European Automaker Warranty Expenses:

Total warranty claims payments increased by 15% from 2023 to 2024 among the European auto OEMs, while accruals increased by just 3%, and reserves increased by 2%. The European automakers accrued a median of €1,528 per vehicle sold.

Since the 2021 merger of PSA Group (Peugeot Citroën) and Fiat Chrysler Automobiles (FCA) to form the Netherlands-based Stellantis N.V., there are five major European automakers: Volkswagen AG, Stellantis, Mercedes-Benz Group AG, BMW AG (Bayerische Motoren Werke), and Renault S.A. Luckily for us, all of them report their warranty expenses in their annual reports, as do the Chinese Geely Holding-owned subsidiaries Volvo Cars and Polestar, and the luxury automaker Ferrari S.p.A.

Up until 2022, Mercedes-Benz Group was called Daimler AG. In 2019, Daimler formed a division called Daimler Truck, which included the heavy truck brands Freightliner, Thomas Built, Western Star, Fuso, BharatBenz, and powertrain manufacturer Detroit Diesel. In 2022, Daimler AG spun off Daimler Truck Holding AG as a separate listed company, 30% owned by the renamed parent Mercedes-Benz Group AG. Since then, Mercedes-Benz has essentially been a pure play in the passenger car market.

Chrysler was owned by Mercedes-Benz Group from 1998 to 2007, during which period the parent company was known as DaimlerChrysler. In 2007, Chrysler was sold to private equity, and then filed for Chapter 11 bankruptcy in 2009 as a result of the financial crisis. It was bailed out by the U.S. and Canadian governments, and emerged primarily owned by the United Auto Workers union and Fiat S.p.A. Fiat acquired the rest of Chrysler from UAW in 2014, forming Fiat Chrysler Automobiles (FCA), and then merged with PSA in 2021 to form Stellantis.

FCA also owned Ferrari, but spun off the luxury vehicle manufacturer in 2016, in anticipation of the upcoming merger. Ferrari began reporting its warranty expenses in 2019.

Stellantis is the parent company of over a dozen passenger vehicle brands, including Dodge, Ram, Jeep, Chrysler, Opel, Peugeot, Fiat, Lancia, Citroën, Alfa Romeo, Maserati, and Vauxhall.

Unlike Mercedes-Benz and Stellantis, some of the European automakers are not pure plays in the passenger car industry.

Volkswagen also makes heavy trucks, through its Traton SE subsidiary (formerly Volkswagen Truck & Bus), which owns the International Motors (formerly Navistar), Scania, and MAN brands.

BMW is also the parent company of Mini and Rolls-Royce Motor Cars, and makes motorcycles under its BMW Motorrad division.

Renault also owns the Dacia brand. Renault is a member of the Renault-Nissan-Mitsubishi Alliance, which grants each of the three automakers voting power in the other. Nissan owns 15% of Renault, and the French state owns 15% of Renault as well. Note that the commercial vehicle brand Renault Trucks has not been owned by Renault S.A. since 2001.

In 2001, the Swedish heavy vehicle manufacturer Volvo Group acquired Renault Trucks. Volvo Group, also known as AB Volvo, is a pure play in the commercial vehicle industry, and thus is not included in this report.

It's important to note the difference between Volvo Group and Volvo Cars. Although they share the same logo, the two have been separate entities since 1999, when Ford Motor Co. acquired Volvo Cars. In 2010, Ford sold Volvo Cars to the China-based Geely Holding Group. Volvo Cars still publishes its own annual report, despite being a fully-owned subsidiary of Geely.

Polestar is technically a subsidiary of Volvo Cars, which in turn is a subsidiary of Geely Holding. Volvo Cars acquired the Polestar brand in 2015, and pivoted it to luxury electric vehicles in 2017. Its first year of reporting warranty expenses was 2020.

Data from Jaguar Land Rover are not included in this report, because it does not file its own annual report. Instead, Jaguar Land Rover's expenses are included in the annual reports of its parent company, Tata Motors, which is based in India.

For each of the nine European automakers (including PSA's data from the before the 2021 formation of Stellantis), we perused their annual reports, and collected three warranty metrics: the amount of claims paid, the amount of accruals made, and the year-end balance of the warranty reserve fund.

In addition, we collected two sales metrics from each automaker: the amount of automotive product revenue, and the number of vehicles sold.

Using these data, we calculated three additional warranty metrics: claims as a percentage of sales revenue (the claims rate), accruals as a percentage of sales revenue (the accrual rate), and the amount of accruals per vehicle sold (accruals divided by unit sales).

