April 28, 2003 |

ISSN 1550-9214 |

EPA02 Diesel Engines:Diesel engine makers deliver upbeat quarterly results. Warranty crisis averted, sales gains reported for new generations of cleaner burning diesel engines.by Eric Arnum, Editor

Almost seven months after the U.S. Environmental Protection Agency deadline passed for cleaner diesel engines for on-highway trucks, several top manufacturers are reporting cautiously optimistic sales gains.

For all but Caterpillar, the 1Q03 financials are the first full quarterly income statement reflecting sales of the new generation of EPA-compliant diesel engines used in trucks, buses, and motor homes. And for all but Caterpillar, the first quarter is looking like an improvement from the fourth quarter's market bottom. And all manufacturers including Caterpillar agree that demand is now genuinely picking up. The Story So Far

See Warranty Week, Feb. 10 edition, for more background information. Under terms of that consent decree, these seven manufacturers had until Oct. 1, 2002 to modify their engines so that their emissions levels came in below the EPA's 2.5 gram NOx+NMHC standard. That standard cuts emissions of nitrogen compounds for new engines by something on the order of 50% from 1998 model-year levels, according to an old 1997 EPA document announcing the policy and its benefits. The EPA kept to its Oct. 1 deadline, and shortly thereafter Cummins, Mack, Volvo, and Detroit Diesel delivered emissions-compliant engines to the market. As the EPA expected, fuel economy was down a few percentage points and the purchase price of the typical on-highway truck was up a few percentage points, while engine horsepower ratings were generally the same as before. Most notably, with a few months of sales now behind them, manufacturers now are relieved to report that the engines are proving to be more reliable than some predicted. Warranty claims are not spiking, and backup vehicle/engine loaner programs they created just in case have seen only light usage. CAT the Odd Man Out?Caterpillar was the last to comply when it announced its new engine line in March 2003, with some of the smaller engines available immediately and the larger on-highway truck engines due later this year. Caterpillar's current large engine product line doesn't meet EPA rules, for which it pays a small penalty on every unit sold. However, the new engines use something called Advanced Combustion Emission Reduction Technology (ACERT) to bring emissions levels down below the 2.5 gram threshold, so once they come to market all major on-highway diesel engine manufacturers will be within EPA limits.

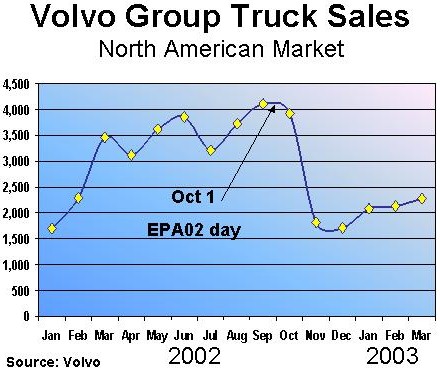

Last summer, as the October deadline approached, many fleet operators read the tea leaves and decided to load up on the last of the old engines. They worried the EPA02 engines would burn fuel faster, provide less power, and would cost more to run. That four out of five diesel engine makers favored one technology and Caterpillar favored its own made them think, what do they know that they're not telling? Maybe EGR didn't work, they worried. Some thought engines that used EGR would break down more often, suffer more warranty claims, and be off-highway more than pre-EPA02 engines. That worry, and the pre-buy that resulted produced a bubble in the second and third quarter sales data last year, and a trough in the fourth quarter that we're just now apparently coming out of. If demand for diesel engines is any sort of leading economic indicator, then perhaps the real recovery in industrial production has now begun.  For the Volvo Group, combined monthly Mack and Volvo brand truck sales peaked in September and bottomed out in December. So far this year, sales rates have remained above 2,000 units per month. The chart above demonstrates clearly how severe and sudden the sales trough hit, and how closely it correlates to the EPA's deadline. Call it the EPA02 recession. Jim McNamara, senior manager of communications at Volvo Trucks, said the experience with the new EPA02 engines thus far -- both the Volvo and the Cummins -- has been very positive. "We have not experienced any large amount of customer issues with the new engines," he said. "Their reliability, which some people had raised as a potential issue prior to these engines coming into the market, has not been an issue." The pre-buy skewed last year's sales, adding to the August-through-October totals and taking away from late-year figures. But now sales are coming back, with first quarter orders up from third- and fourth-quarter levels, even if year-over-year sales were down. In fact, McNamara said Volvo is now increasing the production rate in its factory this month to accommodate the increased demand. Cutting Warranty ClaimsInitially, the impact on fuel efficiency was estimated to be between 0% and -2%. Subsequent experience has proved that estimate to be accurate, McNamara said. But because of the cost of the new emissions technology, a $3,500 EPA surcharge was added to the cost of each new vehicle. McNamara said Volvo dealt with the EPA02 jitters last year in several ways. "One of the things we did to help allay any perceived fears about the '02 engines was to set up a program where we strategically positioned 20 "swing" engines across North America, so that if you had a major problem with an engine that couldn't be fixed right away, we could drop a whole new engine into your truck." So far, none of those spare engines has even needed to be unpacked, he said.

