Detroit Auto Warranty Update:It was supposed to be a down year, with car sales down and warranty expenses down also. The first part came true, and warranty work was way down last spring, but the latest financial data from the top U.S.-based automakers has warranty costs soaring late last year.

It's the question everyone in the industry is asking: did the pandemic and the lockdowns that followed help or hurt the warranty business? Shopping patterns changed. Usage patterns changed. And the process of bringing a vehicle in for warranty work changed. But did those behavioral changes drive up or drive down warranty costs?

In the last few weeks, we've received annual reports from three of the top U.S.-based automakers: General Motors Co., Ford Motor Company, and Tesla Inc. And while we're not going to assume that every manufacturer in every industry is going to follow the same trends, what we're seeing in this early data is that warranty expenses plummeted in the spring and soared later in 2020.

But even within this small group of three, there were some important differences. While sales fell and warranty costs soared at GM and Ford, sales grew and warranty costs remained proportional at Tesla. And we think we're beginning to see clues that suggest the answer is "Yes!" to the question of whether electric cars really do have lower warranty costs than their combustion cousins.

Warranty Claims Totals

Let's begin with the claims payments. In calendar 2020, GM, Ford, and Tesla together paid out $7.22 billion in claims, a reduction of just over $600 million from their combined 2019 totals. That represents a -7.7% overall decline, but it's merely an average of three very different stories. GM's claims cost fell by less than -1% in 2020. Ford's fell by -14%. And Tesla's claims cost actually rose by +25%, from $250 million in 2019 to $312 million in 2020.

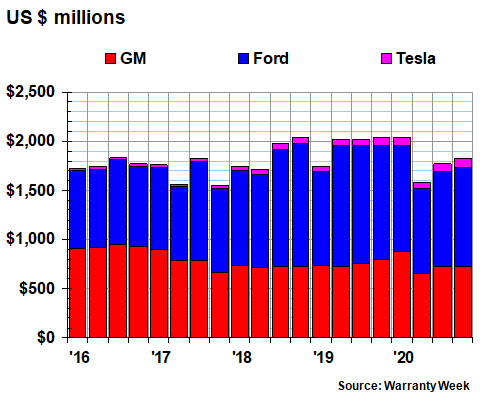

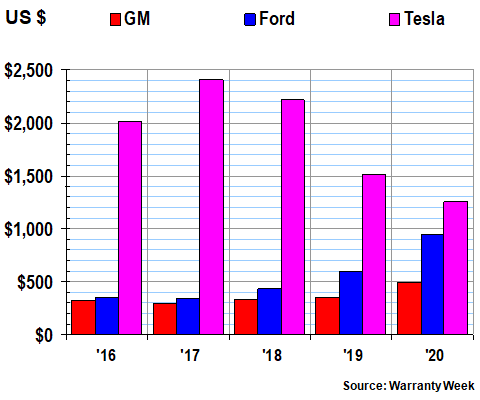

Figure 1

American Auto Manufacturers

Claims Paid per Quarter

(in millions of dollars, 2016-2020)

As is plain to see, however, in the quarterly data of Figure 1, the pace of these declines was uneven over the course of last year. In the first quarter, hardly anything changed, with the group's total claims cost coming in at just over $2 billion for the fourth quarter in a row.

And that makes sense, given that the first quarter ended on March 31, only 20 days after COVID was declared a pandemic, the lockdowns started, and the worldwide state of emergency began. There was hardly enough time left in the quarter for meaningful change to occur.

But then in the second quarter, when the lockdowns and cancellations became widespread, claims fell -$434 million or -22% as it became difficult, if not impossible, to bring a vehicle into the shop for warranty work. That decline continued into the third quarter (-12%) and the fourth quarter (-10%), but the year-long average decline still looks mild at -7.7%.

Again, the story was quite different for each manufacturer. GM, which registered just a small decline for the entire year, saw a +20% increase in claims during the first quarter, followed by a -10% decline in the second quarter, and then somewhat smaller percentage declines in the third and fourth quarters. Ford reported a much smaller gain in the first quarter, but then claims plummeted by -29% in the second quarter and by -20% in the third quarter. Tesla, meanwhile, reported year-over-year claims increases during all four quarters, though the second quarter gain was only +1.2% over 2019 levels.

