Worldwide Auto Warranty Expenses:Last year, claims fell -10% to $43.9 billion while accruals rose +4% to $51.0 billion. And with some additional adjustments along the way, that drove worldwide warranty reserves up to a new record balance of $114.9 billion. And because sales fell so fast, the average claims rate rose to 2.8% last year, while the average accrual rate jumped to 3.3%.

Last year was not a good one for the worldwide automotive industry. Sales fell dramatically while expense rates rose significantly. And some of the automakers known for their long warranties and reliable product lines found themselves among those that saw their expense rates rise fastest and highest. And while the lockdowns postponed a lot of warranty work, they also impacted supply chains, hurting sales both last year and this year.

Because there is such good reporting in the automotive industry, it is one of the few for which it is possible to come up with worldwide statistics not only for sales, but also for warranty expenses. Even a good portion of the Chinese auto industry is now reporting their annual claims and accrual totals, though sometimes we suspect they're leaving a zero off the end of their figures. So here goes another attempt to quantify the world's automotive warranty expenses.

Methodology

From the annual reports of each automaker, we extracted three key warranty metrics: the amount of claims they paid, the amount of accruals they made, and the amount of warranty reserves they held at the end of each fiscal year.

We also extracted a pair of sales figures for each company: the number of vehicles sold each year, and the revenue that arose from these sales. Wherever possible, we tried to avoid including service and investment revenue, so that the figures represented only the revenue that arose from warranted products.

With these figures in hand, we calculated three additional metrics: claims as a percentage of sales revenue (the claims rate) and both accruals as a percentage of sales (the accrual rate) and accruals made per vehicle sold.

Most of the companies ended their fiscal years on December 31, but as is the style in Japan and India, some ended their fiscal years on March 31. Therefore, in all the figures below, when the data is labeled "2020," for most companies it refers to the 12 months between January and December, but for Japanese and Indian automakers, it refers to the nine months between April and December 2020 coupled with the three months between January and March 2021.

We examined the annual reports and financial documents of some 35 different automakers based in the U.S., Europe, Japan, China, Korea, and India. Of those, 28 revealed the year-ending balance in their warranty reserve funds, representing about 95% of the world's auto production in 2020. And 22 revealed either their annual claims payment totals or their annual accrual totals, or both, representing 93% of the world's production. For the remainder, we had to construct estimates.

While the three U.S.-based automakers reported their financial figures in U.S. dollars, the rest reported in a mixture of yen, euro, Korean won, Chinese Yuan, Indian rupees, and for Volvo Car Group, Swedish kronor. In each case, we used a document published by the U.S. Internal Revenue Service to find the proper foreign exchange rate to use for each of the past five years.

The warranty metrics for many of these companies have already been detailed in one of several regional reports. The U.S.-based automakers were covered in the February 18 and April 15 newsletters. The top European automakers were covered in the May 20 and May 27 newsletters. The Japanese automakers were covered in the August 5 newsletter. And the Korean and Indian automakers were covered in the August 12 newsletter. This week, we will bring them all together.

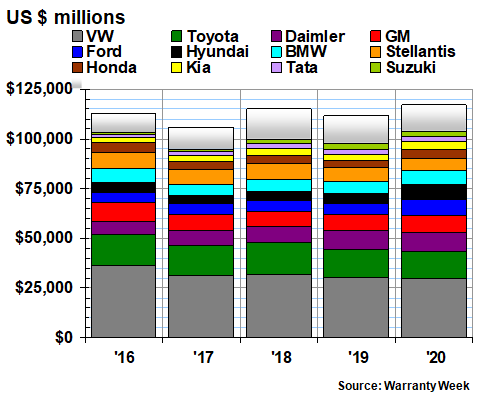

Because of the limitations of the chart-making software we are using, and because of the wide range in size from the largest to the smallest automakers on our charts, we are breaking up most of the metrics into two charts. For instance, Figure 1a below contains the annual claims totals for the top 12 automakers, based on the amount of claims they paid in 2020, plus a figure for all "other" manufacturers. Figure 1b provides some detail on these others, naming automakers 13 through 24, then it provides yet one more "other" tabulation that represents the totals for automakers 25 through 35.