Volvo established a cross-functional team from across the organization, including key Volvo dealers, to swiftly identify the root causes and to fix any product issues involving the new VN. If an issue is discovered on a truck in service, VNAT has the resources to develop a solution to resolve the issue in the field (at the dealership repair facility), as well as to find a manufacturing solution to eliminate the situation from future production. To date, the VNAT approach has reduced the time it takes to resolve field service issues by two-thirds. On a page in its 2002 annual report entitled "Volvo meets new emissions standards," the company said the jump in orders last summer and fall, "fueled by customer concerns about the performance of the new engine technologies required to reach the significantly lower levels of emissions, and about the effect of the emission-reduction technologies on factors such as fuel consumption," turned out to be unnecessary, because performance was not reduced and fuel consumption increased only slightly. "During the autumn the North American range of Mack and Volvo engines was conditionally certified in accordance with the new standard. We consider our new engine range to be competitive in the market, with a very limited increase in fuel consumption for the new Volvo VN truck." Mack Trucks Launches ASET

Mack Trucks Inc. and Volvo Trucks North America Inc. remain separate brands within the Volvo Group, but behind the scenes the two companies are combining some back office and support functions. They're not quite as integrated as all the General Motors brands, nor are they as separate as perhaps Mercedes and Dodge are within DaimlerChrysler. Still, their sales figures are reported together by the Volvo Group.  Mack Trucks uses its own engines, and its own implementation of the exhaust gas recirculation technology that helps cut emissions. Within Mack's Application Specific Engine Technology, the ASET AI family is used in construction vehicles, dump trucks, and garbage trucks, while the ASET AC is used in on-road highway transporters. McNamara said he doesn't yet have any specific data on ASET warranty claims or trouble reports, but anecdotally so far he's hearing fairly positive reports from the field. "One thing we have discovered is that the engines operate in different ranges of RPM, and in some applications they are a little more responsive than their predecessors were." He said the Mack Truck field teams are working with customers, showing drivers how they need to adjust the way they operate the new engines. "They've been having a little bit of a familiarization period, but in general we're hearing very positive things about the engines." Drive the Future TourLast fall, Volvo Trucks took four of the new VN models on a "Drive the Future" road show, visiting 17 different truck stops on a tour that lasted from September to November. Of a total of 605 test drivers -- all holders of commercial licenses -- 87% preferred the new VN's styling over their own truck's, 91% preferred its ride, and 89% preferred its quietness. "The comments we received from professional drivers were awesome," noted Susan Alt, vice president of marketing for Volvo Trucks North America, in a company press release. "They just loved the truck, the ride, the styling and the driver amenities. They especially liked the new features, such as the standard air-ride front suspension, new cabinets and unique features like our fold-out side fairings." This year, Volvo Trucks has embarked on another road show that will take it to 20 truck stops in the U.S. and Canada by the end of June. The first stop was west of Atlanta, where Volvo parked its rigs for four days last week at a Petro Stopping Center truck stop near Exit 12 of Interstate 285. Mike Cantwell, product applications manager for Volvo Trucks, said that at the Atlanta truck stop, between 25 and 30 drivers stopped by for a test drive during each of the first three days, and that 18 had already come by halfway through the final day on April 25. Many of the test drivers reported hearing from others about the smooth and quiet ride of the new VN trucks, and wanted to see it for themselves. Some complained about little things like the driver's window not opening all the way, but nobody is complaining about performance.

