Top 100 Warranty Providers of 2020:As we've done for the past 18 years, it's time to compare the most recent warranty metrics of the largest warranty providers in the U.S. to their year-ago warranty metrics, to see which of them have most successfully reduced their warranty costs.

Now that most of the largest U.S.-based warranty providers have filed their annual reports for 2020, it's time to take a look at how they fared during the year of the pandemic and the lockdowns that followed. And at least at this early point in our examination of the data, it kind of looks like any other year. It certainly looks nothing like the carnage of 2009, when many manufacturers struggled to remain in business and some failed to do so.

From the annual reports and quarterly financial statements of all U.S.-based manufacturers, we gather three essential warranty metrics: the amount of claims paid, the amount of accruals made, and the amount of money held in the warranty reserve fund at the end of each period. We also gather details on product revenue totals, and we use that data point to calculate claims as a percent of sales (the claims rate) and accruals as a percent of sales (the accrual rate).

Each year, we also tabulate the top 100 warranty providers, based on the amount of claims they reported paying during the calendar year. And then we calculate how much their warranty and sales metrics have changed since the year before. The theory is that while we can't readily compare one company in one industry to another company in a completely different industry, we can easily compare any given company to itself over time, and then measure the biggest changes.

For 2020, because it was such an awful year for so many people, between the pandemic, the lockdowns, the election, and even the weather, we are going to publish only the biggest positive changes of the year. All the negative news -- we'll leave that data for another publication to wallow in, while we look at just the bright side of life.

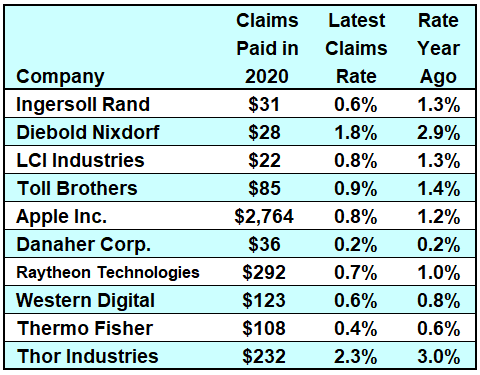

Claims Rate Reductions

In Figure 1 we're looking at a list of the top 10 claims rate reductions, starting with the post-merger Ingersoll Rand Inc. At the end of calendar 2019, its predecessor company's claims rate stood at 1.3%, but by the end of 2020 it was down by more than half to 0.6%. Close behind were ATM manufacturer Diebold Nixdorf Inc., parts manufacturer LCI Industries, and homebuilder Toll Brothers Inc.

Figure 1

Top 100 U.S.-based Warranty Providers:

Top Ten Claims Rate Reductions,

Calendar Year 2020 vs. 2019

(claims as a % of product sales)

Source: Warranty Week from SEC data

The first seven of these companies cut their claims rates by a third or more. The last three on the list plus six more not on this list each cut their claims rates by 20% or more. Among the top 100 warranty providers, 51 saw their claims rates fall from 2019 to 2020, and 49 saw their claims rates rise.

Although we're not dwelling on the bad news, we though it worth mentioning that LED sign maker Daktronics Inc. saw its claims rate soar from 1.5% at the end of 2019 to 7.5% at the end of 2020, thus topping that not-good list. Second place went to Boeing Company, which saw its claims rate jump from 0.8% to 1.6% over the same time period due to a stream of bad news. And then Paccar Inc. was third on the bad list, with its claims rate rising from 1.4% to 2.5%.

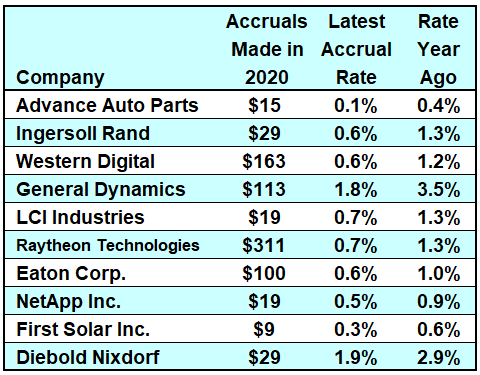

Accrual Rate Reductions

Figure 2 is the best list in the world. If your company's name is on this list, and you're working in the warranty department, you should demand a raise and a bonus, plus another week of paid time off this year. You've earned it. Tell them Warranty Week said so.

