Nine-Month Truck, RV & Car Warranty Trends:While the pandemic left a clear mark on sales and warranty accruals last year, the downturn was brief and the recovery was fast. So far in 2021, other events such as safety recalls and environmental warranty problems seem to have had more of a noticeable effect on their warranty metrics.

Now that it's November, most warranty-issuing companies have delivered their financial statements covering the third quarter of 2021, so it's possible to check in and see how the year is shaping up in terms of claims and accruals.

During the Great Recession a decade ago and during the pandemic this year and last, the automotive industry was heavily impacted by the lockdowns that followed, especially the manufacturers of passenger cars, recreational vehicles, and large vehicles used on-highway, in construction, and for agricultural work.

To check on trends in these three branches of the motor vehicle industry, we selected a dozen representative companies: Ford Motor Co., General Motors Co., and Tesla Inc. from the passenger car industry; Thor Industries Inc., Winnebago Industries Inc., Skyline Champion Corp., and Rev Group Inc. from the mobile home and RV industry; and Caterpillar Inc., Deere & Co., Cummins Inc., Paccar Inc., and AGCO Corp. from the truck and large vehicle industry.

Passenger Cars

All of the European and Asian passenger car manufacturers release their warranty data only once a year, and none of them end their fiscal years in September. So to get a midyear readout on the state of warranty within the passenger car industry, we can look only at the data of the three leading U.S.-based manufacturers (Chrysler is part of Stellantis NV, which won't publish new data until late winter 2022).

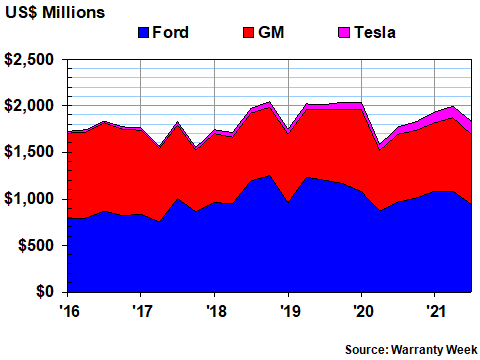

In Figure 1, where we're looking at 23 quarters of claims payments for Ford, GM, and Tesla, conditions appear fairly steady. There is a noticeable notch in the second-quarter-2020 data, but then again there's also a notch in the first-quarter 2019 data and two in the 2017 data.

Figure 1

Passenger Car Warranties

Claims Paid by Top U.S.-based Manufacturers

(in US$ millions, 2016-2021)

Ford is now the largest claims payer in the group, spending $940 million in the third quarter and $3.11 billion in the first nine months of 2021, compared to GM's $756 million and $2.28 billion, respectively. Tesla is a distant third, reporting a $140 million claims total in the third quarter and a $381 million total for the first nine months of this year.

In terms of year-over-year changes, Tesla takes the lead, however. Its claims payments are up 82% for the quarter and up 73% for the nine months, compared to 2020. GM's claims are up four percent for the quarter and are up only 0.7% for the first nine months. Ford's third-quarter claims total is actually down by $28 million from 2020 levels, while its nine-month total is up $196 million, or 6.7%.

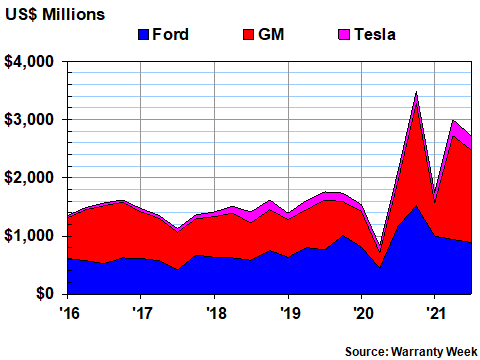

Warranty Accruals

The warranty accrual picture is much more chaotic. First of all, the second-quarter notch in accruals last year during the depths of the lockdowns is quite deep. And second of all, the quarterly totals have been especially erratic ever since, particularly for GM.

In the third quarter of 2021 -- the quarter just ended -- GM's accruals soared 105% to $1.58 billion. For the first nine months, because of all the added recall expenses, accruals are up 139% to $3,94 billion.

