Credit Card Extended Warranty:

A wide variety of U.S.-issued credit cards offer extended warranty coverage as an ancillary benefit, for electronics and appliances purchased with the card. We perused the Guides to Benefits of dozens of major credit cards across three card networks and seven card issuers, and found the policy terms, administrators, obligors, and underwriters.

All of the premium credit cards on the market offer extended warranty protection on electronics and appliances purchased with the credit card. Extended warranty coverage benefits are also becoming more popular as a perk of mid-range credit cards, including co-branded cards, and even some $0 annual fee cards as well.

There are dozens of credit card extended warranty benefit round-ups on credit card blogs such as The Points Guy or Nerd Wallet, as well as many other financial blogs and webpages. All of those pages are aimed at consumers, who may be swayed to apply for one of those cards because of the extended warranty, among many other benefits.

This newsletter is not taking the same approach; instead, we're taking an industry perspective on this topic. None of those blog posts will tell you what companies are the administrators, obligors, or underwriters of those "free" extended warranty credit card benefits.

Extended warranty is a lesser-known, and seldom advertised, additional benefit of many credit cards, especially those issued by a few particular banks and card networks. Two of the largest American card issuers include extended warranty protection with most of the cards they offer, though one of those banks does not include the benefit with some of its co-branded cards. And then other networks and banks offer extended warranty as a benefit for a select few of their credit cards.

Methodology

To create this newsletter, we scoured the Guides to Benefits for most of the major American credit cards. We did use several credit card blogs to help us identify which cards offer extended warranty protection. Then we searched online for the Guides to Benefits for those cards, and searched for language detailing the details of each extended warranty benefit.

We collected general credit card information, including: card name, annual fee, network, issuing bank, and whether it's a co-branded card. In addition, we collected several key data points on the extended warranty plan terms, including: length of coverage, maximum length of manufacturer's warranty, maximum coverage, both per claim and per policy, other extended warranty coverage benefits, as well as the administrator, obligor, and underwriter of the policy.

We created the following graphics to synthesize our findings on the companies involved in these policies. In addition, we'll explore the similarities and differences in the maximum length and coverage of the extended warranty policies associated with purchases made on a variety of credit cards.

Of course, we do not own the copyright to any of the following logos, and use them purely for educational purposes. We are not affiliated with any of these credit card networks, banks, insurers, or extended warranty providers.

We also want to note that this article only details the credit card extended warranty benefits associated with credit cards issued within the United States. We do not include any credit cards issued in Canada, Europe, the U.K., etc.

How Credit Card Extended Warranty Works

While credit cards are increasing in popularity around the world, American credit cards are unique. Because the United States allows merchant credit card fees, banks are able to use those funds, along with the annual fees associated with mid-range and premium cards, to offer a wider range of benefits, including points, miles, credits, concierge services, extended warranty coverage, and a wide range of insurance coverage, especially travel insurance, including rental car collision insurance, trip cancellation and interruption, trip delay, lost luggage, travel accident coverage, and emergency medical.

Credit card extended warranty coverage automatically applies to all eligible items purchased with the credit card. The most common types of covered items are electronics and appliances, including a wide range from computers, to cameras, to televisions, to toasters and blenders, to ranges and ovens, to refrigerators and dishwashers, to washers and dryers.

Motorized vehicles are never included in these credit card extended warranty policies, including automobiles, boats, aircraft, trailers, motorcycles, etc. These policies also do not include anything purchased for resale, commercial, or professional use, nor do they include medical equipment, software, or used items.

Credit card extended warranties only apply after the manufacturer's warranty expires. Most credit card extended warranties add 1 year — though a few add 2 years, and one particular card adds 3 years — of warranty coverage onto the end of the limited warranty. Some policies specifying that they begin after the cumulative end of the manufacturer's warranty and any service contracts, either purchased or provided by the manufacturer or retailer.

However, each credit card extended warranty policy also excludes any products that come with cumulative warranty coverage, including limited warranty and service contracts, lasting longer than a particular period, typically 1 year, 3 years, 5 years, or, in one case, 7 years.

Each policy also specifies maximum coverage for both each claim, and the lifetime of the overall policy. Maximum coverage for credit card extended warranty is typically $10,000 per claim, in all but one case. Most cards specify a maximum of $50,000 of extended warranty coverage per credit card or account. However, some cards specify a maximum of $50,000 per cardholder, a maximum of $50,000 per calendar year, and a few have no annual or lifetime limit.

Credit Card Networks & Issuers with Extended Warranty Benefits

We'll quickly explain the difference between credit card issuers and networks. Credit card networks provide the payment technology, connecting the merchant's and customer's banks to facilitate the transaction, while credit card issuers are the ones approving or denying applications, managing the credit card accounts, and billing customers.

The four primary credit card networks in the United States are Visa, MasterCard, American Express (AmEx), and Discover. In May 2025, Capital One, which is a bank and credit card issuer, acquired Discover Card. Discover and AmEx are unique in that they are card issuers, as well as card networks.

