Machine Learning in Warranty Management:

Quite a few companies talk about machine learning as the next step to improve warranty management. However, in more detailed discussions, I haven't come across too many real solutions or active projects in that field. In this article I will discuss the topic in more detail -- what is machine learning, what are the comparable use cases in other areas, and which could be the most compelling applications for it in warranty management.

Editor's Note: This column, written by Matti Kurvinen, the managing

director of sd-ize consulting, is the latest in an ongoing series of contributed

editorial columns. Readers interested in authoring a contributed column in the

future can click here to see the Guidelines for Editorial Submissions page.

By Matti Kurvinen, Managing Director at sd-ize consulting

A common definition for machine learning is "The field of study that gives computers the ability to learn without being explicitly programmed." We give the computer large amounts of data, and it can learn how to make decisions about the data. For instance, in rules-based warranty claims validation, there is a pre-determined set of warranty rules, and the violation of those rules may result in rejection or adjustment of the claim. In machine learning, the warranty rules are not pre-set in the system, but learned through example cases.

Although machine learning may be new to us, most of us may encounter machine learning on a daily basis. Common examples include recommendation systems in applications like Netflix or Spotify, algorithms deciding the flow of input in Facebook or LinkedIn, chatbots, machine condition monitoring and predictive maintenance and on-line, credit card and insurance fraud detection.

Figure 1

The Key Steps in the Machine Learning Process

The input data set needs to be large and representative. The general assumption, supported by research, indicates that depth and breadth of data is more impactful to machine learning model performance than the cleverness of the algorithms used. Part of the data is used to train the model, another part for validating and optimizing the model, and the rest for testing the model.

Feature extraction selects the data fields to be used and adjusts them into a format suitable for the mathematical models in the machine learning algorithms. With warranty claim data, the idea is to select the characteristics, which could identify a fraudulent customer, service agent or claim. The model is then trained by the algorithms, using the claims data, as described by the extracted features. When training is complete, the initial model is validated and adjustments are made, resulting in the model becoming ready to be used. Machine learning operations include the usage of the model, as well as adjusting it further over time.

The two main types of machine learning are supervised learning and unsupervised learning. The main difference is that in supervised learning, our input data includes knowledge of what the output values should be. For example, the training data for warranty claims would include the claims validation outcome -- approved, adjusted/partially approved, rejected, or on-hold for further verification. The result of training the supervised learning model is a function that best approximates the desired output with any given input.

On the other hand, unsupervised learning does not have given outputs in the training data. Its goal is to learn the inherent structure of the training data, to cluster commonalities, and to identify exceptions. In warranty management, unsupervised learning can be used to find exceptions and anomalies in the data, and to identify potential issues or suspected fraud.

Figure 2 shows an example where the blue boxes, representing 70% of the claims in the training set, are approved, while the grey boxes, representing 20%, are adjusted, and the red boxes, representing 10%, are rejected.

Figure 2

Supervised Machine Learning

Issues with Traditional Warranty Management

Although many companies have considerably improved their warranty management processes and related system support, we still see common issues.

A rules-based claim management approach often stays the same for extended periods and doesn't evolve at the same pace as fraud methods evolve. Over time, the service agents will learn which tricks are rejected, and which are approved, and how to by-pass the rules. Many companies are struggling with the right number of rules, getting either too many false positives (difficult for the honest service partners) or too many false negatives (e.g. fraud goes undetected).

The sheer volume of warranty claims to be validated makes it difficult to configure the rules to the right level. Again, if too many claims need to be processed manually, the validation lead time gets longer and the validator may in some cases do mass-approvals to shorten the backlog. Having too many claims approved automatically can be costly as well.

Relying on validation alone and not having adequate analytics to support it is not enough -- it is always possible to generate fraudulent claims meeting all the rules, which are not caught.

Quite often, claims management teams experience high turnover rates, leading to inconsistent skills and performance of the validation team. In the worst-case scenario, the system might flag claims for rejection but the team still approves them.

Why Is Machine Learning Suitable for Warranty Management?

Machine learning is commonly applied in fraud detection and process automation. The training data for the machine learning model should be straightforward to get from most warranty claims management applications (the claim data and the resolution (approve/reject/adjust/on-hold)).

Globally consistent warranty operations can be achieved through process automation and supporting claim handlers with resolution proposals to make better decisions. Internal control can be improved and the validator performance can be evaluated against the machine learning models (e.g. how many resolutions did I make, which were not in line with the recommendation?).

Process automation should also lead to faster validation and operational savings.

With skilled validators, the model will constantly learn from new cases and decisions, so it will evolve at the same pace as new fraud methods come up. Analytics using anomaly detection may detect fraud schemes which were previously unknown.

Potential Areas to Apply Machine Learning in Warranty Management

There are certainly many potential areas, where machine learning could be applied in warranty management. One classic example having a major impact on warranty costs is predictive analytics and maintenance. However, that is not in the direct scope of warranty management, or this article.

