Security Equipment Warranties:

The systems that scan baggage, cargo and passengers have to detect every single threat, every single time. And while these systems may require a lot of routine maintenance and warranty work to keep up with the heavy usage, they should never fail to do that job flawlessly. Lives literally hang in the balance.

The makers of security equipment, as with airplanes and medical devices, place an enormous emphasis on never letting their products fail while in use. Predictive and preventative maintenance play a big role in uptime. But as with virtually every manufactured product, things break, parts wear out, and repairs are necessary. So of course there's a warranty expense involved.

Last week, while returning from the Warranty Innovations conference, your editor had quite a bit of time to kill in Chicago O'Hare International Airport. And the security folks staffing Concourse K of Terminal 3 were quite proud of their new full-body scanners, which can "see" through clothing and detect objects other systems cannot.

"Imagine the warranty claims on that thing," your editor thought while running the gauntlet of radiation between the two giant blue boxes. So mental notes were made of the brand name on the boxes at the security checkpoint. And with the help of Google Images, the identity of the new Rapiscan Systems Secure 1000 Single Pose machine was discovered.

Aerospace Overlap

So armed with nothing but a mental snapshot of that brand name, your editor set off this week to profile the security equipment industry and its warranty expenditures. Many of the top defense contractors fall into the category, as does everything from burglar alarms to hunting rifles. But there is also a small set of companies providing scanners and detectors to those airport security folks. And that is where we'll focus this week.

Turns out there is quite a bit of overlap between the aerospace and security industries. And that's to be expected, given the overlap between the military and commercial aviation manufacturers. But it's also a symptom of the biggest problem facing commercial aviation today: How to secure both passengers and cargo from attack?

The latest and greatest systems, such as the Rapiscan Systems Secure 1000 Single Pose machine, are now being deployed in airports such as O'Hare to intrusively inspect both cargo and passengers. With attackers having shown their willingness to disguise their explosive devices as both underwear and printer toner cartridges, there is simply no other way to proceed than to use these huge and expensive machines that emit radiation, screen objects, create images, sniff odors, measure heat, and detect threats that other equipment (not to mention unaided humans) would likely miss.

Top Security Equipment Companies

First, let's get a sense of the scope of the industry. As mentioned, many of the top military and commercial aviation companies are part of this sector. In fact, six of the top 10 warranty providers in this sector are also leaders in the aerospace industry: Boeing Co.; General Dynamics Corp.; L-3 Communications; Rockwell Collins Inc.; Textron Inc.; and United Technologies Corp.

We profiled several of them last week from the perspective of their avionics operations, so we won't repeat that again here. And there are others we wish we could profile, but they publish little or no details about their warranty expenses. The top names in this group of warranty non-believers are Lockheed Martin and Northrop Grumman, two of the world's largest defense contractors. It's a good thing their major customer doesn't make them provide warranties, let alone disclose their cost.

There's also a hefty crossover between security equipment and the high-tech electronics industry, in the form of players such as Diebold Inc.; NCR Corp.; and Tyco International Ltd., making everything from banking equipment to burglar alarms. There's also a segment of the automotive industry that also supplies secure vehicles, police cars, and fire trucks, led by companies such as Federal Signal Corp. and Oshkosh Corp. And there are several building security companies that use ID cards and tags for everything from electronically unlocking doors to electronically detecting shoplifters. Leaders in this corner of the industry include Checkpoint Systems Inc. and Zebra Technologies Corp.

Four Snapshots

The one we're going to take a much closer look at this week, however, are the companies that provide systems that screen airline passengers and air cargo for threats. We found four: OSI Systems Inc., the owners of Rapiscan Systems; FLIR Systems Inc.; Analogic Corp.; and American Science and Engineering Inc. They're not the largest vendors on our list of 42, but in terms of air passenger and cargo safety, they're the most important of all.

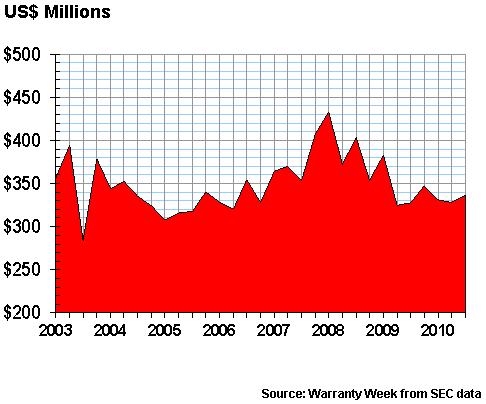

So far in the first three quarters of 2010, our roster of 42 security equipment vendors and warranty providers have paid out a total of $996 million in warranty claims, down from $1.035 billion in the first nine months of 2010. Quarter by quarter, the outlays of the security equipment manufacturers is depicted in Figure 1.