Figure 2 is the list of the top 10 largest declines in accrual rates from the end of 2019 to the end of 2020. For instance, at the top of the list is Advance Auto Parts Inc., a retail chain whose accrual rate dropped from 0.4% to 0.1% in the past year. Ingersoll Rand, whose merger-driven claims rate fell precipitously in 2020, came in second on this list, with an accrual rate that fell from just under 1.3% to 0.6%.

Figure 2

Top 100 U.S.-based Warranty Providers:

Top Ten Accrual Rate Reductions,

Calendar Year 2020 vs. 2019

(accruals as a % of product sales)

Source: Warranty Week from SEC data

Note that we're measuring the relative rate of decline, not the absolute difference between the old and new rates. In other words, a decline from 0.8% to 0.2% is proportionally larger than a decline from 2.4% to 1.4%, which is what Whirlpool Corp. reported to capture the number seven spot on this list. A full-point decline is still impressive, but an 80% decline is even more so.

Of the top 100 companies that we started out with, 54 or just over half reported declining accrual rates in 2020. Only three were down by half or more, but 16 were down by 20% or more.

And then at the other extreme that we said we wouldn't speak about, of the 45 that were up (one remained unchanged), 23 were up by more than 20%, and three doubled or worse. And by worse we mean cases such as Daktronics again, whose accrual rate spiked from 1.8% to 7.7%. That's the textbook definition of warranty pain.

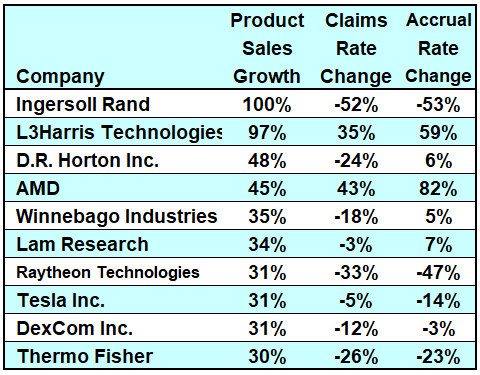

Product Sales Gains

In past years, we've hardly ever spoken about product sales, except as the divisor we use to calculate the claims and accrual rates. With all the data that we've gathered so far, it looks as if manufactured and warranted product revenue was actually up by two percent in the U.S. in 2020, but that's because the middle of the year was down slightly less than the first and fourth quarters were up.

On balance, it was a bad year, with only 40 of the top 100 warranty providers reporting any product sales growth. But for some, sales growth was actually impressive. In Figure 3, we're spotlighting the 10 largest sales gains among the top 100 warranty providers, along with the corresponding changes in their claims and accrual rates. And we're doing that because it's important to remember that declines in the claims and accrual rates can also be caused by increases in sales, even when the actual expense totals in dollars are way up.

For instance, let's look at Tesla Inc. Product sales rose 31%. Warranty claims rose 25%, from $250 million to $312 million. And accruals rose 13%, from $555 million to $625 million. However, Tesla's claims rate fell from 1.2% to 1.1%, and its accrual rate fell from 2.6% to 2.2%. Neither was impressive enough to make any of the top 10 lists, but here they are at number eight on the list below.

Figure 3

Top 100 U.S.-based Warranty Providers:

Top Ten Product Sales Growth Rates,

Calendar Year 2020 vs. 2019

(product sales %, claims rate %, accrual rate %)

Source: Warranty Week from SEC data

Ingersoll Rand Inc. and L3Harris Technologies Inc. are there only because of their respective mergers, which added revenue and also earned them a place on the lists in Figures 1 and 2. The same goes for Raytheon Technologies Corp., in seventh place on this list.

