Commercial Truck Service Contracts:

At roughly one percent of revenue, commercial extended warranties for trucks represent more of a convenience for customers than a major additional source of profits for manufacturers. Still, we know they bring in more than a billion dollars a year just in the U.S., even though only a handful of truck manufacturers report the relevant metrics.

While extended warranties sold to commercial truck buyers aren't as important a source of revenue as the vehicle service contracts sold by car dealers to consumers, they are nevertheless an essential part of most manufacturers' product lines.

And thanks to financial rules that require public companies to reveal some data about their deferred service revenue, a handful of truck makers are now providing as thorough an accounting of their extended warranty metrics as they have been with their product warranty metrics. But you have to know where to look, and what it means.

First, let's define some terms. In this week's newsletter, when we say commercial service contract, we mean an extended warranty sold to the owner of a new heavy truck, diesel engine, or transport refrigeration unit. In all the cases we will look at this week, the seller is a unit of the commercial truck manufacturer, and the buyer is a commercial user as opposed to a consumer. And the contract they're buying is much like insurance: a means of protection against the risk of a contingent loss.

These are not the kinds of service contracts that provide scheduled maintenance, like lawn mowing or office cleaning services. Those are contracts for services, but they're not extended warranties. And they're not service contracts like the annual subscriptions the mobile phone companies sell to their customers for dial tone. These are separately-priced contracts that provide additional coverage, similar to a product warranty, for mechanical breakdowns, defects, and in some cases damage. And in this case they're sold by truck manufacturers to their commercial customers.

Commercial Service Contract Definitions

The revenue raised from the sale of these extended warranties will be called "new contract sales," and will be marked in green. Traditionally, these service contracts last for multiple years, and so the money received is initially set aside as deferred revenue, to be recognized gradually over the life of the contract.

The fund into which this new money is added will be called "deferred revenue," and will be marked in purple. Specifically, with this metric we're measuring the ending balance in this fund for each of the years in question. It's simply a measure of how much money is still hanging around, waiting to be recognized. And the ending balance for one year will be the beginning balance for the next year.

The amount of revenue recognized each year will be called "earned premium," and will be marked in red. It could also be called amortized or recognized revenue. Either way, this is part of the amount that will come out of the deferred revenue fund and go onto the income statement as service revenue. But it's not the amount spent on extended warranty work. That's a separate metric, which most companies still keep secret. The earned premium would be the revenue against which that expense would be measured, to determine the profitability of the extended warranty program. But the earned premium is not an expense.

So in a way, it's somewhat analogous to product warranty, with the reserve fund receiving deposits in the form of accruals and withdrawals in the form of claims. But it's also very different, in that we're measuring revenue, not expenses. The truth is we don't really know much about the expenses of most extended warranty programs, nor their profitability.

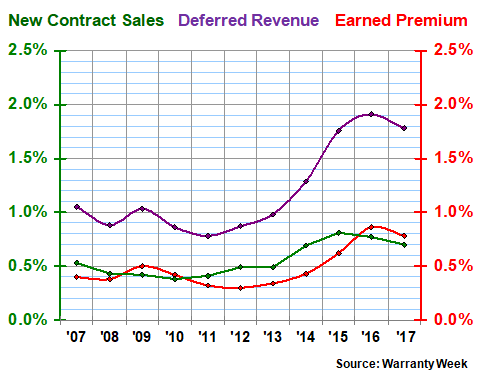

John Deere Extended Warranties

In Figure 1, we're looking at the extended warranty metrics of Deere & Company, the agricultural and construction equipment company founded 181 years ago in Grand Detour, Illinois. Rather than measuring the extended warranty metrics in dollars, we're measuring them as a percentage of equipment revenue. And so, in fiscal 2017 the company reported $181 million in new contract sales, which represented about 0.7% of its equipment revenue.

Figure 1

John Deere Commercial Service Contract Sales

As a Percentage of Product Revenue

(in percent, 2007-2017)

Meanwhile, the amount of revenue recognized in fiscal 2017 was $202 million, which represented nearly 0.8% of equipment revenue. And the balance in the fund holding all the still-deferred revenue, still waiting to be recognized, had a balance of $461 million at the end of Deere's fiscal year on October 29, 2017. That amount was equal to 1.8% of the company's equipment revenue for the year.

Note that all three metrics declined slightly from 2016 to 2017. That's because equipment sales grew faster than extended warranty sales. Or to be more precise, extended warranty sales did not grow at all, while equipment sales grew by 11%. The amount of new contract sales was also $181 million in fiscal 2016, but it represented almost 0.8% of equipment sales that year. It's only a tiny decline, but these tiny declines also pop up at other companies.

