Worldwide Jet Engine Warranty Report:While many of the engines for today's jet airliners are made by diverse conglomerates, there are a few "pure play" turbofan makers that bear watching. And even some of those conglomerates are shedding some of their non-aviation businesses to focus on commercial aircraft.

While the poster boys of the last recession were the automakers and the homebuilders, this time around it's the travel and entertainment industry that's one of the hardest-hit. In the Midwestern U.S., runways are being used for jet storage, because who needs them for take-offs and landings when nobody wants to fly?

Still, commercial aircraft lifecycles are measured in decades, not months. Some of the Boeing 747s still in the air are older than the pilots inside them. Today's jet planes and their engines also have some of the longest warranties outside of the solar industry. And they take years to build. Planes and engines ordered today won't be delivered for a year or two. Their warranty life could span the coming decade.

Market Data

The list of the world's top jet engine manufacturers includes Rolls Royce Holdings plc; GE Aviation, a subsidiary of General Electric Co.; Pratt & Whitney, a subsidiary of Raytheon Technologies Corp. (formerly known as United Technologies Corp.); Safran Aircraft Engines, a division of the Paris-based Safran S.A.; Honeywell Aerospace, a division of Honeywell International Inc.; the Munich-based MTU Aero Engines AG; and privately-held Williams International.

There are several other turbofan manufacturers descended from the Soviet era. OJSG Aviadvigatel and its parent JSC United Engine Corp. are owned by the Russian government. JSC Klimov makes engines descended from Rolls Royce and Renault designs. NPO Saturn, also part of United Engine Corp., was formed through a merger of Rybinsk Motors and Lyulka-Saturn. And then there's Ivchenko-Progress ZMKB, which is owned by the Ukrainian government. There are also a couple of new manufacturers emerging in China as well. However, there is no publicly available warranty expense data for any of these companies.

There are also several joint ventures amongst and between some of the top industry players. The Engine Alliance is a joint venture between GE Aviation and Pratt & Whitney. CFM International is a joint venture between GE Aviation and Safran Aircraft Engines. Safran also has a joint venture with Boeing Co. to produce auxiliary power units for aircraft.

PowerJet is a joint venture between Safran and UEC-Saturn. International Aero Engines AG, also known as IAE, is a joint venture of Pratt & Whitney, MTU Aero Engines, and Japanese Aero Engine Corp. Rolls Royce and Avio S.p.A. are former IAE shareholders. And Avio in turn was formerly part of Fiat S.p.A. However, those two along with MTU and ITP Aero, a Spanish subsidiary of Rolls-Royce, are also partners in a joint venture called EuroJet Turbo GmbH.

It sounds complex, because it is. Further complicating the story is the fact that GE, Honeywell, and Raytheon have much more extensive product lines than just jet engines. Yet each company issues just one set of worldwide warranty expense figures for all their product lines combined, with no segmentation data for just those jet engine warranty expenses.

Therefore, as we did with the commercial airplane warranty data in last week's newsletter, we are going to present the company totals alongside some revenue segmentation data. And we will invite our readers to make assumptions, if they like, about how much of each total comes from jet engines.

Furthermore, five of the six companies named in the charts below publish their warranty expense data only once a year, in their annual reports. So the data stops at December 31, 2019. Raytheon Technologies is the sole exception, but the first and second quarter 2020 reports that it has issued are vastly different from the annual report that United Technologies issued for 2019, because of the spin-off of both Carrier Global Corp. and Otis Elevator Company into separate entities in March of this year. And so, as annoying as it may be, in this report we are going to present the old United Technology numbers, to be modified and renamed in next year's report, by the removal of UTC's HVAC and elevator warranty expenses and by reassigning them to Raytheon.

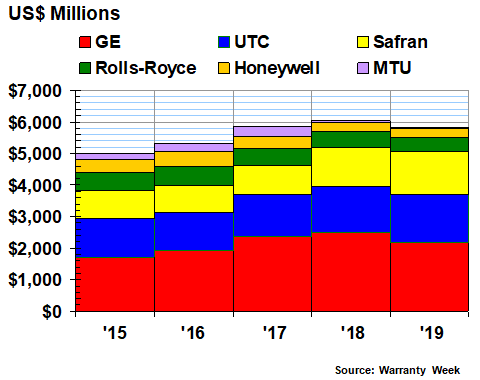

Worldwide Warranty Expenses

These six companies reported $1.81 billion in claims paid during calendar 2019, down about $259 million from 2018 levels. GE reported the biggest drop, from $960 million paid in 2018 to $715 million paid in 2019. Honeywell reported a $48 million drop, and Rolls-Royce reported a $19 million drop. Safran, United Technologies and MTU reported increases of $31 million, $19 million, and $3.1 million, respectively.