Volkswagen, Stellantis, Mercedes-Benz, BMW, Renault, and Ferrari all report in Euro. Volvo Cars reports in Swedish kronor, and Polestar reports in U.S. dollars. For Volvo Cars, we first converted the totals in Swedish kronor into U.S. dollars, using the IRS Yearly average currency exchange rates table. Then, we converted the U.S. dollar amounts for Volvo Cars and Polestar into Euro, using the same exchange rate table.

Note that for 2020, the data labeled as Stellantis are the numbers from FCA Group, while the PSA data are in green for that year. For 2021 onwards, the Stellantis data represent both entities united post-merger.

Warranty Claims Totals

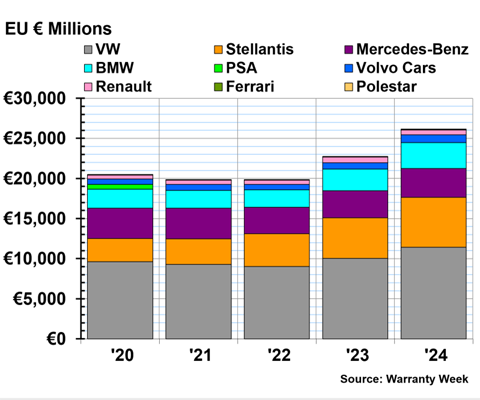

Figure 1 shows the total warranty claims paid by nine European automakers, from 2020 to 2024. For 2020, we have pre-merger data from PSA Group and FCA, which is labeled as Stellantis; the two are combined under the Stellantis label from 2021 onwards.

Figure 1

Warranty Claims Paid by

Nine European Manufacturers

(in EU € millions, 2020-2024)

In 2024, the eight European automakers paid a total of €26.163 billion in warranty claims. This is a rather significant 15% increase from 2023's total of €22.758 billion. The 2024 total comes close to, but is just shy of, the record high of €26.960 billion, which we saw in 2017 amidst Volkswagen's emissions scandal. All but Renault and Polestar saw their total claims costs rise from 2023 to 2024.

Volkswagen paid €11.432 billion in warranty claims in 2024, a 14% increase from 2023's total of €10.047 billion. The automaker's claims costs have been on the rise since 2022, though still not as high as we saw in the midst of the scandal in 2017.

Stellantis paid €6.209 billion in warranty claims in 2024, a 23% increase from the year prior.

It's a notable departure from the warranty expenses of its two predecessors, FCA and PSA. In 2020, their final year of reporting separately, FCA paid €2.897 billion in claims, and PSA paid €624 million. Those two figures combined totals €3.521 billion, just a little over half of Stellantis' warranty claims costs in 2024.

Mercedes-Benz paid €3.618 billion in warranty claims in 2024, a 7% increase from 2023. BMW paid €3.217 billion in claims in 2024, a 20% increase from the year prior.

Volvo Cars paid €976 million in claims in 2024, a 23% increase from the year prior. Renault paid €610 million in claims, a -14% decrease from the year prior. Note that the warranty expenses of these two manufacturers are independent from those of their parent companies and alliance members — in the case of Volvo Cars, these data are independent from those of Geely, and in the case of Renault, these data are separate from those of Nissan, though they are highly collaborative as part of the Renault-Nissan Alliance.

Then we have the warranty expenses of our two luxury automakers, which are much smaller relative to those of the six large European automakers, and don't really show up visually in Figure 1. Ferrari paid €61 million in warranty claims in 2024, a 21% increase from 2023. Polestar paid €40 million in claims, a -5% decrease from the year prior.

Warranty Claims Rates

It's important to analyze these data relative to each manufacturer's total vehicle sales revenue, because OEMs with more sales will naturally be spending more on warranty.

This is especially true since Ferrari and Polestar are making luxury vehicles at higher price points, with more expensive repairs, but also making fewer sales in a year, by design. Volkswagen and Stellantis, on the other hand, are two of the largest automakers in the world, and sell million of vehicles worldwide every year.

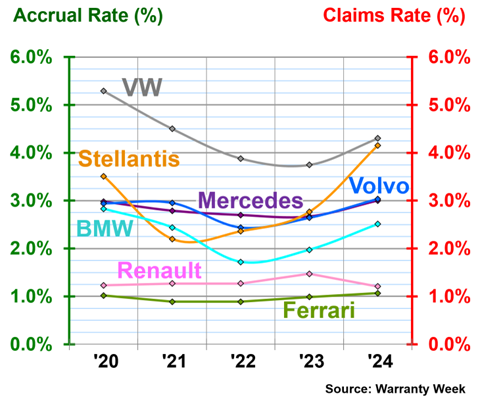

Our warranty expense rates are useful in normalizing out total claims costs in proportion to each OEM's total vehicle sales revenue. Figure 2 shows the warranty claims rates of seven European automakers, from 2020 to 2024.

Polestar's warranty expense rates are not included in Figures 2 or 4, because 2020 was its first year of reporting, and its expense rates were very wonky as the company figured out how much it needed to accrue for future warranty costs.

