Mobile Home Warranty Expenses:While much of the industry collapsed a decade ago, the five large manufacturers that remained in business have made a steady comeback. Last year, claims and accruals finally surpassed their pre-recession peaks, even while most of the remaining manufacturers have been able to keep those expenses steady as a percentage of sales.

As the tenth anniversary of the financial panic of 2008 approaches next month, we thought it time to take a look back at how warranty expenses virtually collapsed in one of the hardest-hit industry sectors, mobile homes.

The panic began with the homebuilders and their mortgage lenders, and quickly spread to the automakers and their finance companies, catching mobile homes in the middle. Home sales fell. Car sales fell. But mobile home sales really plummeted, in some cases by 50% or more, and most of the top manufacturers went out of business by the end of 2009.

Adding insult to injury, when those manufacturers went out of business, dealers were left with inventory whose warranties were no longer valid. In response, some actually began buying vehicle service contracts for the leftover units and giving them away with the unit as a deal sweetener. The automakers and their lenders were bailed out by the government. But the mobile home companies were liquidated and their remaining assets sold off to the highest bidders.

Industry Recovery

It took a while, but eventually new home sales recovered, and new car sales actually set a new sales record. And now, a decade later, we are happy to report that the recreational vehicle and mobile home industry also has recovered, at least in terms of warranty expenses.

According to the data we've been gathering since 2003, the amount of warranty claims reported by the top nameplates peaked in 2006 at $254 million. Warranty accruals peaked the year before, at a level of $270 million. By the time the financial panic began in September 2008, both warranty expense metrics were already in free fall. By 2009, claims were down to $68 million and accruals were down to $54 million.

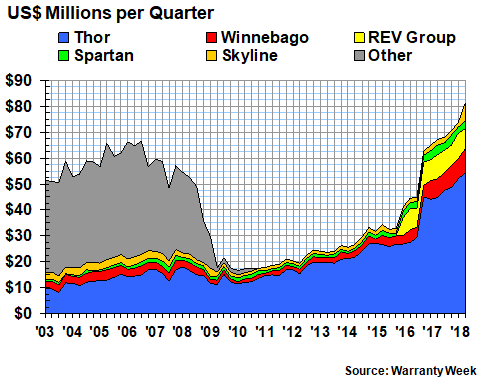

In Figure 1, we're tracking the warranty claims reported by a dozen of the top RV and mobile home manufacturers. Five of them are still with us, and seven are no longer in business (All American Group Inc., Featherlite Inc., Fleetwood Enterprises Inc., Kingsley Coach Inc., Monaco Coach Corp., National R.V. Holdings Inc., and Rexhall Industries Inc.). Those seven we've grouped together into the gray "other" category.

Figure 1

U.S. Recreational Vehicle Industry

Warranty Claims per Quarter

(in $ millions, 2003-2018)

It's immediately clear that the claims payments by "other" part of the industry dominated in the early years covered by the chart, but dwindled to nearly nothing as they each took their turns going out of business. The All American Group (also known as Coachmen Industries) went bankrupt and was acquired by a unit of Berkshire Hathaway that does not report its financials. Featherlite and Kingsley Coach went out of business and were also acquired by private companies. Fleetwood Enterprises and Monaco Coach were acquired by an entity that eventually went public under the name REV Group Inc.

The REV Group did not begin reporting its warranty expenses until 2016. From 2009 to 2013, Monaco Coach was actually part of Navistar International. Other RV and motor home brands now included under the REV Group heading include Holiday Rambler, American Coach, Midwest Automotive Designs, Renegade, and Lance. The company has also acquired companies manufacturing buses, ambulances, and fire engines. It is now the third-largest warranty provider on this list, after Thor Industries Inc. and Winnebago Industries Inc.

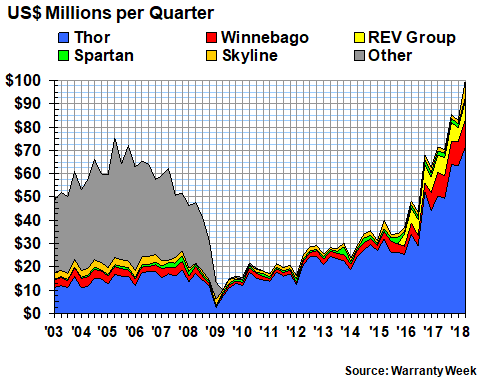

Warranty Accrual Totals

Much the same pattern can be seen with warranty accruals, as detailed in Figure 2. The quarterly peak for accruals came early in 2005, about a year before the peak in claims, as would be expected. When a company sells an RV or mobile home, it immediately sets aside an amount of accruals it believes is sufficient to pay for all the warranty work it requires. And then the actual claims are paid a year or two later. So if sales plummet, accruals will drop first, and the drop in claims will lag behind.