We should note that while three of the companies report in U.S. dollars, one reports in pounds sterling, and two report in euro. This can magnify or diminish the size of some of the changes. For instance, Rolls-Royce reduced its claims total by 9 million pounds from 2018 to 2019. But because the value of the pound also dropped from $1.33 to $1.28 over the intervening year, the dollar amount dropped by $19 million.

It also works the other way. Safran's claims total rose by 37 million euro. But because the value of the euro fell from $1.18 to $1.12, that amount translates to only a $31 million increase. In fact, if many of Safran's customers are trading in dollars, that in and of itself may have contributed to the rise, because even if claims remained the same in dollar value, they would have risen by more than five percent in euro terms.

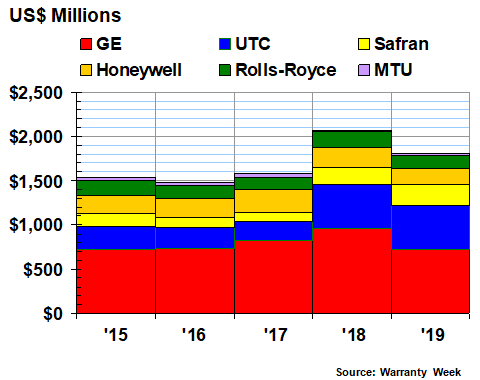

Figure 1

Top Jet Engine Makers Worldwide

Claims Paid per Year

(in US$ millions, 2015-2019)

The problem with the data in Figure 1 is that we know for sure that it is not all coming from warranty work on jet engines. The problem is, we have no way of knowing how much doesn't. We could extrapolate the figures based on revenue, but that solution has its own set of problems. First and foremost, how can we know if warranty expenses arise at the same rate for vastly different product lines?

In its 2019 annual report, GE said about 38% of its revenue came from the aviation sector, up from 35% in 2018. So does this mean that 38% and 35% of its warranty expenses came from aviation? Its other major product lines include turbines and health care equipment. Do they create more or less than their proportional share of warranty expenses? Internally, the warranty professionals know the answer out to three decimal places. But as external observers, we'd just be guessing.

Safran states that only 21% of its total revenue is from sales of aerospace propulsion equipment. Almost 44% of its revenue comes from services, and from commercial service contracts. Safran lists on its balance sheet more than 45 billion euro in performance obligations that are mainly "service and after-sales support contracts" -- translated from the original French, that's deferred revenue from service contracts and "support by the hour" contracts.

Honeywell, meanwhile, said aerospace sales comprised 38% of its revenue in 2019, up from 37% in 2018. But only 62% of that sum is from commercial aviation, and some of that is from the sale of avionics equipment -- not just engines. So to guess at Honeywell's jet engine revenue, an external observer would have to multiply two assumptions together, yielding a figure of 24%.

United Technologies presents a different puzzle. By comparing the original first-half 2019 figures published by United Technologies in July 2019 to the year-ago figures published by Raytheon Technologies in July 2020, we can calculate that exactly 65% of its claims and 69% of its accruals came from aerospace, while 35% of its claims and 31% of its accruals came from Carrier and Otis.

However, we still don't know the ratios for the second half of 2019, and we still don't know how much of that came from jet engines, and how much came from defense, space, and avionics (United Technologies acquired Rockwell Collins in November 2018). So far in 2020, Pratt & Whitney has accounted for 34% of Raytheon Technologies' total revenue, against 26% for the old Raytheon and 40% for Collins. Figures for 2019 are not available.

And so, our best guess is that commercial aviation accounts for 38% of GE's revenue, 24% of Honeywell's revenue, and 34% of Raytheon's revenue. But we'd still have to guess the splits between jet engines and avionics. So, like we said, in the end we'd just be multiplying our assumptions together.

