Seventeenth Annual Product Warranty Report:For a variety of reasons, claims and accruals continue to grow in the vehicle sector and shrink in the electronics sector. But sales have grown faster, so the overall share of manufacturing revenue going towards warranty expenses remains below 1.5%. Warranty reserves, meanwhile, came close to setting a new high water mark late in 2019, after years of declines.

Even though everything has changed in just the past few months, we continue to look back at the warranty metrics of top manufacturers reported in the past few weeks in their annual reports for the year ended December 31, 2019.

We began the process many years ago by searching for the annual reports and quarterly financial statements of all U.S.-based companies providing product warranties to their customers. In those reports, we found figures for the amounts of claims paid, accruals made, and warranty reserves held. We also looked for product sales data, and used those amounts to calculate the percentage of sales revenue going towards paying claims and making accruals.

This is the seventeenth year since U.S. accounting regulators required all publicly-traded and warranty-issuing companies to disclose their claims, accrual, and reserve totals in their financial statements. Before 2003, these figures were rarely disclosed to investors. Now, as we've seen with Apple Inc. and Tesla Inc., among others, they become the basis for entire financial news articles.

Totals & Averages

What we're going to do in the charts that follow is to highlight the annual totals and averages for these five warranty metrics: claims, accruals, reserves, the claims rate, and the accrual rate. Then we will take the annual claims totals of the thousand or so U.S.-based companies that have ever reported these figures to investors, and reorganize them into three broad sectors: vehicles, electronics, and buildings, and then into 18 different industry groups, such as cars, trucks, computers, and appliances.

In the weeks to come, we will take deeper dives into the metrics of each of those industries, though some have already been published. In the March 5 newsletter, we looked at the top carmakers. In the March 19 newsletter, we looked at the truck industry. In the March 26 newsletter, we looked at auto parts suppliers. And in the March 12 newsletter, we looked at the homebuilders. So actually, it's four down and 14 to go.

One advantage of waiting until April to provide the annual totals and averages is that virtually all the data is now in. Of the thousand or so companies we've been tracking since 2003, only a handful have yet to file their annual reports for 2019, with only a few smaller companies such as SORL Auto Parts Inc. and GSE Systems Inc. among the largest warranty providers yet to be heard from.

Much more common are situations where companies either go out of business or get acquired by even larger companies. In the last two years, the names of those who dropped off the list of warranty-reporting companies because of mergers and acquisitions includes Arris International plc; Electro Scientific Industries Inc.; Electronics for Imaging Inc.; L3 Technologies Inc.; Rockwell Collins Inc.; VeriFone Systems Inc.; and William Lyon Homes.

However, so far this year the trend seems to favor huge companies that split themselves in half, thus creating two warranty providers where there used to be one. So far, this has happened at both Ingersoll-Rand and United Technologies. And this should help us with our industry sorting challenges, such as when a company could belong in either trucks or appliances, or aerospace vs. HVAC. In all the industry categories below, each company is assigned to one and only one industry category, based on its dominant product line.

Warranty Claim Totals

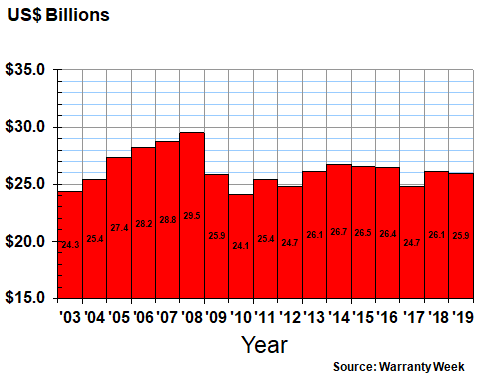

In Figure 1, we're looking at the annual totals reported for claims paid. In 2019, the total came in at $25.9 billion, down around $200 million or just under one percent from 2018 figures. Industries showing the greatest declines included Appliances, Semiconductors, Computers, and Power Generating Equipment, while those showing the largest increases included Cars, Trucks, Auto Parts, and Homebuilders.

Figure 1

Worldwide Warranty Claims

of U.S.-based Companies

(claims paid in US$ billions, 2003-2019)

Note that the U.S.-based warranty providers have reported spending just above or just below $25 billion per year on warranty claims for most of the past decade. From 2003 to 2008, there was a gradual annual increase, but since 2009 the trend has remained more or less flat, with minor peaks in 2014 and 2018 and minor valleys in 2010 and 2017. None of this data is adjusted for inflation, and of course until this year's pandemic, sales have been rising the entire time. So as we will see in a page or two, the percentage of sales going towards claims payments has been declining.

