Aerospace Warranty Expense Report:Because one major airframe manufacturer has now separated its warranty and extended warranty accounts, the aerospace industry totals and averages are in disarray. However, many OEMs and suppliers continue to cut their warranty costs, setting new record lows for their expense rates.

Despite an accounting change that upsets the totals and averages of the aerospace industry in a big way, we are still able to calculate some warranty expense totals and averages for the industry.

We began with a list of U.S.-based commercial aircraft manufacturers, such as Boeing Co., General Dynamics Corp., and Textron Inc. And then we added in all their U.S.-based suppliers, such as B/E Aerospace Inc., L-3 Technologies Inc., and Rockwell Collins Inc. But the list wasn't yet complete, because there were suppliers from other industries, such as Harris Corp., Honeywell International Inc., and United Technologies Corp., which also had a major presence in aerospace. So we added them into the mix as well.

In all, we ended up with a list of 100 companies: 10 aerospace OEMs, and 90 suppliers. For each of these companies, we collected four essential warranty metrics from their financial reports: the amount of claims paid, the amount of accruals made, the amount of warranty reserves held, and the amount of products sold. Using the latter metric, we developed two additional measurements: claims paid as a percentage of sales, and accruals made as a percentage of sales.

We have repeated this process four times a year for the past 14 years, so in all we have 56 sets of measurements and calculations, from 2003 to 2016. However, some companies such as Honeywell and B/E Aerospace report their warranty expenses only once a year, so we've extrapolated their annual totals and averages over the four quarters of each year.

Incomplete Picture

This is the core of the U.S.-based commercial aerospace industry. But it doesn't include internationally-based companies such as Airbus Group NV, Bombardier Inc., Dassault Aviation Group, or Embraer SA. We'll get to them later in the year when their annual reports become available. And it also doesn't include the top combat aircraft manufacturers, which don't issue warranties to their military customers in the same way as do commercial aircraft makers.

In Figure 1, we're totaling the industry claims payments for each of the past 14 years. Note that this will not exactly correspond with the industry totals included in the April 23 report, because here we're borrowing a handful of companies such as United Technologies from other industries.

Figure 1

Aerospace Warranties

Claims Paid Worldwide by U.S.-based Manufacturers

(in US$ millions, 2003-2016)

The most striking aspect of the industry data is the dramatic decline in claims payments by the aerospace OEMs seen in the past two years. Claims plummeted by $235 million last year, following a $138 million decline from 2014 to 2015. And the 2016 claims total was the OEMs' lowest amount in more than a decade.

There was lots of good news in the numbers. Boeing paid out $14 million less in 2016 than it did in 2015. General Dynamics, the owners of Gulfstream Aerospace, reduced its annual claims total by $29 million. But the biggest news of all was Textron's massive claims reduction, from $323 million in 2014 to $237 million in 2015 and then $70 million in 2016.

Textron's Accounting Change

It could have been an amazing story for the manufacturer of Cessna and Hawker airplanes and Bell helicopters, but it turns out to be just an accounting change. From 2003 until the third quarter of 2015, Textron counted the spending on both its limited warranty program and its product maintenance program together. But then, beginning with the fourth quarter of 2015, and continuing through the four quarters of 2016, the company partitioned the two and reported them separately.

Here's a glimpse at the warranty section of Textron's financial report for the quarter ended October 3, 2015. It identifies claims payments as settlements, and accruals as provisions. And it compares the totals for each to the corresponding nine months of 2014.

Note that the company explains how the totals are for both its limited warranty and product maintenance programs. The latter is what would be called an extended warranty program in the consumer space, consisting of an optional service contract, sold separately from the product. Revenue from the sale of a product maintenance contract is initially deferred, and is then recognized gradually over the life of the contract. Its expenses are not normally disclosed to the public. And for most companies, it's accounted for separately from the limited warranty program, although some truck manufacturers and Dell Inc. from the computer industry have also bundled them together.

Textron did so until October 2015. However, this methodology changed in the company's annual report for the year ended January 2, 2016. In the table below, spending is detailed for the limited warranty program only. Spending on the product maintenance program is no longer disclosed, either together or separately.

We know that back in 2014, Textron reported $323 million in claims payments and $334 million in accruals. In 2013, it reported $293 million in claims and $299 million in accruals. So now we know that the vast majority of those amounts was from the extended warranty program, not the limited warranty program. And now we know that the limited warranty program settled only $60 million in claims in 2013 and $71 million in 2014. So that means the company's extended warranty program was roughly four times larger than its product warranty program.

The question is, what should we do about the last quarter of 2015 and the entire year of 2016? Figure 1 includes the data as originally reported, with no retroactive adjustments to remove the extended warranty spending from the years 2013-15. If we did that, then the data for 2003 to 2012 would still be inflated by the inclusion of Textron's extended warranty expenses. And there would still be a massive drop in the OEM totals, but it would happen in 2012-13 instead of 2015-16.