Figure 1

Security Equipment Warranty

Claims Paid, 2003-2010

(in US $ millions per quarter)

There is in fact a peak in the claims data, with the first quarter of 2008's total coming in just above $433 million. And there is a trough in the third quarter of 2003, which by the way is the only dip below the $300 million level in the past 31 quarters. During the past six quarters, claims have remained relatively flat around a level of $330 million per quarter.

Increasing Accruals

There's been a bit more volatility in terms of accruals. As can be seen in Figure 2, the security equipment industry has seen its cumulative accrual total dip below $300 million on seven occasions during the past 31 quarters, with the lowest coming in the third quarter of 2003 (same as for claims). The peak came in the last quarter of 2007 ($430 million), just before the peak in claims.

For the first three quarters of 2010, our list of 42 security equipment warrant providers have set aside a total of $957 million in warranty accruals, up from $901 million during the same period in 2009. So why are accruals up and claims down this year? Let's hope it's a combination of rising sales and increasing product reliability.

Figure 2

Security Equipment Warranty

Accruals Made, 2003-2010

(in US $ millions per quarter)

Unlike the roster of aerospace companies or automotive OEMs, however, many of these security equipment manufacturers are relatively young companies with extremely high sales growth rates. Especially in the years after the World Trade Center and Pentagon attacks, they couldn't make their imaging and scanning equipment fast enough to satisfy demand.

That shows up in the warranty statistics not so much as a rapid increase in claims or accruals, but rather as an increase in instability. The big companies like United Technologies and Boeing have their warranty operations well under control. But these new companies with their hot new machines -- they still manage warranty by lurching from one crisis to the next, never resting and never having time to reflect on what they've learned.

Learning to Manage Warranty?

In the data in Figure 3, one can almost see how the chaos of 2003 to 2006 eventually gave way to the calm of 2007 to 2010. In this chart, we're comparing warranty expenses to product sales. So what the bouncing ball curves of those early years suggests is that the manufacturers were simply paying the claims, processing the transactions, and moving on. And then by 2007 or so, they began to get a better grip on the process, reducing the surprises and flattening the curves.

Figure 3

Security Equipment Warranty

Claims & Accrual Rates, 2003-2010

(as a percentage of product revenue)

Of course, the statistics in Figures 1 through 3 are a blend of 42 different companies (plus another 40 companies that have since 2003 either been acquired or gone out of business). But the point is that even with the added stability of top companies such as United Technologies, Boeing, and Textron, there is still a lot of chaos in the ratios.

Profile the Profilers

Our four candidates for more intrusive examination this week are not very large companies. Together, the sales of OSI Systems, FLIR, Analogic and American Science add up to around $2.3 billion. Their warranty claims comprise between 1.1% and 1.8% of the security equipment industry's total, depending on the quarter. And the $20 or so million these four companies pay for warranty work each year is a small price to pay to keep their scanning and detection systems operational.

Let's start with OSI Systems, which acquired Rapiscan Security Products back in 1993. The company's new Rapiscan Secure 1000 system is the one getting all the recent publicity, thanks to its ability to "see" through clothing. These units, costing upwards of $130,000 each, look like two large boxes, which passengers must stand between with their arms raised. The Transportation Security Administration hopes to have units deployed in 33 large airports by year's end.

OSI Systems doesn't break out either sales or warranty expenses by division or product line. But it does say that around 42% of its $595 million in sales last year came from "security," which is where we assume the Rapiscan division resides. Interestingly, the company noted that sales of passenger screening systems were up by $25.5 million, while sales of cargo screening systems were down by $19.4 million last year.

In addition, the company said its security service revenues increased by 10% last year, thanks to the growing installed base of products from which it derives service revenue as warranty periods expire. So while these security systems generate significant warranty costs during their early years, they must also generate significant out-of-warranty repair revenue as they age.

What Caused the Spikes?

The balance of OSI Systems' sales came from health care and optoelectronics. In Figure 4 below, we can't with any precision say which product line accounted for the obvious spikes in warranty expenses, but we can't deny that those spikes exist.

Figure 4

OSI Systems Inc.

Warranty Claims & Accrual Rates, 2003-2010

(as a percentage of product revenue)

Since 2003, OSI Systems' claims rate has ranged all the way from 0.5% to 3.4%. Its accrual rate has ranged from 0.2% to its recent high of 2.45%. Let's hope the company gets on top of its warranty process as quickly as possible, so that someday it detects 100% of the threats and makes 0% of its revenue from out-of-warranty repairs.

