Semiconductor Warranty Report:

After a sudden jump in claims in 2018, warranty expense rates took a jump early last year. But by year's end, both the amount of money going towards warranty costs as well as the percent of sales it represented were back down to normal ranges. But warranty reserves haven't been this low since 2009.

In 2018 and early 2019, the warranty metrics of the semiconductor industry took some worrying jumps. Claims and accruals rose to multi-year highs in 2018, and then warranty expense rates spiked in early 2019. But in the second half of last year, these metrics suddenly returned to normal.

Every year since 2003, we've been looking at the semiconductor industry's warranty metrics around this time. This year, we began the process with a list of 171 U.S.-based companies with a significant presence in the semiconductor and printed circuit board manufacturing industry, either as a manufacturer of the devices and PC boards, or as a supplier of the manufacturing and test equipment. We designated 146 as device manufacturers, and 25 as suppliers of the manufacturing and test equipment.

Market leaders among the device makers include Honeywell International Inc., SunPower Corp., SolarEdge Technologies Inc., Advanced Micro Devices Inc., First Solar Inc., and Teradyne Inc. Leaders among the equipment makers include Lam Research Corp., Applied Materials Inc., Agilent Technologies Inc., Coherent Inc., Cohu Inc., and Brooks Automation Inc.

From each of these 171 companies, we extracted three essential warranty metrics from their annual reports and quarterly financial statements: the amount of claims paid per year, the amount of accruals made per year, and the balance in their warranty reserve funds at the end of each calendar year. For companies whose fiscal years did not end on December 31, we used the figures from the quarter that ended closest to, but not after, December 31, combined with the three previous quarters.

We also gathered product sales data, which in each case was based upon the segmentation provided by each manufacturer. Most segmented their product and service revenue, and some also segmented their product revenue into capital equipment and consumables. The goal was to find the figures that approximated the revenue derived from the sale of products that came with warranties. The next step was to take the claims and accrual data, and divide each by this sales data, so we could calculate the percentage of revenue spent on claims (the claims rate) and the percentage of revenue spent on accruals (the accrual rate).

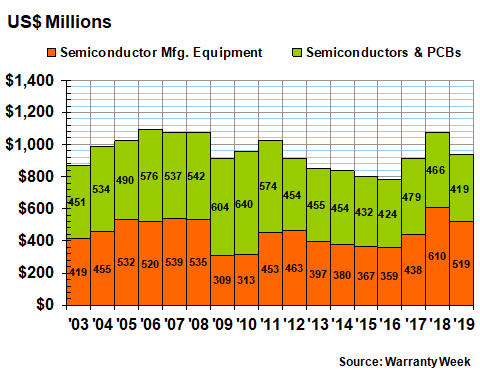

Warranty Claims Totals

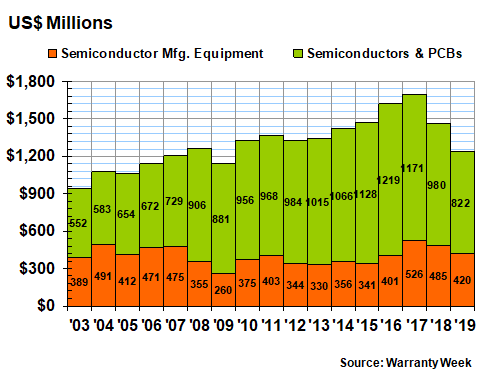

In Figure 1, we are detailing the claims totals for the past 17 years, for both the device makers and the equipment makers. Claims fell for both groups in 2019. In fact, the totals for all the warranty metrics for both groups fell in 2019. Claims fell by $46 million for the device group, and by $91 million for the equipment group, for a total decline of 13% from their combined total of $1.076 billion in 2018.

Also, the share of the total accounted for by the equipment group also fell back slightly, after hitting a record in 2018. The two groups had been trading the lead back and forth between 2003 and 2017. But in 2018, the equipment group's claims accounted for 57% of the combined total. In 2019, their share fell back to 55%.