Figure 2

U.S. Recreational Vehicle Industry

Warranty Accruals per Quarter

(in $ millions, 2003-2018)

The good news, if warranty expenses can ever be seen as a positive indicator, is that the quarterly amounts of claims paid and accruals made finally set new records last year. In the quarter ended June 30, 2018, they rose to new heights: $81 million for claims and $99 million for accruals. Normally we wouldn't celebrate a record-setting level of expenses, but in this case it's a proxy for new unit sales, which have also reached new heights.

Thor Industries

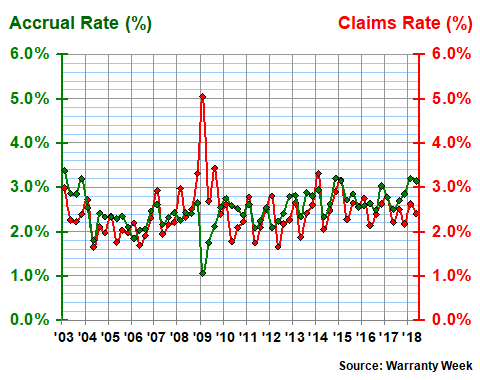

The actual warranty expense levels of the five companies we're tracking have not changed very much, with some exceptions. For instance, in Figure 3 we can see that the claims and accrual rates for Thor Industries have both remained close to an average of 2.5% since 2010.

Figure 3

Thor Industries Inc.

Warranty Claims & Accrual Rates

(percentage of sales, 2003-2018)

That spike in the company's claims rate in 2009 was caused not so much by rising claims payments as it was by falling revenue. And since the claims rate is calculated by dividing claims paid by sales made, the percentage rate soared past five percent because sales were so small. The accrual rate also fell at the time, probably as the company over-compensated for the sales decline. By the end of 2009, both metrics were back around 2.5%.

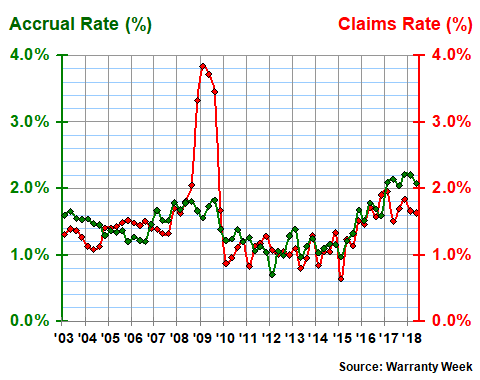

Winnebago Industries

Winnebago, now the second-largest warranty provider in the industry, also saw a 2009 spike in its claims rate, as sales fell to new lows. But unlike Thor Industries, it maintained a steady ratio between accruals and sales during the recession, keeping its accrual rate close to 1.7% for most of 2009.

But then right at the end of 2009, Winnebago cut its accrual rate to 1.4%, and took it lower over the course of the next six years. But then its claims rate began to rise, and so it had to increase its accrual rate to pay for the increased cost. Bu 2017, Winnebago's accrual rate was above two percent, where it has remained for six quarters and counting.

Figure 4

Winnebago Industries Inc.

Warranty Claims & Accrual Rates

(percentage of sales, 2003-2018)

Long term, Winnebago's claims and accrual rates have averaged out to 1.5%. Obviously they're above that level now, having crossed the line in 2015. However, for the past six quarters the rates have at least remained fairly stable, though at a higher average level.

REV Group

Allied Specialty Vehicles was formed through acquisitions in 2010, and changed its name to the REV Group in 2015. It has acquired additional units from Thor and Spartan Motors. But its biggest acquisition was the 2013 purchase of Navistar's RV assets, which included the Monaco nameplate.

Although the common stock of the REV Group did not begin trading publicly until January 2017, the company released claims and accrual data for 2016 in the run-up to that initial public offering. Still that means we have only 10 quarters of warranty expense data for the company, which we've compared to revenue in Figure 5 below.

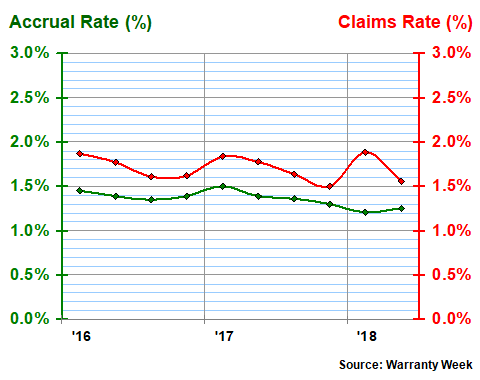

Figure 5

Rev Group Inc.

