Building Material Warranty Report:

As we've seen in recent reports, warranty costs are generally far below their levels of 16 years ago. But in the building trades, depending how we break them into groups, the most recent expense rates of the top manufacturers are the same or slightly higher than they were in 2003.

Although their warranty expense rates have been relatively stable over the last 16 years, the claims and accruals of the manufacturers of fixtures, furniture, and other building materials have seen their costs creep up in recent years. The changes are minor, but they seem to be present no matter how we chop up the list of U.S.-based manufacturers with significant product lines in the building trades.

We began with a list of 118 building materials manufacturers, with a handful, such as Crane Company, Illinois Tool Works Inc., Lennox International Inc., Mueller Water Products Inc., and W.W. Grainger Inc., borrowed from other closely-aligned industries. From the financial reports of each company, we gathered four essential metrics: warranty claims paid, accruals made, reserves held, and product sales revenue. Using the claims, accruals, and sales totals, we calculated two additional metrics: claims as a percent of sales, and accruals as a percent of sales.

With this data in hand, we split up the 118 companies into three groups: manufacturers of plumbing and electrical fixtures, furniture, and other building materials such as windows, flooring, roofing, carpets, and doors. We assigned 28 companies to the fixtures group; 34 to the furniture category; and the remaining 56 to the other building materials list.

Warranty Claims

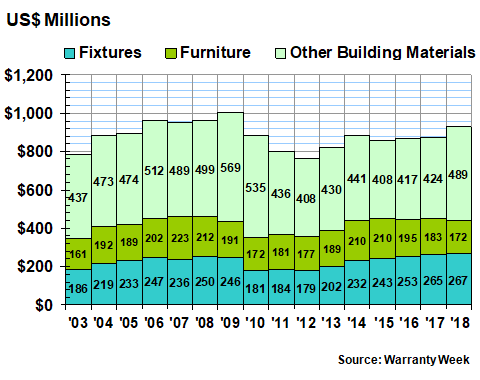

In Figure 1 we are charting the amount of claims paid by each group during the past 16 years. In 2018, the combined total was $928 million, up $55 million from 2017. It was the biggest year for building material claims since 2009, which in a twisted kind of way is a positive sign: more expenses mean more activity, and a return to pre-recession levels is a sign of recovery.

However, that increase was attributable primarily to a big jump in the claims payments of the companies in the "other building materials" category, partially offset by an $11 million decline in the furniture group and only a slight increase in the fixtures group. But all three groups showed positive sales growth: +3.5% for fixtures; +6.9% for furniture; and +9.2% for other building materials.

Figure 1

Building Material Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2018)

Stanley Black & Decker Inc., the largest warranty provider in all three groups, saw a $17 million increase in its claims costs last year. Plumbing fixture Masco Corp. saw a $6 million increase in claims payments in 2018. And Sherwin-Williams Company, which acquired Valspar three years ago, saw a $4.7 million increase in claims payments.

Among some of the smaller warranty providers, lighting fixture manufacturer Hubbell Inc. saw one of the biggest expense increases when its claims costs rose from $10 million in 2017 to $23 million in 2018. Nordson Corp., manufacturers of a variety of paints, adhesives and coatings, saw its claims cost jump by almost a third to $13 million. And cabinet maker American Woodmark Corp. saw its claims cost rise by $4.6 million to $23.5 million.

But there were also some notable decreases. Lighting fixtures maker Acuity Brands Inc. cut its claims cost by $6.2 million. Water pump maker Pentair plc cut its claims cost from $63 million to $55 million. Bedding maker Tempur Sealy International Inc. reduced its claims cost from $44 million to $38 million a year. And office furniture maker Steelcase Inc. cut its warranty costs by $1.1 million to $16 million in 2018.

Warranty Accruals

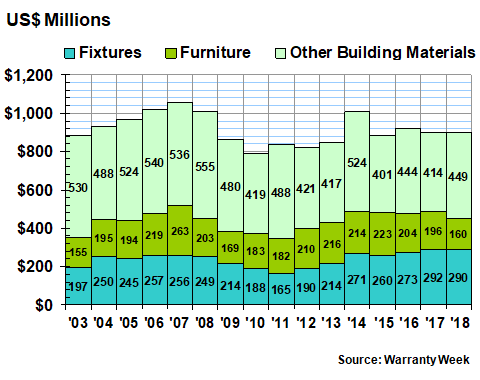

Accrual totals, meanwhile, fell ever-so-slightly in 2018, slipping from $901 million in 2017 to $899 million in 2018. Accruals made by furniture manufacturers were down by $35 million, but accruals by other building products manufacturers were up by $35 million. The fixtures manufacturers made the decisive -$2 million change.