Thermal Imaging Systems

FLIR Systems is actually the largest of the four vendors we're profiling this week. Sales in 2009 surpassed $1.147 billion, and are on track to exceed that total by almost 20% this year.

FLIR stands for Forward-Looking InfraRed, which is a pretty good description of what the company makes. FLIR sells everything from infrared cameras that can spot ways that heat leaks from a home to systems that use infrared imaging to give "night vision" to airline pilots and ship captains. In addition, FLIR's Government and Military Program Office provides everything from weapon sighting to surveillance systems.

In terms of warranty, however, by the looks of Figure 5 it seems the company has some work to do. Claims range from above 1.5% back in 2006 to 0.3% in the quarter ended September 30, 2010. The accrual rate has been as high as 2.0% and as low as 0.4%.

Figure 5

FLIR Systems Inc.

Warranty Claims & Accrual Rates, 2003-2010

(as a percentage of product revenue)

The good news, though, is that the most recent measurements are the lowest of the past 31 quarters. And like the industry in general, the chaos of 2003 to 2006 seems to have given way to the relative calm of 2007 to 2010. Perhaps the company has finally become the master of its warranty process?

Explosive Detection Systems

Analogic is another manufacturer of imaging systems used in security applications. But because it's more of a supplier and technology developer, its brand name won't be found all over the machinery at an airport security checkpoint.

That doesn't mean it's not in use. Analogic's eXaminer family of explosive detection systems, incorporated into systems sold by L-3 Communications, is used to screen checked baggage. And its OnGuard family is used to scan carry-on luggage.

Product sales in the fiscal year ended July 31, 2010 rose to $393.8 million, but warranty expenses consumed around 1.3% of that sum. Last year, claims equaled 0.9% of product sales while accruals equaled 1.1%. And for some unknown reason, claims dropped to only 0.2% of sales in the months of February, March and April 2009.

Figure 6

Analogic Corp.

Warranty Claims & Accrual Rates, 2003-2010

(as a percentage of product revenue)

There's another obvious notch in the claims data from the first quarter of 2004. But let's give the company some credit. At least there are no towering spikes in Analogic's warranty claims data, as there are in the other three charts.

Massive One-Time Spike

The most obvious spike of all is in the data for the first quarter of 2008 at American Science and Engineering. During those three months, which correspond to the fourth quarter of the company's fiscal year, AS&E sold $25.7 million worth of security products but paid out $1.2 million in warranty claims.

For anyone keeping score at home, that's roughly three or four times what it paid out during any of the calendar quarters before or after that period. In fact, to cover the sudden one-time increase in costs, the company also had to replace a quarter-million dollars it had removed from the warranty reserve in late 2007. That change in estimate isn't part of the chart below, but the spike in claims most definitely is.

Figure 7

American Science and Engineering Inc.

Warranty Claims & Accrual Rates, 2003-2010

(as a percentage of product revenue)

So what did AS&E have to say about its sudden spike in claims? Absolutely no explanation was included in the company's annual report for that fiscal year. In fact, one wouldn't even know there had been a spike in the fourth quarter of that fiscal year if one didn't bother to subtract the totals for the first, second and third quarters from the company's 12-month figures. Averaged out over a full year, it would have blended right in, evading discovery.

Detecting Warranty Anomalies

In other words, a company that makes detection systems used at borders and airports to combat smugglers and terrorists may have tried to conceal some warranty unpleasantness by hiding it in plain sight. They might have found my extra liter of duty-free single malt, but I found their surge in claims and accruals!

Actually, AS&E makes X-ray inspection systems that use what the company calls Z Backscatter technology, which produces images that it says reveal the shape and form of contraband objects inside a container. The company has an online image library that compares what other X-ray systems and what its systems "see" when pointed towards vehicles and luggage.

And all kidding aside, we hope these companies soon become so good at managing their warranty process that their charts become incredibly boring flat lines. We want no warranty surprises, no mechanical breakdowns, and no missed threats to the security of our airports, borders, passengers or cargo. In fact, we want their stuff to work so well that we never have to mention it again.

Product Warranty Series

This is the seventh in a series of 11 industry-by-industry newsletters that examine product warranty claims and accrual trends in detail over the past eight years. Links to the others in the series are included below, in case you've missed any.

September 16: Computer Warranty Claims & AccrualsSeptember 23: Data Storage Warranties

October 7: HVAC & Appliance Warranties

October 14: New Home Builders & RV Maker Warranties

October 21: Construction Equipment Warranties

November 5: Aerospace Warranties

November 11: Security Equipment Warranties

November 18: Automotive OEM Warranties

December 2: Automotive Supplier Warranties

December 16: Medical & Scientific Equipment Warranties

December 23: Telecom Equipment Warranties