Warranty Accrual Totals

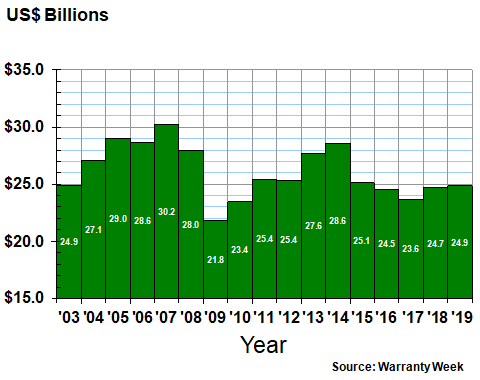

In Figure 2 we're looking at the amount manufacturers report setting aside each year as warranty accruals. These amounts are determined based on the best predictions the companies have for future warranty expenses, and are made at the time a product is sold. And so, they are affected by factors such as the lengthening or shortening of warranties, the cost of parts and labor, and the quality and reliability of the products themselves.

As can be seen in the chart below, the trend looks a little different from claims. There are definite peaks in 2007 and 2014, and a definite valley in 2009. But there is still a flattening of the data at or near the $25 billion mark, though only for the past five years rather than the last ten.

In 2019, the warranty accruals of U.S.-based companies rose by $220 million or just under one percent, to a level of $24.9 billion. It was the highest annual total for accruals since 2015, though it was only the twelfth-highest total of the past 17 years.

Figure 2

Worldwide Warranty Accruals

of U.S.-based Companies

(accruals made in US$ billions, 2003-2019)

Power Generation Equipment and Semiconductors once again show up as some of the industries reporting the largest declines for this metric, while Cars and Trucks once again show some of the biggest gains. But with this metric, Computer accruals were up while Auto Parts accruals were down, contradicting the direction they took with claims. Also, while Appliance claims were way down, that industry's accruals barely fell.

Warranty Expense Rates

A major reason for these seeming contradictions is the schedule on which they're reported. As was mentioned, accruals are made at the time a product is sold. Claims come later, after the product is put to use. Sometimes, there is a lag time of years between when accruals are made and when claims are actually paid, as was the case with the ignition key recalls of 2014, the appliance-caused fires of 2015, or the diesel emission test failures of 2018. The accruals were made at the time the problems were discovered, but some manufacturers are still paying the claims today.

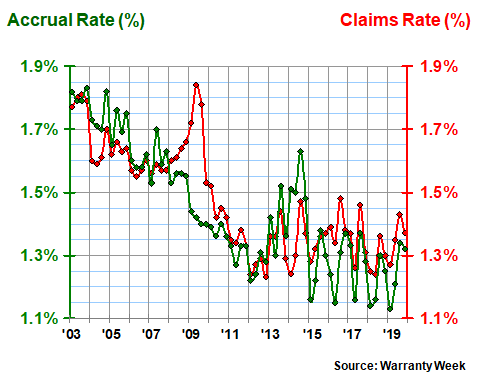

In Figure 3, we have taken the data from Figures 1 and 2 and divided the amounts by product sales revenue totals. This produces a pair of additional metrics that illustrate the percentage of sales going towards warranty expenses: the claims rate (in red) and the accrual rate (in green). At the end of 2019, the industry-average claims rate stood at 1.4%, up from 1.3% at the end of 2018. And the industry-average accrual rate stood at 1.3%, up from 1.2% at the end of 2018. However, both metrics remain below their long-term averages of 1.47% and 1.45%, respectively.

Figure 3

All U.S.-based Companies

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2019)

This chart is for all U.S.-based manufacturers in all industries, so it's difficult to pick out the problems of any one manufacturer or product line. But note that the claims rate in 2009 rose to its highest-ever level -- not so much because claims spiked (see Figure 1), but because sales fell. Also note that accruals fell more or less in proportion to sales (see Figure 2), so the accrual rate in 2009 more or less remained the same.