Is there a better way? We try not to include estimates or guesses or retroactive adjustments, unless absolutely necessary. For instance, when a company sells off a division with high warranty costs, it might adjust its past-year warranty expense data so that it looks like it never owned the division. But the money was spent, and the totals were reported.

What we can say is that Textron did reduce its limited warranty expenses a bit in 2016. Claims fell from $72 million to $70 million. But accruals, or provisions, rose slightly from $78 million in 2015 to $79 million in 2016.

Warranty Accruals

Figure 2 suffers from the same problem as Figure 1. It shows a massive decline in OEM warranty accruals made from 2014 to 2016. And once again, it's caused primarily by Textron's accounting changes.

On the other side of the industry, accruals by the 90 aerospace suppliers actually rose by $60 million in 2016, after registering their lowest annual total in 2015. Large declines in accruals were reported by United Technologies and L-3 Technologies, but large increases were reported by FLIR Systems Inc. and Honeywell, among others. On balance, the increases prevailed.

Figure 2

Aerospace Warranties

Accruals Made Worldwide by U.S.-based Manufacturers

(in US$ millions, 2003-2016)

On the OEM side, there were also some notable reductions in accruals. Boeing cut its annual accrual total from $421 million in 2015 to $356 million in 2016. General Dynamics cut its accruals from $158 million to $140 million. But both improvements were vastly overshadowed by Textron's accounting change.

OEM Warranty Expense Rates

The problem also extends into the data for claims and accrual rates detailed in Figure 3. When Textron removed its extended warranty data from its totals, its claims rate dropped from roughly two-and-a-half percent to roughly half a percent. And that drove the industry averages down as well.

In Figure 3, we can see the claims and accrual rates for the OEMs take a dive in the fourth quarter of 2015, when Textron first made the change. Notably, both rates continue to decline, hitting their lowest-ever levels by the end of 2016. And that's five quarters after Textron made the change, so the year-ago comparisons are now taking it into account.

Figure 3

Aerospace OEMs

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2016)

Boeing's claims and accrual rates remained about the same, as did Textron's, after the accounting change. The big change came from General Dynamics, which reduced its claims rate from 1.7% in 2015 to 1.1% in 2016, and also cut its accrual rate by half a percent to 1.7%. This is one of the reasons the company made it into two of the "good" charts in the top 10 lists of the March 16 newsletter.

Supplier Warranty Expense Rates

On the supplier side, Honeywell was the only aerospace company to make it onto any of the "bad" top 10 lists, for its accrual rate increasing from 0.7% in 2015 to 1.0% in 2016. And L-3 Technologies was the only supplier to make it onto any of the "good" lists, for its accrual rate reduction from 1.1% in 2015 to 0.8% in 2016.

United Technologies managed to reduce its accruals by $45 million in 2016, but because of its massive size, that cut its accrual rate by only 0.1%, to 0.6%. And as external observers looking at just the company-wide totals, we can't be sure if that improvement came from air conditioners, elevators, or aerospace manufacturing.

On balance, however, warranty expense rates for the entire group of 90 suppliers rose in 2016, as can be seen in Figure 4. Their year-end accrual rate rose from 0.7% at the end of 2015 to 0.8% at the end of 2016, while their average claims rate rose by just a bit. Expense rates were significantly higher during the first quarter of 2016, however, because of increases at Honeywell, B/E Aerospace, and FLIR Systems, among others.

Figure 4

Aerospace Suppliers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2016)

The long-term trend still looks good, however. For aerospace suppliers, warranty expense rates were highest in 2003 and 2004. They were lowest a decade later. And while 2016 saw their average expense rates climb a bit, they're still well below their 2011 levels.

By the way, if we go back and revise all of Textron's 2013-15 data to remove all the product maintenance program spending from the totals, it would drop the industry averages by about 0.3% for the 11 quarters between the beginning of 2013 and the end of 2015. Therefore, if we were to redraw Figure 3 with that revised data, it would look like there was a spike in the industry's accrual rate at the end of 2012, followed by a massive decline in early 2013, and then a more gradual decline from 2013 to 2016.

In other words, there has been a genuine and constant decline in aerospace OEM expense rates from 2013 to 2016. The Textron accounting change makes it look more dramatic. But it's real nonetheless. Readers who would like to see both the original and the revised charts should send a message to the editor.

Warranty Reserves

Finally, we want to take a look at the amount of money reported to be in the warranty reserve funds of the 10 OEMs and 90 suppliers that we're tracking in the aerospace industry. Here, the Textron effect is less pronounced. If you look back to the before-and-after warranty tables from the company's financial reports, you'll see why.

