Nine-Month Auto Warranty Report:Though the headlines warn of layoffs, neither the sales nor the warranty expense data of the industry suggest any sort of imminent slowdown. On the contrary, many truck, car, powertrain, and automotive parts manufacturers are cutting warranty costs while enjoying rising sales.

Back in 2007 and 2008, the onset of the recession was heralded by rising interest rates, increasing layoffs, and decreasing sales. Among manufacturers, the real estate and automotive industries were affected first and hit hardest, as is plain to see when looking back on the data a decade later.

But what if we knew what to look for, and what if we looked for it now? After all, interest rates are now once again rising, and several high-profile layoffs have been announced recently by top car manufacturers. What if we knew the early warning signs of a recession and checked the latest data to see if we're once again on the brink?

It never happens the same way twice, however. We might be looking for a slowdown in new home sales or new car sales, but instead next time it's caused by upwardly spiraling prices or foreign currency chaos. Or maybe it's set off by some other so-called "black swan" event such as an oil embargo, sanctions, trade wars, real wars, government collapses, or some other unexpected factor. The point is, just because the last recession was predictable more than a year in advance doesn't mean the next one will be.

Search for Clues

In our search for trends in the automotive industry, we began the process by gathering the warranty metrics of 50 vehicle manufacturers and 120 of their suppliers, all of them based in the U.S. We collected figures for warranty claims paid, accruals made, reserves held, and product sales, as listed in the footnotes of each company's financial statements. And then, using the claims, accrual, and sales data, we calculated the claims rate and accrual rate, as a percentage of sales.

For this week's newsletter, we divided the 50 vehicle makers into two groups: 24 that manufacture passenger cars, motorcycles, and other small vehicles, and 26 that make trucks, buses, RVs, and other large vehicles. And for the 120 automotive suppliers, we divided them into two groups as well: 27 that manufacture primarily drivetrain components such as engines and transmissions, and 93 that manufacture other parts and components.

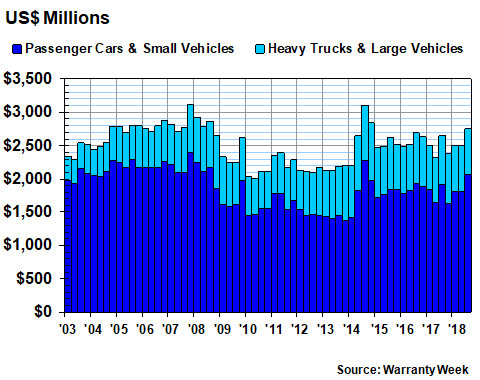

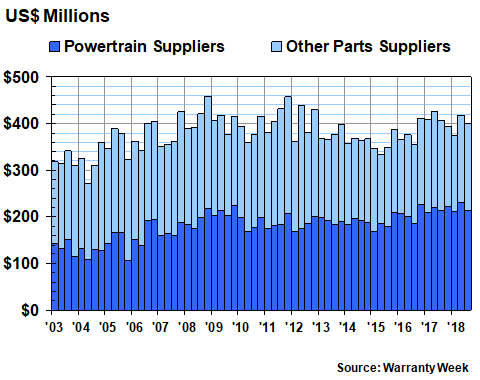

In Figure 1, we're looking at the claims payments of the vehicle makers over the past 63 quarters, from the start of 2003 until the third quarter of 2018. Nothing looks out of the ordinary. During the months of July, August, and September, the car manufacturers paid out the most since the recall-heavy year of 2014. Truck manufacturers paid about the same as usual.

Figure 1

Automotive OEM Warranties

Claims Paid Worldwide by U.S.-based Manufacturers

(in US$ millions, 2003-2018)

For the first nine months of 2018, the small vehicle manufacturers spent $5.67 billion on claims, up around $259 million or 5% from the same period in 2017. Large vehicle manufacturers paid out $2.09 billion, up around $33 million or 2% from 2017 levels. Once again, nothing seems out of the ordinary.