Warranty and the Pandemic

The reason we mention this is because we're now in the midst of yet another great manufacturing and sales crisis, and there's no way to predict what will happen to these metrics in 2020 as the effects of the coronavirus translate into financial figures. For instance, one reason sales fell in 2009 but claims didn't was because customers were able to bring their equipment in for warranty work. How much of the late-first-quarter and early-second-quarter warranty claims are being deferred until workers return remains to be seen. And of course, sales are at a virtual standstill, so accruals are not being made either.

The good news is that many forward-thinking and customer-centric brands are now adding months to the end date of their warranties, so that customers need not worry about how to arrange for any warranty work before the deadline. Others are employing videoconferencing and Internet chat technology to allow for not only work-at-home, but also for remote diagnostics and troubleshooting. Any system or service that reduces the need for a customer to visit a shop, or for a repair technician to visit a customer, is being put to work.

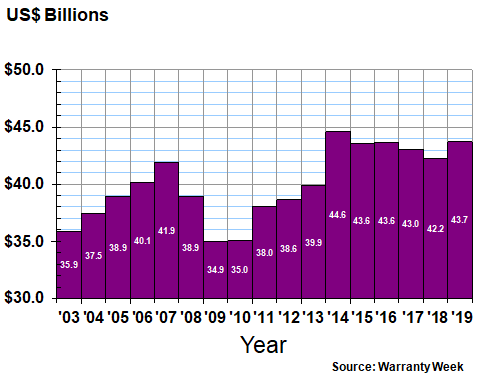

The annual totals in Figure 4 represent the closing balances in the warranty reserve funds of all U.S.-based manufacturers for the past 17 years. For all companies that report their balances quarterly, the figure is taken from the financial statement filed on or just before December 31. In other words, for GM and GE it's the balance listed in their annual reports for the calendar years. For Cisco and Apple, it's their balance at the end of their first fiscal quarter (their fiscal years end in September). For HP Inc., it's the balance on October 31, the end of their fiscal year. And so on.

At the end of 2019, the balance in all the warranty reserve funds had surged by just over $1.5 billion for the year, to just shy of $43.7 billion. It was the second-highest year-ending balance of the past seventeen years, surpassed only by the $44.6 billion recorded in 2014.

Figure 4

Worldwide Warranty Reserves

of U.S.-based Companies

(reserves held in US$ billions, 2003-2019)

In Figure 4 we drastically shortened the scale in order to better show the notch that the last recession took out of the balance in 2009-2010. But it also helps to illustrate the trend of the past five years, where the balance was gradually declining from that 2014 high, before snapping back suddenly in 2019. We will look for specific reasons in the weeks ahead. For now, let's just note that it happened.

Also, although we're not showing the distribution of these metrics between vehicles, electronics, and building trade sectors in this week's newsletter, let us simply note that in 2019, as happened briefly in 2014, the vehicle sector accounted for more than 60% of the entire country's warranty reserve balance.

The vehicle sector accounts for only half of the claims and accrual totals, while the electronics sector accounts for 36% of claims and 37% of accruals. But its share of warranty reserves hit an unprecedented 61.5% in the final quarter of 2019.

Warranty Claims in Each Sector

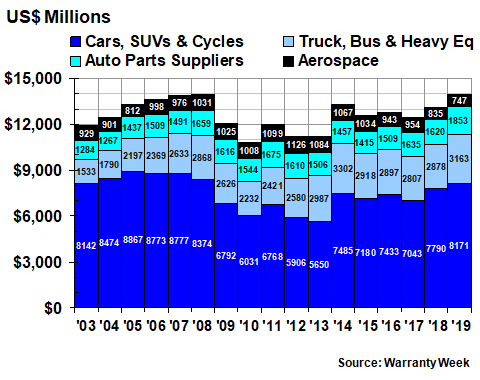

Speaking of which, in Figure 5 we're enumerating the annual claims totals in the four specific industries grouped together under the Vehicles heading. We should note that there are some boat and train engine and parts manufacturers mixed in with the trucks and buses, so this is truly a chart for all types of vehicles, land, sea, and air (satellite manufacturers are included in telecom equipment, however).

Three of the four industries saw claims rise in 2019, with auto parts showing the proportionally fastest growth. Only the aerospace industry saw a big decline, and that completely contradicts what one would have expected, given Boeing's problems with the 737. But more on that next week, when we take a deep dive into the civilian aircraft warranty metrics.

