August 25, 2011 |

|

ISSN 1550-9214 |

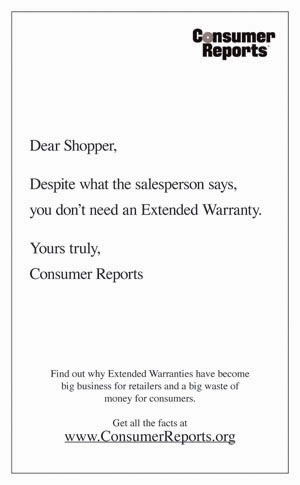

How to Buy Extended Warranties:Step One: Read the contract. Research the terms and conditions of the service contract while you compare the prices and features of the products themselves. Then use your common sense and Google to decide if the extended warranty offer is a deal worth adding, or if you should shop elsewhere.A freelance reporter recently called, asking your editor for advice on when to buy and when not to buy an extended warranty. What should a consumer look out for, what should they avoid, and what should be in an extended warranty offer? Oh no, not another one of those articles. They usually end up slamming the entire concept, trashing the whole industry, and advising consumers to avoid extended warranties altogether, except in some very narrow instances. Well, it's not that easy. It's a bit like asking who needs earthquake insurance, or who needs hurricane insurance. Last week, many people might have given a very different answer than they'd give now. The statistics tell you one thing, but real life tells you otherwise. The real simple advice was this: ask to read the contract. That advice, however, turned out to be too simple. Her editor was looking for an article on how to spot scams and rip-offs. Her editor wanted a list of good and bad extended warranty underwriters, administrators, and selling agents. Her editor wanted a black and white picture of an industry filled with gray areas. Reading Contracts Before Signing Them?The reporter asked, incredulously, "You don't mean to tell me you expect shoppers to ask the cashier at Target to let them read the contract, do you?" Well, no. By then it's far too late to begin your research on extended warranties. Consumers should have read the terms and conditions of the service contract long before they leave home. They should read it while they're still researching the product's price and features. In other words, if a consumer should happen upon this week's newsletter before they go shopping, they're doing a good job. If they Google it after their product breaks, while they're wondering where they put the contract they never read that contained the phone numbers they thought they'd never need, then they can stop reading here. It's too late. The reporter was incredulous. Best Buy is going to email me a copy of the contract? Will the guy who answers the phone at Wal-Mart even understand what I'm asking to see? Why wouldn't they? In fact, Sears Roebuck has a nifty automated system that sends copies of user manuals, warranties and service contracts in reply to emails containing just a model number. Federal Warranty LawIn fact, there's actually a U.S. federal law called the Magnuson-Moss Warranty Act that requires retailers to keep copies of all warranties handy for pre-sale inspection by customers. Though that's not also required for service contracts, it's a common courtesy to allow customers to read a contract before asking them to sign it. So why read a contract? Isn't it filled with fancy judicial phrases, fine print and big words that mean little outside the legal profession? Well, yes. But it contains a few items that will quickly help a consumer decide whether or not this particular extended warranty is worth purchasing. First, it will establish whether or not there is an insurance underwriter involved. Second, it will establish what company will administer and process the claim. And third, it will outline the process and policies themselves. Let's take a look at each of these in turn. The reporter asked how a consumer is supposed to evaluate one underwriter versus another. That's not really necessary. Basically, it's more a question of whether or not there is an underwriter. If there is, the underwriter is probably rated A- or better by the insurance industry's leading ratings agency, A.M. Best. That's denoted as an "Excellent" rating by the company, as is a plain A, while an A+ or the elusive A++ are designated as "Superior." Comparing Underwriters?So how is an A- different from a plain A or an A+? It really doesn't matter to the average consumer. The more relevant question is whether there is or isn't an underwriter involved. If there is, chances are that it's a good one. If there isn't, chances are that the seller doesn't have a clue about extended warranty financing. When Warranty Week calculated the A.M. Best financial strength ratings of the underwriters involved in the vehicle service contract industry (newsletter of September 9, 2010), we found that 80% of the contracts were backed by an underwriter with an A- or better. Only 14.4% had a B++ or lower, but most of those were underwritten by insurance agencies linked to Ford, General Motors, Toyota, and other OEMs who at the time were pretty down on their luck. And the vast majority of them had a B++, which A.M. Best classifies as "Good." In other words, 