Probing a little deeper, we see that General Motors Co. has paid $295 million less in claims so far this year, compared to the first nine months of 2017. Ford Motor Co., however, has paid out $511 million more, and Tesla Inc. saw its claims cost rise by $60 million (a 69% increase!). Polaris Industries Inc., recovering after a rough 2017, saw its claims cost fall by 14%. Harley-Davidson Inc. cut its claims cost by around 5%.

Warranty Accruals

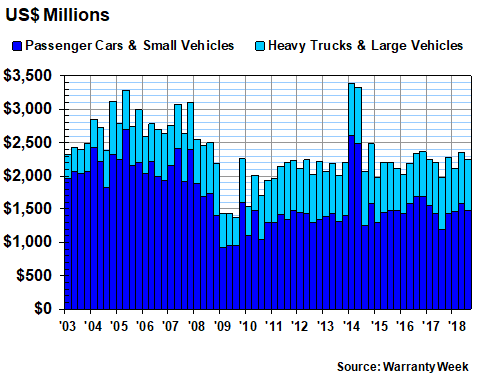

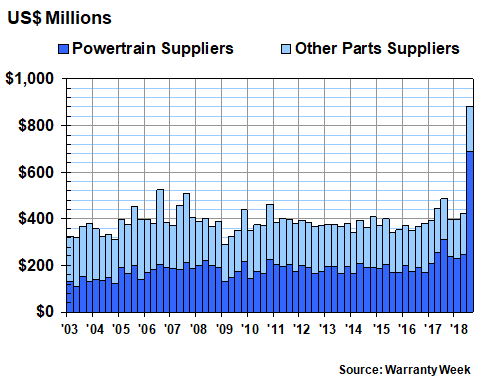

In Figure 2 we're counting up the accruals of the vehicle manufacturers. The 2014 recall-related spike is even more prominent, because at that time, General Motors Co. set aside a huge amount of accruals all at once, and then gradually spent it on claims over several subsequent quarters. But once again, there's nothing remarkable about the most recent data.

Figure 2

Automotive OEM Warranties

Accruals Made Worldwide by U.S.-based Manufacturers

(in US$ millions, 2003-2018)

In the first nine months of 2018, the small vehicle manufacturers made about $4.55 billion worth of warranty accruals, up about $351 million or 8% from the same period in 2017. In contrast, the large vehicle manufacturers made about $2.17 billion worth of accruals, down around $62 million or 3% from 2017 levels.

Caterpillar Inc. was the large vehicle manufacturer that cut its accruals the most, reducing its total for the first three quarters from $749 million in 2017 to $556 million in 2018. Both Deere & Co. and Oshkosh Corp. reduced their accruals modestly, while both Rev Group Inc. and Astec Industries Inc. cut their accrual totals by about 15% apiece.

Among the large vehicle companies increasing their accruals the most, Paccar Inc. raised its accruals by $68 million, and Thor Industries Inc. raised its accruals by $52 million. Winnebago Industries Inc. raised its accruals by 17%. Terex Corp. raised its accruals by 25%. AGCO Corp. raised its accruals by 8%.

Navistar International Corp., meanwhile, raised its accruals by $2 million, or 1.5%. Meanwhile, its claims cost is plunging. During the fiscal period covering the months of May, June, and July, which we're mapping into the third calendar quarter of 2018, Navistar paid only $71 million in claims -- its lowest quarterly claims cost since way back in 2005.