Given that product sales were up, the accrual declines are a sign of confidence. Typically, sales and accruals rise and fall together, keeping the ratio between them constant, unless manufacturers believe the products they're selling now will have less warranty expense than past production did. The fact that the furniture manufacturers cut their accruals by more than 18% is a strong suggestion they believe this.

Figure 2

Building Material Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2018)

Some of the biggest accrual reductions were in fact made by the furniture manufacturers. Both Tempur Sealy and Herman Miller Inc. cut their accruals by about a third. Sales were up for Herman Miller but down slightly for Tempur Sealy. Acuity Brands, Pentair, and Sherwin Williams each cut their accruals by about a fourth. Due to acquisitions and divestitures, however, comparisons to their year-ago sales totals are not meaningful.

In terms of increases, Hubbell and Masco each raised their accruals by about one-fourth. American Woodmark and Mohawk Industries raised their accruals by about a third. And Mueller Water Products Inc. raised its accruals from $13 million to $20 million, causing losses and helping to spark several shareholder lawsuits. All five companies reported sales increases, but for Masco, Mueller and Mohawk, accruals rose faster than sales.

Warranty Expense Rates

The reason we mention changes in sales along with changes with claims and accrual totals is because the dollar amounts alone don't tell the complete story. So what we've done in Figures 3, 4 and 5 is to take the raw totals from Figures 1 and 2 and divide them each by the corresponding product sales totals, making sure to subtract any service, investment, or other non-warranted sources of revenue before making the calculations.

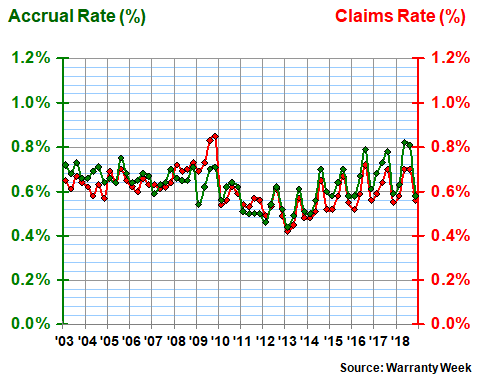

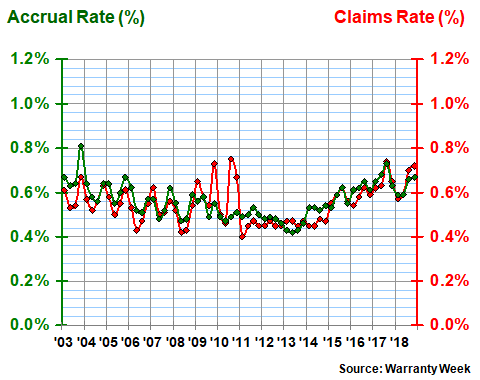

In Figure 3, we can see that the warranty expense rates of the fixtures manufacturers have generally been rising since bottoming-out in early 2013. However, there also seems to be a seasonal pattern within each year that sees warranty expenses peaking in the spring and summer and declining in the fall and winter. This would seem to follow the typical construction season in the U.S.

However, also note that the seasonal highs and lows have gotten farther apart in recent years. In 2018, they ranged from under 0.6% to over 0.8%. Long-term, this group' s average expense rates have been just over 0.6%, with a standard deviation just under 0.1%.

Figure 3

Fixture Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

In relative terms, Hubbell saw the biggest increase in claims, jumping from 0.3% to 0.5% of sales. But it kept its accrual rate steady at 0.3% anyhow. Pentair saw its claims rate jump from 1.3% to 1.7%, and changed its accrual rate accordingly. Masco boosted its accrual rate from 0.8% to 0.9% after a slight rise in its claims rate.

W.W. Grainger made a small reduction in its accrual rate after a small reduction in its claims rate. Acuity Brands cut its accrual rate almost in half after its claims rate fell from 0.8% to 0.6%.