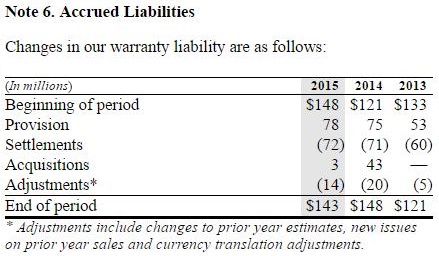

While the amount of claims and accruals Textron was reporting from 2003 to 2015 turned out to be about one-fifth from limited warranties and four-fifths from product maintenance contracts, its reserves turn out to be more evenly split. At the end of 2013, Textron reported $223 million in reserves for its combined warranty and product maintenance programs, rising to $281 by the end of 2014. But in the retroactive revisions taken from the 2015 annual report, which is detailed above, the new balances are $133 million and $121 million, respectively.

At the end of the third quarter of 2015, Textron reported $265 million in warranty reserves. At the end of the fourth quarter, that total dropped to $148 million. In other words, unlike with either claims or accruals, more than half the reserves were apparently for limited warranty. And the removal of the product maintenance portion from the totals probably took away $115 to $120 million.

So if we keep this in mind while we look at Figure 5, we can safely assume that most of the 2014-to-2015 drop in OEM reserves came from Textron's restatement. But none of the $94 million drop in reserves from 2015 to 2016 can be attributed to that accounting change.

Figure 5

Aerospace Warranties

Reserves Held Worldwide by U.S.-based Manufacturers

(in US$ millions, 2003-2016)

Boeing, for instance, reduced its warranty reserve balance by $71 million. Even Textron, when comparing apples-to-apples, reduced its reserves by $5 million from 2015 to 2016. But there were increases for General Dynamics, Raytheon, and a few others.

On the supplier side, the biggest reduction in reserves was reported by United Technologies. But its $13 million reduction doesn't look like much when compared to the company's $1.2 billion total balance. Yes, that means United Technologies counts for more than half of all the suppliers' reserves. And that's why we couldn't leave them out, just because they also issue warranties for air conditioners and elevators.

More impressive, on a relative basis, were Harris's $5.0 million reduction in reserves (to a $29 million balance) or Curtiss-Wright's $3.3 million reduction (to an $11.8 million balance). On the flip side, Honeywell increased its reserves by $71 million to $487 million, while B/E Aerospace added $11 million to its reserve fund, bringing its total balance up to $111 million. L-3 Technologies raised its reserves by $4 million to $109 million, while Rockwell Collins reduced its reserves by $3 million to $84 million.

All told, the OEMs reduced their reserves by $94 million while the suppliers reduced their reserves by $54 million. And for the suppliers, at least, it was the second straight year of reserve fund balance reductions, following an $8 million decline from 2014 to 2015.

Industry Comparisons

Compared to the automotive industry, warranty expenses in the aerospace industry seem to be more balanced between OEMs and suppliers. Or, to put it another way, inefficient supplier recovery efforts are less of an issue in the aerospace industry.

There are numerous reasons why this is the case. First, in the aerospace industry, claims and accruals are more evenly distributed between the two groups. While in the automotive industry the OEMs account for close to 90% of the claims and accruals, in the aerospace industry the suppliers actually account for almost two-thirds of the overall total.

Second, the warranty expense rates of the two groups are also closer together. In the automotive industry, the OEMs spend two to three percent of their sales revenue on warranty expenses. In the aerospace industry, the OEMs are closer to one percent. In the automotive industry, the suppliers are well below one percent. In the aerospace industry, they used to be above one percent but now they're a bit below that level.

Finally, in the automotive industry, at the end of 2016, the gap between the average warranty expense rates of the OEMs and their suppliers stood at somewhere between 1.1% and 2.2%, depending on whether you're measuring the gap between cars or trucks on the one hand, and powertrain suppliers or other suppliers on the other hand (see the March 30 newsletter for more details). In the aerospace industry, at the end of 2016 the gap was 0.2% to 0.3%, and thanks to Textron, the suppliers were higher!

There may be a very good reason for this difference. It's in the nature of how warranties are issued by each industry. With passenger cars, OEMs such as Ford and GM issue a "bumper-to-bumper" warranty to the vehicle buyer. And then when claims are paid, they make their best attempt to collect from their suppliers, if they're to blame.

However, with airplanes and helicopters, each manufacturer issues their own warranty to the buyer. Boeing doesn't issue a "nose-to-tail" warranty for everything on board. So if there's a problem with the cabin interior, B/E Aerospace pays the claim. If there's a problem with the avionics, Rockwell Collins pays the claim. And so on.

This is the way it's done with trucks, buses, and recreational vehicles. And that may explain why there was so small a gap between the warranty expense rates of truck OEMs such as Paccar Inc. and Oshkosh Corp. on the one hand and truck powertrain suppliers such as Cummins Inc. and Allison Transmission on the other hand. Each company issues its own warranties to the customer, and that's more efficient with less friction and fewer disputes.

With warranty expense statistics for 14 more industries in hand, we will have at least two more opportunities to look at the gap between OEMs and their suppliers: in the electronics sector, and in the building trades. But as with cars and planes, we will have to make some allowance for imports whose expenses are not part of the mix, and for private companies that don't report their warranty expenses at all.

|