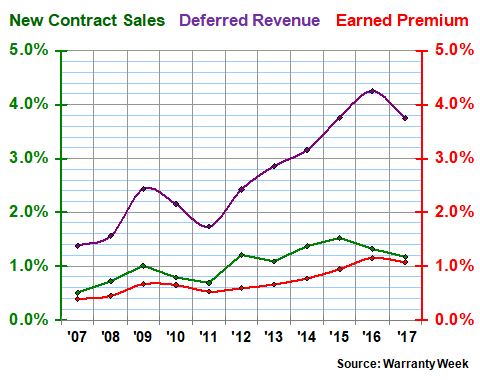

Cummins Extended Warranties

Diesel engine maker Cummins Inc. also reported slight dips in all three of its extended warranty metrics. But in its case product sales grew faster than service contracts, though both grew. For instance, new contract sales rose from $231 million in 2016 to $240 million last year, but their share of product revenue fell from 1.3% to 1.2%. Earned premium took a very slight dip, while the deferred revenue balance fell from 4.3% to 3.8% of revenue.

Figure 2

Cummins Commercial Service Contract Sales

As a Percentage of Product Revenue

(in percent, 2007-2017)

Let's not make a big deal out of these declines. And let's not make a big deal out of whether each company's extended warranty metrics represent one percent, two percent, or four percent of product revenue. What we're looking for is a pattern, and in Figures 1 and 2 the pattern is for the green line to peak in 2015, and the red and purple lines to peak in 2016. And all six metrics declined in 2017. So now we have a trend.

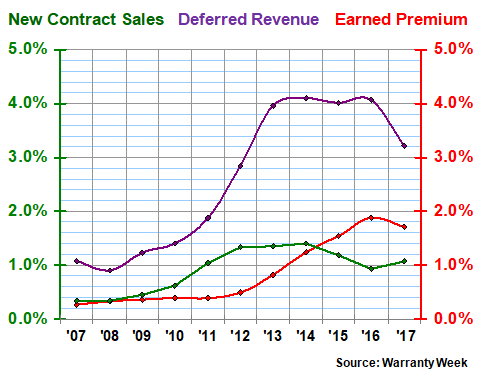

Navistar Extended Warranties

Next we will look at Navistar International Corp., makers of trucks, buses, diesel engines, and until recently, recreational vehicles, garbage trucks, and concrete mixers. This company's extended warranty story is complicated by the product warranty debacle its diesel engines suffered, failing to meet U.S. emissions requirements and suffering from frequent repairs and downtime. But all that trouble now seems to be behind it, so its metrics are now returning to normal.

Figure 3

Navistar Commercial Service Contract Sales

As a Percentage of Product Revenue

(in percent, 2007-2017)

In Figure 3, we see a company whose deferred revenue balance and earned premiums peaked. But look at the green line. There's a bit of growth there, from 0.9% in fiscal 2016 to 1.1% in the last fiscal year. We should note, however, that Navistar doesn't actually reveal its total for new contract sales. But it does reveal the beginning and ending balance in its deferred revenue fund, and the amount of earned premium, so we can use those figures to estimate new contract sales.

Still, most of the prevailing industry pattern seems to hold. Deferred revenue peaked at 4.1% of product revenue in fiscal 2014. New contract sales peaked at 1.4% the same fiscal year. Earned premium peaked last year at 1.9%. And two out of the three metrics declined in fiscal 2017.

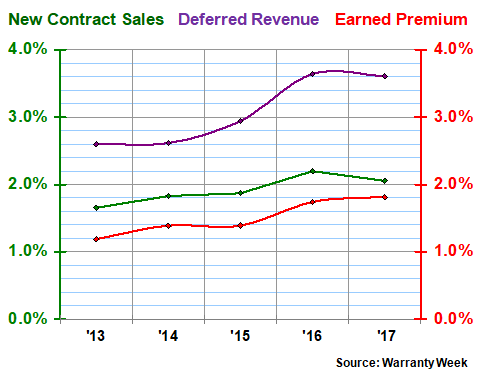

Paccar Extended Warranties

Paccar Inc., whose name derives from the Pacific Car and Foundry Company that was founded in Seattle in 1905, owns the Kenworth and Peterbilt truck brands in the U.S., and both the Leyland Trucks and DAF brands in Europe. However, it did not begin reporting its extended warranty metrics until 2013, so we have only five years of data for them.

In Figure 4, we can see that Paccar diverges somewhat from the trend. Deferred revenue peaked at 3.6% of product revenue in 2016, and new contract sales peaked at 2.2% the same year. But earned premium rose last year to a new high of nearly $372 million, representing 1.8% of revenue.

Figure 4

Paccar Commercial Service Contract Sales

As a Percentage of Product Revenue

(in percent, 2007-2017)

That means Paccar is the apparent market share leader in commercial service contract sales for the trucking industry. Cummins is second at $240 million, and Deere is third at $181 million. We don't know where Volvo Trucks or Daimler and their truck brands stand, because neither company discloses their extended warranty metrics in their financial reports. Or if they do, we can't find it. Sharp-eyed readers with better information are urged to contact the editor.

