Unleash New Profitability and Customer Loyalty." As is the case with eXclaim, this workshop is aimed primarily at the financial people who need to know how their extended warranty programs are doing, though it might also appeal to the engineers who need failure data that goes past the initial warranty period. In fact, Fulcrum is working with two large manufacturers to link their product warranty and extended warranty experiences together with advanced analytical techniques to provide a more complete picture of their quality and failure experience. On the same day, SAS will use the WCM Conference as its forum to announce a significant upgrade of its SAS Warranty Analysis package. Ever since SAS formally launched the package nearly six years ago, it's always been aimed primarily at the engineering people who need to know what their failure data means, though it might also appeal to the financial types who need to know what these failures are costing the company. In fact, SAS is actively aiming its analytics towards warranty reserve forecasting and even extended warranty-only applications such as justifying an alteration of the rate at which deferred revenue is recognized (from the default straight-line method). Overlap vs. Compete?Both analytic approaches will appeal equally to both manufacturers and retailers, and will appeal to their core constituencies across multiple industries. And while both would fit into the catalog under the heading of warranty analytics, they don't really compete as much as they overlap a bit in the middle. Here's why:

Richard Vermillion, Fulcrum's chief technology officer and one of five presenters at the WCM workshop, said what his company provides is a different kind of early warning. It's a financial early warning -- essentially a notification that your failure rates are so high and your extended warranty prices are so low that you're on a track to lose money in years to come. In the vernacular of extended warranties, you're "upside down," with a loss cost that is going to exceed premiums paid. "We do think of it a little differently than is traditional," Vermillion said. "I think it's financial and it's program optimization. It's not 'Oh, here's a supplier or a part or a plant that's having problems. We caught it quick. We can fix it before too many roll off the line,' which I think is what a lot of the quality/reliability/early warning stuff is. It's more 'Let's catch it quickly before this program gets upside-down,' because we're going to continue to sell coverage on the extended service side. That can be incredibly important, because if you catch it early enough, obviously you can change your pricing." David Froning, product manager for SAS Warranty Analysis, said the software package is generally aimed at manufacturers of durable goods, although some major retailers have also deployed it. And it's not specifically aimed at any one industry, although most of the existing customers are making or selling appliances, vehicles, or electronics. "Warranty analysis is critical for any company that warrants a product," Froning said. "Whether they manufacture the product directly, utilize contract manufacturing, or just market and sell the product, companies have a vested interest in minimizing their warranty liability and keeping customers happy." And that vested interest extends across multiple industries, he said. "This solution is really built around early detection, and faster definition, to get to the root cause of a problem," Froning said. "And at its heart, that's a quality and engineering type of problem. But obviously, the results from that can then help you predict what your costs would be if you sell a service contract that extends this for three years. Certainly, that's related to failure rates, which is what this system is focused on." Built for Warranty