But Tesla makes its first and only appearance here in Figure 3, as does Advanced Micro Devices Inc., D.R. Horton Inc., DexCom Inc., L3Harris, and Winnebago Industries Inc. They're here because, essentially, their warranty expenses grew more or less proportionally to product revenue.

The truth is that very few of the very largest warranty providers see their warranty metrics change very much from one year to the next. The only one named in any of the "good" charts in this newsletter is Apple Inc., and that's only because their claims and accrual totals fell so much. The only top 10 warranty provider to make any of the "bad" lists are Ford Motor Company, which saw its accrual rate jump from 2.3% to 3.6%, and General Electric Co., whose claims rate jumped from 1.7% to 2.4%. But we're not dwelling on the bad news this time around.

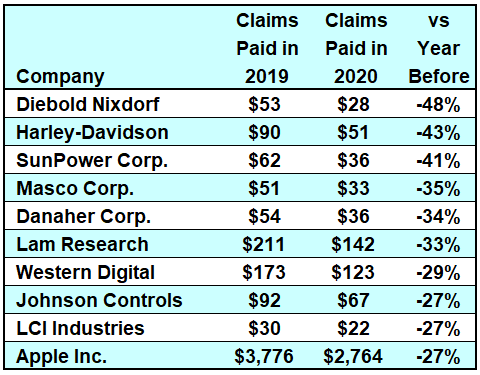

Warranty Claims Totals

In an effort to broaden the list slightly, this year we're including charts for companies whose claims and accrual totals fell the most, no matter what happened to sales and/or their claims and accrual rates. And we're listing both the 2019 and the 2020 amounts in dollars, along with the percentage change from one year to the next.

And so, for instance, Diebold Nixdorf's claims fell from $53 million in 2019 to $28 million in 2020, while Harley-Davidson's claims payments plunged from $90 million in 2019 to $51 million in 2020 -- down by nearly half in a single year. To be sure, motorcycle and parts sales also plunged, so don't apply for that extra week off. But in Harley's case, claims fell faster than sales, so the claims rate also fell, from 2.1% to 1.7%.

Figure 4

Top 100 U.S.-based Warranty Providers:

Top Ten Reductions in Claims Paid,

Calendar Year 2020 vs. 2019

(claims in US$ millions)

Source: Warranty Week from SEC data

Lam Research made the sales top 10 in Figure 3. Apple, Diebold Nixdorf, LCI Industries, Western Digital Corp., and Danaher Corp. made it into the list in Figure 1. Diebold Nixdorf, Western Digital, and LCI Industries also made it onto the accrual rate list in Figure 2.

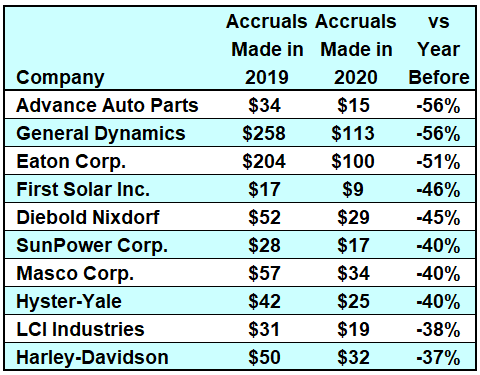

Warranty Accrual Totals

Predictably, six of the 10 companies that saw their claims totals fall the fastest also cut their accrual totals significantly. In other words, six of the companies listed in Figure 5 are also named in Figure 4. And that means the radical declines they reported in claims are more or less confirmed as real by the corresponding reductions in accruals. If the claims declines were temporary or if they were caused by other one-time factors such as time-shifts of payments from early 2020 to late 2019, the companies would not have slashed accruals by so much.

