US Auto Warranty Expenses:During the Great Recession, vehicle sales fell faster than accruals but slower than claims, so claims rates slowly rose while accrual rates slowly fell. During this pandemic, however, claims rates jumped quickly, while accrual rates are holding steady. But sales are plunging just like they did 12 years ago.

One of the big questions on the minds of warranty professionals is how the Pandemic is affecting the provision of warranty work. With half a year's warranty data now in hand, we're able to partially answer that question with some very tentative answers.

First, this market downturn came on faster than the Great Recession did in 2007 (in fact, it wasn't until September 2008 that most people knew we were in one). And the warranty metrics reflect that. Warranty claims and accruals are declining faster than they did in 2007 and 2008. But sales are declining even faster than they did back then, which actually makes the claims rate rise.

More Or Less Warranty Work?

We don't yet know whether consumers are too fearful of the virus to leave home and bring their vehicles in for warranty work, or if they're taking advantage of all the new flex time they have from working at home to bring in their vehicles more often. Cone are the days when you'd have to take the morning off to get your car to the dealership. For the most skittish customers, some dealers will even schedule vehicle pick-ups and drop-offs from the consumer's own home.

And then there's the parallel question of what is happening to warranty work for business vehicles. Certainly, those package delivery vehicles are getting a heavy workout from consumers shipping by mail. And even during the height of the lockdowns, food trucks remained a common sight on the highways. We know many planes are still parked and idle, but how about trucks and buses?

To make an attempt to answer these questions, we began by extracting four key metrics from the annual reports and quarterly financial statements of all U.S.-based automotive industry manufacturers: the amount of claims they paid, the amount of accruals they made, the amount of warranty reserves they held, and the amount of product sales revenue they reported.

Using the claims, accrual, and revenue totals, we were able to calculate two additional metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate). So we have five warranty metrics to examine: three totals taken straight out of the financial reports, and two ratios calculated from those metrics.

Data was compiled for some 170 companies for the period beginning with the first quarter of 2003 and ending with the second quarter of 2020. We initially separated the list of companies into OEMs and suppliers, based on whether their primary product was a vehicle or parts/components. We then further divided the list into 24 makers of small vehicles (cars, motorcycles, pickup trucks, golf carts, etc.), 26 makers of large vehicles (trucks, buses, recreational vehicles, construction equipment, farm equipment, etc.), 24 makers of powertrain components (engines, transmissions, axles, etc.), and 96 makers of other parts and components.

Warranty Claims

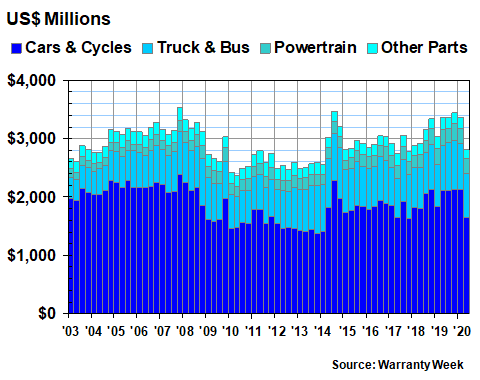

In Figure 1 we're looking at 70 quarterly measurements of claims paid for each of the four product categories. What becomes immediately apparent is the big drop in claims paid during the second quarter of 2020. The total for all of them fell to just over $2.8 billion, from $3.36 billion in the first quarter and $3.35 billion in the year-ago quarter, and the lowest quarterly total since the end of 2017.

Figure 1

Automotive Supplier Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2020)

For the first half of 2020, compared to the first half of 2019, claims are down by $214 million, or -3.4%. But the drop-off has been uneven. Claims fell -4.1% for the small vehicle makers, but rose +2.7% for the large vehicle makers. Powertrain suppliers saw a -6.3% drop in claims, while the other suppliers saw the steepest decline of all: -15%.

Five manufacturers saw their claims payments rise by more than 10% in the first half: LKQ Corp.; Paccar Inc.; Tesla Inc.; Toro Co.; and Winnebago Industries Inc. And then four saw their claims payments fall by more than 10%: Brunswick Corp.; Ford Motor Co.; Harley-Davidson Inc.; and Standard Motor Products Inc.

As to how the pandemic affected these numbers, we can only guess. The rise in large vehicle claims would suggest that truck dealers and fleet managers were more likely to remain open for business than the consumer-facing dealerships selling cars, pickup trucks, and SUVs. The larger downturns for suppliers than for OEMs suggest that the supply chain was more likely to shut down than the customer-facing sales and service end of the business. But who knows?

