Warranty Software Acquisition:

Engineering wants to talk to warranty and so does manufacturing. And warranty needs user manuals and parts from them. No single company's software can make them all talk to each other, not even a CAD/CAM company like PTC. So it bought warranty software company 4CS to round out its product line.

Warranty management software has always been a tough business, with relatively small vendors facing off against relatively hesitant customers. It can take years to make a sale. And then once the customer realizes how interdependent the warranty process really is, it can take years to connect it all.

Anyone who can make a long-term career out of warranty management software sales has certainly earned their merit badge in entrepreneurship. We salute them all.

Last week, one of those Eagle Scouts was acquired by a much larger software company that was looking to round out its aftermarket product line. 4C Solutions Inc., of East Moline, Illinois, was acquired by PTC, the preferred name of what's formally known as the Parametric Technology Corporation. Price was not announced, nor were the terms of the acquisition as regards the timing or form of payment (stock or cash).

4C Solutions, of course, is one of the leading warranty management software companies, and since early 2005 has also been a leading sponsor of Warranty Week. So while it's somewhat difficult for us to remain impartial to this news, we'd probably be just as enthusiastic about it if it came from a company we didn't know as well.

Warranty Eagle Scout

We recently spoke with Ashok Kartham, the founder, president and chief executive officer of 4CS, about the acquisition. Kartham said he was also the majority shareholder of 4CS, and that there was one other shareholder, who also sold to PTC. The deal was completed on September 6.

Now Kartham, who entered the warranty business as a custom software developer 16 years ago, works for a great big public company (NASDAQ: PMTC). And as such, he said he could not discuss the selling price. But we believe the pricetag was in the neighborhood of $15 million.

Kartham also said he couldn't disclose revenue numbers for 4CS. But various outside estimates peg the company's size at $10 to $20 million; at $15 million; and even at $30 million per year. We're going to add our own revenue estimate of $16 to $17 million per year, but none of the people we spoke with were willing to confirm or deny any of those numbers.

4CS: A Profitable Company

Kartham said he was able to provide at least one financial metric. "We have been profitable for the last ten years, except for one year, since we started on the warranty side," he told Warranty Week. "Since 2003, once we introduced our [warranty management] product, we have been profitable."

That, we think, is what differentiates 4CS from most of its competitors. It grew organically, pouring its profits back into the business, and never needing to tap into outside investors. And in the process of growing from just one initial customer in the agricultural machinery business back in 1995, it virtually cornered the market for warranty management software in whatever you call that segment of the vehicle manufacturing industry -- heavy machinery, construction/agriculture equipment, trucks and buses, vocational vehicles, etc.

The company in this transaction that we didn't know much about was PTC. Luckily, before speaking with Kartham, we were given a quick quarter-century snapshot of PTC's history by Tom Sears, the senior director of product management in PTC's Arbortext Business Unit.

"Our roots are really in the engineering environment," Sears explained. Pro/Engineer, a parametric design, 3D modeling software package, was introduced just over 20 years ago. It represented a brand new approach to the way companies designed their products, he said.

PTC was incorporated in Massachusetts in 1985. In a very short time, it grew to be one of the top CAD/CAM software companies. Manufacturers of heavy equipment began to use it, as did several computer manufacturers and companies in the drivetrain sector of the automotive business. Among them: Caterpillar Inc., Deere & Co., CNH Global N.V., and Dell Inc.

History of Acquisitions

Ten years ago, PTC acquired a product line called Windchill, which moved it into the product lifecycle management arena. Among its innovations was the addition of capabilities that allowed OEMs to communicate and collaborate with their suppliers throughout the development process, Sears said.

Customers then began to ask PTC for help with their post-sales support activities, such as the creation of assembly instructions, service manuals, and parts catalogs. "In most companies, that's been disconnected from both the engineering and manufacturing environments," Sears said. "They said, 'We need better ways to create the information that needs to go along with the product to operate and support it."

