Warranty Early Reporters:Because some companies end their fiscal years months before December 31, they also report their warranty expenses a bit sooner than most. So we've collected warranty expense data from 18 early reporters in 10 industries, representing about a third of the U.S. total.

While we await the annual reports of most of the top warranty providers to be filed for the calendar year of 2020, we already have in hand the financial reports of some 18 major companies. Some follow fiscal years that ended in late October. Others already published their annual reports for fiscal years ending June 30 or September 30, and are now publishing their final quarterly reports for the year. Either way, their fourth and final financial reports of 2020 have been published in the past few weeks, while most companies will wait for later in February or early in March to do so.

- From the vehicle sector, we already have complete year 2020 warranty expense data from Boeing Company; Deere & Company; Navistar International Corp.; Thor Industries Inc.; Toro Company; and Winnebago Industries Inc.

- From the electronics sector, we already have data from Apple Inc.; Applied Materials Inc.; Cisco Systems Inc.; Hewlett Packard Enterprise Company; HP Inc.; and Seagate Technology.

- And from the building trades, we have data from D.R. Horton Inc.; Johnson Controls International; Lennar Corp.; PulteGroup Inc.; Signet Jewelers Ltd.; and Toll Brothers Inc.

These 18 companies are in no way representative of the entire U.S.-based manufacturing base. However, they do represent roughly a third of the claims and accruals reported last year by all U.S.-based warranty providers. So if nothing else, they can provide us with an early indication of trends we will be exploring for the entire U.S. warranty industry in the months ahead, as the rest of the top warranty providers file their annual reports.

These 18 companies come from 10 of the 18 industry sectors we track. From the small vehicle industry we have the lawn mower king Toro. From the large vehicle industry we have Deere, Navistar, Thor, and Winnebago. From aviation we have Boeing. The computer industry is represented by Apple and the two HPs. Cisco represents data communications. Seagate is from the data storage industry. Applied Materials represents semiconductors. Johnson Controls is from the appliance group. Lennar, Toll Brothers, D.R. Horton, and PulteGroup are new home builders. And Signet is a top jewelry retailer, through brands such as Jared, Zales, and Kay Jewelers.

Warranty Claims Totals

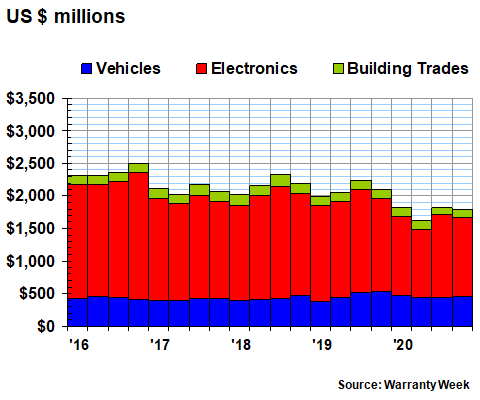

Let's start with a quick look at the quarterly claims and accrual totals of the 18 companies for the past five years, grouped into three sectors: vehicles, electronics, and building trades. There are six companies in each of the three sectors, though obviously some are larger than others.

In Figure 1, it is clear that their claims payments followed a steep decline in 2020 from one quarter to the next. In fact, during the first quarter of 2020, their claims were down by -9%, compared to the first quarter of 2019, showing the effect of the first month or so of the pandemic, and the lockdowns that followed. During the second quarter, claims were down by -21%, year over year. In the third quarter, claims were down by -19%. And in the just-concluded fourth quarter, claims were down by -15%. Sequentially, however, the second calendar quarter of 2020 seems to be when things hit bottom.

Figure 1

Worldwide Warranty Claims Paid

by 18 U.S.-based Early Reporters

(claims paid in US$ millions, 2016-2020)

Again, these results are not representative of the U.S. manufacturing space as a whole. Many of the largest warranty providers, and many of those most deeply affected by the pandemic and the lockdowns, are not on this list. Some that are among the early reporters are deep into "essential" industries, such as farming, schools, and trucking. And others, such as the homebuilders, seem to have grown in spite of, or perhaps because of, the lockdowns and the flight from the cities.

Surprisingly, the claims totals of these six vehicle makers actually rose by +24% during the first quarter of 2020. They barely declined in the second quarter of 2020, compared to the second quarter of the year before. We call that surprising because the passenger car makers were deeply impacted by the pandemic, beginning in March and continuing throughout the year.

Meanwhile, the claims totals of the six building trade companies hardly declined at all in the first quarter of 2020, but plummeted -31% in the third quarter. Electronics suffered its steepest claims decline in the second quarter (-28%) and its shallowest in the fourth quarter (-15%). In other words, the timing and impact was different in each sector, and in the industries within those sectors.