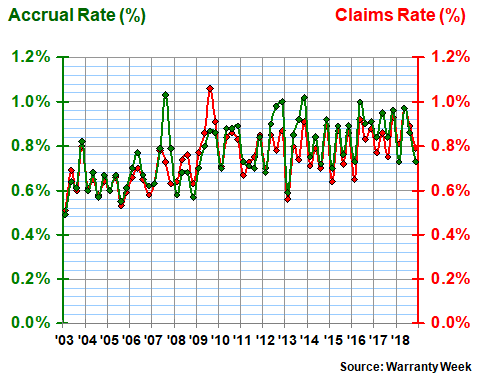

Furniture Expense Rates

The furniture segment also has gently rising warranty expense rates, as can be seen in Figure 4. Though their 16-year average expense rates have been around 0.75%, the average more than a decade ago was closer to 0.6%. In the last few years, in fact, their accrual rate has jumped above one percent for brief periods.

Figure 4

Furniture Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

On the downside, Tempur Sealy led the expense rate reductions among the largest furniture warranty providers, cutting its accrual rate from 2.0% to 0.9% after its claims rate fell from 1.7% to 1.0%. Herman Miller and American Woodmark also reduced both their expense rates significantly.

Sleep Number Corp., formerly known as Select Comfort, saw a slight rise in its claims rate and a slight decline in its accrual rate. La-Z-Boy Inc. saw a modest reduction in its claims rate, but raised its accrual rate anyhow. And HNI Corp., which makes office furniture, saw both its claims and accrual rates rise from 0.9% in 2017 to 1.0% by the end of 2018.

Other Building Materials

The rest of the building material manufacturers also have seen their warranty expense rates rise slowly in the past few years. Their long-term average expense rates are just below 0.6%, with a standard deviation just under 1.0%. But their quarterly expense rates haven't been below average since the start of 2016.

Figure 5

Other Building Material Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2018)

Stanley Black & Decker saw a slight rise in its claims rate but made a slight cut to its accrual rate. Nordson saw a big jump in its claims rate but made a slight cut to its accrual rate. RPM International Inc., which counts Rust-Oleum and Day-Glo among its brands, saw a slight rise in its claims rate but gave a big boost to its accrual rate.

Sherwin Williams, meanwhile, saw its claims rate fall from 1.4% to 1.1%, and doubled down by cutting its accrual rate from 1.1% to 0.6%. Owens Corning and La-Z-Boy Inc. both saw modest reductions in their claims rates, but raised their accrual rates anyhow. The company's warranty expense rates initially rose after it completed the Valspar acquisition midway through 2017, but they're getting back to historical norms now.

Lincoln Electric Holdings Inc., which makes welding equipment, and PGT Innovations Inc., which makes doors and windows, reduced both their claims and accrual rates by significant proportions. Tennant Company, which makes floor cleaning systems, cut both expense rates by modest amounts, as did pump maker Franklin Electric Company Inc.

Warranty Reserves

Our final metric is the year-ending balance in the warranty reserve funds of the 118 companies on our building material lists. Their combined balance at the end of 2018 was $1.2 billion, down $225 million from the end of 2017. The fixtures companies raised their reserves by $88 million. The furniture makers saw a $65 million drop in reserves. And then the other building material manufacturers saw a $247 million decline -- more than a third of their 2017 year-ending balance.

Figure 6

Building Material Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2018)

The biggest drops in dollars were the $94 million decline at Sherwin Williams and the $74 million decline at Stanley Black & Decker. But in relative terms, the $12 million decline at Acuity Brands and the $11 million decline at Louisiana-Pacific Corp. were also significant. Steelcase, Pentair, and Trex Company Inc. also made sizeable cuts in their warranty reserves.

Mueller Water Products reported one of the biggest two-year reserve increases. At the beginning of October 2016, it had $2.0 million in its warranty reserve. A year later, it was up to $8.5 million and by the end of September 2018 it had reached $20 million. Claims haven't increased by much, but accruals have soared.

After that, the biggest increase in reserves was reported by Hubbell, which boosted its reserves from $14 million at the end of 2017 to $92.7 million at the end of 2018. But almost all of that was caused by its acquisition of metering and monitoring company Aclara Technologies. Fortune Brands Home & Security Inc., which makes locks, faucets and tools, saw the largest non-acquisition increase in reserves, going from $17 to $25 million in the course of the past year.

Other significant increases in warranty reserve balances included Mohawk (+8.5 million), Owens Corning (+$5.0 million), La-Z-Boy (+$3.6 million), and Sleep Number (+$1.1 million).

Next week, we will wrap up our tour of the building trades with a look at the warranty expenses of homebuilders. In a way, these are the "OEMs" of this sector, while the brand names we've looked at this week are their suppliers. And although it stretches the analogy to its limits, the makers of the heating, cooling, and refrigeration systems and appliances are the "powertrain manufacturers" of the building trades. We will see how the totals and averages line up.