Figure 2

Warranty Claims Rates of

Seven European Manufacturers

(as a % of product revenue, 2020-2024)

Volkswagen had the largest claims rate of the group, though it was a near thing, as Stellantis' claims rate rose substantially from 2023 to 2024. In 2024, Volkswagen had a warranty claims rate of 4.30%, up a little from 2023, when its claims rate fell below 4% for the first time in a decade.

Stellantis had a claims rate of 4.15% in 2024, an increase of one-half from 2023's claims rate of 2.76%. This was the most drastic change in the claims rate of the European automakers from 2023 to 2024.

In 2024, Volvo Cars had a claims rate of 3.03%, and Mercedes-Benz had a claims rate of 3.00%, both up a bit from the year prior.

BMW had a claims rate of 2.51% in 2024, up by about one-fourth from the year prior. Polestar had a claims rate of 2.10%, also up a bit from the year prior.

Renault had a claims rate of 1.21% in 2024, a decrease of about one-fifth from 2023. Renault was the only one of the European automakers that saw its claims rate decrease from 2023 to 2024.

Ferrari had a claims rate of 1.07% in 2024, up slightly from the year prior.

Warranty Accrual Totals

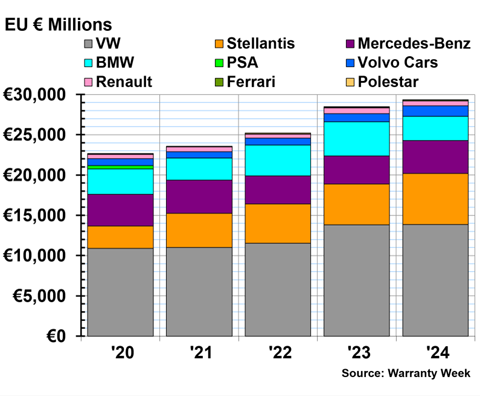

Figure 3 shows the total warranty accruals in Euro of the nine European automakers, from 2020 to 2024.

Figure 3

Warranty Accruals Made by

Nine European Manufacturers

(in EU € millions, 2020-2024)

In 2024, these eight European passenger car OEMs set aside a total of €29.365 billion in warranty accruals, a 3% increase from 2023.

Volkswagen set aside €13.861 billion in warranty accruals in 2024, a very slight 0.20% increase from 2023. Stellantis accrued €6.332 billion for future warranty costs, a 25% increase from the year prior. Mercedes-Benz accrued €4.086 billion in 2024, a 17% increase from the year prior.

BMW accrued €3.007 billion in 2024, a -29% decrease from 2023. This was the largest decrease in warranty accruals from 2023 to 2024, among the European automakers.

Volvo cars set aside €1.333 billion in warranty accruals, a 32% increase. Renault accrued €586 million, a -19% decrease from the year prior.

Ferrari accrued €92 million in 2024, a 46% increase from the year prior. This was the largest increase in warranty accruals among the European automakers.

Polestar accrued €68 million in warranty accruals in 2024, a -21% decrease from the year prior.

Warranty Accrual Rates

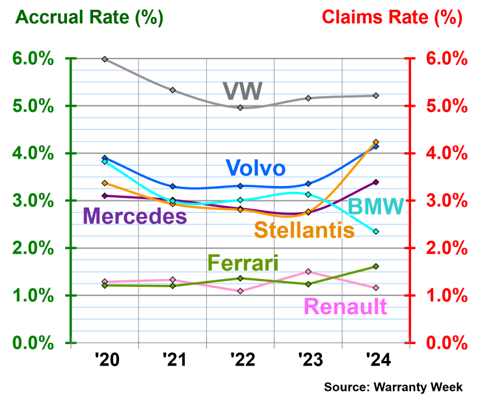

Figure 4 shows the warranty accrual rates of the seven European automakers, from 2020 to 2024.

Figure 4

Warranty Accrual Rates of

Seven European Manufacturers

as a % of product revenue, 2020-2024)

In 2024, Volkswagen had a warranty accrual rate of 5.21%. While Volkswagen does tend to have warranty expense rates at the high end of the spectrum for major global automakers, it's been quite consistent with the proportion of total annual vehicle sales revenue that it sets aside for warranty expenses, and spends on warranty claims payments.

Stellantis had a warranty accrual rate of 4.23% in 2024, up by one-half compared to 2023's accrual rate of 2.76%. This was the sharpest increase in the accrual rate we saw among the European automakers in 2024.

Volvo Cars had an accrual rate of 4.14% in 2024, up about one-quarter from 2023. Mercedes-Benz had an accrual rate of 3.39% in 2024, up by a similar degree from the year prior.