Warranty Claims & Accrual Rates

(percentage of sales, 2003-2018)

Note that the REV Group's claims and accrual rates have remained very close to their 1.5% average for all of the past 2-1/2 years. In the first half of 2018, its accrual rate dropped as low as 1.2%, while its claims rate rose as high as 1.9%. But it remains the least variable of the five companies we're tracking, with a standard deviation of only 0.2% over ten quarters.

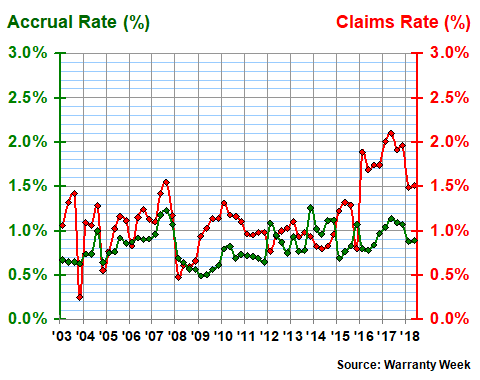

Spartan Motors

In contrast, Spartan Motors has seen its claims rate rise and remain elevated for the past ten quarters, as can be seen in Figure 6. From 2003 until 2015, the company's claims and accrual rates averaged out to only 0.9%. But since the start of 2016, they have averaged half a percentage point higher. In addition, the standard deviation, which measures volatility, has nearly doubled from 0.24% before 2016 to 0.47% afterwards.

Figure 6

Spartan Motors Inc.

Warranty Claims & Accrual Rates

(percentage of sales, 2003-2018)

Finally, we have Skyline Corp., which only recently merged with Champion Home Builders and has subsequently renamed itself Skyline Champion Corp. The company manufacturers both recreational vehicles and modular homes -- the difference being the mobility of the finished product.

To vastly oversimplify the difference, RVs are assembled and then driven someplace (or towed someplace, in the case of travel trailers, fifth wheels, and pop-up campers), while modular homes are driven someplace in large pieces and then the sections are assembled into the finished product. But there are no tires, hitches or steering wheels on the finished modular homes, and they are not designed to be transported to another site after that initial build is complete.

Vehicles vs. Modules

In that respect, Skyline is something of a hybrid company. Companies such as REV Group that make a combination of RVs, buses, and fire engines are basically making numerous kinds of large vehicles. But modular homes are not vehicles. They're more like site-built homes, except the pieces are more complete when they arrive at the building site.

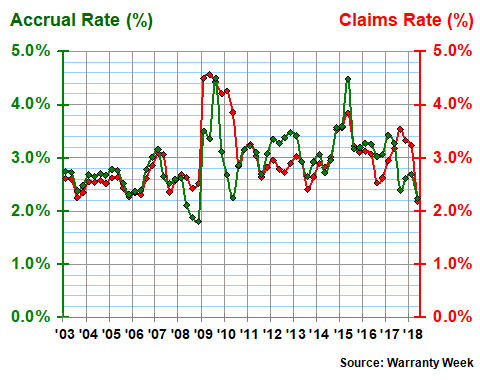

The reason we mention this is because the warranty expense rates detailed for Skyline in Figure 7 are higher than even Thor's claims and accrual rates. For this particular hybrid company, claims have averaged 3.0% of revenue since 2003, while accruals have averaged 2.9% over the same period. In other words, its mixed product line has generated historically higher rates of warranty expense than the primarily vehicle-based product lines of the others detailed in the charts above.

Figure 7

Skyline Corp.

Warranty Claims & Accrual Rates

(percentage of sales, 2003-2018)

As Warranty Week was going to press today, Skyline Champion published its first financial report as a unified company, covering the months of April, May, and June. And the warranty expense figures that it contains were something of a surprise. With the addition of the warranty expenses of Champion Home Builders, claims paid by the entire company during the second quarter more than tripled to $7.0 million, while accruals more than quadrupled to $7.2 million, compared to the same three months a year before.

However, revenue also soared as Champion was added to the totals, with the result being that both the company's claims and accrual rates fell to 2.2%, the lowest either of them have been in a decade. So forget that part about modular site-built homes generating proportionally more warranty expense than vehicle-based homes. In this case, the additional modular home product lines actually reduced the averages for the entire company. And that's a happy ending.

|