Warranty Expenses When Conglomerates Break Up:

In early 2020, two diversified companies spun off product lines to become "pure plays" in specific industries. And now, seven quarters later, the warranty expense metrics of the five new companies, which were previously blended together, have diverged in very distinct ways.

After news broke last month about the plans of General Electric Company and Johnson & Johnson to break themselves into three and two companies, respectively, it made us recall the break-ups of last year, when United Technologies Corp. and Ingersoll-Rand plc reorganized themselves into three and two units.

As we wrote about in the May 28, 2020 newsletter, our main interest in the break-ups of these conglomerates was how their subsequent financial statements would allow us to get a much clearer view of their warranty expenses, since the aerospace claims and accruals would no longer be blended with those of the air conditioning or industrial/building products lines of business. And now, with nearly two years of separate data in hand, that clearer picture has emerged.

Last year on April 3, United Technologies Corp. completed its merger with the Raytheon Company, having previously spun off its HVAC operations into a new company called the Carrier Global Corp., and its elevator operations into a new company called Otis Worldwide Corp. And then also last year, Ingersoll-Rand plc sold off its Industrials Group, which makes a variety of pumps, compressors, and other gear, to Gardner Denver Holdings Inc. Then Ingersoll Rand renamed itself Trane Technologies, while Gardner Denver took on the Ingersoll Rand name.

In other words, two companies became five, just as GE and J&J will do next year. And just as we eagerly await a clear look at GE's separate aviation-versus-energy warranty expenses, now we have a clear look at Raytheon's aviation, and Carrier's and Trane's separate HVAC and refrigerator truck warranty expenses.

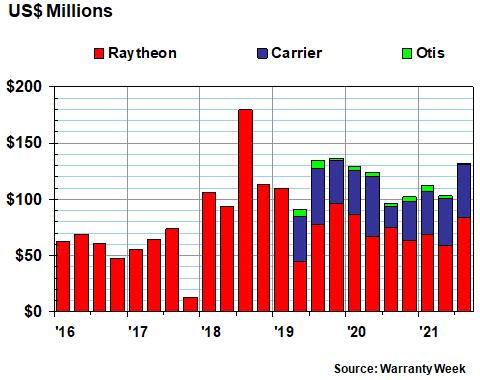

In Figure 1, we're looking at 23 quarters of claims totals for Raytheon Technologies Corp., Carrier Global Corp., and Otis Worldwide Corp., the successors of the United Technologies conglomerate. United Technologies and Raytheon are in red; Carrier is in dark blue; and Otis is in bright green.

Carrier and Otis were created in March 2020, so they filed their first independent financial reports in the second quarter of last year. But in that report as well as all of their subsequent financial reports, they also provided year-ago claims totals, allowing us to track them as if they were separate companies from the second quarter of 2019 going forward.

Figure 1

The United Technologies Breakup

Claims Paid by Successor Companies

(in US$ millions, 2016-2021)

For the first nine months of 2021, Raytheon's claims total is down $17 million to $212 million. Carrier's claims total is up $16 million to $127 million. And Otis has seen its claims total fall by 20% so far this year to $8.0 million.

Note that in that second quarter of 2019, Carrier's claims comprised 44% of the conglomerate's total, its highest percentage ever. By the second quarter of 2020, that ratio had dropped to 43%, and by the second quarter of this year it was down to 41%. For this year so far, Carrier's share of the pie is 37%, up from 32% in the first nine months of 2020.

Otis, meanwhile, barely registers its share of the total, despite our choice of a relatively bright color for its representation. For instance, in the latest quarter, Otis reported only $1 million in claims paid, less than 0.76% of the former conglomerate's total. Its share of the pie has slipped from 2.9% last year to 2.3% this year.

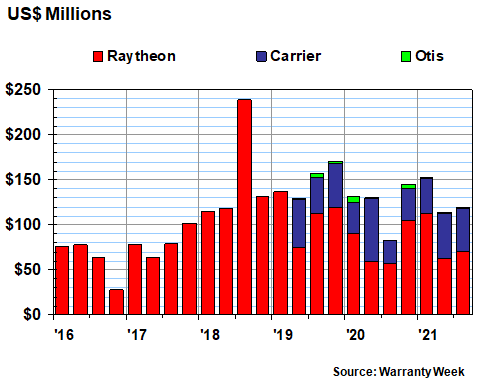

Warranty Accruals

In the second quarter of 2020, which was Carrier's first as an independent company, it actually accrued more than its former parent: $70 million to Raytheon's $59 million. But that has not happened again, and for the year so far, Carrier's share of the accrual pie is 35% to Raytheon's 64%.

For the first nine months of 2021, Raytheon's accruals have risen by $41 million to $247 million, while Carrier's accruals have risen by $5.0 million to $136 million.

Otis has allowed its accruals to fall from $8.0 million in the first three quarters of 2020 to $3.0 million in the first three quarters of 2021. And it's not an exaggeration to say that the representation of that has made it virtually disappear from the chart below.

