Steve Kakouros, and Dorothea Kuettner is the latest in an ongoing

series of contributed editorial columns. Readers who are interested

in authoring future contributed columns can click here to see the

Guidelines for Editorial Submissions page.

Changing the Way We Think About Warranty Management:

Warranty is a critical element of new product strategy. It not only provides assurance to customers, but also serves as a very effective promotional tool. A change in the approach to warranty management is needed so that warranty related decisions are made in the context of the product life cycle and take into account the interaction between warranty and other decision variables. This new strategic approach is similar to that which has transformed supply chain management over the last 10 to 15 years.

by D.N. Prabhakar Murthy, Wallace Blischke, Steve Kakouros, and Dorothea Kuettner

The markets for all types of new products -- consumer durables, industrial or commercial products -- are characterized by the following:

- New products are appearing at an ever increasing pace making existing products obsolete.

- Products are becoming more complex due to a significant increase in their capabilities and/or performance relative to the products which are being replaced.

- Customers are more demanding with regard to product performance and support.

- Governments have passed stringent regulations to protect consumers against products not meeting explicit or implicit performance standards.

- Markets are becoming more global and competitive.

Figure 1 illustrates these points in the context of automobiles. Survival in such an environment requires manufacturers not only to develop new and improved products constantly, but also to attract and retain customers through comprehensive product support in the form of pre-sale and post-sale services. Product performance and product support play an important role in customers� purchase decisions and in customer satisfaction.

Figure 1:

The Automotive Industry

|

Product warranty is a key element of post-sale product support. A warranty implies that the manufacturer will either rectify and/or compensate the buyer should the item purchased not perform satisfactorily over the warranty period. Warranties increase costs to the manufacturer as a result of the servicing of claims during the warranty period.

The average warranty cost varies from 1% to 10% of the sale price, depending on the manufacturer and the product. For large businesses, this can run into billions of dollars annually and has an impact on the bottom line of the business as Figure 2 taken from Warranty Week shows. American manufacturers are spending an average of 1.7% of their product revenue on warranty. The automotive sector accounts for just under half of all warranty claims, while the telecom & IT sectors account for another third.

Figure 2:

Top U.S.-based Warranty Providers in 2006

| 2005 | 2006 | Latest | |

| Claims | Claims | Claims | |

| Company | $ Mil | $ Mil | Rate |

| General Motors Corp. | $4,696 | $4,463 | 2.6% |

| Ford Motor Co. | $3,986 | $4,106 | 2.9% |

| Hewlett-Packard Co. | $2,353 | $2,346 | 3.2% |

| Dell Inc. | $1,521 | $1,775 | 4.0% |

| Motorola Inc. | $716 | $891 | 2.1% |

| IBM Corp. | $831 | $762 | 3.4% |

| Caterpillar Inc. | $712 | $745 | 1.9% |

| General Electric Co. | $699 | $665 | 1.0% |

| Deere & Co. | $453 | $509 | 2.6% |

| Whirlpool Corp. | $294 | $459 | 3.3% |

How can a manufacturer reduce warranty costs? One way is to reduce the warranty period and/or make the warranty terms less attractive. This course of action will impact sales and revenue in a negative manner and hence might not be a good strategy from an overall business viewpoint. The customer demands a warranty, which in turn impacts business performance for a manufacturer through its effect on sales and customer satisfaction.

Besides demanding a warranty, a customer often perceives the warranty offered as an indication of product quality. An alternative is to reduce warranty costs by managing the warranty processes more effectively. What is clear is that sophisticated modeling techniques are now required to evaluate all the impacts for different warranty alternatives.

Product Warranty: A Brief Overview

For the purpose of our discussion, a warranty is a contractual agreement between customer and manufacturer that is entered into upon the sale of a product. A warranty may be implicit or it may be explicitly stated. The purpose of a warranty is to establish the liability of the manufacturer in the event that an item fails or does not perform its intended function when properly used under normal conditions. The contract specifies both the performance that is to be expected and the redress available to the buyer for a specified period of time.