In other words, it's designed with warranty data in mind. The difference between SAS Warranty Analysis and other analytics packages, Froning said, is how SAS has built in an expectation that the sales records and warranty claims data it's pointed at is going to be incomplete and/or incorrect. Why? Because that's the way warranty data usually is. "We have business rules in place out of the box that address all of those issues as well as seasonality and many other warranty-specific issues," he said. "Warranty data is very messy," he said, "and there is a standard approach to how you deal with those data issues, regardless of what you're manufacturing." Within a company, SAS Warranty Analysis is usually aimed at the engineering or quality departments, with some additional applications in finance (such as accruals forecasting and service contract pricing). And that's where it overlaps a bit with Fulcrum's offerings. Though SAS Warranty Analysis isn't optimized to help clients price their extended warranties or calculate if they're upside-down, it conceivably could be used to do so. And though Fulcrum Analytics doesn't set out to help companies spot persistent defects, it can be used that way. Paul Swenson, president of Fulcrum Analytics, said one client used his company's loss cost analytics to help it identify some bad electric motors. They were even able to use the claim emergence patterns that Fulcrum produced to help the company bill the cost back to a supplier. But that was more a product of not seeing what was expected in the data, and looking for a reason why. "You expect a certain claim frequency to evolve over time," Swenson said, "and a certain severity associated with that claim emergence pattern. When you start to see new product, new chassis, and new models, and compare them against that expected claim emergence pattern, you can start to detect some emerging issues." At the WCM workshop, Vermillion and Swenson will be joined by two co-workers and a client. Hongjie Wang, Fulcrum's vice president of customer analytics and R&D, and Scott Morrison, Fulcrum's executive vice president, will share the stage with a client, Teresa Reber, the service contract business manager at International Truck and Engine Corp., a subsidiary of Navistar International Corp. How It WorksSwenson said that towards the end of the tutorial, Reber will be discussing how she uses Fulcrum's analysis techniques from a practitioner's standpoint. "We're going to factor her numbers, so that when we put up the information, it won't be the exact numbers, but relationally they'll be correct," he said. "Then she'll be able to discuss how she uses some of the input, and how she's going to use it in the future." Vermillion said the main themes of the workshop will be what loss cost analytics means, what are the different aspects of it, how it can be used, and what questions it can answer. "Then we are going to go through some of the problems with the data that we've seen, and what makes this challenging, in terms of both sparse data sets and the kinds of statistical challenges you run into when you try to analyze it and do the forward projections," he said. "Then you have different issues with the fact that you have a lot of variables, particularly in some of the more complex situations such as trucking and automotive, where you have multiple coverage levels, multiple terms, and a lot of custom terms. "We're going to go into some of the issues with the data -- things that make it hard to do it all right," Vermillion added. "Then we're going to talk about some of the different methods that you can use to address those problems, with an emphasis that there's no one size to fit all. You need to understand the business, understand what the data is giving you and what it's not giving you, and then select the right approach to take." Swenson and Morrison also did a workshop at last year's WCM Conference in Tampa. This time, they'll have twice as much time, and more than twice as many speakers. "This will be quite different in two ways," Swenson said. "Last year, we did an hour-and-a-half tutorial that was more geared towards how you use loss cost information in optimizing your programs. This year, it's a longer tutorial, and we'll get into at least a medium level of technical specifications, analytical and statistical techniques, and why some work and why some don't." Vermillion also said they'll be aiming at the middle level. "We're not going to be writing a bunch of equations on the board or doing it on a level that you have to be a statistician to follow along," he said. "But I think we will be talking about specific issues and how they can confound simple techniques, and what techniques there are that can help you with them." Answering Financial Questions