94% of the vehicle service contracts were backed by carriers rated "Good" or better. And what we're saying is that "Good" is good enough; and is certainly better than "None." Ironically, at the time some of those OEM insurance companies still had a B++ rating (they've been upgraded since) they were still majority owned by the U.S. Department of the Treasury following the auto bailouts of 2009. Essentially, this meant that A.M. Best was assigning lower grades to wards of the state than they were to private companies. And the state can collect taxes and print money -- two things private insurance companies merely wish they could do. Lagging IndicatorsBut we're not here to defend A.M. Best ratings. In fact, they're always reactive, in that they can tell you where an underwriter's been but not where they're going. And they're not even very good at reacting quickly to the news. For instance, back in June 2003, the National Warranty Insurance Risk Retention Group was at the center of one of the most spectacular flame-outs in extended warranty history, when it was placed into bankruptcy proceedings in the Cayman Islands. As late as February 2003, however, A.M. Best had NWIG rated an A-. Until late May, it had a B++ rating. And then, on June 10, six days after NWIG went into liquidation, A.M. Best downgraded NWIG to a C- (Weak). Administrators who relied on NWIG for their underwriting were taken by surprise. Some had to declare bankruptcy themselves. And these were experienced administrators -- seasoned professionals in their field. If they didn't see it coming, then how can an average consumer be expected to evaluate the goodness or the weakness of a given administrator's underwriter literally years before they're likely to make a claim? Fortunately, there aren't many NWIGs. So what we're suggesting is that since 8 out of 10 vehicle service contracts have an "Excellent" underwriter, and 1 out of ten are merely "Good," turning the complex ratings research into a simple yes/no question (Is there an underwriter?) will turn out to be good enough 9 out of 10 times. The Benefits of InsuranceBut why is an underwriter so important? To answer that, we need look no further than the home electronics industry, where in 1989 the chain known as Crazy Eddie filed for bankruptcy, taking all of its service contracts with it to the bottom. There was no underwriter. Crazy Eddie sold them. Crazy Eddie administered them. And when the money ran out, they were worthless. Compare and contrast that to the collapse of Circuit City Stores in 2008-2009. After the company declared bankruptcy and shut its stores, consumers who bought its extended warranties were directed to contact the underwriter, Assurant Solutions, which has continued to arrange for repairs and to pay claims until all the remaining extended warranties expire. That's not a unique case. Assurant Solutions (a longtime sponsor of Warranty Week) also had to step in for CompUSA Inc. when they shut their doors. Other underwriters have also had to step in when their administrators or retailers collapsed. It doesn't make much news, because by and large the underwriters always do the right thing: they step in and clean up the mess. It's when there's no underwriter that consumers find they are on their own, should there be a bankruptcy. That's when it's time to call your local attorney general's office or your city or state's department of consumer affairs, to find out how to get your name onto a list of unsecured creditors that will be dealt with by the bankruptcy court. It can take years, but eventually at least a partial refund is likely. Who Is the Administrator?The second reason for asking to read the contract is to find out what company is contracted to process the claim and to decide whether to repair or replace the covered product. And again, this information in and of itself isn't very useful to a consumer. But it could prove to be quite valuable if they're near a web browser. Not only can they look to see what a company says about itself on its website, but they can also Google the name to see what others say about the administrator. Granted, every administrator is going to have a great-looking website. And every administrator is going to have at least a few disgruntled customers who are adept at posting reviews. So it's never going to come down to a simple yes/no answer. It will always be a matter of weighing the good against the bad reviews. Even in the case of bad reviews, consumers can look to see how the administrator responded. You can't please everyone. But you can at least try. You can make an attempt to put things right -- to ask the consumer for more details or for another chance to impress them. Or you can ignore your online reputation altogether, hoping that most consumers will never bother to Google your name because they won't know it until after they've taken home a copy of the contract they signed without