A related concept is the extended warranty or service contract. The difference between a warranty (also referred to as base warranty) and an extended warranty is that the latter is entered into voluntarily and is purchased separately. There may be a choice of terms for an extended warranty whereas the base warranty is an integral part of the sale and is factored into the sale price.

Role of Warranty

Most consumer, commercial and governmental product purchase transactions include a warranty. Warranty serves a different purpose for the customer than for the manufacturer.

Customer�s Point of View

From the customer's point of view, the main role of a warranty is protective, insuring against a loss due to a faulty or defective item that fails to perform satisfactorily. The warranty assures the buyer that such an item will either be repaired or replaced at no cost or at reduced cost or that a monetary compensation will be provided (e.g. a money back guarantee).

A second role is informative. Customers find it difficult to assess product performance, reliability and durability prior to the purchase. A product with a relatively long warranty period conveys the message that it is a more reliable and longer-lasting product than one with a shorter warranty period.

Manufacturer�s Point of View

One of the main roles of warranty from the seller's point of view is protective. Warranty terms specify the conditions of use and provide limited coverage (or no coverage at all) in the event of misuse of the product. The warranty terms may include regular maintenance carried out by a suitably qualified authorized service agent. If this is violated, it may affect the terms of the warranty.

A second important purpose of warranties is promotional. Seagate Technology LLC, for example, increased their warranty for internal hard disk drives from three years to five years in order to boost sales. Since customers associate product reliability with warranty, warranty has been used as an effective advertising tool, similar to product performance and price, in order to differentiate a company�s product from competitor�s products in the marketplace.

Warranty in Government Contracting

New, complex military equipment (such as aircraft, missile systems, etc.) involve the latest technologies and state-of-the-art materials and processes. The equipment is used for long periods and as such reliability is of paramount importance. Warranties of a certain type (called Reliability Improvement Warranties or RIW) are often employed in the procurement of such equipment. These warranties play a very different and important role, that of providing an incentive for the manufacturer to increase the reliability of the item. The manufacturer is required to make changes to the original design if the observed field reliability is below some specified value with the incentive of an higher price if it can be demonstrated that the reliability of the item has improved.

Determining Warranty Cost

Warranty cost depends on the reliability of the product and on usage. Product reliability, in turn, is influenced by the decisions made during the design and production phases. Warranty affects sales and with them total revenue. In the automotive industry, for example, sales increased dramatically when Chrysler increased car warranty from 2 to 5 years in the early sixties. The same phenomena occurred when Hyundai offered longer powertrain warranties almost a decade ago. The overall profit depends on revenue and the production and warranty costs. The systems approach provides a framework to characterize the relationships between these different variables.

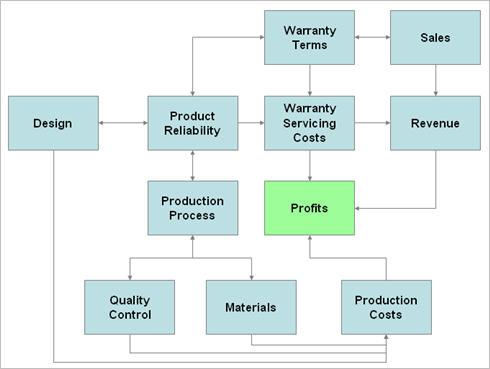

A flowchart expressing these relationships is shown in Figure 3 (adapted from a book by Murthy and Blischke, 2005). Each of the elements in the figure can be analyzed in more detail, leading to a more refined understanding of the process.

Figure 3:

Factors Affecting Warranty Costs and Profits

The traditional mechanisms used to understand and reduce warranty costs usually focus exclusively on the analysis of product failures. However, as shown in Figure 3, warranty costs can also be influenced by factors that do not directly involve product failures. In addition, within the same company or division, different functional groups tend to have specific definitions of what warranty means to them, for example, marketing view warranty as an attribute to promote sales (a product feature) whilst engineers see warranty as a material or component issue.