Warranty Accruals

Warranty accruals are different. Accruals are usually kept proportional to sales, unless a manufacturer predicts a change in failure rates or repair costs. And they're always forward-looking, in that a manufacturer estimates a product's future warranty costs and then sets that amount aside as the product is sold. No sale, no accruals.

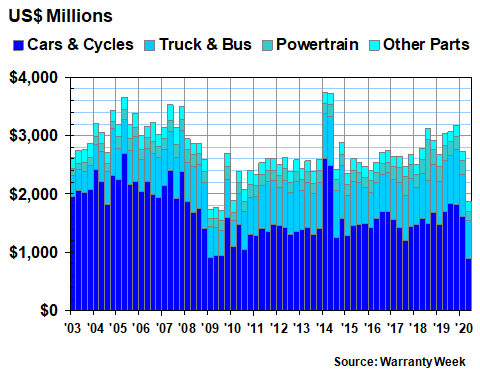

In round numbers, automotive product sales are down around -30%, including all U.S.-based OEMs and suppliers. And accruals are down by -19% for the first half of 2020, compared to the same period in 2019. So while the declines are not precisely proportional, they're close enough. You can see the steep decline in Figure 2. Give it another quarter or two and accruals will catch up to current sales.

In contrast, claims are always based on past sales, and the money available to pay them is based on past predictions. So it's no surprise to see truck claims rise even as truck sales slow dramatically -- you're fixing last year's vehicles.

What would be a surprise would be to see accruals rise even though sales fell dramatically. And no, that has not happened. Accruals fell for all four sub-groups as well as for the entire group. For the first half of 2020, they were down by $660 million for the small vehicles, down $238 million for the large vehicles, down $129 million for the powertrain suppliers, and were down $80 million for the other parts suppliers.

Figure 2

Automotive Supplier Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2020)

Two things that jump out of the chart above are the 2014 spike in accruals (caused primarily by recalls, such as the GM ignition switch defect) and the 2009 drop in accruals (caused by the Great Recession). Accruals spent three quarters at the bottom during the Great Recession, and they were preceded by several consecutive quarterly declines.

But also take a look at the right-most column, representing the second quarter of 2020. Simply put, accruals plunged, and they did so faster than even the 2008-2009 drop that heralded the arrival of the Great Recession. So is that it? Is this the bottom of the Pandemic? Or is it just the initial decline?

On a percentage basis, and compared to the first half of 2019, the first-half 2020 decline was steepest for the powertrain suppliers (-24%) and lowest for the large vehicle makers (-15%). Car manufacturers cut their accruals by -21%. And all the other suppliers cut their accruals by -19%. But some of the individual manufacturers cut accruals even more aggressively in the first half: Harley-Davidson Inc. -40%; Navistar International Corp. -38%; Cummins Inc. -38%; General Motors Co. -33%; and Paccar Inc. -23%.

Warranty Reserves

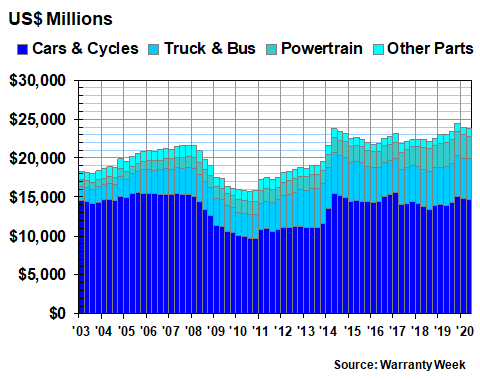

In Figure 3, it's clear that the warranty reserve balance is the metric that's least likely to respond to calamity. During the Great Recession, for instance, it took three years for the balance to hit bottom, from the end of 2007 to the end of 2010. Over that period, the combined balances of the 170 manufacturers fell from $21.65 billion to $15.84 billion -- a -27% decline. In contrast, the accrual total took only two years to hit bottom, from the fourth quarter of 2007 to the third quarter of 2009. And over that period, the industry-wide decline was -51%, from $3.5 billion per quarter to $1.72 billion per quarter.

During this go-round, the reserve balance has hardly reacted at all. In fact, the June 2020 balance of $23.78 billion was $767 million higher than the June 2019 figure. And it was down only $607 million, or -2.5%, from its December 2019 peak of $24.39 billion. In fact, it hasn't changed by much over the past 25 quarters.

Figure 3

Automotive Supplier Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2020)

From June 2019 to June 2020, only three large companies reduced their warranty reserve balances by more than 10%: Harley-Davidson, Thor Industries and Navistar. Meanwhile, five large companies increased their reserve balances by more than 10%: AGCO Corp., American Axle, BorgWarner Inc., Ford, and Tesla.