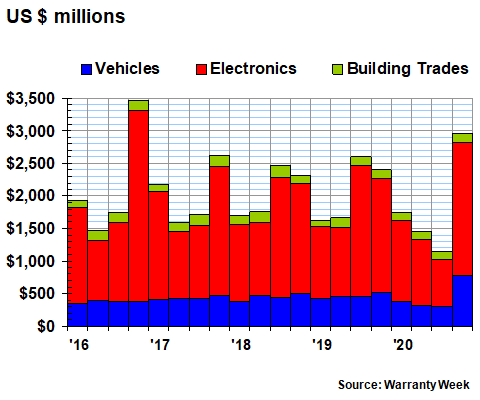

Warranty Accrual Totals

In Figure 2, we're looking at the reported quarterly accrual totals of the 18 companies for the past 20 quarters. The first thing that jumps out is the massive spikes in accruals that seem to occur once or twice a year. Most of the blame for that phenomenon can be directed at Apple, which, as we explained in the November 5, 2020 newsletter, has a habit of making extra-large accrual payments during the months of October, November, and December of each year.

In the fourth calendar quarter of 2020 (Apple's first quarter of fiscal 2021), the company made an extra-large accrual of $1.493 billion, 23% more than the final quarter of calendar 2019 and its largest three-month accrual total since the same quarter in calendar 2016. But then Apple also accrued 85% less in the months of July, August, and September 2020 than it did during the same months of 2019. And because of its size, this predictable inconsistency results in a curious-looking pattern.

Figure 2

Worldwide Warranty Accruals Made

by 18 U.S.-based Early Reporters

(accruals made in US$ millions, 2016-2020)

Therefore, we would suggest that in terms of uniformity, the accrual metrics are less consistent than the claims figures, for instance plunging by -56% in the third quarter and then rising by +23% in the fourth quarter. Accruals were down by only -12% in the second quarter and were actually up by +7% in the first quarter.

This suggests that when it comes to a major crisis such as the pandemic and the lockdowns it caused, customers may actually behave more rationally as a group in terms of making claims, than do the handful of decision-making executives who determine a given company's accrual totals. In terms of adjusting their accruals to changes in sales volumes, some were slow to react, while others over-reacted. And some of those that were slow to react in the winter and spring seem to have over-reacted during the summer.

Warranty Expense Rates

The generally-accepted procedure for determining accruals is to figure out the average cost per warranty for every product, and to then set that amount aside whenever a product is sold. That way, if sales soar, so do accruals. If sales plummet, accruals also do so in exact proportion. In other words, in a well-run warranty operation, a time series chart of the accrual rate, which is calculated by dividing accruals by sales, would be a flat line.

Claims are a different story. A flat line for the claims rate would be very unusual. First of all, there is always some amount of lag time between when a product is sold and when it needs repairs or replacement. Second of all, this warranty metric depends on not only the frequency and severity of product failures, but also upon the beliefs and behavior of customers, and to a small extent, the dealers or repair organizations providing the actual warranty work.

What do we mean by that? In the case of a massive worldwide health crisis like we're in now, customers would want to keep old equipment running longer, because new purchases are less affordable, but they would have to balance that with the real fear that merely visiting the dealer, repair shop, or retail storefront risks exposing the customer to the virus. Besides, in some countries during some of the most severe lockdowns, travel for anything but food was effectively banned. And in those countries, many manufacturers simply added months to their warranties.

But we also have to consider a parallel effect of the downturn, in terms of if you do get up the nerve to bring your product in for warranty work, a dealer or a retailer who hasn't made a sale all day might give it an extra-long look over, perhaps to find even more items in need of repairs. And the customer, worried about keeping their equipment in top shape, will gladly appreciate the added effort.

And then there are curious new usage patterns, again caused by the pandemic and the lockdowns. Exercise equipment in the home might be heavily used, while exercise equipment in the locked-up gyms goes untouched. Laptops and printers might be used all day by the work-at-homes, while the units in deserted offices sit idle. For personal vehicles, there was actually a point in time last year when insurance companies began making partial refunds, because commuting distance dropped from miles to yards.

With accruals, the temptation is always to manipulate earnings by raising or lowering the accrual totals depending on how other expenses are impacting net income. In other words, if earnings per share are falling a few pennies short of break-even, why not cut accruals by enough to turn that loss into a profit? If net income is running too hot, why not bank a little for the future by raising accruals by enough to create a cushion for the future?

Of course, these accounting methods would not be legal. But can they be proven? The only disclosures we usually see in annual reports about how accrual amounts are determined are some variant of "once in a while we adjust them up or down depending on whether they turned out to be high or low." At the end of the day, accrual totals are merely a best guess.