To increase the accuracy of overall warranty perception, one needs to move away from the traditional warranty views and adopt a broader, more holistic, systems approach to warranty accruing and management. Using a sophisticated systems approach as described in "Reinventing Warranty at HP: an Engineering Approach to Warranty", warranty analysts can help product managers predict more accurately the costs of removing certain warranty events or changing warranty policies or offering extended warranties for their products.

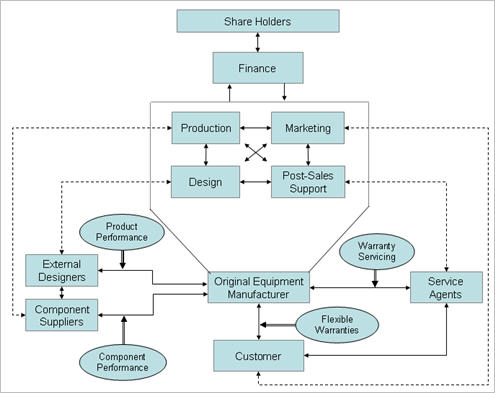

Outsourcing Impact

Often manufacturers outsource their design and components are bought from external component suppliers as shown in Figure 4 (adapted from a book by Murthy and Blischke, 2005). Components that do not conform to design specifications, or have�design faults, lead to lower reliability and higher warranty costs. Manufacturing may also be outsourced. Again, this can have a negative impact on warranty costs due to deficient manufacturing processes and inadequate testing procedures. These additional warranty costs should be shared between the OEM -- the brand name on the product -- and either the manufacturer or the external designers or the component suppliers or some combination of these parties.

The question of responsibility for product failure is further complicated due to the existence of a chain of suppliers and sub-suppliers. Failures should be governed by a workmanship warranty. This implies that the manufacturer needs to have reliability improvement warranty contracts with external designers and group warranty contracts for items bought from component suppliers.

However in most industries, and in particular in the automotive and computer industries, the OEM is frequently left holding the bag when the time comes to pay warranty claims as discussed in Warranty Week, June 2, 2004. As the latest data show, their suppliers usually see much lower warranty claims rates. Another approach is to negotiate the material price to reflect release of supplier�s liability in case the warranty policy is difficult to enforce or implement.

Figure 4:

External Factors in Determining Warranty Cost

Finally, warranty servicing is often carried out by a service agent (the retailer or some other external agent). In either case, the warranty costs depend on how efficiently the service agent carries out their task. Since the interests of the service agent are not the same as those of the OEM, the costs may be difficult to regulate. One way of controlling this is through a proper contract that incorporates incentive schemes so that the agent�s actions are compatible with the interests of the manufacturer.

Flexible Warranties

Customers vary in terms of the type of assurance that they require for the product they buy. Some prefer not to purchase extended warranties, whereas others prefer to choose from a range of warranty possibilities. The manufacturer needs to be able to analyze different warranty structures for different customers. Significantly, there exists a high revenue potential in extended warranties.

"We've found that the margins for aftermarket parts and service can be an 85 percent margin business, compared to 25-35 percent for traditional OEMs," says Mark Demers in "The Word on Warranties". "Why do you think Circuit City and Best Buy push customers so hard?"

Modern Warranty Complexity

All of these external parties and factors relate to the design, production, marketing and post- sales departments of the OEM as indicated in Figure 4. These in turn interact with the finance department and subsequently impact the share value.

Effective warranty management is not simply controlling and/or reducing warranty costs. Rather, it is making warranty related decisions in a framework which considers all the different factors and dependencies shown in Figures 3 and 4 in the context of the product life cycle

Warranty Management Evolution

One can define three stages in the evolution of warranty management.