The Great Recession vs. The Pandemic

Last week, a longtime reader asked a question about this automotive warranty data: how has the virus impacted the industry, compared to the financial panic 12 years ago? We don't have any data on either the frequency or the severity of claims, so we can't say if customers are visiting more or less often. All we can do is compare the totals and averages.

So let's assume that the peak before the Great Recession came in the fourth quarter of 2007, and the peak before the Pandemic came in the fourth quarter of 2019. As was mentioned, during the Great Recession, it took eight quarters for the warranty metrics to hit bottom, in the third quarter of 2009. With the Pandemic, we're now in the third quarter of an indeterminate period of downturn.

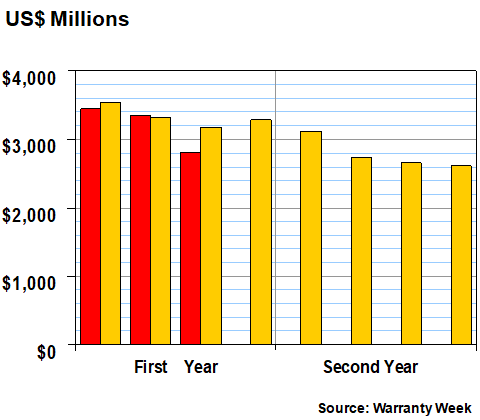

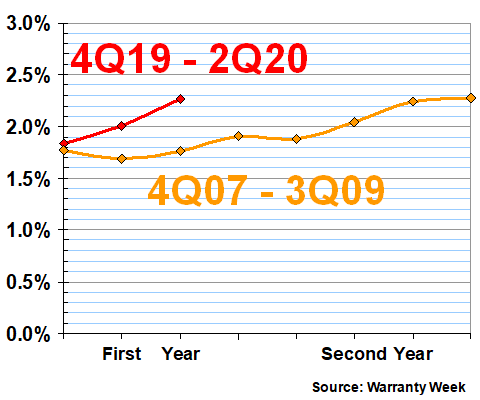

In Figure 4, we're looking at eight quarters of Great Recession claims and comparing them to the first three quarters of Pandemic-era claims. By early November, we'll have the current quarter's data in hand, and by next March we'll have the year-end 2020 data as well. But it will likely be next year before we see a true bottoming out of the data, unless something miraculous happens during the dead of winter.

Notice that the current claims decline, in red, has so far been a bit steeper than the decline from 2007 to 2009. Back then, claims fell -26% over eight quarters. So far this time, claims are down -18% over three quarters.

Figure 4

Warranty Claims per Quarter

Great Recession vs. Pandemic

(in US$ millions)

We need no reminder that sales are plummeting now, as they also did during the Great Recession. But one important difference between now and then is how swiftly we knew there was trouble: it wasn't until the collapse of Lehman Brothers in September 2008 that we knew we were in a recession, while this time the lockdown began in mid-March.

In the chart above, then, it wasn't until the end of the first year that we knew how bad things were last time. That fourth orange column represents the months of July, August, and September 2008.

But this time, during the Pandemic, it was almost the end of the first quarter of 2020 before the lockdowns kicked in. The second red column represents the months of January, February, and March 2020. So the lockdowns impacted just the last few weeks of that quarter.

Rising Claims Rates

Coincidentally enough, the industry-average claims rate at the end of 2007 was just under 1.8%, while the industry-average claims rate at the end of 2019 was just over 1.8%. In Figure 5, we've plotted them one on top of the other, to illustrate a trend. In the Great Recession, when we didn't know we were in a recession for almost a year, the claims rate didn't really rise much until the second year of the downturn. But in the Pandemic, the claims rate began to rise immediately, even before the lockdowns took hold.

Figure 5

Warranty Claims Rates

Great Recession vs. Pandemic

(as a % of product sales)

We've already noted that the claims total was falling from the get-go in both cases (Figure 4). So what Figure 5 is telling us is that sales were falling faster than claims (the claims rate is claims divided by sales) and therefore the claims rate rose. But this time it's rising faster. And that's due to the swiftness of the lockdown, which hurt sales and made consumers less likely to seek out warranty work.

Trucks vs. Cars in the Pandemic

Remember, claims actually rose this year for trucks. And something similar actually happened during the Great Recession. Back then, small vehicle claims fell by -32% by the third quarter of 2009 (and didn't bottom out until early 2010), but large vehicle claims actually rose throughout 2008 (and didn't bottom out until the middle of 2010).

The difference between large and small, of course, isn't just the size of the vehicle -- it's the type of customer: consumer vs. business. While some businesses own pickups and sedans, we dare say that very few consumers own Class 8 trucks or transit buses. And it seems like business customers are more likely to pursue warranty claims, even during a downturn (or perhaps because of the downturn, in the sense that it makes them more skittish about broken trucks).