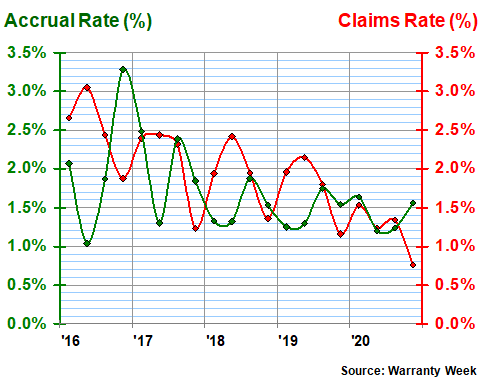

Apple

Having said that, let's take a look at the warranty expense rates of six of the 18 early reporters. We'll start with Apple, which in the fourth calendar quarter of 2020 paid $723 million in claims, or almost 0.8% of its product revenue, while making $1.423 billion in accruals, or nearly 1.6% of its product revenue. As the chart in Figure 3 illustrates, this represented a massive divergence from the third, second, and first quarters of calendar 2020, when Apple's claims and accrual rates were relatively close together.

Figure 3

Apple Inc.

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2016-2020)

Note that the most recent 0.8% claims rate represents a new low for the company. Apple's claims rate has never been measured lower, at least not since warranty expense disclosures began in 2003. It helps that product sales rose +21% in the quarter, and that claims fell by -21%. But it hardly explains the massive accrual, or the annual pattern whereby accruals in the final three months of the year are always extra-large in dollar amounts (and at the end of calendar 2016, also as a percentage of sales).

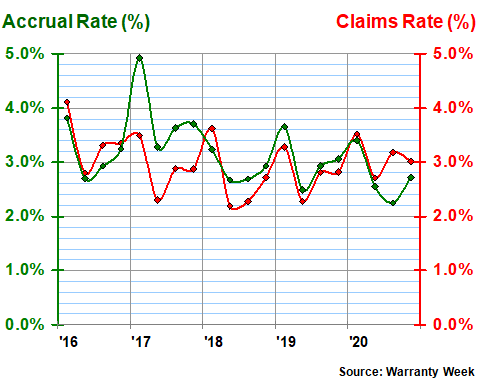

Boeing

Boeing actually ends its fiscal year on December 31, so the fact that its annual report was filed less than five weeks later is a tribute to the skill and efficiency of its accounting team. However, the grounding of the 737 MAX fleet and other problems drove the company to a massive $11.9 billion net loss and a nearly 50% decline in commercial aircraft sales.

Warranty accruals in the fourth quarter were extra-large as well. And at $455 million for the year, they comprised more than 2.8% of that shrinking total for commercial aircraft sales. And as Figure 4 illustrates, the company's claims rates were also extra high for the entire year.

Figure 4

Boeing Co.

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2016-2020)

We also should mention that most of last year's accruals came suddenly at the end. For the first 19 quarters of the years 2016-2020, Boeing's quarterly accruals averaged just short of $48 million. But in the final quarter of that period, they suddenly climbed to $405 million. And while the claims rate was also elevated throughout 2020, that was due primarily to the sales decline -- the bottom half of the fraction that determined the claims rate (claims / sales).

Meanwhile, the four quarterly claims totals of calendar 2020 were $82 million, $67 million, $53 million, and $58 million -- nothing unusual. In fact, what was really unusual was the extra-low claims total in the first quarter of 2019, which produced a claims rate well under 0.1%.

John Deere

There's nothing remarkable about the data in Figure 5, which tracks the warranty expense rates of John Deere for the past five years. On the one hand, they show an obviously seasonal pattern, as one would expect for a company whose product line is dominated by farm equipment. On the other hand, from one growing season to the next, there's not much change.

Figure 5

Deere & Co.

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2016-2020)

In the fiscal year ended November 1, 2020, Deere's product sales were down -10%. Its claims were down -4%, but its accruals were down -20%. Therefore, claims didn't fall as fast as sales, while accruals fell about twice as fast as sales.

Deere's accruals actually fell fastest in the third fiscal quarter -- roughly the months of May, June, and July. And that was the time when the seasonal pattern seems to have been interrupted, and also when the claims and accrual rates diverged by an unusual amount. That also happened back in fiscal 2017, though with the accrual rate diverging in the opposite direction.

Hewlett-Packard

HP Inc. is the laptop-and-printer company created at the beginning of fiscal year 2016 through the spin-off of Hewlett Packard Enterprise as the business-oriented computing company. Both still end their fiscal years on October 31, so both are part of our team of 18 early reporters.