The target audience includes chief financial officers, risk managers, and extended warranty program managers -- more or less the same people Fulcrum counts as clients. Usually, Swenson said, they want answers to one of two simple questions: Are our extended warranties priced properly? Do we have enough to pay claims? "Starting several years ago," Swenson said, "we were called on to perform some detailed loss cost analysis. And then we had some situations where CFOs, risk managers, and ESP program managers wanted to be able to answer some questions their auditors were asking, and they didn't really have a lot of comfort in being able to say unequivocally, 'Yes, I know that I have enough reserves. I know my loss costs.' "We have found that a lot of CFOs, risk managers, and ESP program managers engaged us for one of two things. One is they wanted to sign off that they had the appropriate level of premiums on their books or with their underwriters, to cover their liabilities going out several years. And then there's a whole new level of analytics that we've been providing for several clients that allows you to optimize your ESP program and pricing." Swenson said they can't possibly teach the material fast enough in the allotted three hours to turn attendees into loss cost analytical experts. But the Fulcrum team can hopefully get through enough material to give the attendees a taste of the possibilities. And usually, he said, when that happens, he can see the figurative light bulbs go on above each person's head as they realize they "get it." "If someone really has a passion for this," he said, "I mean, if it's one of their areas of responsibility, and it's something that they need to know and to understand and to come to grips with, once they start to see why some of the more traditional statistical methods and software can oftentimes lead to erroneous conclusions for their particular program or their particular business problem, and they start to see some of the other types of techniques that are available, and how it can provide much more detailed and deeper segmented levels than they ever have been able to put their hands on, the light bulbs start going off for them." They Could Meet All DaySwenson said one time, a client had set aside 90 minutes for their initial meeting with Fulcrum, but once they became immersed in the topic, and the light bulb turned on, they kept extending the meeting until it stretched to six hours. "Not because we wanted to, but because they were so interested," he said. "I'm thinking of one CFO in particular that asked us to stay the entire afternoon. Took us out to lunch. Took us out to dinner." Vermillion said it doesn't usually happen that way. But, he added, there is a small group of people that could talk about loss cost analytics all day. "Obviously, people care about loss cost analytics and their reserve fund differently depending on how they've set up their warranty or extended service plan programs, and how they're carrying the risk -- if they are," he said. In some cases, clients ask Fulcrum for help determining if their rates are justified based on what their underwriters are telling them. "We can help them push back against the third party insurers that are trying to raise the rates," he said. In other cases, there is no underwriter, and the company is carrying the risk itself, and its auditors need to know if the rates need to be adjusted given the current loss ratio, he said. "Am I earning the premium correctly? Do I have enough?" In the U.S., most retailers that sell extended warranties work with administrators and underwriters, and many manufacturers that sell extended warranties carry the risk themselves. But there are exceptions to the rule on both sides. And one thing they have in common is a need to figure out if their extended warranties are making or losing money. "You could be a retailer or you could be a manufacturer, and you could be consumer electronics or you could be trucking, and you could have some shared problems or different problems based on how you've set up the program," Vermillion said. Examples Across Multiple Industries"Some of our examples will be consumer electronics and white goods, with retail examples as well," he added. One of the examples will actually come from the marine industry. "So I don't think we're targeting a specific industry here. I think we're going to touch on things that are relevant to lots of different industries, depending on how they've set up the program, and I think they'll be applicable to a lot of different ways that they can set up the program." Swenson said most of the statistical techniques and the methodologies that Fulcrum discusses in the workshop will be applicable across industries. But, he stressed, there is no "one size fits all" solution. To be meaningful and worthwhile, the statistical techniques will have to be adapted to each individual case, he said. But, when properly tuned to each company's situation, these exercises can frequently produce multi-million-dollar savings, he added. "The techniques that we've found to be the most useful and the most accurate are very specific to individual programs," Swenson said. "But they are agnostic when it comes to the structure of the risk itself, and whether or not they use an underwriter, for example. The information is valuable for the underwriters of programs that we're involved with. And they're also important to the program managers from the perspective of having enough sub-segmented detailed loss cost information available to ensure that they are not only covered as far as the risk is concerned, but they're also optimizing their program pricing and marketing decisions." Product warranties, meanwhile, don't usually include underwriters in the mix, and of course they would never be sold to customers. But, as one expert in vehicle service contracts put it several years ago, product warranties are simply extended warranties without prices. So theoretically at least, all of Fulcrum's tools would work the same with the price entered as $0 (except of course every program would always be upside-down from the get go). But figuring out the cost of future claims is only one aspect of warranty analytics. An analytics package aimed at product warranty would also need to be capable of affecting the outcome of those calculations. In other words, don't just tell me how many will fail. Tell me how to fix them before they leave the factory. Working FasterThis is the focus of SAS Warranty Analysis. And the focus of this new version 4.1 is to help engineers and business analysts to use these tools to work faster, taking less time to detect problems and correct them, and allowing each person to follow-up and monitor more solutions at once. In the very old days, very smart people used to read reams of claims, looking for patterns that suggested persistent defects. And then in the more recent old days, people used to code those claims so that something like Microsoft Excel could more precisely count the recurrence of problems. But in this decade, warranty analytic tools have appeared that can do that coding for you, so now all you need to do is decide which patterns and anomalies are the most interesting to probe further. Sub-Zero Inc. is one of the 19 companies that have selected SAS Warranty Analysis as their warranty analytics package. Several others are using more generic SAS analysis tools that they've customized to their own installations. And indeed, Sub-Zero is still using a highly customized installation of SAS Warranty Analysis version 2.1, having skipped the 3.1 upgrade launched in July 2006.

