Fourteenth Annual Product Warranty Report:

Warranty expenses are down but sales are up, which means a lot of companies have learned how to improve their warranty processes, increase quality, and reduce costs. But the cost reductions have become less steady in recent years, as if there's no more progress to be made. Is that the case? Or is this merely a pause before the next breakthroughs arise?

Now that most manufacturers have filed their annual reports, we can begin calculating the latest product warranty expense totals and averages for 2016. Ever since manufacturers began including warranty expense data in their financial reports 14 years ago, it has become possible to figure out how much is spent on warranties in every industry that issues them.

All the warranty expense data is harvested from the annual reports and quarterly financial statements of the companies, as filed with the U.S. Securities and Exchange Commission in the form of 10-K and 10-Q statements. From each statement, we extracted figures for claims paid, accruals made, warranty reserves held, and warranted products sold.

The latter metric is particularly important, because it usually isn't the same as total revenue. Companies make money from services sold, consumables sold, basic materials sold, interest, dividends, royalties, and many other non-hardware sources. In each case we tried to deduct these other sources of revenue, leaving us with just the revenue generated by products that come with warranties, though some companies are better at identifying their segments than others.

SEC Filing Deadlines

Most manufacturers file their annual reports for the calendar year in February, though some don't do so until March. In 2016, we gathered warranty expense data from about 450 companies, down significantly in numbers from years past. For instance, back in 2003 and 2004 we were tracking more than 800 warranty reporters. In those intervening years, numerous companies were acquired or went private, thus ending their duty to file reports with the SEC.

Some of the biggest warranty providers to leave us in 2016 were EMC Corp.; FMC Technologies Inc.; Jarden Corp.; Keurig Green Mountain Inc.; Lexmark International Inc.; Nortek Inc.; and Sirona Dental Systems Inc. Most were acquired by fellow warranty reporters, but some were acquired by foreign firms or by private investors, in which case there's no duty to continue reporting.

If their acquiring companies were also reporting companies, then their balances simply transferred over. If not, they dropped out of the statistics. For instance, Jarden's warranty reserves transferred over to Newell Brands Inc., which also now reports. But EMC transferred to Dell Inc., which does not report (it's private). And when the latter situation happens, sometimes it can do funny things to the industry totals, making it look like spending is down when actually it's just hidden.

Also, some companies do not end their fiscal years on December 31. When their fiscal years end on September 30 or June 30, we simply relabel their data to conform with the quarters of the calendar year. So Apple's fourth fiscal quarter is counted in the column for the third calendar quarter of each year.

When their years end on dates like October 2 or January 4, we shift them back by a few days to conform to the calendar quarter just ended. But when fiscal years end on dates such as October 31 or January 31, we count them as ending in the quarter that we were in the middle of. In other words, when HP Inc. ends its fiscal year on October 31, we count it as if it ended in the fourth quarter, on December 31, shifting the data forward by two months. That way, they're always early instead of always late.

Warranty Expense Totals

Equipped with all that explanation, we're ready to look at the warranty expense totals. We should note that strictly speaking, some of the companies included in these totals are no longer U.S.-based. Some moved to England or Ireland, or to Bermuda or the Cayman Islands. But we still count them here, because they still file Form 10-K and 10-Q reports with the SEC, and those reports still contain warranty expense data. Oh, and for each company, the totals represent their worldwide warranty spending, on both their domestic and international sales.

Claims, accruals, and reserves are distinct but related metrics. You really need to look at all three to get the full picture of what's going on. Accruals are made at the time of sale, with the manufacturer setting aside an amount of money deemed sufficient to pay claims for those products in the future. Claims are paid some time later, when the products actually require warranty work. And then the warranty reserve acts like a savings account, with the balance rising and falling as accruals are added and claims are paid.