Stage 1 (Beginning around 1960): [Administrative]

Here the focus of warranty management is on the efficient administration of warranty claims. This involves the following steps:

- Receiving claims from service agents

- Processing claims to check their validity (to prevent fraud)

- Arranging for reimbursement

- Managing parts (updating the parts inventory of service agents)

The aim is to control warranty costs through the detection of fraud (by customers and/or service agents) and to ensure a certain level of customer satisfaction through the efficient servicing of valid claims by service agents. This approach to warranty was reactive and warranty was viewed mainly as a cost element with an accounting emphasis.

Stage 2 (Beginning around 1995): [Operational Improvement]

Here the focus moved to understanding the causes behind warranty claims for a product which has already been launched. Product reliability is influenced by decisions made during design and production phases. Warranty data collected from service centers is used to improve the quality of the product which reduces warranty costs and increases customer satisfaction. This involves the following:

- Evaluating product reliability in the field and then initiating changes to the production processes to improve the quality of conformance and even possibly redesigning weak components.

- Assessing customer dissatisfaction and if necessary initiating changes to warranty servicing.

As can be seen, the thrust of warranty management has shifted from simply the accounting focus of Stage 1 to focusing on the cost of warranty as well as on customer satisfaction. However, there is still no perspective on the overall strategic role and importance of warranty.

Transformation of Supply Operations

Ten to fifteen years ago, the same problem of fractured views existed for supply operations. Different departments tried to take ownership of supply as it affected them. Manufacturing, Logistics, Finance and Marketing all saw supply as their problem alone. They did not have a complete view of the supply process. There was no framework to make strategic decisions for supply.

In fact, the term supply chain did not exist. There existed limited modeling and data analysis compared with what is applied today to the whole supply operation. The data was less complex (single dimensional and not multi-dimensional with linked data points e.g. the same data point for manufacturing and inventory).

Supply has since been revolutionized and millions of dollars have been saved through the use of sophisticated modeling techniques using complex data analysis. This has given the ability to evaluate and compare different supply scenarios ranging from that for individual products at any point during the PLC to that for the whole business operation of a company.

It is now time to adopt a similar approach for warranty.

Stage 3 - Strategic Warranty Management

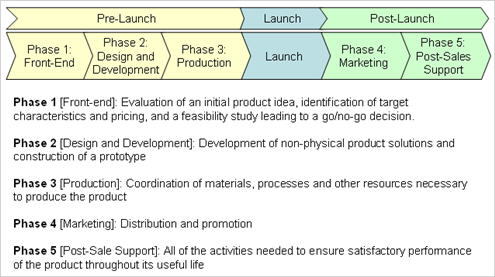

Here the manufacturer looks at warranty management for a new product from a strategic viewpoint and considers its role throughout the whole of the product life cycle from the initial conception of the product to the final withdrawal of the product from the marketplace - see Figure 5.

Figure 5:

Product Life Cycle

The basic underlying principle of Strategic Warranty Management is that decisions with regard to warranty must begin at a very early stage in the product life cycle and not as an afterthought just prior to the launch stage. There should also be an awareness that technical and commercial decisions at the Front End phase influence the various strategies for the next four phases (Design and Development, Production, Marketing, and Post-sale).

The business strategy adopted at the Front End phase determines the goals for the new product through targets such as (i) total revenue, (ii) return on investment, (iii) market share, and so on. In turn one defines targets (technical and commercial) for the next four phases of the product life cycle and formulates strategies to achieve them. The outcome of the strategy formulation process is the overall business strategy, in which all the lower level strategies are cohesive and well integrated.

Strategy formulation in the Front End phase is only the first step in the strategic management of new products. Once the strategies have been formulated, they need to be implemented and this involves executing a variety of tasks in each of the next four phases. As the implementation proceeds, new information is obtained and this is used to make changes to the strategy.