There's an exception to every rule, and with our big vs. small categories the big exception is the recreational vehicle. As large as they are, they're primarily a consumer item. And during a health emergency like this, touring the country in an RV seems a much safer option than plane trips, car rentals, and hotels.

So far, we've seen a mixed picture, however. Sales for Winnebago, Thor, and Rev Group Inc. are all down, though not by as much as Ford or GM. Claims are up for Winnebago and Thor, while accruals are up for Winnebago and Rev Group. Then again, our data ends in June 2020, so perhaps we need to see the data for this past summer before the trend becomes clear.

Around the world (but not so much in the U.S.), the early reaction by many manufacturers to the Pandemic was to suspend the expiration of all product warranties, giving customers more time to bring in their products for repairs. In other words, don't feel like you're in a rush to make a claim and have to endanger yourself by leaving home to get the work done.

Some dealers, meanwhile, made it easier for consumers to get necessary repairs by scheduling valet pick-ups and drop-offs of vehicles. But while many consumers could postpone warranty work because they didn't really need to drive to work or to school, essential workers couldn't really put it off, and the essential businesses where they worked couldn't do so either.

Accruals During the Pandemic

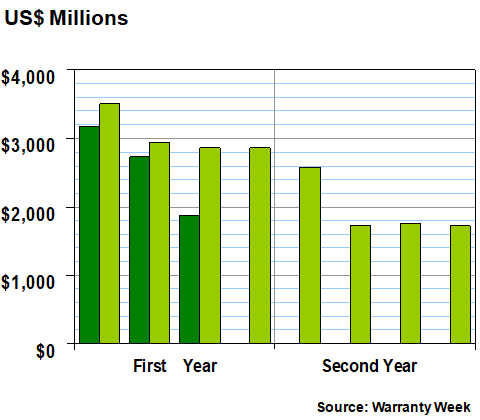

With accruals, the downturn once again has been swifter during the Pandemic. In Figure 6, we can see that it took eight quarters for accruals to hit bottom. And that decline, from $3.50 billion per quarter to $1.72 billion per quarter, was -51%. So far this time we're down only -41% (from $3.18 billion to $1.88 billion). But it's only the third quarter of the decline.

Figure 6

Warranty Accruals per Quarter

Great Recession vs. Pandemic

(in US$ millions)

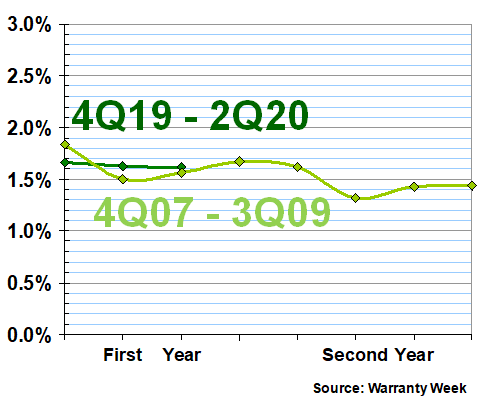

In Figure 7, we see that the industry-average accrual rate dropped in both cases. From the end of 2007 to the third quarter of 2009, the industry-average accrual rate fell gradually from 1.8% to 1.4%. This time, it's down only -0.04% so far, but still, it's down, not up.

The accrual rate for small vehicles is actually up a bit, primarily because Ford's warranty expenses have risen appreciably. In contrast, Harley-Davidson and Tesla are down significantly, while GM is down a bit. On the large vehicle side of the ledger, Thor and Navistar are down significantly, while Winnebago, Paccar, AGCO, and Caterpillar are up significantly.

Figure 7

Warranty Accrual Rates

Great Recession vs. Pandemic

(as a % of product sales)

So what does this all mean? First, it proves that no two downturns are alike. Back in 2007-2009, the decline was long and slow. In 2020, it was fast and deep. And while claims rates rose during both downturns, they're rising faster now (mainly because sales are falling faster now).

Back in 2007-2009, the downturn was caused by financial failures, which made it harder to get a loan to finance a car or home purchase, and therefore deepened and prolonged the downturn. This time, a health emergency has made it dangerous to leave home, to go to work, to go shopping, or to bring a vehicle in for repairs. But that's not true for "essential workers," so that means trucks are still rolling and business vehicles are still in need of warranty work.

Of course, three quarters isn't really enough time to detect a trend. And while there's been some amount of recovery during this past summer, the virus is still with us, and is still impacting work and shopping patterns. And the return of cold weather may only help its spread. So we may need three more quarters of data before we know how deep and how long this downturn will turn out to be.

|