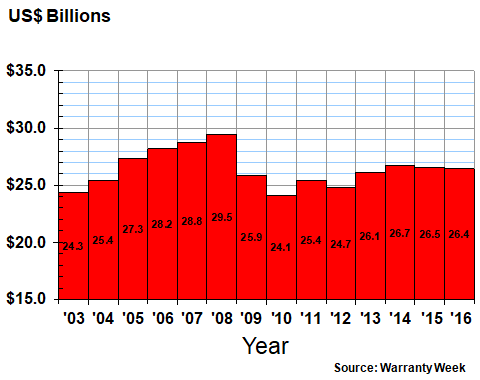

In calendar 2016, U.S.-based manufacturers paid $26.4 billion in claims, which was about $83 million less than they paid in 2015. Some paid less because of reduced sales. Others paid less because their products were better. It's very difficult for external observers to say which prevailed, but we note that in 2016 total warranted product sales were down by 3.6% while claims were down by 0.3%. But each manufacturer was different.

Figure 1

Worldwide Warranty Claims

of U.S.-based Companies

(claims paid in US$ billions, 2003-2016)

The peak year for claims paid was 2008, which is when the recession began to deepen. It's safe to say that much of the drop off in claims in 2009 and 2010 was caused by reduced sales, and therefore a reduced need for warranty work. But since then, a remarkable thing has happened. Sales slowly rose, but claims did not. We've remained relatively close to the $26 billion mark for eight years running, suggesting that manufactured products are becoming more reliable and less costly to repair.

But keep in mind that there's always a lag time with claims. For instance, a car sold in 2008 might not need warranty work until 2009 or 2010. And the warranties on cars sold in 2011 might not expire until 2016. So what you see in Figure 1 is simply a tabulation of when claims were paid, not when the products were sold.

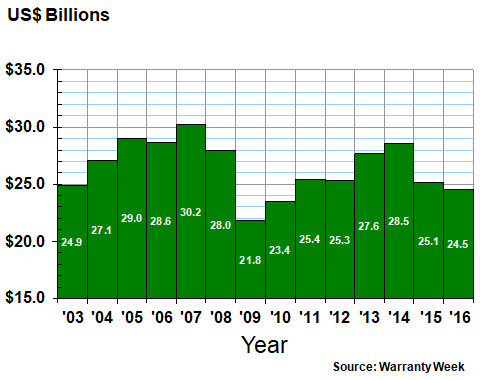

Warranty Accruals

With warranty accruals, there shouldn't be any lag time. When sales drop, so do accruals. Therefore, there was a much steeper drop in Figure 2 in 2009, and a much faster rise in the years since. But still, accruals have been dropping again in recent years, even as sales continue to rise. This is a sign of improved product quality and reduced repair cost.

Figure 2

Worldwide Warranty Accruals

of U.S.-based Companies

(accruals made in US$ billions, 2003-2016)

Last year, U.S.-based manufacturers reported making $24.5 billion in warranty accruals, down $564 million from 2015 totals. And there was a $3.4 billion decline from 2014 to 2015. But 2007 remains the peak year for accruals made, even though sales have since surpassed that high water mark. This again is a sign of improved product quality.

Warranty Reserves

The total balance in all the manufacturers' warranty reserve funds is charted in Figure 3. At year's end in 2016, the total was $43.6 billion, down by $59 million from the end of 2015, and down by $929 million from the peak year of 2014. But it's still well above the trough seen in 2009-2010, when sales were down and reserves weren't needed.

Figure 3

Worldwide Warranty Reserves

of U.S.-based Companies

(reserves held in US$ billions, 2003-2016)

It's not always a precise mathematical addition, where reserves equal accruals minus claims, however. There are other adjustments that manufacturers make, such as when they acquire or divest a company, or for global companies, when the relative value of the currencies in which they pay claims changes. And some companies simply correct past over- or under-accruals by making changes of estimate, adding or removing funds from their reserves as they fix their mistakes. Some of these adjustments can be sizeable.

For instance, General Electric Co. made an acquisition in 2016 that added $135 million to its warranty reserves. Hewlett Packard Enterprise Co. divested companies with $23 million in reserves. Boeing Co. removed $118 million from its warranty reserves to correct for past over-accruals. General Motors Co. added $625 million to correct for past under-accruals. Ford Motor Co. added $807 million to correct for past under-accruals, but made a -$232 million adjustment for the change in value of its foreign reserves. Paccar Inc. made a -$13 million adjustment as the value of its foreign reserves declined. And somehow, Deere & Co. managed to report a net gain of $11 million in the value of its warranty reserves denominated in foreign currencies.