In contrast, Ford's warranty accrual total was down 24% to $886 million in the third quarter. Its nine-month accrual total, however, is up $400 million or 16.5% compared to 2020 levels.

Figure 2

Passenger Car Warranties

Accruals Made by Top U.S.-based Manufacturers

(in US$ millions, 2016-2021)

With this metric, Tesla is now the most predictable one, with accruals growing 43% during the third quarter and 71% for the nine months -- somewhat proportional to its 57% product sales growth rate. In contrast, GM's product revenue is down significantly for the third quarter while Ford's nine-month sales gain of 16.2% is just marginally lower than its accrual total growth rate.

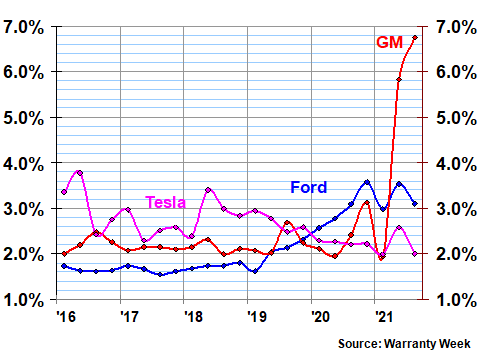

The reason we mention sales is because those figures are used to calculate each manufacturer's accrual rate -- accruals as a percentage of product sales. And in Figure 3, we're taking the data from Figure 2 and comparing it to product sales.

Since September 2020, Ford's accrual rate has barely changed at 3.1%, while Tesla's has actually declined from 2.2% to 2.0%. But GM's accrual rate -- we had to go back and check our math just to be sure -- has soared from 2.4% to 6.75% thanks to the added weight of recalls.

Figure 3

Passenger Car Warranties

Accrual Rates for Top U.S.-based Manufacturers

(as % of product revenue, 2016-2021)

Readers who want to do their own verification should add together the accrual totals for product recall campaigns -- $1.237 billion -- to the accrual total for new product warranties -- $345 million -- and then divide those two numbers by $23.426 billion in automotive sales. Yep, it's 6.75% all right, as unbelievable as that sounds.

Now, ask yourself, why haven't you read that simple computation in one of the numerous publications that closely follow every move of the Detroit automakers. Don't they have calculators too?

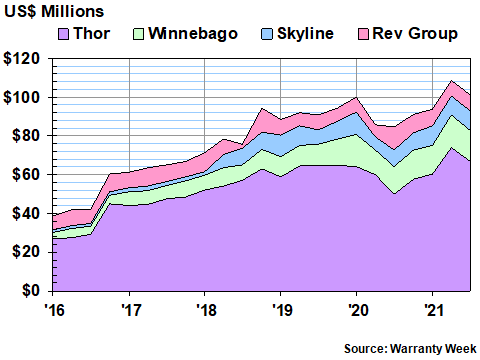

Recreational Vehicles

The RV and mobile home industry also saw its warranty metrics fall during the early days of the pandemic last year. But a quick look back at the older data included in the November 12, 2020 newsletter reveals that things were a lot worse back in 2008 and 2009, when many RV manufacturers were folding and dealers were left holding warranty-less inventory on their lots. Some, in fact, resorted to buying extended warranties for their orphaned vehicles and giving them away to fearful customers.

Things are much better now. Sales are soaring, and warranty expenses are not. Thor ends its fiscal year on July 31, while Winnebago ends its fiscal year on August 29. In its latest annual report, Thor reported claims were up by $20 million or 8.4% last year, while Winnebago said claims were up 9.2% last year.

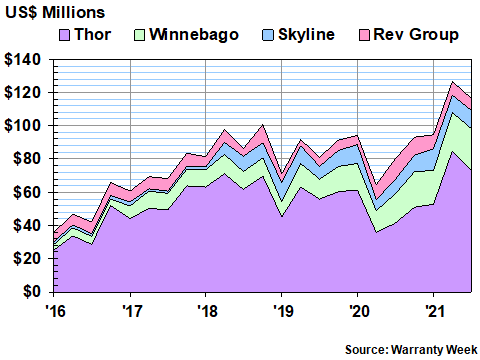

Figure 4

RV & Mobile Home Warranties

Claims Paid by Top U.S.-based Manufacturers

(in US$ millions, 2016-2021)

The Rev Group, which is a company cobbled together from pieces of others such as Fleetwood Enterprises, Monaco, and Holiday Rambler, saw only 8% sales growth in the first nine months of its fiscal year. But claims fell by 3.1% over the same period, meaning expenses are declining while sales rise slowly.