Another area where machine learning can help out is with customer entitlement and return material authorization, where it can help determine whether the case is a genuine warranty claim, and if it is safe to ship a spare part or a replacement product to the customer in advance, before receiving the defective product or returned part.

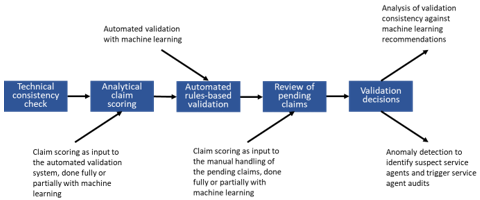

The third promising area is our earlier example from the claims validation process. Figure 3 shows the areas, where machine learning could fit in it.

Figure 3

Areas Where Machine Learning Could Be Applied

in the Warranty Claim Validation Process

Claim scoring

Analytical claim scoring analyses the likelihood of fraud for each service agent and claim. Machine learning fits well with that types of classification problems. The results can be used as input for the automated rules-based validation, or for the claims validator for manual validation and handling of the pending claims.

Automated validation

If there is enough repetitiveness and confidence in the machine learning model, it could take care of the validation decisions entirely or partially. For instance, machine learning would provide a recommendation for each claim and also a confidence factor for the recommendation. Clear cases would be handled automatically and cases with lower confidence would be directed to the rules-based validation or manual handling.

Internal control and validator performance

Machine learning can be used for internal control and to evaluate the claims validator performance. The results of validation would be compared against machine learning recommendations, and the performance of validators with big deviations would be supported to get it to the same level with the others.

Complementing warranty analytics

It is quite easy to create a few fraudulent warranty claims, which meet all criteria and pass rules-based validation. However, it is very difficult to execute large-scale warranty fraud and remain statistically consistent with the reality. With statistical analytics you can identify individual claims, which have a high likelihood of being incorrect. It can also help identify service agents or customers who have a high number of these suspect claims, and therefore are candidates for further investigation.

Most known fraud methods can be analyzed with traditional warranty analytics. Unsupervised machine learning and anomaly detection can be effective in detecting unknown fraud and keeping up with the evolving fraud methods. They can also be effective in bringing up other reasons for higher costs, such as issues in service technician skills.How to Get Started

In warranty management, context machine learning is a new approach, with little practical experience and skills available. So, I wouldn't go "all-in" in the first project. I rather would start with small pilots complementing and supporting the existing processes, and expand from that, once experience grows and confidence increases. Also, moving to higher automation levels involves quite a lot of systems integration work with the existing warranty systems, and related process changes.

Once you have the first models ready, it is important to verify they are working correctly. This is done by showing the model new claims data which it hasn't seen before, where we know the outcome. If the model behaves in a correct way, we can start deploying it with real transactions.

The quality of the model can be measured by following the number of false positives (the claim is OK, but the system classifies it as fraudulent) or false negatives (the claim is fraudulent, but the system classifies it as OK). Both are harmful for the business. False negatives imply accepting fraudulent claims and additional cost, false positives imply rejecting valid claims, issues with service agents and additional hassle in the process.

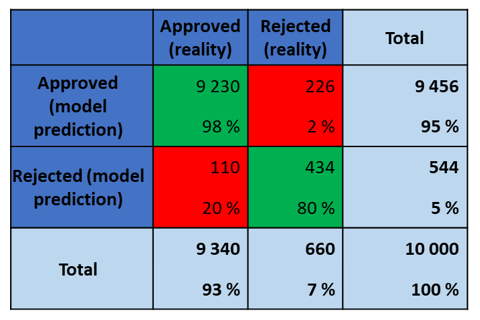

Figure 4 shows an illustrative example of a matrix evaluating the model.

Figure 4

Machine Learning Model Accuracy

In the example, a sample of 10,000 claims is evaluated against the trained machine learning model. In reality, (e.g. the validation results of the sample data, using the existing process) 7% of the claims were rejected and 93% were approved. The machine learning model rejects 5% of the claims and approves 95%. The red cells highlight the false results provided by the model. Two percent of the claims approved by the model are false negatives and 20% of the claims rejected by the model are false positives.

Conclusions

Although these concepts are fairly new in the field of warranty management, I believe machine learning and artificial intelligence can provide the foundation for highly effective warranty control and fraud detection, with clear advantages to complement traditional warranty processes.

To build an effective machine learning solution for warranty management, a combination of data science and warranty expertise is required. Cloud-based solutions can offer a jump start, with the readily available models and optimizers, but any company should also invest in building the internal expertise on the topic. Start exploring, capture the first benefits and build on that.

About the Author

Matti Kurvinen is the Founder and Managing Director at sd-ize consulting, located in Espoo, Finland, near Helsinki. He has for the past 15 years focused on how to run a service business -- both through client engagements and through various leadership positions in Accenture. sd-ize consulting was formed in 2014, with the goals to help clients on their paths to digital service businesses and to increase transparency and control over their warranty and service operations.

If you want to learn more, sd-ize consulting is conducting a multi-client research project on machine learning in warranty management. Feel free to reach out to matti.kurvinen@sd-ize.com if you are interested in participating, or if you want to get further information.