Auto Supplier Warranty Report:The data for the first half of 2019 is not looking so good for the suppliers of automotive parts and systems. Claims hit a new record high and so did warranty reserves. The silver lining in this cloud, however, is that rising sales have reduced the pain and have kept expense rates close to their historical averages.

Every quarter since the start of 2003 we've looked at the financial statements of all U.S.-based automotive parts suppliers, in search of four key metrics: the amount of warranty claims paid, the amount of warranty accruals made, the amount of warranty reserves held, and the product sales revenue total. Using the claims, accrual, and sales data, we have calculated two additional metrics: claims as a percent of sales (the claims rate), and accruals as a percent of sales (the accrual rate).

In order to illustrate some important differences in warranty expense patterns, we split the available list of 120 automotive suppliers into two groups: the 24 powertrain suppliers that manufacture engines, transmissions, and axles; and the 96 suppliers that manufacture all the other parts of the cars, trucks, buses, and other vehicles made by the OEMs we covered in last week's newsletter.

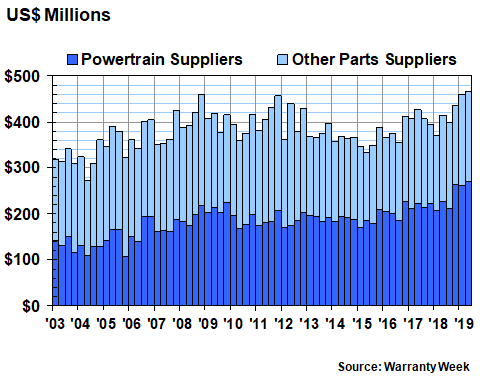

Warranty Claims Totals

In Figure 1, we're looking at the quarterly totals for the past 66 quarters, including the first two quarters of 2019. As is plain to see, the powertrain suppliers have hit a new all-time high for claims payments, and that in turn has driven the entire supplier group to a new record high of $467 million in the second quarter of 2019.

For the first half of 2019, claims are up to $926 million, an astonishing 18% increase over the first half of 2018. Claims rose by $96 million (+22%) for the powertrain suppliers, and by $45 million (+13%) for the other suppliers. And because claims costs are rising so much faster for the powertrain suppliers, their share of the total is now approaching 60%, when it had been roughly half-and-half as recently as 2015.

Figure 1

Automotive Supplier Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2019)

Cummins Inc. is the main culprit, thanks to a $96 million (+45%) increase in its half-year claims total, caused by repairs and replacements of diesel engines that failed U.S. and California emission tests. Elsewhere within the group, American Axle & Manufacturing Holdings Inc. saw its claims cost increase by $6.2 million, and Meritor Inc. saw claims rise by $5 million during the first half.

But there were also some spectacular increases outside the powertrain group. For instance, Wabtec Corp., Carlisle Companies Inc., and Tenneco Inc. each saw their claims costs more than double in the first half of this year. Donaldson Company Inc. and SORL Auto Parts Inc. each saw their claims cost rise by more than three-quarters over first-half 2018 levels. And Stoneridge Inc. saw its claims costs rise by more than 50% over year-ago levels.

The decreases were less numerous, but some were quite large as well. On the powertrain side, Allison Transmission Holdings Inc. cut its first-half claims cost by $7.0 million (-37%), and Visteon Corp. cut its claims cost by $3.0 million (-25%). On the other side, Regal-Beloit Corp. cut its claims costs by $5.3 million (-53%) and Lear Corp. reduced its claims by $8.0 million (-48%). And an honorable mention goes to Aptiv plc (formerly Delphi) for cutting its claims costs by 20% during the first half of 2019.

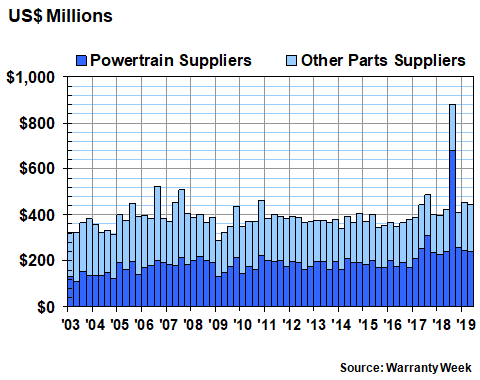

Warranty Accrual Totals

In Figure 2, the most peculiar feature is that towering column for the third quarter of 2018, in which the warranty accruals of the powertrain suppliers soars to $682 million, which drives up the all-supplier total to $879 million for the quarter. Once again, it can all be traced back to Cummins. That was the quarter in which the company determined the future cost of its emissions problems and set the money aside, which it is now spending (see Figure 1).