Figure 2

The United Technologies Breakup

Accruals Made by Successor Companies

(in US$ millions, 2016-2021)

United Technologies never had much to say about why its accruals suddenly spiked in the third quarter of 2018. But as a quick glance back at Figure 1 will confirm, it was done in response to a parallel spike in claims.

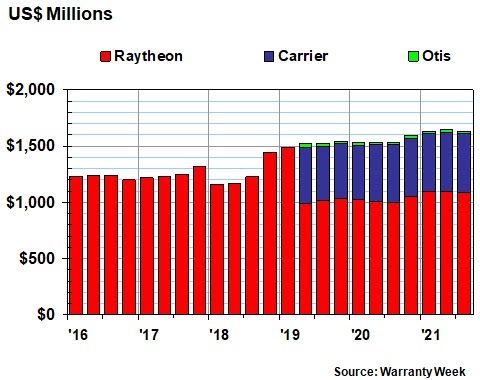

Warranty Reserves

The amount of money kept in the warranty reserve funds of the united and separate companies is detailed in Figure 3 below. Unlike either the claims or accrual data, this metric tends to change slowly from one quarter to the next. And indeed, the separate and united totals are also slow to change.

At the end of the first quarter of 2019, United Technologies reported having $1.485 billion in its warranty reserve fund. At the end of June 2019, the three new entities had $1.522 billion in their theoretically separate reserve funds, an increase of just 2.5%. A year later, when their reserve funds were truly separate, they'd increased in size by less than one percent, to $1.536 billion.

Figure 3

The United Technologies Breakup

Reserves Held by Successor Companies

(in US$ millions, 2016-2021)

At the end of September 2021, compared to the end of September 2020, Raytheon's reserve balance had increased by $89 million to $1.089 billion. Carrier's reserves grew by $15 million to $524 million. And Otis let its reserve balance decline by $3.0 million to $21 million.

The collective balance of the three is up by $101 million to $1.634 billion as of September 30, 2021. Carrier's share, which briefly surpassed 33% last year, is now back down to 32% of the total.

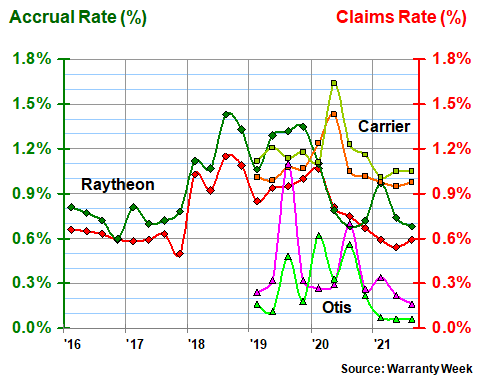

Warranty Expense Rates

In Figure 4, we've taken the claims and accrual totals from Figures 1 and 2 and compared them to product revenue totals for the same timeframes. This results in three pair of percentage figures, representing claims as a percent of sales (the claims rate) and accruals as a percent of sales (the accrual rate), for Raytheon, Carrier, and Otis.

It's a bit hard to decipher, but the claims rates are in shades of red while the accrual rates are in shades of green. Raytheon's data points are diamond-shaped, while Carrier's are squares and Otis uses triangles.

Figure 4

The United Technologies Breakup

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2016-2021)

In the years 2016 and 2017, United Technologies reported warranty expense rates that were about the same as those reported by Raytheon in late 2020 and the first nine months of 2021 -- on the vicinity of 0.6% to 0.8%.

Carrier's latest report has its claims rate just below 1.0% while its accrual rate is just above 1.0%. In its earliest days as a separate company, its claims rate rose above 1.4% while its accrual rate was above 1.6%.

Otis, in the year before it became a separate company, briefly saw its claims rate climb above 1.1%, and saw it rise as high as 0.7% last year. But its warranty expense rates have generally been the lowest of the three, with its accrual rate falling under 0.1% this year.

What to make of all this? While the trend is not as decisive as perhaps we'd like it to be, it does appear that Carrier's HVAC and refrigerator truck product lines have a higher rate of warranty expense than Raytheon's avionics, airframes, and aircraft engines. And both of those have much higher warranty expense rates than elevators and escalators.

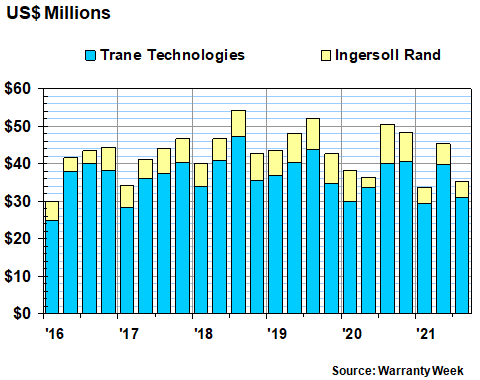

Ingersoll Rand and Trane

In Figure 5, we're looking at 23 quarters of claims totals for both Ingersoll Rand and Trane Technologies. But remember, before the end of February 2020, what's now called Ingersoll Rand was then called Gardner Denver, and what's now called Trane Technology was the Trane HVAC and Thermo King refrigerated truck product lines of Ingersoll-Rand.