Discover does not offer extended warranty benefits on any of the cards it issues. On the other hand, AmEx offers extended warranty benefits on almost every card it issues.

The other card issuers included in this newsletter are: Chase, Citi, Capital One, U.S. Bank, USAA, and Navy Federal Credit Union.

Wells Fargo is a credit card issuer, but does not offer extended warranty as a benefit on any of its credit card products.

Some credit card issuers are loyal to a particular card network, while others use several networks across their credit card products. At one extreme, we have American Express, which is the network and issuer for almost all of its cards, and also does its own extended warranty card benefit administration and underwriting.

Most, but not all, of Chase's credit cards are Visas, but a few are MasterCards. Most of Citi's credit cards are MasterCards.

Capital One issues both Visas and MasterCards, and even offers cards with both networks for the same credit cards. This is especially true for its mid-range cards with annual fees around $100, including the Venture and the Quicksilver. It seems that Capital One determines whether to issue customers a Visa or MasterCard for each credit card product, based on their credit profile. Both product types typically offer extended warranties, but the policy terms vary based on the network provider.

The following three figures detail which credit card issuers, using the three main credit card networks, offer extended warranty protection for their credit cards.

Credit Cards with Extended Warranty Benefits: Visa

Visa's blanket extended warranty policy applies to its Visa Infinite and Visa Signature products. Visa Infinite is the premium product, and the label applies to the Chase Sapphire Reserve and Capital One Venture X cards. Visa Signature is a mid-range product, with cards with annual fees generally between $150 and $0.

These terms are posted on Visa's website, although Visa itself is not a card issuer, and it seems that the banks that do issue Visa cards have the opportunity to customize these plans to their own liking. Visa's base terms for the credit card extended warranty policies are that it adds one year onto cumulative warranty coverage of three years or less (length of manufacturer's warranty plus extended service contracts). Its maximum coverage is $10,000 per claim, $50,000 maximum per account. The listed administrator of these policies is Asurion LLC (see Figure 5), and it seems that the underwriter of this standard plan is Indemnity Insurance Company of North America, owned by Chubb Insurance.

It's also worth noting that not all Visa Signature cards come with extended warranty protection, if the issuing bank chooses not to participate, such as with Wells Fargo.

Figure 1 shows the card issuers offering extended warranty benefits, using Visa as the card network provider.

Figure 1

Credit Cards with Extended Warranty Benefit:

Card Issuers in Visa Network

We know that the Bank of America Premium Rewards Visa card offers extended warranty benefit, which adds up to one year of additional coverage, if the limited warranty is three years or less. The maximum coverage is $10,000 per claim, $50,000 total. However, we could not find any online information about who the administrator, obligor, or underwriter of this card's extended warranty benefits are. If any Warranty Week readers hold this credit card, and want to send us a copy of their Guide to Benefits, our inbox is open.

Chase

The majority of Chase's credit cards that offer extended warranties are Visa cards. This includes Chase's premium card products, the Sapphire Reserve and Sapphire Reserve for Business, along with its mid-range credit cards, such as the Sapphire Preferred and Ink Business Preferred, and most of its $0 annual fee cards, including the Freedom Unlimited, Ink Business Cash, and Ink Business Unlimited. We also collected data from a limited survey of Chase's co-branded cards, including the $150 annual fee Chase United Explorer Credit Card from the mid-range, and the Chase Amazon Prime Visa, which has a $0 annual fee.

The extended warranty coverage for all of these cards adds an additional year of warranty for products that come with cumulative warranty coverage of three years of less, including the length of the manufacturer's warranty and any purchased service contracts. The maximum coverage for most of the extended warranty policies is $10,000 per claim, with a $50,000 maximum per account. The one exception from our sample was the United Explorer card, which has more generous maximum coverage terms of $10,000 per claim, $50,000 per calendar year.

The extended warranty coverage of the premium Sapphire Reserve personal and business cards also includes extended warranty coverage for accidental damage from handling (ADH) and theft, for 120 days from the date of purchase (90 days in New York), for up to $10,000 per item. The Sapphire Reserve cards also include return protection in the extended warranty coverage; if the store will not take the item back within 90 days of purchase, customers can be reimbursed for up to $500 per item, for a maximum of $1,000 per year.

Naturally, JPMorgan Chase Bank, N.A. is the underwriter of all of Chase's credit card extended warranty benefit policies. The administrator of most of these credit card extended warranty plans is Virginia Surety Company, Inc., an Assurant company (see Figure 4). However, the administrator of the extended warranty coverage for the Chase Ink Business Preferred is Asurion LLC (see Figure 5).

U.S. Bank

U.S. Bank offers extended warranty coverage for many of its credit cards. Since U.S. Bank stopped accepting applications for its premium card, the U.S. Bank Altitude Reserve Visa Infinite Card, in November 2024, we did not include it in this newsletter, although that card did offer extended warranty coverage. It seems the bank is currently in the process of overhauling the card.