Figure 1

Semiconductor Industry Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2018)

One of the reasons for the big decline was a huge drop in claims reported by Lam Research. In 2018, its claims cost soared to $271 million, but in 2019 it fell back to $211 million, a 22% decline in one year. Honeywell reported another big decline, from $228 million in 2018 to $180 million in 2019. Kulicke and Soffa Industries Inc. saw a much smaller $2.2 million decline in claims, but that represented a 15% drop from 2018's total. Similarly, Coherent reported a drop that was numerically smaller but proportionally larger (-12%).

There were also some huge increases in claims, particularly among the solar power equipment manufacturers. First Solar reported a 90% jump in claims. SolarEdge reported a 56% jump. And SunPower reported a 51% increase. But as large as they were proportionally, they were more than matched by the declines of Lam Research alone.

Meanwhile, the other large warranty providers on this list, such as Applied Materials, AMD, Agilent, and Teradyne, each reported annual changes in their claims totals that were neither large in terms of dollars nor in terms of percentages. But further down the list, there were lots of changes that were proportionally very large.

For instance, five companies -- AXT Inc., GrafTech International Ltd., Kopin Corp., MagnaChip Semiconductor Corp., and Monolithic Power Systems Inc. -- more or less doubled their claims totals in 2019. And five companies -- Compass Diversified Holdings LLC, Cree Inc., Emcore Corp., and Roper Technologies Inc. -- more or less cut their claims totals in half last year.

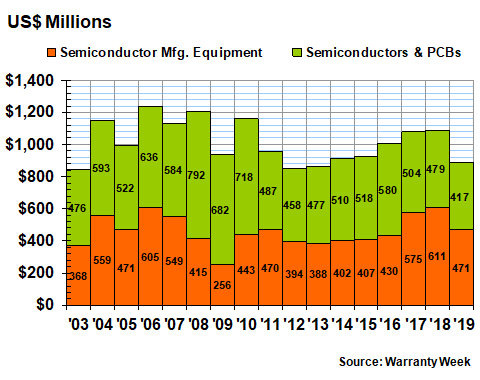

Warranty Accrual Totals

Warranty accruals fell by $202 million in 2019, to their lowest level since 2013. Accruals declined by $62 million for the device group and by $139 million for the equipment group.

Also, the accruals of the equipment group declined faster, meaning that their overall share of the total also slipped. Though 2019 was the third consecutive year that the equipment group accounted for more than half the accruals of the entire industry, at 53% it was the smallest share among the three.

From 2003 to 2016, meanwhile, the device group always accounted for half or more of the combined total. As recently as 2016, the group accounted for more than 57% of the total. But in 2017 and 2018, the equipment group raised its accruals considerably, while the accruals of the device group fell.

Figure 2

Semiconductor Industry Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2019)

With this metric, however, the annual changes were less extreme than some of the claims total changes were for individual companies. There were four big declines: Lam Research led the pack with a $63 million decline. Applied Materials and Honeywell each reported a $35 million decline. And Coherent reported a $16 million decline in accruals, which compared to its 2018 total, represented a 26% decline.

Further down the list of 171 companies, some of the changes were small in terms of money but enormous in terms of percentages. That was mostly because of under-accruals in 2018 giving way to normal accruals in 2019. For instance, Kopin, MagnaChip, and ON Semiconductor Corp. each accrued less than $1 million in 2018, and in 2019 they more than quadrupled their accruals -- or in the case of MagnaChip, boosted them more than ten-fold.

And then eight companies cut their accruals in half or more, with Monolithic Power Systems topping the list, cutting its accruals from $6.6 million in 2018 to less than $900,000 in 2019.

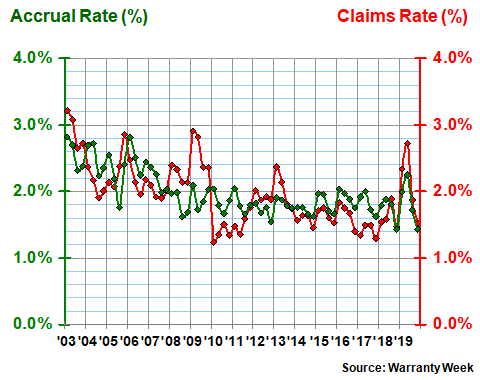

Warranty Expense Rates

The discussion above leaves out an important component: sales growth. For instance, some of the solar power equipment manufacturers were mentioned due to the large annual increases in their claims or accrual totals. However, most of those increases were proportional to increases in sales, which were significant for SolarEdge (+52%), First Solar (+36), and SunPower (+26%). In other words, not all expense increases are bad news, especially those that come alongside sales increases.