Using the same methodology, Figures 3a and 3b name the top 24 automakers based on the amount of accruals they made in 2020, while Figures 7a and 7b detail the top 24 based on warranty reserve balances. Figures 5a, 5b, and 5c detail the 2019 and 2020 totals for accruals made per vehicle sold.

Worldwide Warranty Claims

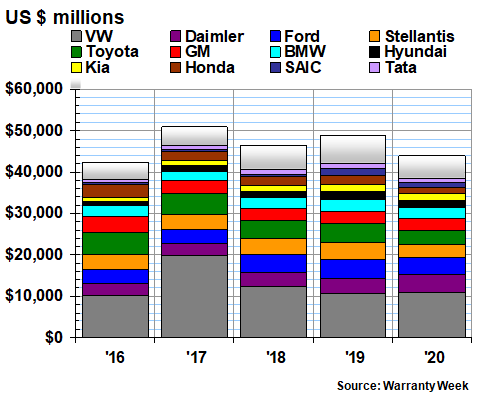

As is detailed in Figure 1a below, in 2020 we estimate that worldwide automakers paid $43.86 billion in warranty claims, down by $5.0 billion or -10% from 2019 figures. As can be seen in the chart, the actual peak year for claims was 2017, when $50.9 billion was spent on claims by these 35 manufacturers. That was also the peak year for worldwide car sales.

Figure 1a

Worldwide Auto Manufacturers

Claims Paid per Year

(in millions of dollars, 2016-2020)

For all of the past five years, Volkswagen AG has stood out as the world's largest claims payer, with its annual claims cost peaking in 2017 at $19.8 billion and its 2020 total landing at just under $11 billion. Although it is now well below that peak, that latest figure actually represented a 4% increase from the 2019 total.

Of course, 2020 was a pandemic year, and worldwide auto sales contracted significantly, from 91.4 million units in 2019 to only 77.0 million units in 2020, according to data published by the International Organization of Motor Vehicle Manufacturers. One would expect claims to also follow suit, but that's not always the way things work. Most claims paid in 2020 would theoretically have arisen from vehicles sold in previous years, so a sales slowdown in 2020 would not necessarily cut claims totals in 2020. However, last year, given the health emergency and the lockdowns that resulted, the very act of bringing a vehicle in for service was difficult if not impossible in many countries, so warranty work was at least deferred in many cases.

Still, the relationship was far from linear. Sales revenue fell by -14%. Unit sales volume was down by -16%. And claims totals were down by -10%. Therefore, all three metrics plummeted, but claims fell the least.

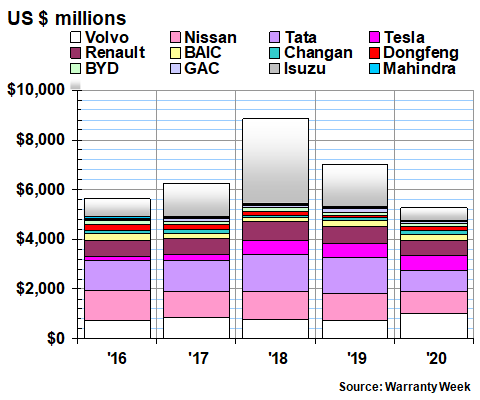

Figure 1b

Worldwide Auto Manufacturers

Claims Paid per Year

(in millions of dollars, 2016-2020)

Among the 24 manufacturers named in Figures 1a and 1b, claims totals increased for only eight from 2019 to 2020. VW was one of those eight. The others were Volvo (+27%), Tesla Inc. (+25%), the Chinese manufacturer Changan Automobile (Group) Company Ltd. (+15%), Daimler AG (+12%), two more Chinese manufacturers (Dongfeng Motor Corp. +10%, and BAIC Motor Corp. Ltd. +5%), and Kia Motors Corp. (+2%).