The link between warranty and the various activities at various phases of the product life cycle is discussed in more detail in a book by Murthy and Blischke. Throughout one looks at expected warranty costs and the trade-offs necessary to reduce them that take into account the interactions indicated in Figures 3 and 4. As a result, warranty is integrated into the overall decision-making process. Warranty strategy is defined in conjunction with all other technical and commercial strategies formulated for the business goals. The following statement from Jim Ericson highlights the point:

"Warranty management today is about faster cycles for engineering design and redesign, better consumer response, recovering costs, improving channel relationships, and building a service business with much higher margins than traditional manufacturing. Today, the customer demands the warranty, but the manufacturer needs it more."

In the early phases of the product lifecycle, a manufacturer's warranty management goal must be to reduce the cycle time for uncovering the root causes of defects in products so that changes can be made quickly. In the latter phases of the product lifecycle, warranty management must deal with various aspects of warranty logistics and achieve a balance between costs and customer satisfaction.

Finally, Strategic Warranty Management is the dynamic force in the company that propagates the policy that warranty is everybody�s business and not something owned exclusively by one function.

The Situation Today

The warranty management practice at most manufacturing businesses is still at Stage 1. This is reflected in the fact that the majority of the warranty management systems currently available are suitable only for this kind of warranty management. A growing number of businesses are moving to Stage 2 and some new warranty management systems that are useful for this stage have appeared over the past few years.

The approaches in both these stages can be viewed as reactive with warranty being viewed as an afterthought and warranty issues being addressed in the later phases of the product life cycle. In contrast, Strategic Warranty Management is a proactive approach with warranty issues being addressed in all phases of the product life cycle with the focus being not only to lower the warranty cost but also ensuring high customer satisfaction and greater profitability.

Integral to Strategic Warranty Management is the development and use of a sophisticated Warranty Management System.

Warranty Management Systems

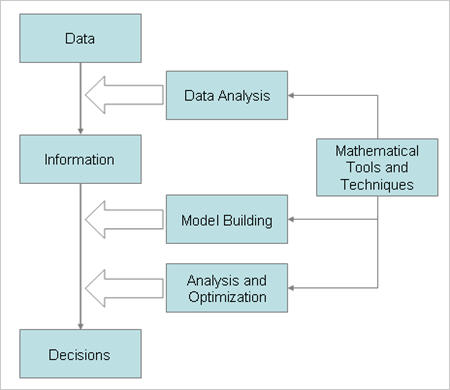

Strategic warranty management means finding solutions for a variety of decision problems, data-analysis and modeling play a critical role in this.

Decision-making involves using information to solve problems. The link between data, information and solutions is indicated in Figure 6 (adapted from a book by Murthy and Blischke, 2005). Through data analysis one can identify issues of concern so that appropriate actions can be initiated. For example if the analysis indicates that the costs are increasing, then the data can be used to update the cost models to yield better estimates of future costs. If these exceed the target limit, then further analysis of data will indicate alternative measures required to reduce these costs.

Figure 6:

Data - Information - Model - Decision

A Warranty Management System (WMS) is a tool for effective Strategic Warranty Management. In the case of new products, it allows one to compare alternative warranty strategies. In the case of existing products it enables the evaluation of different options in order to decide on the best course of action to improve business performance. Different warranty strategies apply to different parts of the business process and may all be considered within the WMS. Some typical examples are the following:

- Flexible warranty strategy: The range of warranty policies to be offered based on the different needs of customers. The terms and pricing for each warranty policy.

- Component purchase strategy: Contracts with component suppliers based on the sharing of warranty costs which result from the failure of components supplied.

- External design strategy: Contracts with external designers to share the warranty costs if failures can be attributed to design problems.

- Contract manufacturing strategy: Contracts with CMs to share warranty costs if failures can be attributed to manufacturing and test issues.

- Spare part distribution strategy: The evaluation of alternative spare part network designs to optimize cost and service.

- Spare part inventory strategy: The setting of adequate inventory policies.