We should also note that in some cases the past-year totals are different from what's been in previous newsletters. For instance, for several years, we included warranty data for FCA US LLC, the owners of Chrysler and Jeep, simply because the data was available. But now the company has redeemed the bonds that brought upon it a duty to report, and the only Chrysler warranty data available is wrapped into the financial reports of parent Fiat Chrysler Automobiles NV (which we shall cover later in the year in a special European spotlight). Therefore, we have retroactively removed FCA from the U.S. statistics, so as not so show a false decline in claims payments last year.

Conversely, new companies sometimes appear in the list, either because they were spun off from larger parents, or because they went public and had to begin reporting their financials to the SEC. In both instances, they frequently include three year's worth of retroactive warranty data in their first public financial reports, and so we revise our past-year statistics accordingly. To make it even more confusing, sometimes companies stop reporting when they declare bankruptcy, but then resume doing so once they reorganize, filling in the gaps as they return to normalcy.

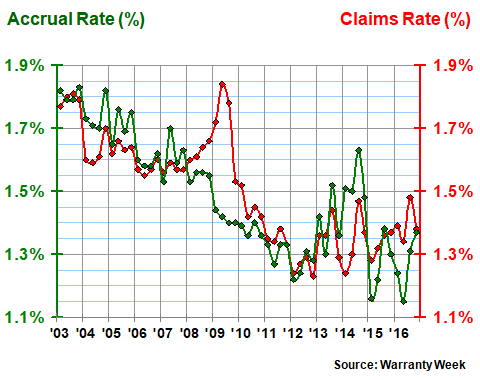

Warranty Expense Rates

To make sense of all these increases and declines, it's helpful to look at the actual expense rates. These rates are calculated by dividing claims paid and accruals made by products sold. Instead of dollars, these rates are expressed as percentages of sales. In other words, as can be seen in Figure 4, by the end of 2016, U.S. manufacturers were spending just under 1.4% of their hardware revenue on warranty expenses.

Figure 4

All U.S.-based Companies

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2016)

The expense rates will rise and fall not only because of gains in quality, but also by changes in sales totals. However, because there's a lag time between when a product is sold and when it's repaired, and because accruals are made at the time of sale, changes in sales totals will impact claims rates, but should not impact accrual rates.

This is most obvious when looking at the 2009 spike in the claims rate. Sales were falling at the time, so claims were being paid on products sold in previous years. But the calculations used current-year sales, so the claims rate spiked to nearly 1.85% in the second quarter of that year. But no accruals are made when a product isn't sold, so the accrual rate continued dropping.

The recession ended and claims rates returned to normal. And the accrual rate continued dropping, at least until 2012. But then a curious thing happened. Warranty expense rates stopped declining. It's as if U.S.-based manufacturers were on a learning curve from 2003 until 2012, learning how to automate their warranty processes, how to analyze current data to improve future quality, and how to cut warranty costs in the process. But the learning apparently stopped in 2012, and for the past four years the trend has become less clear.

In the third quarter of 2016, claims rates were the highest they've been since 2010. But in the second quarter of 2016, accrual rates hit a new all-time low of 1.1%. And by year's end, both expense rates met at a level just under 1.4%. It's baffling.

Industry Claims Totals

We traditionally categorize each manufacturer by the industry in which it sells its products. In the charts below, we've grouped 17 warranty-issuing industries into three big groups: vehicles, high-tech electronics, and building trades. And the latter also is the home of industries that don't quite fit in either of the others, such as jewelry and sports equipment. In 2016, about 49% of the claims paid came from vehicles, with just over 36% coming from high-tech and the remaining 15% from building trades.

In order to classify diversified companies, we choose the dominant product line. The goal is to place each of our 450 warranty providers into one and only one of 18 different industry categories. For instance, United Technologies Corp. is classified as an HVAC manufacturer, because of Carrier. General Electric Co. is listed as a power generating equipment provider, because of its turbines and power plants. But both could also belong in the aviation industry totals, though we're not going to double-count.