McNamara said Volvo is bringing its new trucks to drivers, so they can take a look and report their impressions back to the fleet owners. "This is how we get to drivers where they live and where they work. Because we know once we get somebody to actually sit in the truck -- to touch it and drive it -- we have a much better opportunity to convert them. Even if it's somebody who drives for a major fleet, their voice within their company can have a major impact on buying decisions." Cantwell agreed, adding that the reason Volvo is going to the drivers where they work is because many don't have the time to go to a dealership, and even if they did, they don't want to "get tangled up" with a salesmen before getting behind the wheel for a test drive. "We figure if we can go to them at truck stops, they can take 20 minutes out of their time. None of the people here are trying to sell them a truck. We're just trying to get them to drive it." The tour continues westward across the South until mid-May, then it turns north going up the Pacific coast to Canada, dropping down into the Rockies at the end of May, then across the Plains States and finally to the Northeast in late June. Many Class 8 truck makers give their customers a choice of Cummins, Caterpillar, or Detroit Diesel engines. Cummins supplies Volvo with engines used in some of its new VN trucks, in addition to providing the diesel motors for Dodge Ram pickup trucks. Volvo also uses its own engines in some VN models. Mack Trucks uses its own ASET engines in the new trucks it makes. Detroit Diesel, which doesn't manufacture trucks itself, supplies customers such as Freightliner LLC, North America's leading heavy-duty truck maker. The Uptime Guarantee

Jason Rawlings, director of public relations at Cummins, said less than one in a thousand drivers has had a chance to collect on that promise. "We've had very few opportunities to use that, which is good," he said. "We've had to rent less than eight trucks." On April 17, Cummins reported a loss for the first quarter of $34 million, or $0.86 per share, on sales of $1.39 billion. This compares to a loss of $26 million, or $0.68 per share, on sales of $1.33 billion for the first quarter of 2002. Cummins said engine sales in the first quarter were up 5% to $816 million. However, the net loss attributable to this segment of its business was $23 million, versus a $19 million loss from the engine business in the year-ago quarter. Engines accounted for around 45% of total company sales in the first quarter, in line with last year's 46% average, but below the 51% record set during the pre-buying spike of last year's third quarter. In prepared remarks, Cummins chairman Tim Solso described this quarter as a continuation of the market downturn that began in the second half of 2000. "As we gain production efficiencies with our new products and as the markets recover, we will see our financial returns improve," he added. Successful EPA02 Engine LaunchIn an accompanying Form 8-K filing with the Securities and Exchange Commission, Cummins wrote that the engine business is experiencing a very successful launch of its new emissions-compliant products. "This complete line of new heavy-duty engines is performing well for our customers and end users. More than 8,000 engines have been shipped and order rates continue to improve. The Cummins turbo diesel engine for the award-winning Dodge Ram pickup is also performing well and continues to have strong acceptance in the marketplace. Engine shipments to DaimlerChrysler for the Dodge Ram were up 12,000 units, an increase of 60 percent from the first quarter of last year, resulting from the launch of Chrysler's new model pickup." Not all the news was good, however. Cummins also said it is not yet able to file its Form 10-K annual report for 2002 with the SEC, because it still needs to restate its financial reports due to an accounts payable issue related to a new Oracle enterprise resource planning system installed years ago in one of its plants. This restatement will require a re-audit of the 2000 and 2001 financial statements by the company's new auditors, PricewaterhouseCoopers LLP, and also necessitates the release of unaudited financial statements for 2002. Rawlings said the problems with the Oracle ERP system are not related to the introduction of the new diesel engines or any issue surrounding warranty claims management. "It's basically an Oracle system that helps us match supply chain management with inventory and things like that," he said. "It has absolutely nothing to do with the new product line." Market Share Gains at CaterpillarThen there is Caterpillar. In its quarterly financials, Caterpillar Inc. said sales of on-highway truck and bus engines rose 26% during the first three months of 2003, "as rising North American industrial production, increased housing starts, rising truck tonnage hauled and higher freight rates offset higher diesel fuel prices and insurance costs."