Warranty Expense Rates

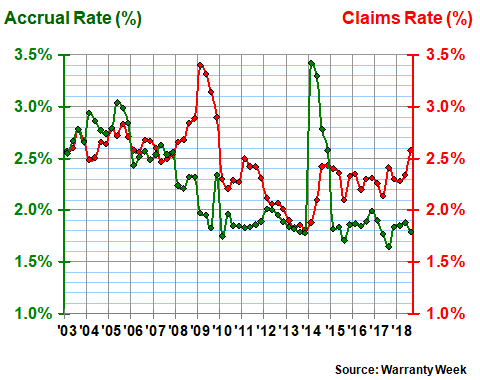

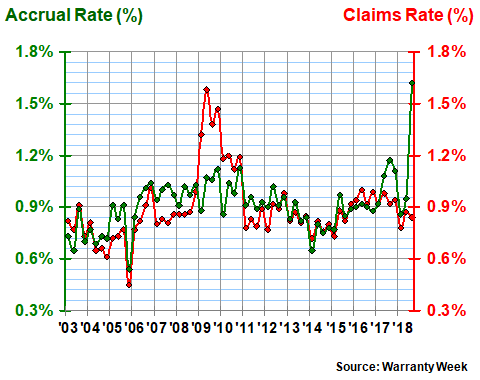

The true test of whether or not a recession has begun would be seen in the sales totals. And so, in Figures 3 and 4, we're comparing claims and accrual totals to the corresponding product sales totals, to calculate a pair of percentage rates.

The claims rate is in red and the accrual rate is in green. As can be seen in Figure 3, the claims rate spikes during a recession, while the accrual rate spikes during a period of elevated recalls. Whether or not another spike has begun is in the eye of the beholder.

The small vehicle manufacturers saw their claims rate rise to 2.6% in the third quarter, their highest average level since the recessionary year of 2009. However, that latest reading was up only a quarter of a percentage point from the second quarter's, and was only about two-tenths of a percentage point above the group's long-term average. So the word spike may be a bit too severe a description for this upturn. But time will tell.

Figure 3

Passenger Car & Small Vehicle Makers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

The long-term claims rate for the small vehicle makers is 2.4%, with a standard deviation of 0.33%. Their average accrual rate over the past 63 quarters has been 2.2%, with a standard deviation of 0.46%.

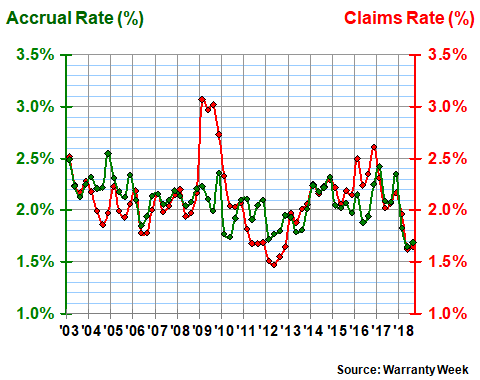

Truck Warranty Expense Rates

For large vehicle makers, the average claims and accrual rates have both been around 2.1% over the long term. The standard deviation for their claims rate is 0.19%, while the standard deviation for their accrual rate has been 0.16%. As can be seen in Figure 4, they also suffered from the recessionary spike in 2009. But as a group, despite the problems of Navistar, they have not seen their accrual rate spike to unusually high levels.

What's notable about the chart below is how their warranty expense rates declined so far below those average levels in 2018. Both their claims and accrual rates dove below 1.7% in the second and third quarters of 2018, the lowest-ever level for their accrual rate and the lowest average claims rate since 2012.

Figure 4

Heavy Truck & Large Vehicle Makers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

That decline in expense rates can be seen all around the large vehicle industry. Both Deere and Cat cut their claims rate by 0.6% and their accrual rate by one percent. Navistar cut its claims rate by 1.6% and its accrual rate by 0.3%.

Among the recreational vehicle makers, Thor and Winnebago saw their expense rates rise modestly, while Rev Group Inc. and Spartan Motors Inc. were down modestly. All four reported healthy sales gains too, which is exactly the opposite of what was happening to that corner of the industry back in in 2007 and 2008.

For the large vehicle makers as a group, product sales were up 21% in the most recent quarter. For the small vehicle manufacturers as a group, product sales were up a more modest 6%.

For the individual companies, sales declines were hard to find. In contrast, sales increases were plentiful, and some were spectacular. Tesla saw a 183% sales increase. Deere saw a 36% increase. For the first nine months of 2018, both Cat and Paccar are up around 25%. The sales growth rates at AGCO, Navistar, Oshkosh, Terex, and Thor are all in the teens.