In Figures 3 and 4, what we've done is to take the claims and accrual totals in Figures 1 and 2 and divide them by the corresponding sales figures. In Figure 3, it's clear that something went very wrong for some members of the equipment group, which saw its claims and accrual rates spike in the second calendar quarter of 2019 before falling back to a more typical range in the third and fourth quarters.

Figure 3

Semiconductor Manufacturing Equipment

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2019)

Lam Research was behind much of that rise, with its claims rate spiking from 1.8% to 3.2% in the middle of 2019, and its accrual rate jumping from 2.1% to 2.6% over the same time period. But Brooks Automation, Applied Materials, Veeco Instruments Inc., and Axcelis Technologies Inc. also saw big jumps in their expense rates.

By the end of 2019, expense rates were more or less back to normal, with the average claims rate ending the year at 1.5% and the average accrual rate coming in at 1.4%. Over the past 68 quarters, both metrics have averaged just under 2.0%, but expense rates have been below that level for most of the past six years.

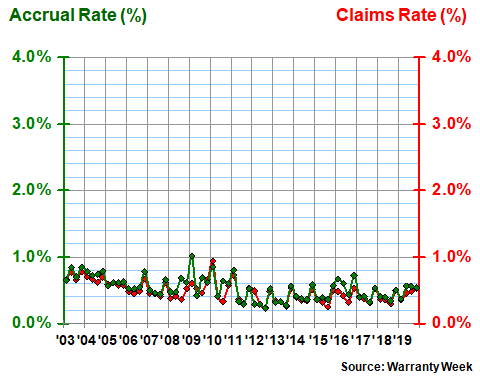

On the device list, the changes haven't been as noticeable. For instance, because of rising sales, First Solar's claims rate rose from 0.5% to 0.7% while its accrual rate didn't change much at all. SolarEdge kept its claims rate the same but cut its accrual rate by 1.0%. SunPower's claims rate rose by 0.6% but it cut its accrual rate by 0.7%.

Outside the solar power manufacturers, the changes were even smaller. Honeywell kept its claims rate at 0.7% and its accrual rate at 0.6%. AMD's claims rate remained at 0.4% but raised its accrual rate from 0.4% to 0.5%. Teradyne's claims rate rose by a tenth of a percent while its accrual rate fell by a tenth.

Figure 4

Semiconductor Devices & Printed Circuit Board Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2019)

Overall, the device group's average claims and accrual rates have both been very close to 0.5% over the past 68 quarters. And that is where they were for most of 2019 as well. But notice that both expense rates dropped below 0.4% in early 2019. Both expense rates were lower than that in the third quarter of 2018, and were lower still at points during 2012, 2013, and 2015. But it was the first time since 2003 that the expense rates were at their lowest point in the opening quarter of the calendar year.

Warranty Reserve Balances

Our final metric is the balance in the warranty reserve funds of all these semiconductor device and manufacturing/test equipment companies at the end of each calendar year. In 2019 their ending balance was $1.24 billion, down by $224 million from the end of 2018. The balances fell more or less proportionally -- down by 16% for the device makers and down by 14% for the equipment makers. But it was the lowest year-ending balance since 2009.

Figure 5

Semiconductor Industry Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2019)

Numerically, the largest balance decline on the list was First Solar's, which cut its reserves from $221 million at the end of 2018 to $130 million at the end of 2019. Lam Research, meanwhile, cut its reserves from $167 million to $118 million. Honeywell's reserves dropped by $41 million, and SunPower's fell by $34 million.

In terms of increases, the only sizeable increase in reserves was reported by SolarEdge, which saw its balance rise from $122 million to $173 million. On a proportional basis, Advanced Energy Industries Inc. more than tripled its reserve balance and MagnaChip more than doubled its reserves. And Richardson Electronics Ltd. exactly doubled its reported warranty reserve balance. But the declines outnumbered the increases.