Claims totals fell in 2020 for the other 16, led by Honda Motor Co. Ltd. (-32%) and Toyota Motor Corp. (-28%), at least in terms of percentage declines. In terms of dollar declines, Toyota was down by -$1.24 billion, while Stellantis NV (the result of a merger of Fiat, Chrysler, and PSA Peugeot Citroen) was down by -$782 million.

Worldwide Claims Rates

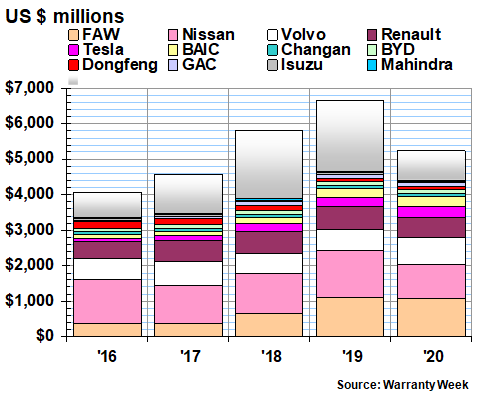

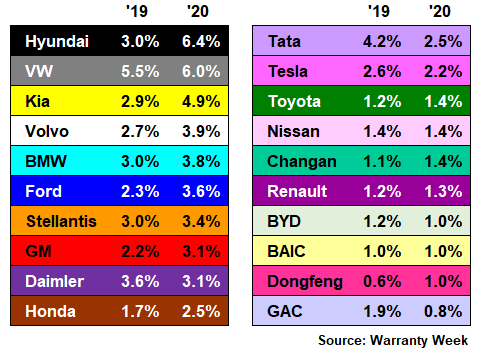

As will be shown in Figure 6 below, these manufacturers spent an average of 2.8% of their automotive revenue on warranty claims in 2020, up from 2.6% in 2019. it would be difficult to construct a readable chart that detailed the annual changes for all these companies individually, so instead we are providing a color-coded table of just the top 20, and just for the years 2019 and 2020.

As has been the case for many years, VW leads this list, with a claims rate of 4.4% in 2019 rising to 5.3% in 2020. Ford Motor Company is next, with a claims rate rising to 3.6% in 2020, from 3.3% in 2019. Stellantis remained the same at 3.5% in both years, while Tata Motors Ltd. actually dropped from 3.9% in 2019 to 3.4% in 2020. Others above the industry average included Kia, Daimler, Volvo Cars, BMW AG, and General Motors Co.

Figure 2

Worldwide Auto Manufacturers

Average Warranty Claims Rates

(as a percentage of sales, 2019 & 2020)

The other 11 companies named in Figure 2 had claims rates that were below the industry average last year. Notice that the five lowest are all based in China. We don't know if it's something in the water or some new kind of math they use over there, but this is a recurring phenomenon. If it weren't for Tesla at 1.1% and Renault S.A. at 1.2%, we'd be blaming a broken calculator for these unbelievably low figures. Also, note that Honda, Toyota, and Nissan Motor Co. Ltd. are all below two percent, which lends some credibility to the low figures on the right-hand side of this table. But still, an 0.7% claims rate?

Worldwide Accrual Totals

In contrast to claims, which always lag sales, the thing about warranty accruals is that they should always remain proportional to sales, because they're supposedly made at the time a product is sold. Unless the manufacturer believes the need for warranty work will rise or fall at a different rate from sales, the totals per vehicle should not change. A quick peek ahead to the data in Figure 5a, 5b, and 5c makes plain that this is not the case.

However, here we are talking about accrual totals for each company's entire fleet. And since unit sales fell -16% and sales revenue fell -14%, it stands to reason that accruals must have also declined in that range.

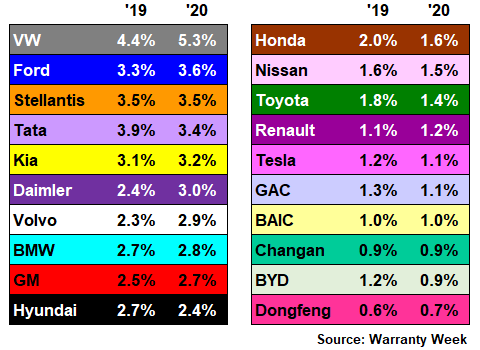

It's pretty clear that didn't happen. In fact, worldwide warranty accruals were actually up by four percent to $51.0 billion, edging past the previous highs in 2016 and 2018, and rising above 2019's total by some $2.06 billion.