WMS Components

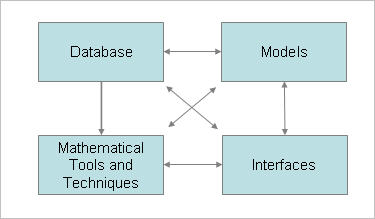

A WMS has four interacting components, as shown in Figure 7. These are briefly described below:

Figure 7:

Warranty Management System Modules

Database

Data from many different sources is needed for effective Strategic Warranty Management. The WMS must be able to incorporate data and information from these sources. In the early stage of product development, much of the data and information will be subjective (e.g. based on the judgment of experts) or come from historical records of similar systems or components. As the development progresses, better data becomes available due to design definition, prototype testing, and trial manufacturing runs. Once the product enters the market, new data relating to product performance, sales, etc. may be analyzed.

For each generation of products, many types of in-house data is generated over the product life cycle and should be included in the WMS database for a new product. This needs to be combined with data from external sources (vendors, industry groups) to make proper decisions.

Thus, the inputs to the database can be organized in two groups: internal and external. External data is data relating to partners in the supply chain (such as component suppliers, service agents, dealers) or to competitors or to customers. Internal data is the data generated by groups responsible for phases 2 to 5� of the product lifecycle (See Figure 5).

Models

Many different types of models are needed to assist the decision making for each phase of the product life cycle. This component of a WMS takes the form of a library of different models.

Mathematical Tools and Techniques

This component contains packages needed for data analysis, model building, general analysis and optimization. Advances in computer technology have resulted in packages that can handle large and complex data sets and carry out the analysis using modern techniques such as data mining, expert systems, artificial intelligence, etc. These are important in looking for underlying patterns in the data set.

Interfaces

The WMS should have a user interface and an application interface. The user interface facilitates the flow of information from the user to the WMS and back, whilst the application interface provides the link between a variety of external databases and programs which may be used for analysis and for transferring data to and from the WMS.

A Strategic Warranty Management Implementation Plan

How should a business proceed with the transition to and the implementation of Strategic Warranty Management?

Step 1: Create a Warranty Management Department headed by a senior level manager with the title "Warranty Manager."

Step 2: Carry out a review of the company�s current approach to warranty management to identify if the business is at Stage 1 or Stage 2 warranty management and formulate a plan for moving to Stage 3.

Step 3: Carry out an audit of the different information and management systems in use to determine the kinds of data being collected and assess their relevance to Strategic Warranty Management.

Step 4: Set up a Warranty Management System. This must link with the various existing systems in use and must contain the components discussed previously. Make provision for the Warranty Management System to be continuously updated so that the company can effectively manage warranty for new products as they are developed and sold.

Step 5: Initiate programs, either internally or with the assistance of external consultants, to assure that the skills needed at all three levels of management (senior, middle and junior) exist.

It is difficult to suggest a checklist that would suit all businesses as they differ in overall organization, product, technology, goals, resources, etc. The following lists are samples of the kinds of things that managers at each level should do.

Strategic Warranty Management Checklist

The CEO must:

- Appreciate that warranty strategy is an important element of new product development, is critical for business success and is a cross-functional activity linking technical and commercial departments,

- Set up a Warranty Management Department or council to monitor warranty strategy, have the authority to implement changes during the PLC. This will be headed by a senior level manager (with the title of "Warranty Manager") responsible for Strategic Warranty Management, and

- Ensure that senior level functional managers understand the link between warranty and their respective functional units and the importance of the Warranty Management Department.

Senior Level Managers will have to:

- Closely interact with the Warranty Manager to ensure that the overall warranty strategy is coherent with the technical and commercial strategies at the front-end stage of the product life cycle,

- Evaluate the implications of the warranty strategy for their various functional operations,

- Ensure that their functional oriented databases are properly linked to the Warranty Management System for effective transfer of relevant data,

- Ensure that middle and junior level managers have the skills and techniques needed,

- Propose alternative strategies for analysis by middle level managers, and

- Recommend strategies for consideration by the CEO

The Warranty Manager is responsible for:

- Setting up the Warranty Management System (WMS) and continuously updating it,

- Formulating the warranty strategy in conjunction with other senior level managers, and

- Monitoring and resolving issues resulting from conflicting cross-functional metrics.