The thing is, sales were also plummeting for GM and Ford, and were also growing for Tesla, even as the amount of warranty work was falling, or rising, respectively. For the full year, product revenue was down -11% for GM, was down -20% for Ford, and was up +31% for Tesla.

Warranty Claims Rates

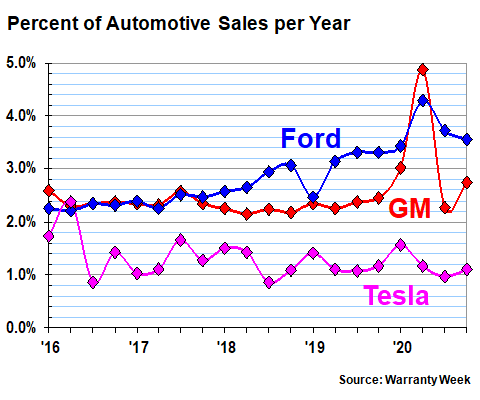

And since the claims rate is calculated by dividing claims paid by sales made, that metric went a bit wacky during 2020. As can be seen in Figure 2, GM's claims rate topped out at 4.9% in the second quarter, while Ford's rose to 4.3% at the same time. In contrast, over the 72 quarters between the start of 2003 and the end of 2020, GM's average claims rate has been 2.7%, while Ford's has been 2.4%. So those measurements were way above average -- anomalies, even.

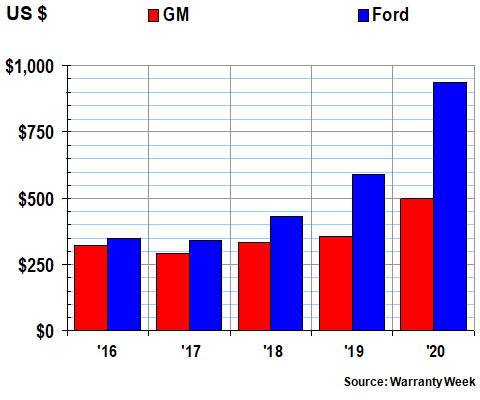

Figure 2

American Auto Manufacturers

Warranty Claims Rates

(as a percentage of sales, 2016-2020)

Tesla's claims rate, meanwhile, followed the same lazy seasonal pattern it's tracked for the past few years: highest in the winter, lowest in the spring or summer, but never far off from that 1.2% average. And please note that Tesla's claims rate has been far below either GM's or Ford's since the middle of 2016. That's 18 consecutive quarters of claims cost leadership, if anyone's counting.

Warranty Accrual Totals

Then again, the claims rate isn't a reliable metric during industry downturns like this, because there's a lag time between when a vehicle is sold and when it needs warranty work. And the reason Tesla's claims rate is so stable in Figure 2 is because its sales grow more or less proportionally with its warranty expenses: sales up +31%; claims up +25%.

In contrast to claims, during a recession the accrual rate should be stable, even during a sales downturn, because accruals are always supposed to be proportional to sales, unless there's been a meaningful change in product quality, reliability, or repair cost. If you believe the average car's warranty cost is going to be $500 over the life of its warranty, then every time you sell a car, you should put $500 aside as a warranty accrual. No sale, no accrual.

Well, that's a nice aspirational theory, which might be true in most normal years, but 2020 was no normal year. Instead, changes in accruals exceeded changes in sales in both directions: plummeting faster than sales fell, and soaring faster than sales rose.