BMW had an accrual rate of 2.35% in 2024, a decrease of about one-quarter compared to the year prior. This was the largest decrease in the accrual rate we saw among the European automakers from 2023 to 2024.

Ferrari had an accrual rate of 1.61% in 2024, up by about one-third from the year prior. And Renault had an accrual rate of 1.16%, a decrease by about one-quarter.

We did not depict the warranty expense rates of Polestar because it was so new to warranty reporting at the beginning of our data frame in 2020. In 2020, Polestar had a warranty accrual rate of 10.81%, and a warranty claims rate of 4.49%. In contrast, in 2024, Polestar had a warranty accrual rate of 3.63%, and a warranty claims rate of 2.10%.

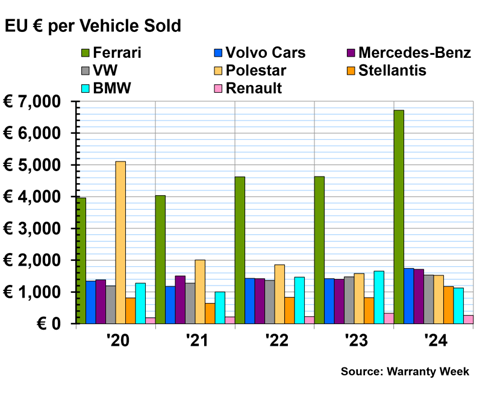

Accruals per Vehicle Sold

Our next metric is another warranty expense ratio, comparing the amount of accruals made to the number of vehicles sold per year. Figure 5 shows accruals per vehicle sold for eight European automakers, from 2020 to 2024.

Figure 5

Warranty Accruals Made per Vehicle Sold by

Eight European Manufacturers

(in EU € euro, 2020-2024)

Luxury vehicle OEMs sell fewer vehicles, but each vehicle costs more than a typical car. Repairs are also more expensive for luxury vehicles. So it's not surprising that Ferrari continues to have the highest rate of accruals per vehicle sold, by a longshot.

In 2024, Ferrari set aside an average of €6,715 in warranty accruals for every vehicle it sold.

Polestar was setting aside a lot more in accruals per vehicle sold when it first started warranty reporting in 2020, but this rate has decreased drastically in the last few years. In 2024, Polestar accrued an average of €1,523 per vehicle sold, right at the middle of the pack. Interesting considering Polestar is also a small company catering to a luxury niche, and electric vehicles at that.

Volvo accrued an average of €1,746 per vehicle sold in 2024. Mercedes-Benz accrued an average of €1,710 per vehicle sold. And Volkswagen accrued an average of €1,534 per vehicle sold.

Stellantis accrued an average of €1,169 per vehicle sold. While this metric did increase from 2023 to 2024, along with Stellantis' total warranty accruals and accrual rate, note that the OEM is still below the median amount of accruals per vehicle sold, across the European automakers.

BMW accrued an average of €1,130 per vehicle sold. And Renault accrued just €259 per vehicle sold, far below the industry norm in this region.

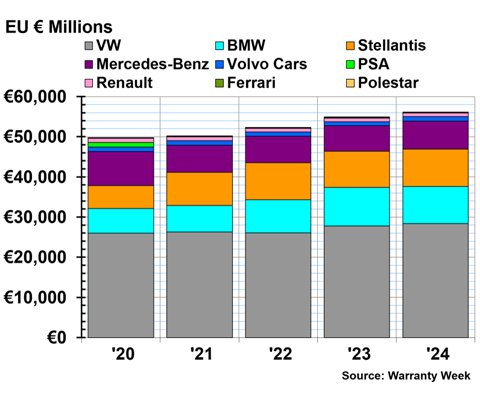

Warranty Reserve Totals

Figure 6 shows the year-end balance of the warranty reserve funds of the European automakers, from 2020 to 2024.

Figure 6

Warranty Reserves Held by

Nine European Manufacturers

(in EU € millions, 2020-2024)

The eight European automakers collectively held €56.176 billion in warranty reserves at the end of 2024, a 2% increase from the end of 2023.

Half of that total balance is encompassed by Volkswagen's warranty reserves. Volkswagen held €28.378 billion in warranty reserves at the end of 2024, a 2% increase from the end of 2023.

Stellantis held €9.308 billion in reserves at the end of 2024, a 4% increase from the end of the year prior. BMW held €9.272 billion in reserves, a -4% decrease.

Mercedes-Benz held €6.934 billion in warranty reserves at the end of 2024, an 8% increase from the year prior. Volvo Cars held €1.148 billion in warranty reserves, a 19% increase.

Renault held €862 million in warranty reserves at the end of 2024, a -3% decrease from the end of 2023. Ferrari held just €152 million in reserves, a 17% increase. And Polestar held just €122 million in warranty reserves at the end of 2024, a -9% decrease from the end of 2023.