So about five years ago, PTC made another acquisition, of an electronic publishing product line called Arbortext. It was named for its origins in Ann Arbor, Michigan, the city of trees, which marries well with the way the product is used by manufacturers to help save paper. For instance, the Arbortext IsoView module allows users to distribute technical illustrations and animations via the Internet. The Arbortext Interactive Electronic Technical Publications Viewer delivers technical data in a Web browser-based environment.

"We're moving away from publications," Sears said, "and actually allowing the OEMs to provide a database of information with an application where users can come in and graphically navigate their product." And because the data is online rather than in print, it's always as up-to-date as the engineering team cares to make it. With a tight connection between engineering and service, enhancements, optional equipment, and upgrades can be edited into the online user manuals, service bulletins and parts catalogs.

In 2008, Synapsis Technology was acquired, bringing environmental impact software into the PTC product line. In 2009, PTC acquired Relex Software Corp., a reliability engineering software company whose products provide system performance metrics and reliability data. And there were other acquisitions that brought in logistics support, modeling solutions, and medical equipment quality management software.

Push Me, Pull You

At that point, Sears said, PTC had a presence in engineering, in manufacturing, and in service. But it was basically always helping its customers push out information.

The next step was to help them pull information back in. Engineering wanted to know how people were using their products, and what design changes were needed in the next generation. Manufacturing wanted to know about defects, and how products were performing in the field. And the service organization wanted to know how to improve the serviceability of the product, and how to adjust the maintenance schedules in ways that would lower the cost of ownership.

"And that's where we got very interested in 4CS," Sears said. He said when he asked customers about the amount of visibility they had in terms of the performance of their products, they replied that they knew little outside of what they got back from the claims coming into their warranty management packages. And whose warranty management packages were in use by many heavy equipment and automotive manufacturers? The same answer kept coming back: 4CS iWarranty.

Sears said he went to the Warranty Chain Management Conference, and met some of the folks from 4CS. He began to realize that they had a lot of common customers. And ironically, because engineering and warranty were still so disconnected inside many shops, some of PTC's key contacts within those companies didn't even know they were common customers of both 4CS and PTC. But those who did know had lots of good things to say about 4CS.

Making Strategic Sense

Kartham said the conversations became more serious right after the conference in March. He wasn't specifically shopping the company, but he was open to something that made strategic sense. "We felt like we had reached a stage," he said, "where we were looking at how we could grow beyond where we are -- globally as well as fulfilling our vision for Service LifeCycle Management."

Going public isn't really an option in the current market. Venture capital or private equity could have been an option, but Kartham said he's always preferred to grow internally. "We feel like this is a lot better way of taking it to the next level," he said.

4CS started as a company doing custom programming for Deere & Co. back in 1995, and that project grew into the commercial launch of its iWarranty software in 2003. After that came additional customers such as Motor Coach Industries International Inc.; Takeuchi Manufacturing (U.S.) Ltd.; Mitsubishi Caterpillar Forklift America Inc.; Kubota Manufacturing of America Corp.; Mahindra USA Inc.; and Freightliner Inc., which is now a division of Daimler Trucks North America LLC.

Kawasaki Construction Machinery Corp. of America began using 4CS software in 2006. And then in 2007 bus manufacturers New Flyer Industries Inc. and Blue Bird Corp. signed on. Chain saw maker Blount International Inc. deployed 4CS iWarranty software in early 2007. Agricultural equipment manufacturer AGCO Corp. signed a deal with 4CS in 2008, as did Zenn Motor Company, makers of the Zero Emission No Noise electric vehicles.

In 2010, Coda Automotive, another maker of all-electric cars, and Dixie Chopper, a maker of fast little riding lawn mowers, both selected 4CS. And then Atlas Copco, the Swedish manufacturer of construction and mining equipment, signed up for iWarranty in April 2010. Customers announced so far this year include Azure Dynamics; Follett Ice; Home Warranty Inc.; Landmark Home Warranty; Ride-a-Way; Manitowoc Foodservice; Revent Inc.; and ZF Services North America.