Ingersoll-Rand Extended Warranties

We have one more company to detail: Ingersoll-Rand plc, the successor to a pair of companies both founded in 1871. IR has multiple industrial units issuing product warranties and selling extended warranties. The one of interest to the trucking industry is the Thermo King Corp., which sells cargo refrigeration, freezer, and passenger air conditioning units for ships, trains, buses, and trucks.

As such, like Cummins, it doesn't make the actual trucks, but it makes major components for the vehicles, for which product warranties are issued separately and extended warranties are sold separately. And although the bulk of IR's total revenue is derived from HVAC systems for buildings, the transport refrigeration business unit accounted for nearly 15% of revenue last year.

In Figure 5, we can see that just under one percent of IR's revenue comes from earned premiums, and that this percentage has remained fairly stable for the last seven years. And it's closely matched by new contract sales, which have also remained steady when compared to total revenue.

Figure 5

Ingersoll-Rand Commercial Service Contract Sales

As a Percentage of Product Revenue

(in percent, 2007-2017)

If we want to get exact, new contract sales peaked in 2012 and earned premiums peaked in 2013, as did the deferred revenue balance. But all three metrics did in fact decline in 2017, though by very small amounts. And to get super-technical, new contract sales did actually rise by $3.5 million last year. But product sales rose a little faster, so the percentage fell slightly.

The thing we want to spotlight about Ingersoll-Rand is a single sentence they included in their annual report last year: "For the years ended December 31, 2017 and 2016, the Company incurred costs of $60.7 million and $60.1 million, respectively, related to extended warranties." That's a new metric.

In fact, that's the metric we've been missing from all the other manufacturers. That's the amount of expenses the extended warranties generate per year, and if measured against the amount of earned premium, it would reveal profit margins of 46% in 2016 and 43% in 2017. Therefore, not only are IR's commercial service contract sales profitable, but they're apparently more profitable than product sales. We suspect conditions are the same at Paccar, Cummins, Navistar, and Deere as well.

Extended Warranty Sales Revenue

There are numerous other industrial product manufacturers that sell extended warranties, but these are the five that we've found in the commercial vehicle industry so far. No doubt, there are others, and we encourage our readers to point them out.

The problem is that while manufacturers are required to reveal the amount of deferred revenue on their books, they are not required to segment it so that extended warranties can be counted separately. They are free to include maintenance agreements, software subscriptions -- even gift cars can be bundled into one lump sum for "deferred revenue."

However, with these five manufacturers, we can definitively say that they sold $983 million worth of new extended warranty contracts last year. And if measured against their $85.6 million in new product sales, then we can definitively conclude that extended warranties represented an average of 1.1% of their sales last year.

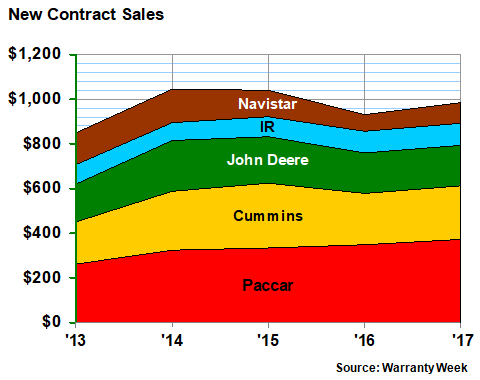

The other conclusion we can reach is that despite how the percentages may be falling in the charts above, at least in terms of dollars the market has remained relatively stable for the last five years. Figure 6 details a market that was slightly larger than one billion dollars in 2014 and 2015, and slightly smaller than one billion dollars in 2016 and 2017. And it grew by nearly six percent last year!

Figure 6

Commercial Service Contract Sales

New Contract Sales per Year

(in dollars, 2013-2017)

The point is, commercial service contracts seem to be a minor but fairly dependable source of revenue and profits for the truck manufacturers that sell them, and a fairly secure source of service and peace-of-mind for the commercial customers that buy them. Yes, they are probably highly profitable, but they're also a highly effective way for customers to keep their commercial vehicles on the road. And at roughly one percent of revenue, they contribute less than consumer service contract sales do for many retailers.

There's also an important difference in terms of perceived value. With fleets of trucks, the perceived value of extended warranties is a bit different than is the case with consumer products. The owner of one pickup truck or one SUV has to wonder whether they're the one out of five who save money by buying an extended warranty or if they're one of the four out of five who would have been better off paying their repair bills out-of-pocket as they arose. But a fleet manager knows that something is always going to be broken somewhere, and that extended warranties are a convenient way to prepay expenses that can't be avoided.