Figure 5

Worldwide Warranty Claims Payments

of U.S.-based Vehicle Makers

(claims paid in US$ millions, 2003-2019)

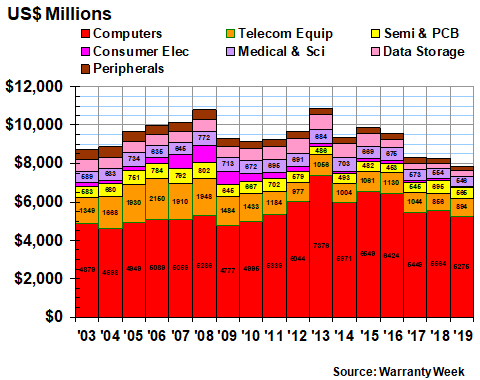

In Figure 6, we're looking at seven industries grouped together in the Electronics sector. Claims totals rose fastest in the data storage industry (+15%), and fell fastest in the semiconductor industry (-19%). But data storage and telecom equipment were the only two industries within the Electronics sector to show any increase from 2018 to 2019.

We should note that Asian and European importers are not counted in these industry statistics. They're for U.S.-based companies only (and the handful that recently redomiciled themselves to Ireland or some other tax haven). And in the vehicle sector especially, it does not include foreign-owned firms such as Chrysler or Autoliv, nor the domestic factories of immigrant companies such as Hyundai or BMW.

This has an especially outsized effect on the consumer electronics category, where even formerly large contributors such as Harman International are now owned by Asia-based conglomerates such as Samsung. In fact, most of the CE claims included in the chart below came from the 2007-2010 Xbox 360 debacle of Microsoft Corp., which no longer reports its product warranty metrics to investors.

Many of the telecom equipment makers also dropped off the list during the last recession. In the computer category, Dell Inc. and some other major players went private or were bought by foreign firms. The end result is that with only $7.9 billion in claims paid last year, the Electronics sector reported their least-ever amount of claims, at least going back to 2003, when public disclosures of warranty expenses began.

Figure 6

Worldwide Warranty Claims Payments

of U.S.-based Electronics Manufacturers

(claims paid in US$ millions, 2003-2019)

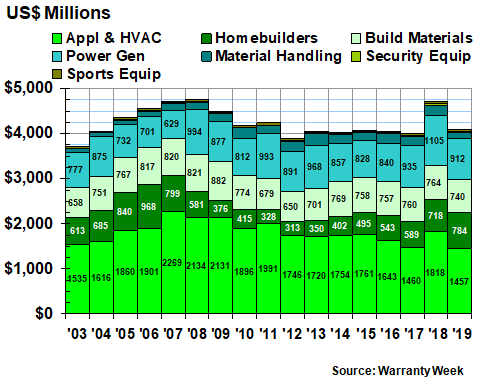

And finally, in Figure 7 we're looking at the balances in the seven industries grouped together under the heading of the building trades. It's a rather loose definition, describing everything from kitchen appliances to the giant turbines used in electrical power plants, as well as all the fixtures, furniture, security alarms, windows, doors, carpeting, and the heating/cooling systems put into buildings, not to mention the homes themselves (commercial builders seem to not ever disclose their warranty metrics, but most new home builders always do).

In 2019, these building trades reported mostly lower claims payments, with the Appliance and HVAC grouping reporting a -20% decline. Power Generation Equipment (e.g. General Electric) also saw a big decline (-17%). But, as only a picture can tell effectively, the totals for both industries in 2018 seem to have been something of an anomaly. So these declines in 2019 are more like a return to normal than an actual reduction.

Figure 7

Worldwide Warranty Claims Payments

of U.S.-based Building Trade Companies

(claims paid in US$ millions, 2003-2019)

We're not publishing details on the changing annual totals for accruals and reserves in specific industries that week. But let's take a moment to describe them. Of the 18 industry groups, nine saw increasing accruals and nine saw decreases. And with their reserve balances, eleven rose while seven fell.

Semiconductors and Power Equipment saw big declines in all three metrics, while Cars and Truck & Bus saw major increases in all three of them. Telecom Equipment saw somewhat smaller increases in all three metrics. Data Storage, meanwhile, saw a big jump in claims but not much change in either accruals or reserves. Auto Parts saw a big gain in claims but a contradictory decline in accruals.

But let's leave it there for now, with a promise to return to each of these specific industries in separate newsletters. We will also delve deeper into the individual companies, as we did for some of the top 100 largest warranty providers in the April 9 newsletter.

|