But here we're detailing the accruals of the first half of 2019, and comparing them to the first half of 2018, so that peculiar anomaly doesn't affect the comparisons. In the first six months of 2019, all suppliers accrued $898 million, up by $77 million or about nine percent from 2018 levels. The powertrain suppliers added only $20 million to their accrual total, so in this case most of the increase came from the other suppliers.

Figure 2

Automotive Supplier Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2019)

Indeed, the three biggest accrual increases across the industry came from that other supplier category. Wabtec boosted its accruals by $38 million. Tenneco raised its accruals by $13 million. And Carlisle increased its accruals by $11 million. All three represented a more than doubling of 2018 levels.

For the powertrain suppliers, the six-month increases were less severe. Cummins increased its accruals by $37 million, a 17% rise. LKQ Corp. added $6.5 million, and Meritor added $3.0 million. Both of those were a little larger than 25% increases. And Visteon added $1.0 million, an 11% increase.

But then there were also some big accrual reductions. Both EnPro Industries Inc. and Titan International Inc. cut their accruals by a little more than half. Twin Disc Inc. and Allison Transmission cut their accruals by just under half. Wabco Holdings Inc., BorgWarner Inc., and Cooper Tire & Rubber Company cut their accruals by about a quarter. Aptiv, American Axle, and Dana Inc. each cut their accruals by about a million dollars. In fact, a total of 12 suppliers each reduced their first-half accruals by a million dollars or more.

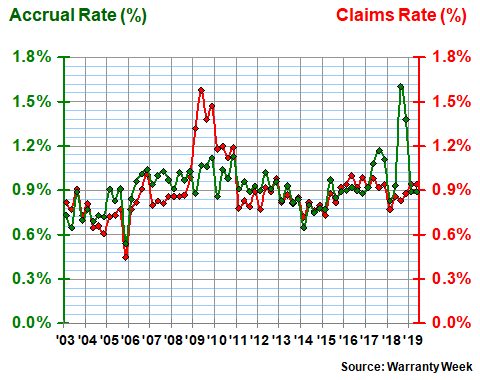

Warranty Expense Rates

The more revealing metrics might be the calculations of these millions of dollars in additions and reductions as a percentage of product sales. That's because as these expenses are rising or falling, so are product sales. And if one rises or falls faster than the other, that on its own can impact both the claims and accrual rates.

For instance, we've mentioned the emissions problems Cummins is having. But its sales are up 4.5%, so that takes away some of the pain. LKQ's sales were up 10%, and Meritor's sales rose 8.5%. So even though they boosted their accruals by multiple millions, none of them saw their accrual rate (accruals divided by sales) rise by more than 0.2%.

In Figure 3, we're looking at the quarterly average warranty expense rates for all the powertrain suppliers. Once again, we see the third-quarter spike that Cummins caused, but once again we're comparing first-half metrics, so we're skipping over that anomaly for now.

In both the first and second quarters of 2019, the warranty expense rates of the powertrain suppliers remained stable and close to their historical averages. Their average claims rate was a little over 0.9%, and their average accrual rate was a little under 0.9%. Long term, both of those averages are at 0.9%, with a standard deviation of 0.19% for claims and 0.16% for accruals. As can be seen in the chart, their claims rate spiked during the recession (when sales fell) and again in 2017 and 2018 when individual companies ran into warranty trouble.

Figure 3

Powertrain Suppliers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2019)

As of June 2019, that trouble was beginning to show up in some of the data. Cummins saw its claims rate rise to 2.5%, up from 1.8% a year before. Wabco saw its claims rate rise from 0.7% to 0.9%. EnPro and Meritor each saw their claims rates rise by 0.1%. It doesn't sound like much, but when your expense rates start out at 0.4% or 0.5%, those increases are proportionally quite large.

For instance, Cummins raised its accrual rate by 0.2%, from 1.9% to 2.1%. That's not so bad. But Meritor also raised its accrual rate by 0.2%, from 0.4% to 0.6%. And so while their accrual rates changed by near-equal amounts, proportionally, Meritor's increase was three times bigger.