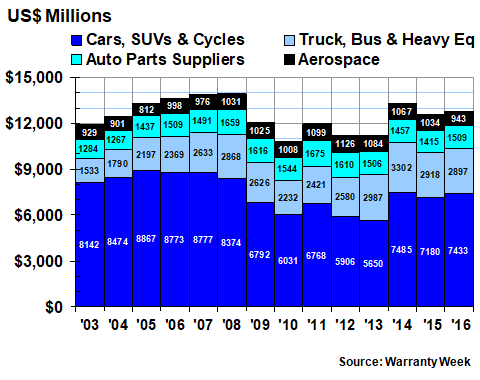

Figure 5 includes the annual totals for three industry groupings: automotive OEMs, automotive parts suppliers, and aerospace. Engine makers such as Cummins Inc. are classified as suppliers, while everything from heavy trucks to motorcycles are classified as OEMs. And the aerospace category contains both the plane manufacturers and all their suppliers.

Automotive OEMs saw their claims rise by around 2% last year, while their suppliers saw a 7% gain. Refining the OEM figures even further based on the size of the vehicles, the car, SUV & motorcycle manufacturers saw a 4% increase, while the truck, bus & heavy equipment manufacturers saw a 1% decline. We will talk more about this trend whereby the OEMs are shifting more of their claims costs to their suppliers in a future newsletter. For now, suffice to say that it is happening.

Meanwhile, in 2016 the aerospace manufacturers paid the least amount of claims since 2005. Again, we'll delve into this more deeply in the future, but clearly, companies such as Boeing, General Dynamics Corp., and Textron Inc. have found ways to reduce their warranty costs significantly.

Figure 5

Worldwide Warranty Claims Payments

of U.S.-based Vehicle Makers

(claims paid in US$ millions, 2003-2016)

Among the automotive OEMs, GM and Paccar cut claims the most, while Navistar International Corp. and Polaris Industries Inc. were among those paying out more. Among their suppliers, Goodyear and Cummins saw modest declines in claims payments, while Eaton and BorgWarner saw worrisome increases. For a much better analysis of individual companies and changes in their expense rates, however, see last week's newsletter.

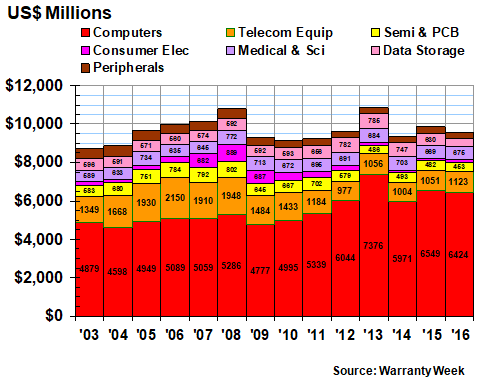

High-Tech Warranty Claims

Readers will need some sharp eyes to read all the industry totals included in Figure 6. Here' we're including seven industry groupings: computers, telecom equipment, semiconductors and printed circuit boards, consumer electronics, medical and scientific equipment, data storage systems, and peripherals.

As is the case with the automotive OEMs above, the computer manufacturers dominate the group here. In fact, the computer OEMs, if you will, account for almost 25% of all claims paid, second only to the automotive OEMs. Third is appliances and HVAC and fourth is automotive parts suppliers, but in fifth place is telecom equipment.

Both HP Inc. and Hewlett Packard Enterprise saw claims totals fall in 2016, compared to full-year 2015 figures for both, after Hewlett-Packard Co. split in two. But we're leaving an examination of their respective claims rates to a future newsletter. IBM and Apple also saw claims declines, and all of these combined helped propel the U.S.-based portion of the computer industry to a $125 million decrease in claims payments last year.

The data storage industry saw its claims total fall the most in 2016, however. But that's likely caused mostly by the departure of EMC last summer, caused by its acquisition by Dell, and causing half a year's worth of claims to go private. However, both Seagate and Western Digital also saw declines in claims payments, with the latter coming despite hefty sales increases (and acquisitions).