Instead, what we will present are the worldwide totals for claims paid by six companies, and their respective shares of the $1.81 billion total for 2019. We'll leave it up to readers who are good at math to figure out how much of this is really from jet engines alone.

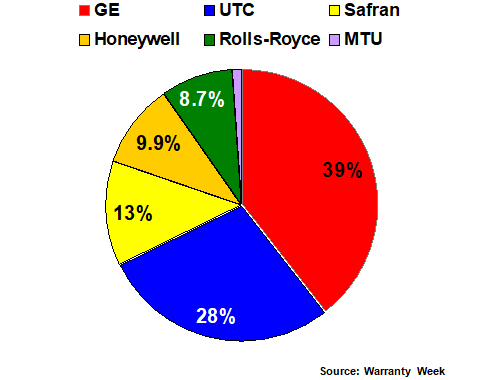

Share of Claims

In Figure 2, we're looking at a simple pie chart of the 2019 claims totals. GE leads at 39%, while United Technologies is at 28%, Safran is at 13%, and Rolls-Royce is just under 10%. Compared to total product revenue, GE is far above quota with its claims cost, while Rolls-Royce is only slightly above quota. The other four are somewhat below what would have been predicted, if claims cost arose at the same rate for every company.

Figure 2

Top Jet Engine Makers Worldwide

Share of Claims Paid

(percent of US$1.81 billion total, 2019)

This illustrates the problem. All six of these amounts and shares are taken verbatim from the annual reports of the companies themselves. There are no estimates. But if we added in the Russian and Chinese jet engine makers, and if we fashioned estimates for them based on what was expected, those estimates would be wrong -- either too high if we expected them to behave like GE, or too low if we expected them to behave like Rolls-Royce.

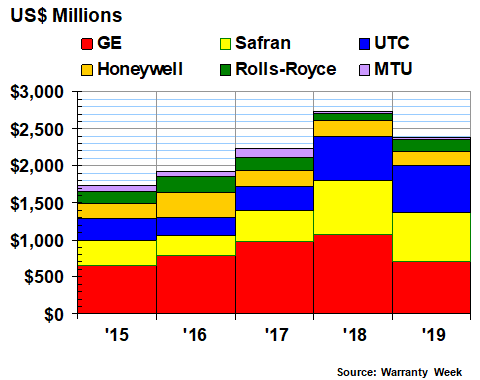

Warranty Accrual Totals

The amount of warranty accruals reported by these six companies was quite a bit larger than the amount spent on claims, not only in 2019, but in all five of the years in question. The total last year was $2.381 billion, which was $571 million more than the claims total. But the imbalance was even greater in both 2017 and 2018.

This is what usually happens if sales are rising quickly, because accruals are based on current sales while claims are paid on past-year sales. But while sales rose significantly at United Technologies and Safran, sales fell significantly at GE and Honeywell (though both also reported asset sales). And sales were flat at Rolls-Royce. So this does not account for the imbalance.

In 2019, GE cut its accruals by $358 million. Safran cut its accruals by $65 million. And Honeywell cut its accruals by $35 million. Rolls-Royce boosted its accruals by $64.5 million. United Technologies increased its accruals by $31 million, and MTU increased its accruals by $11.4 million. So we have three up and three down, and a $351 million drop overall.

Figure 3

Top Jet Engine Makers Worldwide

Accruals Made per Year

(in US$ millions, 2015-2019)

We should also note that Safran and UTC boosted their accruals significantly in 2018, as did MTU in 2017. Traditionally, accruals are always proportional to new product sales, unless there has been a change in product quality or repair cost. None of their annual reports mention any such thing, so the reasons behind these big changes remains a mystery. But they're plain to see in the chart above.

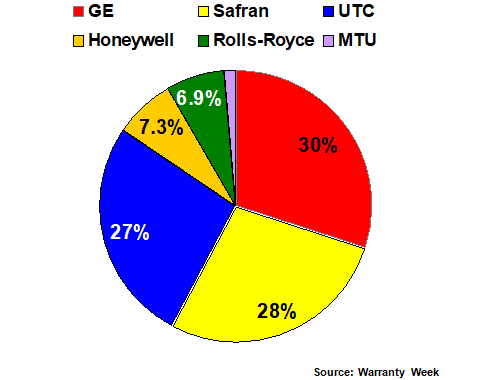

In Figure 4, we're taking the 2019 accrual totals and turning them into a pie chart, illustrating the relative shares of the total reported by each of the six companies. Safran is well over quota here, while GE is well below quota. The other four are more or less reporting the same share of accruals as they did for claims.