But let's not overlook the cost-cutters. Allison Transmission cut its accrual rate from 1.7% to 0.8%, and its claims rate fell from 1.4% to 0.8%. EnPro cut its accrual rate from 0.8% to 0.4%, but its claims rate rose a bit. Visteon's claims rate fell by 0.2% while its accrual rate rose by 0.1%. Wabco cut its accrual rate by 0.2% even though its claims rate rose. And BorgWarner's accrual rate fell by 0.1% while its claims rate rose a bit.

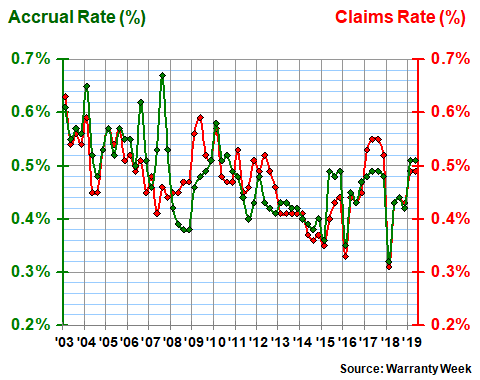

Other Supplier Expense Rates

As can be seen in Figure 4, the other automotive suppliers saw a very deep dip in their warranty expense rates right at the beginning of 2018. In fact, the group saw their average claims and accrual rates drop to their lowest-ever levels for the past 66 quarters. In 2019 they've risen back to around 0.5%, plus or minus a bit, so the year-over-year comparisons are likely to be brutal.

Figure 4

Other Auto Parts Suppliers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2019)

Then again, these are just averages for the group as a whole. And since we're tracking 96 different companies in this group, there's bound to be some good news tucked away in there somewhere. And indeed, Lear, Actuant, Regal-Beloit, and Modine each cut their claims rate by more than a quarter, and Regal-Beloit, Titan, and Cooper Tire each cut their accrual rate by a quarter or more as well.

But then there's the bad news. Tenneco doubled both its claims and accrual rates. Donaldson nearly doubled its claims rate, but cut its accrual rate anyhow. Stoneridge, Wabtec, and LCI Industries saw both their warranty expense rates climb by a third or more. Graco Inc. came in just shy of that threshold, with its claims rate rising from 1.3% to 1.5%, and its accrual rate rising from 1.0% to 1.3%. Taken together, this is what drove the group's average up from 0.3% in early 2018 to 0.5% by June 2019.

As of June 2019, both the claims and the accrual rates for the group were close to their historical averages of 0.5%, though they were each up about 0.1% from June 2018. Interestingly, 0.1% is also their standard deviation, which is another way of saying that most of the 112 data points in Figure 4 are between 0.4% and 0.6% (which even a quick glance can confirm to be true).

Warranty Reserves

Our last metric to be examined is the balance left in the warranty reserve funds of these 150 suppliers at the end of each quarter. As is evident in Figure 5 below, this metric tends to change slowly, though the obvious trend over the past 16-1/2 years had been upward.

Note that the powertrain group's reserve balance hit a new record of just over $3 billion in the second quarter of 2019. The other parts suppliers hit a new record of just over $1.18 billion in the first quarter. And in these two most recent quarters their combined balances have been over $4 billion for just the first and second time in the last 66 measurements.

Since the end of June 2018, the balances of the powertrain suppliers have risen by $204 million, and the other automotive suppliers have added $43 million to their coffers. And one more milestone to note: the powertrain group has accounted for more than three-quarters of the reserves for a year and a half, and that share continues to increase, hitting a new record level in June 2019.

Figure 5

Automotive Supplier Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2019)

As usual, Cummins was the major cause of the upward trend, having raised its warranty reserve balance by $208 million from June 2018 to June 2019. The other big increase on the powertrain side was reported by Dana, which added $20 million to its balance. But Wabco's balance fell by $9.0 million; BorgWarner's fell by $8.7 million; and Allison Transmission's reserves fell by $6.0 million.

On the other side of the industry, Wabtec added $102 million to its reserve fund, and Tenneco added $24 million. Lear's balance dropped by $8.1 million; Aptiv dropped by $6.0 million, and Titan fell by $3.9 million.

Also, in terms of sequential quarters, the other parts suppliers saw their reserved drop by an unusually large amount of $211 million from March to June 2019. Most of that can be traced to Carlisle Companies, which began following the ASC 606 accounting standard, which mandates the separation of product warranty and extended warranty accounts, and which therefore saw the company reclassify $199 million in reserves as "extended service warranties."

|