But there they are again: Diebold Nixdorf, Harley-Davidson, LCI Industries, Masco Corp., and SunPower Corp. And Advance Auto Parts, Diebold Nixdorf, Eaton, First Solar, General Dynamics, and LCI Industries also made the list for cutting their accrual rates dramatically (Figure 2), thus proving that these warranty metrics tend to move in similar directions.

Figure 5

Top 100 U.S.-based Warranty Providers:

Top Ten Reductions in Accruals Made,

Calendar Year 2020 vs. 2019

(accruals in US$ millions)

Source: Warranty Week from SEC data

The message is that if your warranty metrics change enough to get you onto one list, chances are you'll make it onto another list as well. In fact, out of the 29 companies that made it onto any of the six lists in this newsletter, 17 made multiple appearances. But that also means that 71 out of the top 100 warranty providers did nothing remarkable enough to make it onto any list. Admittedly, 16 of them would have been on a "bad" list, if there were any. But still, that means 55 out of the top 100 reported 2020 warranty metrics that were not all that far off from their 2019 readings.

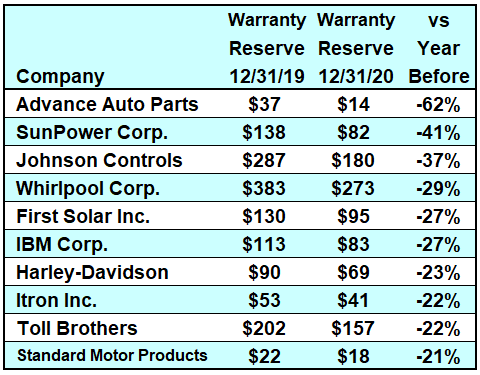

Warranty Reserve Reductions

Our final warranty metric is the change in the balance of the warranty reserve funds from the end of 2019 to the end of 2020. We're never quite sure if up is bad or down is good. For instance, if reserves rose because claims unexpectedly fell, why would that be a bad thing? And why would selling off an entire division or product line along with its warranty reserves necessarily be a good thing?

Figure 6 is a list of the top 10 warranty reserve declines, measured as a percentage of the 2019 balance. For instance, Advance Auto Parts cut its balance by 62%, from $37 million to $14 million. Nine others cut their warranty reserves by 20% or more. And then 31 more of the top 100 companies cut their warranty reserves by somewhere between 0% and 20%.

Figure 6

Top 100 U.S.-based Warranty Providers:

Top Ten Reductions in Reserves Held,

Calendar Year 2020 vs. 2019

(reserves in US$ millions)

Source: Warranty Week from SEC data

And so, for the moment, we're going to assume that since 33 out of the 72 companies that cut their claims and/or accrual totals in 2020 also cut their reserves, that they somehow go together. Or to look at it in the opposite direction, out of the 41 companies that cut their warranty reserve balances in 2020, only eight failed to cut either their claims or accrual totals as well.

The last thing we wanted to mention is the fact that 57 out of the top 100 warranty providers of 2020 increased their warranty reserve balances last year. And 17 of them saw their balances rise by 20% or more.

Three saw their warranty reserve balance more than double. AMD did so because of strong growth in sales (see Figure 3), accompanied by strong growth in claims and even stronger growth in accruals. Ingersoll Rand did so because of a merger. And BorgWarner boosted its reserve balance from $116 million to $253 million.

On balance, AMD's claims rate rose from 0.4% to 0.6%, while its accrual rate rose from 0.5% to 0.8%. In fact, every warranty and sales metric was up for AMD last year. And only six others achieved that rarified status: AGCO Corp.,

Garmin Ltd., Generac Holdings Inc., L3Harris, RPM International Inc., and SolarEdge Technologies.

Next week, we're going to begin to break out the complete list of warranty providers into 18 separate industries. But in case anybody is wondering, 31 of the top 100 warranty providers manufacture land vehicles or parts; five make aircraft or parts; 29 come from a high-tech electronics industry; 10 make appliances; nine build homes; 11 make building materials or material handling equipment; and five make electrical power equipment of one sort or another.

|