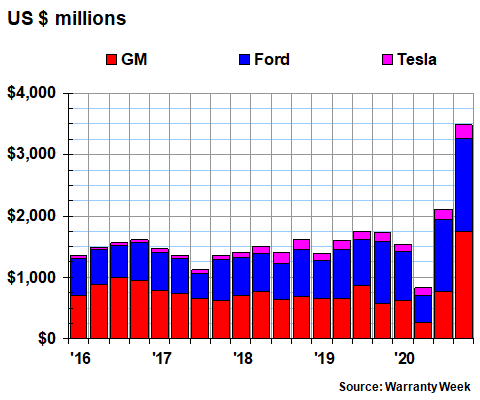

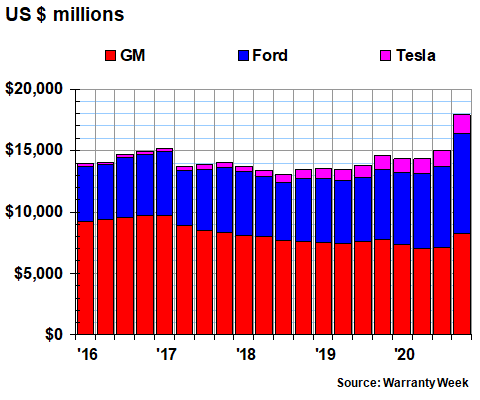

In fact, as can be seen in Figure 3, warranty accruals by these three automakers hit a record $3.48 billion in the fourth quarter of 2020, doubling their level in the fourth quarter of 2019 and surpassing even the previous record, which came in the recall-plagued first quarter of 2014. Compared to the fourth quarter of 2019, accruals in the fourth quarter of 2020 tripled for GM, were up +51% for Ford, and rose +39% for Tesla.

Figure 3

American Auto Manufacturers

Accruals Made per Quarter

(in millions of dollars, 2016-2020)

At the other extreme, in the second quarter of 2020, during the darkest days of that first wave of lockdowns, warranty accruals were down -60% for GM, fell -44% for Ford, and dropped -22% for Tesla. That averaged out to a -48% drop for the group, from $1.60 billion in the second quarter of 2019 to only $829 million in the second quarter of 2020. And yes, that was the least amount of quarterly accruals in the 72 quarters since measurements began in 2003 -- lower even than the totals reported during the darkest days of 2009.

In other words, their lowest-ever accrual totals were made during the months of April, May, and June 2020, and their highest-ever accrual totals were reported just six months later. It's inconceivable that the warranty accrual totals of these companies set a record low in the spring and a record high in the fall, but that's exactly what the data says happened.

Warranty Accrual Rates

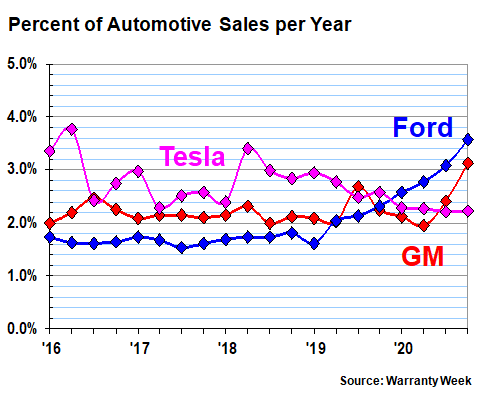

For the year as a whole, GM's and Ford's accruals were both up +24%, while Tesla's total was up +13%. Again, GM's product sales were down -11% for the year, while Ford's were down -20%, and Tesla's was up +31%. So nothing was remotely close to proportional between these two metrics: accruals and sales.

The result is even more surprising than the claims data: by the end of 2020, Ford's accrual rate had risen to 3.6% of sales, while GM's rose to 3.1% of sales, and Tesla's fell to 2.2% of sales. And so, for the second consecutive quarter, but for only the second time ever, Tesla had a lower quarterly accrual rate than both GM and Ford.

Figure 4

American Auto Manufacturers

Warranty Accrual Rates

(as a percentage of sales, 2016-2020)

Tesla's accrual rate was lower than GM's in all four quarters of 2014, and was lower than Ford's during all four quarters of 2020, but it's only been lower than both of them during the third and fourth quarters of 2020. And therefore, for the second consecutive quarter, Tesla can boast having both the lowest claims rate and the lowest accrual rate within this small group of U.S.-based automakers (we're classifying Chrysler as European-owned, though they've never been a contender for lowest warranty expense rates).

Accruals per Vehicle Sold

There is, however, more than one way to measure accrual rates in the passenger car industry. Because the automakers release such detailed unit production and sales data, we can also measure the amount of accruals they're making per vehicle sold.