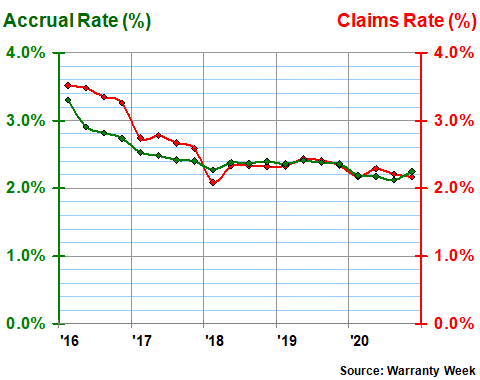

Regarding Figure 6, there's really little to say, besides that the company employs some of the world's best warranty managers and has consistently been able to reduce its warranty expense rates over time. Their rates have been just over two percent for three years running, and it would not be unexpected to see them fall below two percent at some future time.

Figure 6

HP Inc.

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2016-2020)

For the record, HP's claims were down -9.3% in fiscal 2020, while its accruals were down -7.0% and its product sales were down -2.4%. Its warranty expenses fell fastest in the months of February, March, and April 2020, and slowest in the months of August, September, and October 2020 (accruals were actually up a bit in that final quarter of the fiscal year). In other words, there's nothing remarkable about the data in Figure 6. And given the chaos of last year, that in itself is quite remarkable.

Navistar

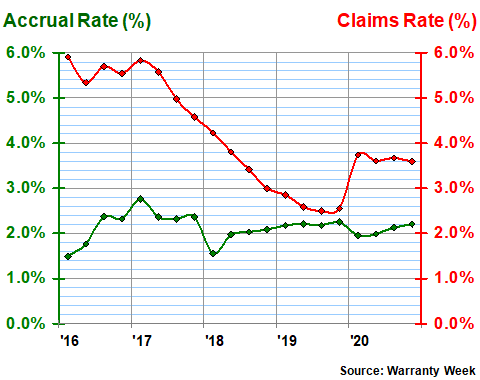

Our final two snapshots are for large vehicle makers: Navistar of trucks and buses, and Winnebago of recreational vehicles. Navistar, in Figure 7, is an illustration of the simplest procedure for determining accrual rates: basically, every time you sell a vehicle, put two percent of that revenue into the warranty reserve fund. The green line in Figure 7 remains nearly flat for 20 quarters, averaging 2.1% with a standard deviation of 0.3%.

Figure 7

Navistar International Corp.

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2016-2020)

The claims rate, meanwhile, has been steadily descending over the past five years, following the end of an expensive manufacturing excursion caused by the company's diesel engines, which failed to meet emission standards. In fiscal 2020, that downward trend was interrupted by falling product sales (down -34%), rather than by rising claims totals (that metric was actually also down, but by only -7%).

But as an example of accruals remaining proportional to sales, even during a downturn, when Navistar's sales of manufactured products fell -34%, warranty accruals fell -35%. And that is why the company's accrual rate (the green line) remained so close to two percent for much of the past few years.

Winnebago

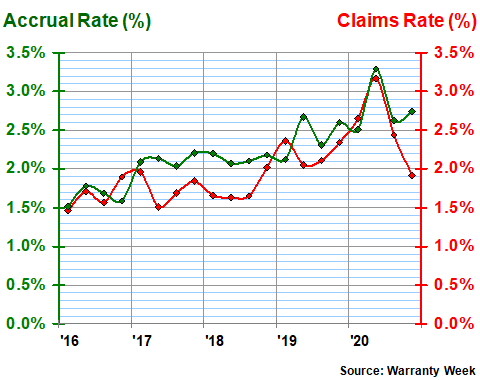

Finally, we get to Winnebago, one of the best-known brand names in the RV industry. In Figure 8, however, we see quite the opposite trend displayed by HP: gradually rising warranty expense rates, which are never a good thing. The good news is both the claims and accrual rates seem to have peaked in the company's second fiscal quarter, which correspond to the months of March, April, and May.

Figure 8

Winnebago Industries Inc.

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2016-2020)

Winnebago ended its most recent fiscal year on August 29, 2020. So what we're representing as the fourth financial report of 2020 is really the company's first fiscal quarter of 2021, and corresponds to the months of September, October, and November. In those three months, sales were up +35%, claims were up +10%, and accruals were up +42%.

Therefore, sales rose faster than claims, and the claims rate fell to 1.9%, and accruals rose a bit faster than sales, so the accrual rate rose slightly to 2.7%. But both those expense rates were much improved from the months of March, April, and May, when the claims rate hit 3.2% and the accrual rate hit 3.3%.

Over the next six to eight weeks, the rest of the manufacturers and retailers that report their product warranty expenses will publish their annual reports. In the December 17, 2020 newsletter, we detailed the trends we saw in the nine-month data.

Basically, what we found was that the vehicle makers were very hard-hit in the spring, and the electronics companies declined all year, while the building trades actually saw their warranty expenses rise. Time will tell whether those trends hold for the fourth quarter as well, and for the year as a whole.

|