Serving Additional Industries

From that list, it's pretty clear that the customer base has now begun to broaden from its heavy equipment roots to include some extended warranty and home warranty administrators, some food service equipment companies, and some consumer electronics companies. Unfortunately, there are several other well-known customers that are extremely reluctant to see their names in print, so they've never made it to the press release stage with 4CS.

Kartham noted that while 4CS was initially focused on product warranty, in the years since it has gradually added modules around that iWarranty core for extended warranty management, service parts sales, supplier recovery, fleet management, product registration, and service center operations. But how could a small company like 4CS bridge that divide between engineering, manufacturing, and service?

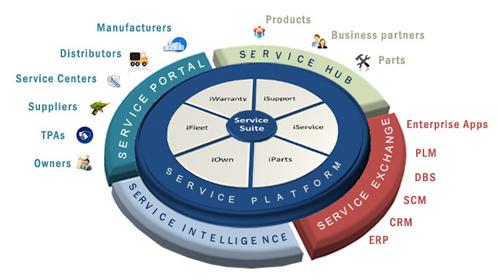

Here's a diagram of the 4CS wheel of Service LifeCycle Management. iWarranty the module is in the northwest of the wheel, and iParts is in the southeast. The names of the other modules are a bit hard to read, so click on the image to see a larger diagram. But notice in particular the alphabet soup of acronyms at the lower right: ERP, CRM, SCM, DBS, PLM. What's a small company to do?

Source: 4CS

So from Kartham's point of view, it was a case of PTC and 4CS both being at the right place, at the right time. Despite the vast difference in size, this is a strategic combination between two companies whose list of has/needs lined up so well.

"We felt like over the last 10 to 15 years, we built a very good product, and have a good customer base," Kartham said. "When we looked at the future -- the options on how we can take it to the next level, grow the customer base globally, and be able to fill in some of the pieces we also needed for Service LifeCycle Management (such as how to improve the profitability of service for our target customers) -- we felt like we needed a strategic partnership. This will enable us to grow faster, to reach more customers, and to fulfill our vision to provide a service solution to the customers."

Staying With PTC

Kartham said he intends to remain with PTC. Right now there are about 200 4CS employees worldwide, of which around 105 are in the U.S. Most of the rest are in Hyderabad or Pune City in India. All will be offered a place within PTC. Kartham said he himself will become PTC's vice president of product management, and will remain based in East Moline.

In Europe, reaction was similarly positive. David Jobling, the UK-based director of 4CS Europe, said he's very happy to become part of the PTC team. "For 4CS Europe, it's great news," he said. "And for me personally, it's also great news."

"Obviously, we've got a stronger backing now. PTC has already got a network of five offices in the UK, and they've got a very strong presence in Germany and France," Jobling said. And several 4CS customers are also using PTC software, so they're quite familiar with the new parent.

And of course, especially in Europe, end user companies prefer to deal with companies they know -- and companies that look like them. And whether 4CS is a $10 or a $30 million company, it's not a billion-dollar company, as is PTC.

PTC's total revenue in the year ended Sept. 30, 2010 was $1.01 billion, up from 2009's $938 million, but still a bit below 2008's $1.07 billion. About 30% is license revenue, about half is maintenance revenue, and the rest is consulting and training revenue.

Meanwhile, as a warranty management software company, 4CS competes with Tavant Technologies Inc., Entigo Corp., Ubiquiti Inc., Snap-on Business Solutions, ServicePower Technologies plc, Camstar Systems Inc., and to some extent with certain analytical solutions sold by IBM, SAS Institute Inc., and others. In contrast, PTC competes with SAP AG, Oracle Corp., Dassault Systemes SA, and Siemens AG, among others.

Global Reach

As of the end of its last fiscal year, PTC had 5,317 employees worldwide, including 1,914 in product development; 1,521 in customer support, training and consulting; 1,347 in sales and marketing; and 535 in general and administration. Of these, 1,956 were located in the U.S. and 3,361 were located elsewhere.

Beth Ambaruch, PTC's senior manager of corporate communications, said there has been quite a bit of growth in the past year, with total employment reaching 6,230 worldwide as of today, of which about 40% are based in the Americas; 36% in Asia, and the rest in Europe.