Skyline Champion, which makes tiny homes on wheels under the brand names of Athens Park and Shore Park, as well as more full-sized modular and mobile homes under brand names such as Skyline Homes, Champion Home Builders, and Genesis Homes, saw its claims rise by 17% in the third quarter and by 12% for the first nine months of the year. And its sales are also rising at an even faster pace.

RV Accruals

In Figure 5, we are looking at the accruals made by these four companies over the past 23 quarters, and once again there's a noticeable notch in the second-quarter-2020 data. But then there's a noticeable spike in the second-quarter-2021 data, leading to some incredible year-over-year comparables.

In the second quarter of this year, Thor accrued 137% more than it did a year before. Winnebago's accruals rose 74%, and Skyline's rose 62%. Only Rev Group accrued less in the second quarter of 2021 than it did in the second quarter of 2020.

Figure 5

RV & Mobile Home Warranties

Accruals Made by Top U.S.-based Manufacturers

(in US$ millions, 2016-2021)

For the latest fiscal year, Thor's accruals are up 32% to $262 million, while sales are up 51%. Winnebago's accruals are up 45% while its sales are up 54%. For the nine months ending July 31, the Rev Group's accruals are down 13% while sales are up 7.8%.

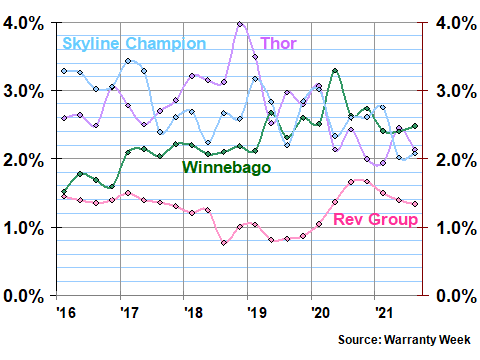

The interplay of sales and accruals are what produces the changes in accrual rates drawn in Figure 6. Data is generally in the two-to-three- percent range, except for Rev Group which has remained below two percent and occasional spikes above three percent for the others.

Figure 6

RV & Mobile Home Warranties

Accrual Rates for Top U.S.-based Manufacturers

(as % of product revenue, 2016-2021)

Thor's accrual rate rose as high as four percent at the end of 2018, while Skyline Champion's accrual rate hit 3.4% in early 2017 and Winnebago's accrual rate peaked at 3.3% in the second quarter of 2020. In the most recent readings, however, Skyline and Thor are both at 2.1% while Winnebago is at 2.5%. Rev Group remains lower, at 1.3% as of July 31.

Trucks and Large Vehicles

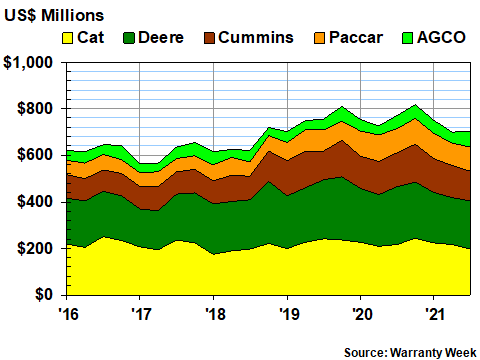

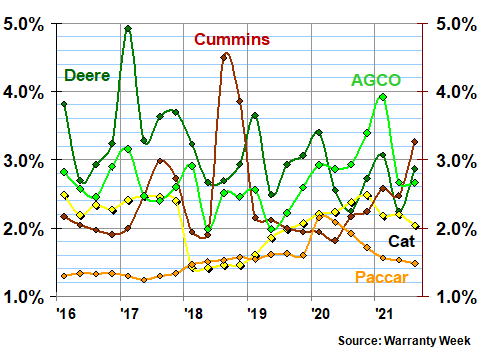

In Figure 7, we're looking at five of the top warranty providers in the truck, farm, and construction equipment industries. It would be six, but as of July 1, Navistar International became part of Volkswagen AG, which won't publish new warranty data until next spring.