first reading it because you pressured them into signing it quickly. That business plan may have worked in the past. It might still work now. But increasingly in the future, consumers will research not only the brand name, price and features of the product, but also the reputation of the sellers and servicers. It will all be one Google page away. And given Google's plans to acquire Motorola Mobility, shopping assistants will likely all soon be in an app for a hand-held smartphone that can help a consumer do their research right in your store, right while you're talking to them about the benefits of your extended warranties. Consumer Reports Says NoAlmost every advice column they read will be telling them not to buy extended warranties. One of the most notorious was published by Consumer Reports towards the end of 2006, which was augmented by an advertising campaign that placed the following full-page ad in newspapers such as USA Today:  The timing couldn't have been worse, coming a few weeks before the 2006 Christmas shopping season got under way. But in the years since, Consumer Reports has softened its blanket rejection just a bit, to allow that sometimes, for products such as Apple computers, home exercise equipment, and refrigerators with built-in icemakers, an extended warranty is a worthy investment. Consumer Reports is a reputable and respected publication. But think about what they aim to do for consumers. They research price and quality, and when they find a "best buy," they give it a special exalted status. Good products get brightly-colored moons and half-moons, and bad products get black circles. In essence, what they're telling us is to buy the best and we won't need repairs. And if we won't need repairs, we don't need extended warranties. Buying Junk with Great Coverage?We often wonder if there's value in the opposite advice: buy the worst and cheapest Chinese junk on the market, and cover it with the best extended warranty that money can buy. Then smile as every minor repair escalates to become a replacement because spare parts can't be found, or perhaps it becomes an upgrade to a more reliable brand (because the junk makers went out of business). Somewhere in the middle is a reasonable attitude. Given a product, the likelihood of its failure, and the cost of a repair, there is a price at which an extended warranty is both attractive to a consumer and profitable to its providers. Certainly, if the extended warranty was free, it would be attractive to consumers. But it would hardly be a profitable offering. If the contract's price were equal to the product's price, it would most likely be profitable, but it would hardly be attractive. Why not just buy two of everything instead, and throw out the first one to fail? Somewhere between 0% and 100% is the sweet spot, no doubt. We've suggested in the past that it's between 5% and 25%, or perhaps more specifically between 10% and 20% of the product's price. That's big enough to cover the risk yet small enough to be affordable. But there are other factors, specifically the likelihood of a product's failure, and the cost of its repair. Unfortunately, Consumer Reports is one of the very few entities that compile this kind of data and are willing to reveal it, and even then they don't reveal it in a way that would make it useful to anybody trying to evaluate an extended warranty offering. Striking BackAll along, top extended warranty administrators have disputed the Consumer Reports conclusions. Led by the Service Contract Industry Council, administrators struck back with their own full-page ad in USA Today a week later: Click on the image above to see the full-size ad

Even back in 2006, the magazine's own data was being used against it. In that original study, the magazine listed failure rates for seven different kinds of products, including laptop and desktop computers, refrigerators, washing machines, rider mowers, and lawn tractors, which suggested that more than one-in-four of these units were likely to require a repair between their third and fourth birthdays. The ad above notes in its text that the magazine's own data found that 23 out of 25 product categories showed failure rates above 10%. But even so, Consumer Reports concluded that the low cost of a repair still didn't make the high cost of an extended warranty economical. New Battle BeginsAmazingly, this battle isn't over, even five years later. Two weeks ago, NEW Customer Service Companies LLC (a major sponsor of this newsletter and a co-founder of the SCIC) launched yet another attack on the magazine's extended warranty advice, again using its own words against it in a press release that crossed the wires August 10. In the numbered list below, the bold text highlights excerpts taken from the August 2011 issue of Consumer Reports, while the plain text sections are the words of NEW's own media relations staff, taken from the press release.