Figure 3a

Worldwide Auto Manufacturers

Accruals Made per Year

(in millions of dollars, 2016-2020)

As we detailed in the August 12 newsletter, two of the biggest contributors to this unexpected increase were Hyundai and Kia, which increased their warranty accruals by +106% and +70%, respectively, in 2020. Twelve other manufacturers also increased their annual accrual totals, while only ten, led by Daimler, Tata, Nissan, Renault, Stellantis, and VW, managed to cut their accrual totals last year.

Figure 3b

Worldwide Auto Manufacturers

Accruals Made per Year

(in millions of dollars, 2016-2020)

Keep in mind that out of all 35 automakers, the only one outside of China to report a unit sales increase last year was Tesla. That's right, unit sales fell for all the others. So for all the others, an accrual increase in accruals coupled with a sales decline, or an accrual total that declined slower than sales, is a giveaway that they expect an increased need for warranty work in the future.

Warranty Accrual Rates

Sure enough, of the 20 manufacturers for which we were able to calculate accrual rates from figures included in their annual reports, 14 raised their accrual rates last year, while only six reduced them. Hyundai and Kia led the increases, followed by Ford, Dongfeng, and Honda. Chinese manufacturer Guangzhou Automobile Group Co. Ltd. (better-known as simply GAC) led the declines, followed by Tata, Daimler, and a pair of electric vehicle manufacturers: the U.S.-based Tesla and the China-based BYD Company Ltd.

Figure 4

Worldwide Auto Manufacturers

Average Warranty Accrual Rates

(as a percentage of sales, 2019 & 2020)

In terms of the highest expenses, VW was dethroned by Hyundai, which more than doubled its accrual rate to 6.4%, while VW's expense rate rose a mere half a percentage point. And Kia now has the automaking world's third-highest confirmed accrual rate, at 4.9%. Plain and simple, long warranties become expensive warranties when it's the engines causing the problems.

The worldwide average accrual rate last year was 3.3%, which means that Stellantis, Ford, BMW, and Volvo Cars were also above average. And it also means that GM was just barely below average, despite a rise in its rate from 2.2% to 3.1%.

Accruals per Vehicle Sold

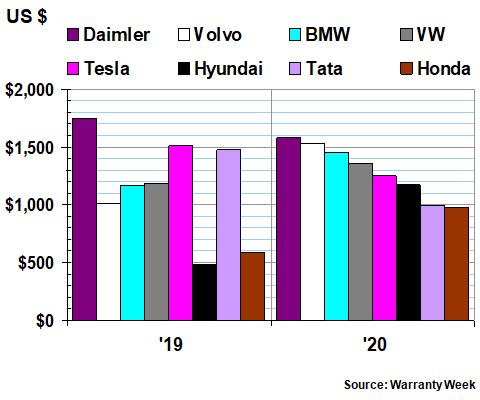

There's another way to measure accrual rates, namely, by dividing the accrual totals made each year by the number of vehicles sold each year. And on that basis, the world's automakers accrued an average of $676 per vehicle sold last year, up significantly from $536 in 2019.