Auto Parts Suppliers

Meanwhile, on the other side of the automotive industry, the suppliers are also humming along. As a group of 120 companies, their sales are up half a percentage point compared to last year, which is admittedly meager, but still positive. In Figure 5, we can see that their claims cost is about the same as well.

Figure 5

Auto Parts Supplier Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2018)

In the third quarter of 2018, claims totals for both types of suppliers were virtually unchanged from year-ago levels. For the first nine months of 2018, the powertrain manufacturers saw claims payments rise by $9 million, or 1%, while the other parts suppliers saw a 10% drop.

Visteon Corp. saw a 38% decline in claims payments during the nine-month period. Dana Inc. saw a 13% decline. Cummins Inc. saw a 6% rise, as did Wabco Holdings Inc. Aptiv plc, the new name of what used to be called Delphi Automotive, saw its claims payments fall from $117 million to $43 million, a 63% decline. Westinghouse Air Brake Technologies Corp. saw its claims cost rise by 28%. In other words, while the overall totals didn't move much, for many of the largest companies in these groups the changes were somewhat large.

Accruals Surprise?

The biggest surprise we found in the whole exercise can be seen in Figure 6, in the third quarter total for the powertrain manufacturers. The culprit was Cummins, whose accrual total soared from $207 million in the third quarter of 2017 to $571 million in the third quarter of 2018. That in turn drove its accrual rate up from 3.0% a year ago to 4.5% in September 2018. The company said most of this spike was related to failed diesel engine emissions testing in California, which in turn will increase its engine replacement costs over the next few years.

Figure 6

Auto Parts Supplier Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2018)

That spike in Cummins' accruals also translated into a big jump in the group's average accrual rate, which soared from 1.2% at the end of September 2017 to 1.6% at the end of September 2018. But the truth is, as can be seen in the chart below, the group's accrual rate was also above its long-term 0.9% average for most of last year.

And as we mentioned with the vehicle makers, the onset of a recession is usually heralded by a spike in claims rates, not accrual rates. Accrual spikes are usually related to recalls, which in fact is what we're seeing here.

Figure 7

Powertrain Component Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

Notice also in the chart above that the powertrain companies suffered the same recessionary spike in their claims rate back in 2009 as did the vehicle manufacturers. However, there's little recent movement in their average claims rate, which is sticking close to its long-term 0.9% average level.

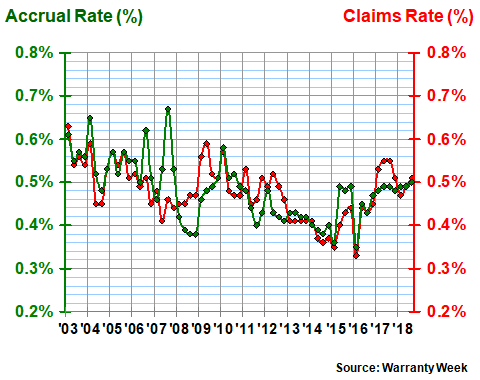

In Figure 8, we're charting the claims and accrual rates of the 93 other parts suppliers that we track. Once again, there's nothing remarkable to see. The group's long-term claims and accrual rates are both 0.5%, and that's almost exactly where they ended up in September 2018.

Figure 8

Other Auto Parts Suppliers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

Notice that there is no recessionary spike at all in this chart, as there were in Figures 3, 4 and 7. However, there's an unusual dip in early 2016, when everyone from Lear Corp. to Snap-on Inc. and Tenneco Inc. reported unusually low warranty expenses, all at the same time.

Predicting the future is always a perilous task. Ten years ago, as late as August 2008 most of the experts were saying the banks would eventually work themselves out of their difficulties. It wasn't until Lehman Brothers failed on Sept. 15, 2008 that the financial system seized up and people realized a recession was under way. And then the experts said retroactively that it actually began in late 2007.

Looking back, there were plenty of clues to be found even in the 2006 and 2007 data. But looking at the new home data in last week's newsletter and the automotive warranty data in this week's newsletter, there's little evidence of sales slowing or expenses increasing, except in some isolated cases related to product defects. That doesn't mean there won't be another panic, but it does mean there's nothing making such an event inevitable.

|