Sears said besides the PTC headquarters in Needham, Massachusetts and the Arbortext development office in Ann Arbor, Michigan, there are multiple PTC development offices across the U.S. as well as in the UK, Israel, China, and Germany.

"In a lot of these companies, we are the primary tool they use to develop their products," he said. "In that sense, they consider us a strategic partner, or a strategic supplier. And as we go in and talk to service organizations, the size of the company, and the fact that we are already a strategic aspect of their business, will surely be beneficial in the warranty space and in other parts of service.

"We basically see that most service organizations today are very fragmented," Sears added. "And they're looking to consolidate and link together the various aspects of their service environment, which is exactly what we're trying to do for them. And being a strategic part of their business already, we absolutely think we have a great opportunity."

Sears said the plan is to keep the 4CS product line and brand names more or less the same. There are no plans to change the names of the 4CS products, or to interrupt the development and upgrade plans 4CS already had for those products, he said.

"The product is going to continue to be offered," Sears stated. "What we see is there's a great synergy between this service information solution that we're building and the products from 4CS." For instance, there's likely to be some integration between Arbortext's ability to publish service information and an iWarranty user's need for that information. But even that sort of integration will take some time to accomplish.

Early Customer Reaction

Among a sampling of 4CS customers, reaction has been mostly positive. Among four customers contacted this week, three had already heard about the acquisition. Two of them were already PTC customers, and the third was at least familiar with the new parent.

Dan Collins, the director of global after-sales development in the Overseas Sales & Marketing Division of Guangxi LiuGong Machinery Company Ltd., China's largest construction equipment manufacturer, said LiuGong is coincidentally a customer of both 4CS and PTC.

"We're quite happy about it, because we have a long and deep relationship with PTC," he said. "We use all their Pro/E engineering software, and their Windchill database software."

Collins also said he likes the fact that PTC has a strong presence in China -- something 4CS didn't have. "So for our company, being headquartered in China, it makes us feel a lot more secure about our long-term future," he added.

As Collins detailed in an October 28, 2010 Warranty Week newsletter, LiuGong has embarked on a global project to implement the complete 4CS Service Suite. That includes not only the iWarranty module, but also the iSupport, iService, and iParts modules, among others.

But while 4CS has a presence in the U.S., India and the UK, it didn't have staff in China. "So this makes LiuGong feel a lot more comfortable," he said, "because as we add modules and get deeper into the product lifecycle business, it will be good to speak with local Chinese representatives."

Collins said the new warranty management system went global just a few months ago. "We have people online now all over the world, filing warranty claims," he said. "It's finally coming together. So we're happy. And they've been a good partner for us."

More Happy Customers

Other 4CS customers had similar reactions. A warranty manager at a heavy equipment manufacturer, whose company's policy discourages executives from being quoted directly, nevertheless said the staff was pleased to learn of the acquisition.

As with LiuGong, this company has been a customer of both 4CS and PTC for some time. So no introductions were necessary.

"Our engineering group currently uses PTC software, so this change expands PTC�s footprint within our company, and their support of our product lifecycle management. It�s a good thing," the manager added.

Ernie Lee, the manager of warranty administration at bus manufacturer Blue Bird Corp., said he thinks PTC is a well-established leader in the industry. "We are comfortable that we will continue to maintain the same level of service that we have enjoyed with 4CS," he added.

So what happens next? With a few other recent warranty management software mergers, after the initial euphoria wore off, the acquired company was virtually never heard from again. We suspect that the acquirer was under the impression that warranty management could somehow be shrink-wrapped and sold at Staples, next to QuickBooks and Business Plan Maker. They weren't prepared for years-long sales cycles, ever-expanding mission creep, and an incredible amount of customization per project.

Is PTC ready? We hope so. For it would be a tragedy to see a prominent and profitable specialty software package become a mere bullet point on some integrated software PowerPoint slide, or a spoke named warranty on yet another capabilities wheel.