Bottom line, the transaction was completed in the first quarter of 2020, so what we're really looking at in the charts below are 16 quarters of data before the transaction and seven quarters since the transaction. And it's really hard to tell them apart. But perhaps that's the point: the warranty claims totals before the transaction look fairly similar to the totals afterwards.

Figure 5

The Ingersoll Rand Breakup

Claims Paid by Successor Companies

(in US$ millions, 2016-2021)

To be sure, there are some big changes in the totals this year. Fir the first nine months of 2021, Trane's claims are down by $9.5 million to $89.8 million. Ingersoll Rand's claims are down by $10.6 million -- almost half -- to $12.1 million over the same period. And more noticeably, in two of the past three quarters, Trane's claims totals have come in under $30 million for the first time in five years.

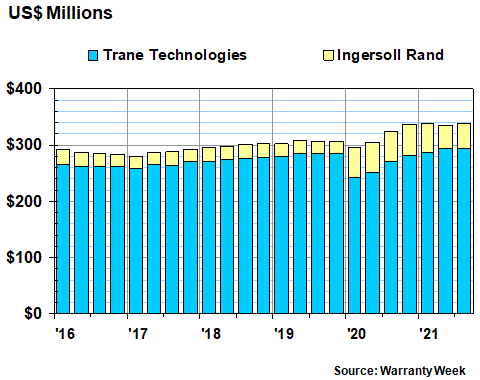

Warranty Accruals

It's much the same with warranty accruals. At first glance, there's not much visible change before or after the transaction was completed in February 2020. But as you probe deeper, you notice that Ingersoll Rand's highest quarterly accrual total came in the third quarter of 2020, just three-to-seven months after the transaction was completed. And Trane's lowest quarterly accrual total in four years came in the first quarter of 2021, barely a year after the transaction.

Figure 6

The Ingersoll Rand Breakup

Accruals Made by Successor Companies

(in US$ millions, 2016-2021)

For the first nine months of 2021, Trane's accruals are down $3.5 million to $100.4 million. Ingersoll Rand's accruals are down $7.1 million to $14.1 million over the same time period -- a decline of more than one-third from the 2020 total. So while warranty expenses are declining for both companies, they're declining remarkably fast for Ingersoll Rand.

Warranty Reserves

Finally, in Figure 7, we can look at the data and use it to guess exactly when the acquisition and name change took place. By the end of the first quarter of 2020, Ingersoll Rand's warranty reserve fund balance had risen from $22.7 million to $53.0 million, while Trane's balance fell from $285 million to $242 million, as the liabilities for the industrial product lines shifted from one company to the other.

Figure 7

The Ingersoll Rand Breakup

Reserves Held by Successor Companies

(in US$ millions, 2016-2021)

By the end of September 2021, Trane's reserve balance had slowly risen to $293 million, while Ingersoll Rand's balance slowly declined to $44.5 million. Over the seven most recent quarters, Trane's share of the combined total has slowly risen from 82% to 87%.

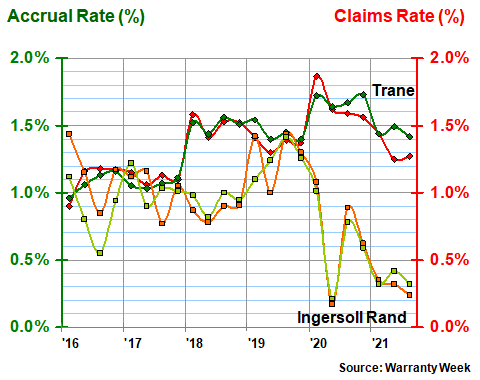

Warranty Expense Rates

In Figure 8, we're looking at the claims and accrual rate pairs for both companies over the past 23 quarters. And once again, if you didn't know the date of the transaction, you could look at the data and guess it must have happened in early 2020.

And you'd be right. At the end of 2019, both pairs of expense rates were in the vicinity of 1.3% to 1.4%. But then, Trane went north while Ingersoll Rand went south. And while Trane is now once again back to that 1.3%-to-1.4% range, Ingersoll Rand is down at 0.2%-to-0.3%.

Figure 8

The Ingersoll Rand Breakup

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2016-2021)

The inevitable conclusion is that the product lines that Trane retained have a higher natural rate of warranty expense than those it sold to Gardner Denver, which are now part of Ingersoll Rand. And that's the same outcome as we saw with Carrier and Raytheon: HVAC systems and refrigerated trucks have a higher rate of warranty expense than the rest of the conglomerate did. And that's to be expected, given the tendency for HVAC warranties to be relatively long and the need for periodic maintenance and service to be relatively high.

But there's one more similarity worth noting: in the early days of 2020, when they both became "pure plays" in the HVAC business, both Carrier and Trane saw their warranty expenses rise. And in 2021, both saw their warranty expense rates fall. They weren't dramatic declines, but they were certainly in the downward direction. So that suggests both companies recently underwent some kind of self-improvement transformation, under which they learned how to make their warranty management process less costly.