Medical & Scientific Equipment Warranty Report:

Though the systems that use lasers or radiation always seem to have higher warranty costs, most of the medical device and scientific instrument manufacturers have cut their costs considerably over the past 16 years.

Medical and scientific equipment makers have always kept their warranty costs lower than most other industries. But over the past 16 years, they have driven those costs even lower, although expense rates have begun to climb ever so slightly in recent years.

To reach this conclusion, we began with a list of 171 medical and scientific equipment manufacturers, plus 25 others that we borrowed from other industries such as semiconductors, computer peripherals, or telecom equipment that also make medical or scientific instruments. We even added in a few furniture makers that also make beds or chairs for hospitals or home health care applications.

With our list of 196 companies in hand, we read through their financial statements and gathered four essential metrics from each: warranty claims paid, accruals made, reserves held, and warranted product sales revenue. In the medical field especially, consumables are a major source of revenue, but not of warranty expenses. So wherever possible, we searched for the figure for systems sales or hardware sales, and subtracted out all the service and consumables revenue.

With that warranted product sales revenue figure in hand, we created two additional metrics: the claims rate (claims divided by sales), and the accrual rate (accruals divided by sales). These percentages express the proportional impact of the claims and accrual totals, as a percent of sales.

Over the past 16 years that we've performed this analysis, we have noticed that while most medical and scientific equipment manufacturers spend a small percentage of their systems revenue on warranty expenses, those whose equipment involves either lasers or X-rays seem to spend a much higher amount.

There are only 24 companies out of the 196 that do this. And while they account for only 5% or 6% of the industry's revenue, they always seem to account for 15% to 20% of the industry's warranty expenses. So we separated the list of 196 into 24 that sell products that use lasers or X-rays, and 172 that do not.

Warranty Claims

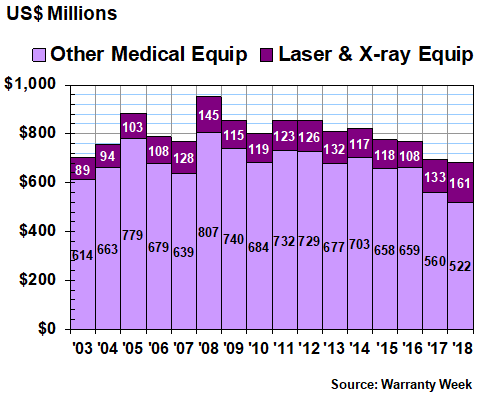

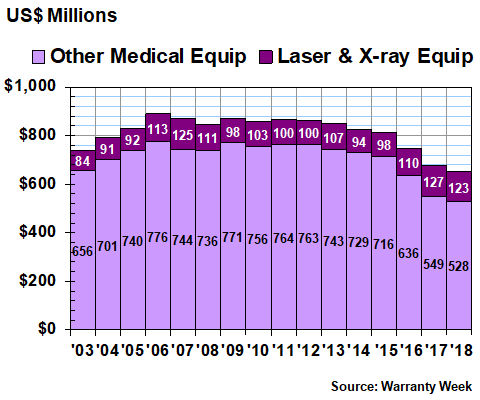

In Figure 1, we're totaling up the reported claims payments by these two groups in the past 16 years. In 2018, their combined claims cost fell by $10 million to $683 million -- their fourth straight annual decline but really just the continuation of a decade-long trend. Notably, the claims cost for the laser and X-ray companies actually grew significantly, to their largest-ever share of the total, while the other medical equipment makers saw their share fall by $39 million to a new low mark of $522 million.

Figure 1

Medical & Scientific Equipment Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2018)

The main culprits for the increasing claims for the laser and X-ray group were Coherent Inc. and Varian Medical Systems Inc., which make laser machines for science and radiation treatment systems for cancer treatment, respectively. Coherent reported an $18 million increase in claims in 2018, while Varian reported a $14 million jump.

Elsewhere among the laser and X-ray roster, Hologic Inc. reported a slight increase in claims payments, while Dentsply Sirona Inc. reported a slight decrease.