Josh Becker, Sub-Zero's manager of reliability, said his company will be one of the first to upgrade to version 4.1. Why? This version has been built around the way his analysts work, probing the comments fields of claims, looking for patterns, developing clusters, and prioritizing solutions. "I've been there. I've done it with Excel before. I've done it with OLAP cubes," Becker said. And he can't bear the thought of going back to the old ways. "This is really where you need to be to understand warranty and get any value out of the data you're getting." In release 4.1, SAS has now integrated text mining into the warranty analysis package for the first time. SAS also sells it separately, and has actually been in that business longer than it's had a packaged warranty solution. But now text analytics is part of the package, and Becker said that will save his guys even more time. "We're up to our neck with text analysis," Becker said. Before, engineers had to read claims by hand, looking for patterns in the commentary, and assigning some kind of failure code to each claim. "We've completely abandoned that manual process and rely entirely on text analysis now to cluster our warranty claims automatically. And then the foundation of the warranty analysis system are these meaningful clusters. The statistical analysis is then run on these clusters." Double-Checking 'Messy' DataBecker said Sub-Zero's business analysts or engineers are going to make heavy use of text analytics to analyze their claims data. But by no means does he expect it to work 100% error free. Analysts will still occasionally have to go in and verify that a new cluster detected automatically is correct and meaningful, and is not caused by some misinterpreted acronym or misspelled word. "But by putting that integrated text analysis into the business analyst's hands, they can more easily do that," he said, because they're always working within the single application. Froning said SAS customers that haven't used separate text analysis tools before now will see an even bigger change once they upgrade to version 4.1. For example, while the old system might have clustered all claims rather broadly, such as clustering all those having to do with doors not closing properly, the new system will delve deeper into the text descriptions and make separate clusters of all the claims that reference bent hinges or improper seals. "Customer feedback drives the product roadmap," Froning said. "I'm out there on the road, working with our current customers, understanding how they use it, and what they're interested in for future releases, and then taking that information back to research and development, as we plan our product roadmap for future upgrades." Froning said there are actually over 200 separate enhancements in this release, but he said three are likely to have the most impact:

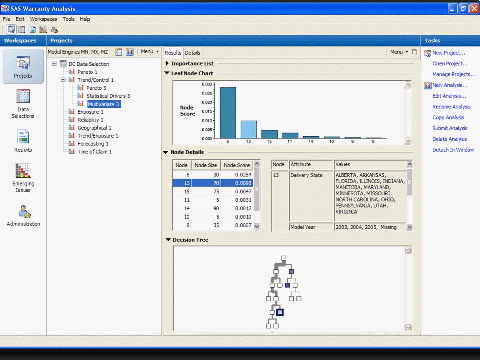

"What we've really focused on in this release is issue definition," Froning said. "So now that the manufacturer knows that an issue exists, they can much more quickly define exactly when and where it's occurring." Integrated text analysis is one way SAS Warranty Analysis 4.1 speeds the process along. Identifying multivariate statistical drivers is another, he said. So what exactly does that mean? "That's a tricky way to say 'faster problem definition,'" Froning said. Basically, it looks at dozens of product and claim attributes to define combinations where the analyst should focus. For instance, one could select attributes such as the supplier, the location of the customer, and the parts replaced, and could then look at every possible permutation of those attributes. Then the system builds a decision tree, which allows the analyst to figure out which combinations of those attributes are really driving up the failure rate. Finding Patterns FasterFroning said that multivariate statistical drivers would allow an analyst to quickly identify a pattern of failure that involves only a certain supplier and occurs only in a certain climate. For instance, it might spot a pattern of tires that tend to fail only on searing hot pavement or engines that tend to stall only in below-freezing weather. There are other ways to reach the same conclusions, but this is likely to figure it out faster. "Instead of running several different pareto charts and trend charts, all of that is done in one analysis," he said. "It very quickly focuses in on exactly where my failures are. And it really accelerates the problem definition." Figure 1

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||