In North America, sales of CAT engines, which also includes units intended for off-road and construction work, were up 10.1% to $676 million in the first quarter. Worldwide, declines in Latin America, flat results in Asia/Pacific, and strong gains in Europe produced an 8.4% increase in engine sales to $1.49 billion during the quarter. Caterpillar spokesperson Carl Volz said he thinks the overall North American trucking industry "is still somewhat depressed, but we at Caterpillar are getting a larger piece of a smaller pie. We had a significant increase in market share," he said, up to a 44% slice of the pie in January -- more than twice its nearest competitor's. "We are seeing some improvement in the economy and so on, but it's really a market share story." Announcing ACERTAll this good news comes months before EPA-compliant engines begin to have an appreciable effect on earnings. Caterpillar is selling "bridge" engines now, which contain some ACERT elements, but not the full suite. Because they don't meet EPA standards, the company must pay a slight penalty for every unit sold. For some types of vehicles, Caterpillar is already delivering its EPA02 engines. The company formally launched its new ACERT family of on-highway truck engines on March 19. The C9 diesel engine, a midrange offering for transit buses, recreational vehicles, and medium-sized trucks, is available now. The smaller C7, for delivery trucks, school buses and smaller RVs, is due in June. Deliveries of the much larger C11, C13, and C15 engines for long-haul trucks follow later in the year (see chart).  In the press release launching the ACERT family, Steve Brown, director of marketing in the Caterpillar Power Systems Division, said the ACERT engines provide reliability and durability equal to or better than the current product line. "We�ll have more than 10.2 million miles of testing on engines with ACERT technology by the time we�re in full production in October," he said. "Reliability and value have always been key drivers for Caterpillar. The 2003 engine line continues that tradition with proven technology and industry-leading performance and fuel economy." Volz said he suspects customers are voting against EGR technology by choosing to have Caterpillar engines installed in their trucks and buses where and when they have a choice. Some customers such as school bus maker Blue Bird Corp. have switched entire product lines to Caterpillar precisely to avoid EGR technology, he said. And it's not just the pre-EPA02 Caterpillar engines that customers such as fleet operators are preferring, but also the forthcoming ACERT engines, which they're pre-ordering now for installation in their trucks later in 2003. "It's really the customer that's going to determine who has the better engine," Volz said, so he said to keep an eye on those market share numbers for clues to what customers think about EGR.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Years ago, the EPA discovered that diesel engine makers were exceeding allowable emissions standards by allegedly disabling their pollution controls during highway driving. The EPA filed suit against seven companies and on Oct. 22, 1998 it announced a settlement and a consent decree with them all: Cummins, Caterpillar, Detroit Diesel, Navistar International Corp., and the then-separate Mack Trucks, Renault Vehicules Industriels S.A., and Volvo Trucks North America Inc. (these three later merged into the Volvo Group).

Years ago, the EPA discovered that diesel engine makers were exceeding allowable emissions standards by allegedly disabling their pollution controls during highway driving. The EPA filed suit against seven companies and on Oct. 22, 1998 it announced a settlement and a consent decree with them all: Cummins, Caterpillar, Detroit Diesel, Navistar International Corp., and the then-separate Mack Trucks, Renault Vehicules Industriels S.A., and Volvo Trucks North America Inc. (these three later merged into the Volvo Group).

In a March 20

In a March 20

Last August, to allay fears that the new EPA02 engines might break down more often than their predecessors, Cummins introduced the "

Last August, to allay fears that the new EPA02 engines might break down more often than their predecessors, Cummins introduced the " In fact, the company said market conditions for early 2003 "have strengthened ... substantially compared to our earlier expectations."

In fact, the company said market conditions for early 2003 "have strengthened ... substantially compared to our earlier expectations."