On the rest of the roster -- those companies whose products don't involve lasers or radiation -- the claims cost-cutting was led by companies such as Agilent Technologies Inc.; Hill-Rom Holdings Inc.; PerkinElmer Inc.; Roper Technologies Inc.; and Steris plc. But there were annual claims increases as well, from the likes of Align Technology Inc.; Bio-Rad Laboratories Inc.; Bruker Corp.; Illumina Inc.; and Invacare Corp.

Warranty Accruals

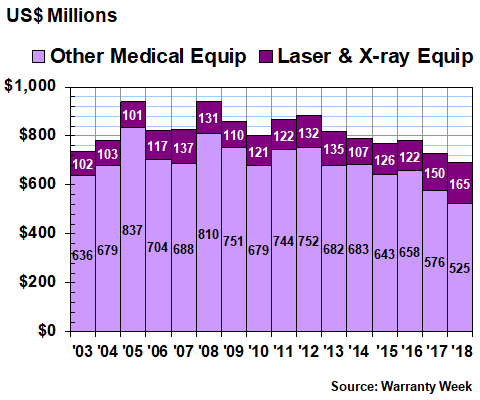

Last year, the laser and radiation group raised its share of total accruals to 21% of a $726 million total. This year, as they added another $15 million to their total, their share grew to 24% of the total. And because the "other" group's total fell by $51 million, the entire industry's total fell by $36 million to a combined $690 million. But because of a slight increase from 2015 to 2016, it was only the second annual decline in a row.

However, as can be seen in Figure 2, the pattern of decline extends at least a decade into the past with this metric as well, with reported accruals having peaked in 2008 at a level more than $250 million higher than last year's mark. Part of the reason is plain old-fashioned non-compliance with warranty expense disclosure rules.

For instance, both Medtronic plc and Boston Scientific Corp. used to be among the largest warranty providers in the U.S., from any industry. But they both stopped reporting their warranty expenses in 2017. Medtronic simply stopped mentioning the word in its financial statements, after recall-related claims soared in 2016. Boston Scientific said "changes in our product warranty accrual during 2018, 2017 and 2016 were immaterial," which is astonishing given that it accrued $25 million in its last full-year report, in 2016. We should all wish for a day when $25 million becomes "immaterial."

Figure 2

Medical & Scientific Equipment Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2018)

Some of the same patterns found with claims were repeated with accruals. For instance, Coherent and Varian increased their accruals by a combined $20 million, while Dentsply and Hologic cut their accruals by a combined $2.4 million. On the "other" list, Bruker and Align Technology reported some of the largest accrual increases, while Hill-Rom reported one of the largest decreases.

But there were also some surprises. Invacare, which saw its claims cost rise by $1.8 million, nevertheless cut its accruals by $2.6 million. Align Technology, which saw its claims cost more than double in 2018, also more than doubled its accruals, from $7.2 million in 2017 to $15.1 million in 2018.

Warranty Expense Rates

The missing metric here is sales. It can be devastating if warranty expenses suddenly double, but not so much if sales also double. In Align Technology's case, sales rose only 33%, which dulled the impact of those expense increases a bit, but couldn't shield it from a doubling of its claims rate.

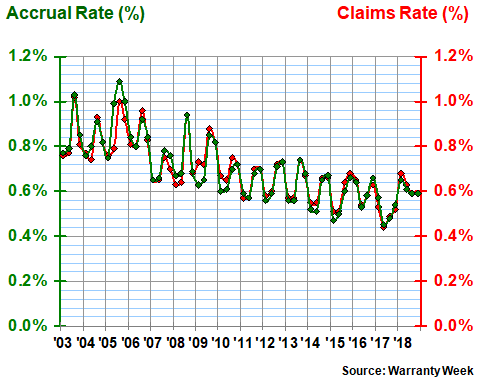

In Figures 3 and 4, what we've done is to take the claims and accrual figures in Figures 1 and 2 and divide them by the corresponding product sales totals. The percentage rates reflect the share of product revenue being spent on product warranties. In Figure 3, we're looking at the 172 non-laser and non-X-ray equipment makers, and in Figure 4, we're looking at just the 24 manufacturers of medical and scientific equipment that use lasers or radiation.

The data in both charts has a decidedly downward slope, which in this case is a good sign, because it suggests that warranty expense rates are generally declining. In Figure 3, we can see that the group started out in a range around 0.9% back in 2003 but had reached 0.6% by the end of 2018. Over the 64 quarters in the chart, their average has been 0.7%, with a standard deviation of 0.14%.