But still, there seems to be a deeply-held belief by some that extended warranties are unnecessary. Even in products with well-documented reputations for unusually high failure rates, such as rear projection screen TVs and refrigerators that include built-in icemakers, they just can't be convinced. Like we said, take that extreme attitude -- buy the best and you'll never need repairs -- and turn it around: buy the worst junk and cover it well. Surely, the more prudent approach lies between these extremes. Selling Risk & Buying Service ContractsThere is nothing wrong with the concept of insuring a risk. If there's a 1-in-10 chance of failure, then there is a price at which a consumer is willing to sell that risk by buying an extended warranty. And there is a price at which an administrator and an underwriter believe they can make a living, even after paying to get all those failures fixed. It's no different than with life insurance or fire insurance. You don't hear consumer advocates pointing out how unlikely a house-destroying fire is, or how bad an investment a term life insurance policy is for a young and healthy person. You don't hear anyone suggesting that most people don't need health insurance. Well, think of extended warranties as health insurance for manufactured products. There is a risk, and there is a price assigned to that risk by highly-skilled actuaries, who factored in all the costs and probabilities. Or at least you hope they did, because if the price was set too low, the company won't be able to afford to cover claims. And if it was set too high, it would create an above-average rate of return that would attract competition. Oh yes, the C word. Despite what all the pundits and critics say, there is plenty of competition in the extended warranty industry. It's just not at the consumer level, however. By the time a consumer gets up to the cash register and is asked, "Do you want the extended warranty with that?" the only replies they can give are yes or no. There's a monopoly at the cash register. The competition is in the back office. No Competition on the Sales FloorOn the selling floor, there usually aren't different plans to choose between, from different administrators. However, a given retailer/dealer may decide to feature different plans for new vs. used cars, for PCs vs. home electronics, or for consumers who live close by vs. far away. But the point is, the seller chooses what to sell, and usually chooses just one company's plans. They don't allow the consumer to choose among several plans. The competition occurs behind the scenes, when the administrators make a sales call. If one administrator has high prices or low sales commissions, another administrator could offer a better deal to the retailer/dealer. And even for administrators, there is equally vigorous competition between underwriters for their business. It's less frequent, but administrators can and do change underwriters. And sometimes underwriters dump an administrator. If there's going to be any price gouging, it usually occurs at the seller-to-consumer level. Sometimes, the administrator allows the seller to add their own mark-up to the contract price, and the seller chooses to add 100% instead of a more reasonable 40% to 50%. Other times, the seller wants high commission rates, so the administrator has to set prices high. This brings us to the third reason for asking to read the contract before agreeing to purchase either the product or the extended warranty. Who does what and how? What will the administrator pay for, and what won't they pay for? The answers are all there in the contract. And those answers can help explain the vast price difference between different extended warranties. For instance, who pays the postage or freight charges to send a broken product in for a repair? Who pays for its return? What if it needs to be reinstalled? What if it breaks again and again and again? If it's a carpet, is there an annual depreciation of the replacement value? If it's an appliance, what if it ruins clothing or spoils food as it's failing? Typical Cost of Service ContractsAlmost five years ago, another reporter asked your editor what extended warranties typically cost. The answer, based on dozens of measurements made on a shopping expedition, turned out to be anywhere from 1.2% to 35% of a camera's price in the case of one Canon model, and between 5.6% and 43% of the product's price in the case of a widely-available Panasonic flat screen TV model. The terms and conditions would detail all the policies and procedures that in turn help the administrator set the proper price for the contract. It would explain who makes the repair vs. replace decision, and when. It would explain whether the contract continues after a claim has been paid, or if it's deemed to be completed after a certain threshold is reached. It also would explain when coverage begins: on the date of purchase, after the manufacturer's warranty expires, or on some other date. All of these policies and procedures have a meaningful effect on