This metric is calculated by dividing the amount of accruals by the number of units sold, resulting in a dollar amount rather than as a percentage of sales. For instance, in 2020, GM accrued just over $3.4 billion and sold just over 6.8 million vehicles, so its accrual per vehicle was just under $500 (actually, $498.02 if you want to get technical).

In Figure 5, we're looking at five years of accruals, measured against five years of unit sales worldwide. And in the last five years, only one of these three companies has seen its warranty costs per unit decline.

Figure 5

American Auto Manufacturers

Accruals Made per Vehicle Sold

(in dollars, 2016-2020)

Last year, Ford accrued just over $3.9 billion and sold just under 4.2 million vehicles, for an accrual rate of $940 per vehicle sold. And Tesla's accrual rate came in at just over $1,250 per vehicle sold -- its lowest cost per unit ever.

Back in 2012, Tesla accrued an astonishing $4,200 per vehicle sold. Even in 2017, its accrual rate was over $2,400 per vehicle sold. And in terms of the multiples between it and its competition, during the five years between 2014 and 2018, Tesla has accrued anywhere between five and nine times as much per vehicle as either GM or Ford did.

But in 2019, that multiple fell noticeably, and in 2020, Tesla accrued only 1.3 times as much per vehicle as Ford, and only 2.5 as much as GM. It's still in third place, but remember, this metric is based on what a company believes will happen. How long until Tesla begins to believe that its claims costs will remain low enough to justify an accrual reduction?

Removing Tesla

However, for the sake of transparency, let's remove Tesla from the chart for a moment, so that we can more clearly see the cost-per-vehicle trend for just GM and Ford. In Figure 6, we see the accrual rate per vehicle sold falling slightly for both in 2017, but then rising every year since. In other words, it's not just the pandemic or the lockdowns. It's not a recent trend. This is the third consecutive year that their accrual rates per vehicle have risen.

Figure 6

Ford & General Motors

Accruals Made per Vehicle Sold

(in dollars, 2016-2020)

We have one more warranty metric to measure. And once again, we will measure it over just 20 quarters, for the five years between the start of 2016 and the end of 2020. In Figure 7, we're looking at the ending balance in the warranty reserve funds of these three automakers. And once again, we see that they set a new record high for this metric at the end of 2020.

Figure 7

American Auto Manufacturers

Reserves Held At Year's End

(in millions of dollars, 2016-2020)

By December 31, 2020, GM reported its highest warranty reserve balance since 2017, while Ford and Tesla each reported their highest-ever warranty reserve balances. And that in turn led to the combined total for the reserves of the three companies rising to $17.88 billion, their highest level ever (or at least since measurements became public in 2003).

Put another way, the warranty reserve fund balance of these three companies is at its highest level ever, not only in terms of sheer dollars held, but also in terms of the multiple between claims paid and reserves held. In the fourth quarter of 2020, the automakers paid $1.828 billion in claims, or roughly $609 million per month. Therefore, their combined balances of $17.77 billion represents a multiple of 29.3 months of claims.

Fully-Funded Liabilities?

That's a decent-sized cushion. At the rate they were paying claims at the end of 2020, their warranty reserves held enough funds to pay claims at that same rate for 29.3 more months -- into the middle of June 2023. And that's very close to the moment at which the warranties for all but a handful of the vehicles they sold between the end of 2017 and the end of 2020 would have expired.

So by that measure, their warranty reserves are more adequate than they have been ever before. However, it also could mean the companies expect future warranty costs to be higher, and they're simply setting aside enough funds now to pay the claims later. Or perhaps they're just over-compensating late in the year for the under-accruals they made earlier in the year?

In contrast, during the bad old days of 2009, when people lost their wealth but still had their health, these automakers were still paying roughly the same amount of claims per month, but their reserves totaled only $10.25 billion, so the multiple between claims and reserves was only 16 months. So if any of them had gone out of business at that time (and a few almost did), their warranty reserves would not have been sufficient to pay off all the claims on all the remaining warranties, as their bankruptcy cases changed from Chapter 11 (reorganizations) to Chapter 7 (liquidations).

So here we are in the second month of the second year of the pandemic, wondering what will happen in 2021. If this data suggests anything, it's clear that things will not turn out as expected. We knew auto sales would be down in 2020, but who predicted warranty expenses would set a new record high?

|