Figure 3

Medical & Scientific Equipment Manufacturers

(Not Laser or X-ray Equipment Manufacturers)

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

PerkinElmer Inc. was one of the most successful recent cost-cutters, reducing its accrual rate from 1.5% to 0.7% to match a decrease in its claims rate. A more-than-doubling of its sales totals helped in that regard. Others cutting both their claims and accrual rates noticeably from 2017 to 2018 include Agilent Technologies, DexCom Inc., Roper Technologies, and Steris.

Besides Align Technology, one of the biggest expense rate increases was reported by hospital furniture maker Hill-Rom Holdings, which raised its accrual rate from 0.6% to 0.8% despite a fall in claims. Bruker, meanwhile, saw both its expense rates climb modestly in 2018.

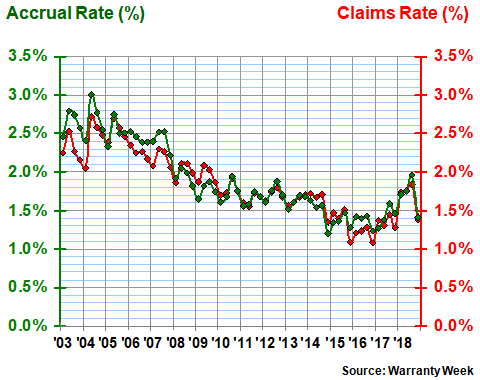

X-ray & Laser Equipment

Among the 24 laser and X-ray equipment manufacturers, clams and accrual rates fell from an average above 2.5% in 2003 and 2004 to as low as 1.1% in 2015 and 2016. But then rates began to rise again, as can be seen in Figure 4 below. But then they fell again at the very end of 2018, settling at a level of 1.4%. Long-term, the claims and accrual rates have averaged 1.7% and 1.8%, respectively, with a standard deviation around 0.5%.

Figure 4

Laser & X-ray Equipment Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

Among the largest laser and X-ray manufacturers, warranty expense rates that were comparatively high went even higher. For instance, Coherent saw its claims rate jump from 2.6% to 4.3%, while its accrual rate rose from 3.0% to 4.5%. However, keep in mind that its product line is more diverse than just medical and scientific instruments.

In contrast, Hologic, whose systems do everything from mammography to fat cell removal and body sculpting, saw its generally low expense rates fall even lower in 2018. Its claims rate fell from 0.8% to 0.5%, while its accrual rate fell from 0.7% to 0.4%. Dentsply and Novanta Inc. reported more modest declines in their expense rates, while Varian reported a jump in its claims rate from 2.4% to 2.9%, but cut its accrual rate anyhow, from 3.9% to 3.3%.

Warranty Reserves

Our final warranty metric is the balance left in the warranty reserve funds of the 196 companies at the end of each calendar year. On December 31, 2018, the balance was $650 million, down $25 million from the end of 2017. Both our groups reported declines -- the laser/X-ray group saw a decline of $4 million while the others saw a decline of $21 million.

Figure 5

Medical & Scientific Equipment Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2018)

For the "other" group, 2018 represented the lowest balance they've ever reported. But again, keep in mind that two of their largest members abruptly ceased reporting their warranty expenses. So while we have a feeling that Medtronic and Boston Scientific still maintain warranty reserve funds, we have no idea how large they are.

For the laser/X-ray group, however, the year-ending balance of $123 million represents their third-largest total of the last 16 years, behind only 2017 and 2007. But among the major warranty providers in this group, only Coherent and Dentsply reported any increases, and they were relatively small. Then again, so were the decreases reported by Hologic, Novanta, and Varian.

In the larger "other" group, there were relatively large increases in reserves reported by Align Technology, Illumina, and La-Z-Boy Inc., and relatively large decreases in reserves reported by Bio-Rad, DexCom, and Invacare.

Thermo Fisher, which has the largest warranty reserve fund of all these companies, added $5 million to its balance, but that represented only a 6% increase. Danaher Corp. which has the second-largest balance, reported a $1.6 million decline in reserves, but that equated to only a 2% change.