Figure 6

Worldwide Warranty Claims Payments

of U.S.-based High-Tech Manufacturers

(claims paid in US$ millions, 2003-2016)

Overall, four out of the seven high-tech industry categories saw claims declines, with only telecom equipment, consumer electronics, and medical and scientific equipment showing modest increases. Again, we're not yet mapping these changes to sales figures, but we will do so in a future newsletter.

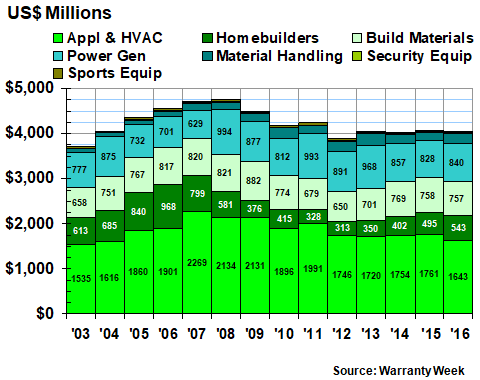

Claims in the Building Trades

The final seven industry categories are counted in what we're calling the building trades. It's a term that definitely encompasses new home builders and appliances, but doesn't really describe sports equipment or security systems. However, if we squint and view exercise equipment as a type of appliance, and see security cameras as building materials, perhaps it makes sense?

Figure 7

Worldwide Warranty Claims Payments

of U.S.-based Building Trade Companies

(claims paid in US$ millions, 2003-2016)

All the major homebuilders saw sales gains in 2016. Yet builders such as Hovnanian, NVR, and Taylor Morrison Home also saw claims declines. Then again, builders such as Beazer Homes, CalAtlantic, and Cavco Industries saw their claims totals rise, so it's a mixed picture. Overall, builders saw a $47 million increase in claims payments, driving them up to their biggest industry total since 2008.

The dominant industry in this grouping, however, continues to be the appliance and HVAC manufacturers. Their claims total fell by $119 million, and their share of the overall pie declined also. Emerson Electric Co. and Manitowoc Co. Inc. saw claims decline the most, but the latter's decline was caused primarily by its spin-off of Manitowoc Foodservice Inc. into a separate entity. Whirlpool Corp. and Newell Brands Inc. saw claims rise the most, but the latter's increase was driven primarily by its acquisition of Jarden last year. Whirlpool, meanwhile, is busy paying an increased number of claims on units sold in Europe by companies it acquired in previous years.

The makers of building materials, which includes fixtures, and furniture as well, and the makers of power generation equipment, which includes wind and solar in addition to power plants, generators and batteries, paid about the same amount of claims in 2016 as they did in 2015. But there were lots of notable increases and decreases at the individual company level, which we will get to in a future newsletter.

More To Come

Our goal here is simply to give readers a high-level snapshot of changes in product warranty metrics over the past 14 years, in hopes that they can serve as benchmarks for their industries, companies, and product lines. Readers with suggestions of how we can best take a deeper dive into the data in future weeks are welcome to contact the editor with their suggestions.

In the mean time, here are the top-level totals: in 2016, claims fell by 0.3% to $26.4 billion. Accruals fell by 2.2% billion to $24.5 billion. Reserves fell by 0.1% to $43.6 billion. The average warranty claims rate and warranty accrual rate for all manufacturers both stood at 1.4% at the end of 2016. That was a slight increase for the claims rate and a slight decrease for the accrual rate from the end of 2015.

Of the 18 warranty-issuing industry groupings that we currently use, aerospace and automotive OEMs saw the biggest dollar declines in claims paid. Telecom equipment and auto parts suppliers saw the biggest increases. In terms of "market share," however, data storage and aerospace saw the biggest relative declines in their shares of the overall total, while security equipment and homebuilders saw the biggest gains.

All three of the largest industry categories, which each anchor their respective industry groupings -- automotive OEMs in vehicles, computer OEMs in high-tech, and appliances within the building trades -- saw declines in claims payments last year. So in a way, it was a very good year for most of the OEMs.

Meanwhile, it was also a good year for some of their suppliers, particularly within the high-tech category. Both semiconductor and peripheral manufacturers saw declines in claims, though some of this was caused by major players going private or getting acquired by foreign firms. We'll get deeper into the details in the weeks ahead.