Figure 4

Top Jet Engine Makers Worldwide

Share of Accruals Made

(percent of US$2.38 billion total, 2019)

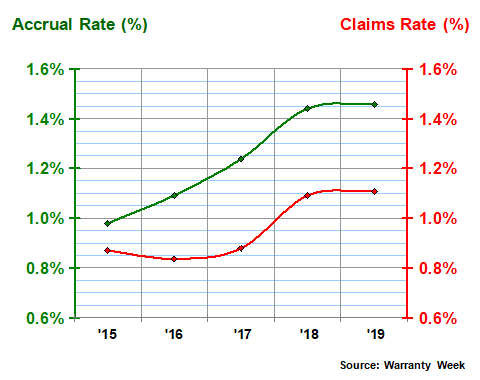

In Figure 5, we're taking all the claims and accrual totals from Figures 1 and 3 and dividing each by the corresponding product sales totals. This chart shows how large and long-lasting the imbalance is between claims and accruals. For instance, while jet engine manufacturers set aside nearly 1.5% of their product revenue as warranty accruals in 2019, they paid out only 1.1% of their revenue in warranty claims.

What's most concerning about the data in the chart below is the upward slope seen with both the red line and the green line. Way back in 2015, the industry-average claims and accrual rates were both under one percent. Now the claims rate is up by a quarter, while the accrual rate is up by half. And three of the six manufacturers we're tracking have raised their accrual rates above two percent at least once in the past five years.

Figure 5

Top Jet Engine Makers Worldwide

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2015-2019)

At GE and Honeywell, the claims and accrual rates are about the same. But elsewhere, the differences between companies are amazing. For instance, UTC's accrual rate was 0.2% higher than its claims rate in 2019. MTU's was 0.75% higher. And Safran's accrual rate (2.4%) was 1.6% higher than its claims rate (0.8%).

Furthermore, while the claims and accrual rates for Honeywell and UTC were both below the industry average last year, the metrics for GE and Rolls-Royce were both above it. MTU and Safran were below on claims and above on accruals.

Again, we don't know how much of each company's warranty expenses came from just jet engines, or at what rate those expenses arose. But we do note that Rolls-Royce and MTU, which could qualify as "pure plays" in jet engines, both came in with accrual rates near 1.8%. And so did GE.

However, while United Technologies reported a 1.2% accrual rate last year, Raytheon Technologies has an 0.8% accrual rate for the first half of this year. That's because it's turning out that Carrier's accrual rate is much higher than that of the aerospace business. Could the same be true at GE and Honeywell?

Warranty Reserve Totals

Our final metric is the balance in the warranty reserve accounts of the six companies over the past five years. And from a glance at Figure 6, it appears that these balances have been on a more or less even keel for the past three years, with the possible exception of MTU. That company's reserves peaked at $295 million in 2017, before falling precipitously in 2018.

Figure 6

Top Jet Engine Makers Worldwide

Reserves Held per Year

(in US$ millions, 2015-2019)

Elsewhere, the changes were notable in terms of dollars, but not massive in terms of percentage changes. GE's reserves dropped by $346 million (-14%). Honeywell's reserves dropped by $41 million (-13%). Rolls-Royce reduced its balance by $57 million (-12%). Safran's balance rose by $134 million (+11%). And UTC's balance rose by $99 million (+6.8%).

Safran and the Billion Club

It should be noted that three of these companies are maintaining a reserve balance over $1 billion: GE, RTC, and Safran. What makes this notable is the fact that only a dozen U.S.-based companies from any industry have ever reported a warranty reserve balance over $1 billion.

What's remarkable is that Safran is also in this club, with a balance of 1.2 billion euro or US$1.36 billion at the end of 2019. That's more than Tesla, HP, Navistar, Whirlpool, or Cisco. That's three or four times the reserves of Airbus. It's even a little more than Boeing keeps on reserve.

And in terms of product revenue, if Safran were based in the U.S. instead of in France, it would be just outside the top ten warranty providers across all industries. In other words, Safran is a major manufacturer and a major warranty provider, not only in Europe but worldwide.

|