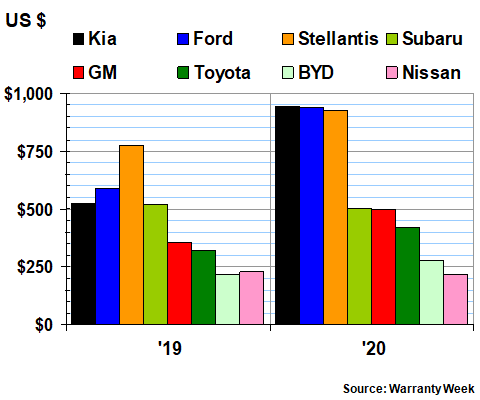

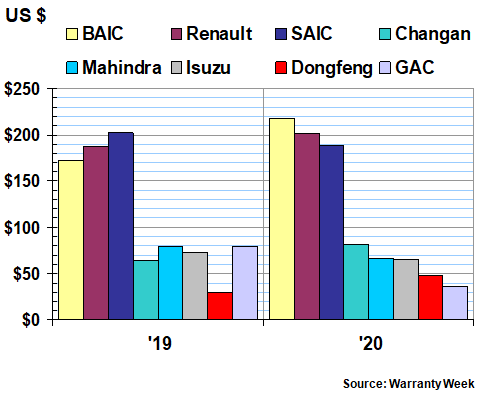

Again, with this many companies, there's simply too much data to fit into a single chart, and some of the calculations are either unreliable estimates or unbelievable calculations. So in fact we're going to split this metric up into three charts, with the eight highest in Figure 5a, the eight in the middle of the range in Figure 5b, and the eight at the bottom in Figure 5c.

The highest three in Figure 5a are European luxury brands with relatively high per-vehicle selling prices, so it's no surprise they would also accrue the most per vehicle sold. Expensive cars have expensive warranties. VW also has some luxury brands such as Bentley and Bugatti under its wings, and of course Tesla is something of a high-end nameplate as well. And don't forget that Tata owns Jaguar Land Rover.

But who ever thought they'd see Hyundai ranked in the top eight? And Honda? Things sure have changed in the latest lineup!

Figure 5a

Worldwide Auto Manufacturers

Accruals Made per Vehicle Sold

(in dollars, 2019-2020)

Hyundai and Kia also led the list of largest proportional increases from 2019 to 2020, followed by Honda and Ford. Dongfeng was also up there, but our calculator was broken when we did that math so we won't mention it again. Ford, Volvo Cars, GM and Toyota were also among the manufacturers with the largest proportional increases in accruals made per vehicle sold last year. That is not good news for any of them. It signals they expect elevated claims costs in the future.

Figure 5b

Worldwide Auto Manufacturers

Accruals Made per Vehicle Sold

(in dollars, 2019-2020)

And then there were nine automakers that actually reduced their accrual rates per vehicle sold last year. Only two of them were using Chinese math. Tata and Tesla were at the top of the list, followed by Mahindra and Mahindra Ltd., then by Isuzu Motors Ltd., and then by Daimler, Nissan, and Subaru Corp.

Figure 5c

Worldwide Auto Manufacturers

Accruals Made per Vehicle Sold

(in dollars, 2019-2020)

We have to say, however, that all eight of the calculations in Figure 5c are somewhat unbelievable, especially the five that came in under $100 per vehicle. These are not scooters or motorcycles. Something is not right. We will have to put in a warranty claim on our calculator, unless somebody can figure out how any passenger car's warranty costs could be so low. They must be making near-perfect cars.

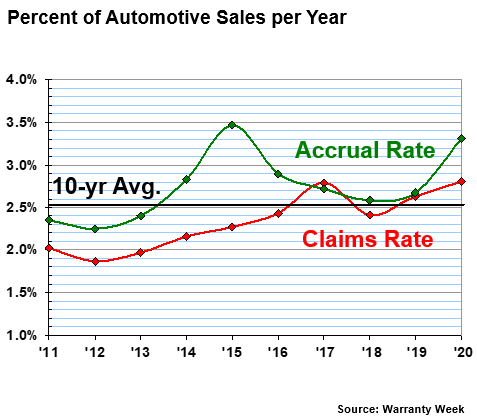

Worldwide Average Expense Rates

We took all the world's hard numbers for claims and accruals and divided them by the corresponding automotive revenue figures to calculate the ten-year averages detailed in Figure 6. Actually, the ten-year average claims rate was 2.3%, while the ten-year average accrual rate was 2.7%, which is how we arrived at the blended 2.5% average for both, and which is signified by the black line drawn through the middle of this chart.