the price of the contract. In cases where the consumer pays the freight in both directions, where the administrator is not responsible for reinstallation costs, where the cost of spoiled food is not covered, and where coverage doesn't even begin until the product warranty expires, a contract that's priced at 1.2% or 5.6% of the product's price begins to look like it's not much of a bargain. At the other extreme, there are providers that want 35% or even 43% of a product's price for their extended warranty plans. But those providers are usually willing to pay the tab to have the product picked up, returned, and reinstalled, or to have it repaired in the home, if appropriate. Some feature next-day replacements. And if the product has to be replaced after three or four unsuccessful repair attempts, the service contract still remains in force for the original amount of time. It isn't deemed complete or fulfilled merely because a replacement has been made or a cost threshold has been reached. Search for ExclusionsIn other words, you get what you pay for. And you know what you're going to get if you read the contract. It's all there, including the exclusions that people never seem to know existed until their claims are denied. Some are straightforward, like the rear screen projection TV service contract that didn't cover the cost of a new projection bulb -- the most expensive and most likely component to fail. Or it covered only one bulb replacement, and that replacement triggered the end of the contract. Some exclusions are even more insidious. Consider, if you will, the furniture stain service contract that specified in its terms and conditions that a report for each fabric stain must be called in within 48 hours. One consumer tried calling in one time to report two different stains that happened at different times. Not only was her claim denied, but her contract was canceled. The reason? The terms and conditions clearly stated that a stain in the singular must be called in within 48 hours. Failure to do so voided the policy. Another company -- a home warranty provider -- had a pairing of conditions in its contracts that effectively blocked all claims. In one place, the contract told the consumer to keep a careful record of all maintenance reports, or the contract was void. In another section, the contract said that nobody besides the home warranty company could touch the equipment. So if you had maintenance records to show them, they became written proof that somebody else had touched the equipment without their authorization. Claim denied. They can get away with these hidden gotchas because most consumers don't read the terms and conditions within a service contract until after they sign it. And even if they do read it, they may not get an oil change every six months or 3,000 miles, or they may not have their HVAC system cleaned and maintained twice a year. Unfamiliar NamesAnd even if they do get a sense of all the rules after a quick skimming of the contract, the names of the administrator and/or underwriter may not be familiar to them. Everyone's heard of Allstate. But who's American Heritage Insurance Services? Who's Pablo Creek Services Inc.? Therefore, what we're saying is that by the time you're ready to make your purchase, it's too late to stop and read the contract. You should have done that at home online or on an earlier visit to the store. The time for doing your extended warranty research is the same time that you're selecting your preferred brand and model and choosing which retailer/dealer to visit. That's when you Google "American Heritage Insurance Services" and see what others have said about them. And then you can make some decisions. The decision you'll have to make, however, is whether you're going to go to the dealer or to the retailer that offers the product you want. If you're unhappy with the choices they made regarding extended warranties, your best course of action is to shop elsewhere. But if you like the product, you like its price, and you like the terms and conditions of the extended warranties they offer, then you've found a winning combination. Go there and haggle a bit, just to make the salesmen feel like they're doing their job. It's real simple advice -- too simple, apparently, for the magazine editor who wanted to expose the alleged scams and reveal the supposed secrets of the extended warranty industry. The reporter's first draft was rejected. Asking to read the contract? It can't come down to consumers doing what they should have been doing all along. If it was that simple, who'd need a magazine's advice? Insane AdviceBy the way, there's one more benefit to making that request. If it's refused, in other words if the merchant wants you to sign a contract before you read it, or to read it only under pressure while they're rushing you at the cash register, then you have a good reason to take your business elsewhere. As Crazy Eddie used to say in the old days, those kinds of sales tactics are insane! | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||