Middle Level Managers are responsible for:

- The analysis of different kinds of data relevant to warranty management,

- Helping senior level managers to evaluate different possible strategies,

- Interfacing with external parties (as well as with fellow middle level managers in different functional units within the business) to resolve problems,

- Initiating improvement actions, and

- Supervising data collection and monitoring the implementation of warranty strategy by junior level managers.

Junior Level Managers are responsible for:

- Implementing improvement changes requested by middle level managers,

- Liaising with their counterparts in various functional units, and

- Data collection.

Warranty Analysts are responsible for:

- Data collection and analysis and must have the technical skills required for these tasks.

The Warranty Management Department is an interdisciplinary group which will include personnel with backgrounds in engineering, reliability, statistics, marketing, law, IT and management.

Conclusions

The evolution in warranty management is similar to that in supply chain management but lagging behind by 10-15 years. The success of supply chain management during this period has been partly due to a good understanding of the processes, the use of strong analytics combined with proper data collection and analysis. The same understanding is now necessary in order to move to Strategic Warranty Management as advocated in this paper. The benefits resulting from Strategic Warranty Management may be a differentiating factor in the overall performance and profitability of a company. Failure to implement Strategic Warranty Management may mean higher costs resulting from increased warranty claims and a loss in sales and revenue due to higher customer dissatisfaction. This is of great significance as markets become more competitive. CEOs needs to move fast to bring about organizational changes, so that their company moves to Strategic Warranty Management in the shortest possible time.

About the Authors:

D.N. Prabhakar Murthy, PhD, is a Research Professor at the School of Engineering, The University of Queensland, Brisbane, Australia. Dr. Murthy has held visiting appointments at several universities in the USA, Europe and Asia. He has authored/coauthored 5 books, 20 book chapters, 150 journal papers, 140 conference papers and co-edited two books. He is on the editorial boards of eight international journals. He has run short courses for industry on various topics in new technology management (new product development, technology forecasting), operations management (quality control, lot sizing) and post-sale support (warranties and maintenance) in Australia, Asia, Europe and the USA.

Email: p.murthy@uq.edu.au

Wallace R. Blischke, PhD, is an Emeritus Professor at the Marshall School of Business, University of Southern California, and a Consultant in Statistical Analysis, Los Angeles. Dr. Blischke is author of over 50 publications, including five books co-authored with D. N. P. Murthy, three on warranty and two on reliability. He is Associate Editor of several journals and is a Fellow of the American Statistical Association.

Email: wrblischke@sbcglobal.net

Phone: +1.818.994.4732

Steve Kakouros is a Process Technology Manager at SPaM, where he works with different HP divisions to improve their business processes by engaging rigorous analysis and state of the art technologies. His most recent research is focused in the areas of logistics optimization, forecasting and planning, product warranty and Demand Management. He is a published author, and his most recent articles were published in Interfaces, Operations Research/Management Science Today, APICS-The Performance Advantage and Quality and Reliability Engineering International. Prior to working with SPaM, he had consulted with Oracle and SPOAR investments. Steve has a MS in Operations Research from Stanford University and a BS in Applied Mathematics from the Aristotle University, Thessaloniki, Greece.

Email: steve.kakouros@hp.com

Dorothea Kuettner is the Managing Director of Athena Insight. Through her use of analytical modeling and expertise in information systems, Dorothea provides data-driven support for strategic and operational decisions in the areas of inventory optimization, supply chain design, forecasting and planning, and warranty chain management. With nearly 20 years of experience, Dorothea was most recently a Distinguished Technologist with Hewlett Packard's Strategic Planning and Modeling team (SPaM).

Email: dk@athenainsight.com

Web: www.athenainsight.com

Phone: +1.650.854.1594