Figure 6

Worldwide Auto Manufacturers

Average Claims & Accrual Rates

(as a percentage of sales, 2011-2020)

As was mentioned, in 2020 the average claims rate was 2.8%, while the average accrual rate was 3.3%. Both were up from 2019, and both were obviously above the respective long-term averages for these metrics. The mildly good news is that their 2020 readings weren't their highest ever. That dubious distinction would go to 2015 for claims and 2017 for accruals.

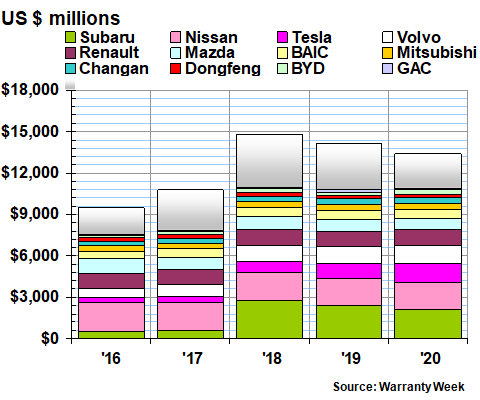

Worldwide Warranty Reserves

Our final worldwide automaker warranty metric is the balance reported to be in their warranty reserve funds at the end of each year. For this metric, 28 out of the 35 manufacturers included this data point in their annual reports, representing 95% of the world's unit sales. Six of those that do not are based in China, while the seventh -- PSA Group -- actually did not manage to file their final annual report before they officially merged with Fiat Chrysler. Pardonnez-nous!

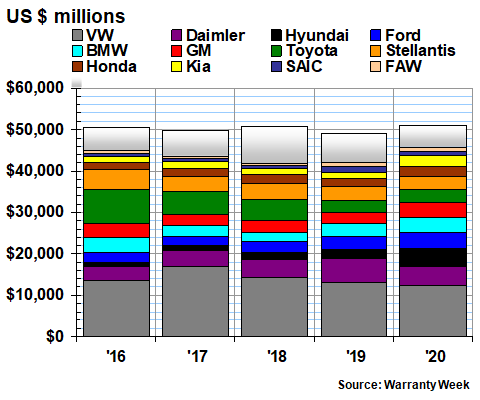

Therefore, we had to estimate the reserves held for only 5% of the total to come up with a new all-time record year-ending figure of $114.9 billion for 2020. And that worldwide figure was actually up by about $3.1 billion or 2.8% from the year-ending total in 2019, primarily because of all the massive increases in warranty accruals, coupled with the drop in claims.

As with the previous charts, in order to make room for the 24 largest manufacturers, we had to split the data in two. In Figure 7a, the leader is again VW, with Toyota and Daimler in a distant second and third place. Thanks to some gargantuan year-ending accruals by GM and Ford, they're next on the list. And another shocker: Hyundai passed both BMW and Stellantis to take sixth place.

Figure 7a

Worldwide Auto Manufacturers

Reserves Held At Year's End

(in millions of dollars, 2016-2020)

On the second half of the chart, there are five more automakers with a billion dollars or more in their warranty reserve funds: Subaru, Nissan, Tesla, Volvo Cars, and Renault. All five were also in the billionaire club in 2019, but Tesla was not in it in 2018, and Volvo and Subaru were not in it in 2017. However, Mazda Motor Corp. left the club after 2016, and has not rejoined it since. In other words, to our knowledge, only 14 automakers have ever reported warranty reserve balances in excess of $1 billion, and Tesla is the 14th company to do so. Welcome to the club!

Figure 7b

Worldwide Auto Manufacturers

Reserves Held At Year's End

(in millions of dollars, 2016-2020)

So if you're looking for a quick snapshot of the world's warranty metrics, here it is: in 2020, claims fell -10% to $43.9 billion while accruals rose +4% to $51.0 billion. The average claims rate rose from 2.6% to 2.8% last year, while the average accrual rate jumped from 2.6% to 3.3%. And in both years, these metrics were above their long-term averages. And finally, reserves rose three percent to $114.9 billion, a tremendous nine-figure sum that confirms just how large and active the automotive warranty industry continues to be on a worldwide basis, despite a brutal decline in sales last year.

|