Like the passenger car industry, the large vehicle sector did not see a massive change in claims last year due to the lockdowns. In fact, as can be seen in Figure 7, these five companies actually reported less claims paid in the second and third quarters of this year than they did during those quarters last year.

Even for the first nine months of 2021, claims are down for this group by 4.3%, to $2.16 billion, from $2.25 billion in the same portion of 2020. AGCO is the only one of the five to pay more claims so far in 2021 than they did in 2020.

Figure 7

Truck & Large Vehicle Warranties

Claims Paid by Top U.S.-based Manufacturers

(in US$ millions, 2016-2021)

Caterpillar saw a $20 million decline in the third quarter and a $14 million decline for the nine months. Deere saw a $41 million decline for the third quarter and a $77 million decline for the nine months. Cummins saw an $18 million decline in claims for the quarter and a $15 million decline for the nine months. And even Paccar saw a $100,000 decline in claims during the third quarter and an $18 million decline for the nine months.

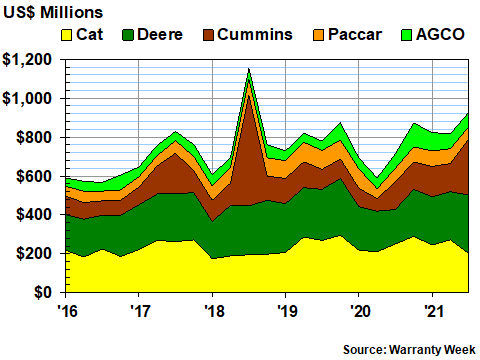

Warranty Accruals

In Figure 8, there are two notable features: the Cummins spike in 2018 and the pandemic notch in 2020. But also note the V shape to that notch -- unlike during past slowdowns, this one was short and the recovery was fast. After all, given all the supply chain problems lately, the priority is to get more new trucks on the roads, not less.

Figure 8

Truck & Large Vehicle Warranties

Accruals Made by Top U.S.-based Manufacturers

(in US$ millions, 2016-2021)

Sales at Caterpillar are up 23% for the first three quarters of 2021. Yet its warranty accruals rose only 5.6% over the same period. Paccar's sales rose 30%, but its accruals rose just 0.5% for the nine months. At Cummins, sales are up 30% for the nine months but accruals are once again spiking -- up by 95% to $593 million so far in 2021. So it seems the company's problems with diesel engine emissions warranties is continuing.

Deere reported a 32% sales increase in the third quarter, but increased its accruals by 69%. AGCO saw just a nine percent sales increase, and cut its accruals by one percent.

In other words, there are mismatches between sales and accruals almost everywhere you look in the large vehicle industry, and that's reflected in the data in Figure 9. But it's not just recently -- accrual rates among these five companies regularly change by one percentage point or more from one quarter to the next.

Figure 9

Truck & Large Vehicle Warranties

Accrual Rates for Top U.S.-based Manufacturers

(as % of product revenue, 2016-2021)

Over the past year, the changes have been a bit less extreme. Caterpillar's accrual rate fell by 0.4% to 2.0%. Deere's rose by 0.6% to 2.9%. Paccar is down by 0.4% to 1.5%. And AGCO is down by 0.2% to 2.7%. Only Cummins' spike to 3.3% is greater than one percentage point.

Warranty Reserves

Finally, we didn't have room to look at warranty reserve fund balances in chart form, but let's mention some of the major trends. First, Paccar was the only one of the 12 companies to let its reserve balance decline in the most recent quarter. Its reserves fell from $395 million as of September 2020 to $337 million as of September 2021.

Second, some of the reserve balance increases have been extreme. GM, Winnebago, and Tesla have each raised their balances by 30% or more over the past year. GM's most recent balance was $10 billion -- its highest since the recalls of 2014 were in full swing.

Third, these 12 companies now have more than $27 billion tied up in their warranty reserve funds, more than twice as much as they did 11 years ago. And six of those companies maintain a balance of $1 million or more, up from only three that did so back in 2010.

|