Two currently available U.S. Bank cards offer extended warranty protection: the $0 annual fee U.S. Bank Shield Visa Card, and the $95 annual fee U.S. Bank Shopper Cash Rewards Visa Signature Card.

The extended warranty coverage for these U.S. Bank cards adds one year onto the limited warranty of three years or less. The maximum coverage is $10,000 per claim, up to $50,000 per cardholder.

The administrator of these plans is Asurion (see Figure 5), and the underwriter is Indemnity Insurance Company of North America, which is owned by Chubb Insurance. Chubb Limited was formed in 2016 through the merger of ACE Limited and Chubb Corp.

USAA

The United Services Automobile Association, or USAA, is a bank open to members of the United States military, veterans, and their families. USAA offers both Visas and AmEx cards (see Figure 3). All of USAA's credit cards include extended warranty coverage, with the same plan terms.

USAA's credit cards include extended warranty coverage that adds one year onto a limited warranty of three years or less. There is a maximum coverage of $15,000 per claim, $50,000 per account.

As far as we could tell, all of these cards had the same extended warranty terms, meaning that they all use Asurion (see Figure 5) as the administrator, and Indemnity Insurance Company of North America (Chubb) as the underwriter.

Capital One

Capital One is a more complicated case. We struggled to find online Guides to Benefits for any of its mid-range or $0 annual fee cards that come with extended warranties, including the Venture, Quicksilver, and Savor. This is because Capital One issues both Visas and MasterCards for these credit card products. It seems that Capital One defaults to the standard Visa or MasterCard extended warranty plan terms for those cards.

We did find a Guide to Benefits for the Capital One Venture X, the premium travel card with a $395 annual fee, because it only comes as a Visa card. This card's extended warranty coverage adds one year to a limited warranty of three years or less, with maximum coverage of $10,000 per claim, $50,000 per cardholder. Asurion (see Figure 5) is the administrator and Indemnity Insurance Company of North America (Chubb) is the underwriter.

Credit Cards with Extended Warranty Benefits: MasterCard

The standard MasterCard credit card extended warranty coverage doubles the limited warranty on items that come with a warranty of 12 months or less, with a maximum coverage of $10,000 per claim, with no annual or lifetime limit. MasterCard uses Sedgwick Claims Management Services (see Figure 6) as the warranty administrator, and New Hampshire Insurance Company, an AIG company, as the policy underwriter.

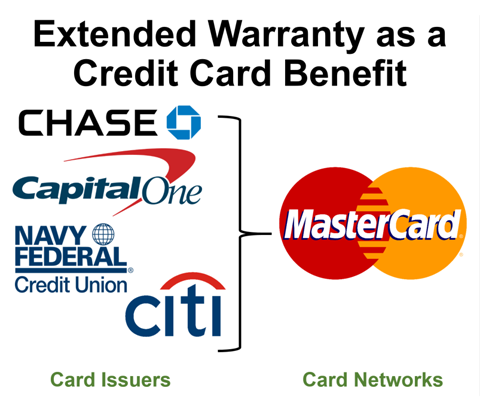

Figure 2 shows the card issuers that offer extended warranties as a credit card benefit, with MasterCard as the card network.

Figure 2

Credit Cards with Extended Warranty Benefit:

Card Issuers in MasterCard Network

Navy Federal Credit Union

Navy Federal Credit Union is an armed forces bank that serves military members, veterans, and their families. Similar to USAA, Navy Federal offers credit cards from three major credit card networks, Visa, AmEx, and MasterCard. Navy Federal's Visa and Visa Signature cards do not come with extended warranty protection. However, the MasterCard and AmEx cards do come with extended warranty protection, each network with different policy terms.

The Navy Federal MasterCards, including the Navy Federal Credit Union Platinum Credit Card and the Go Rewards Credit Card, seem to essentially use the default MasterCard extended warranty benefit, with small adjustments. The coverage adds one year to a limited warranty of one year or less, with maximum coverage of $10,000 per claim, with no annual or lifetime limit.

The administrator of these plans is Sedgwick Claims Management Services, Inc. (see Figure 6), and the obligor and underwriter is AIG.

Citi

Citi offers extended warranty coverage on its Citi Strata Premier, as well as the co-branded Citi AAdvantage Executive World Elite MasterCard. Citi's credit card extended warranty coverage adds two years onto a manufacturer's warranty of five years or less. The maximum coverage is $10,000 per claim, with no annual or lifetime limit.

The administrator of these plans is Virginia Surety Company, Inc., an Assurant company (see Figure 4), and the underwriter is New Hampshire Insurance Company, an AIG company. These are both MasterCard World Elite credit cards, but they use Assurant as the administrator rather than Sedgwick.

Chase

The Chase Freedom Flex is one of the few non-Visa credit cards issued by Chase. Although Chase Freedom Flex is a MasterCard, it still uses the same extended warranty terms as the Chase Visa cards. The card extended warranty adds one year onto a cumulative warranty coverage of three years or less, with maximum coverage of $10,000 per claim, $50,000 per account. The administrator is Assurant (Figure 4), and the underwriter is JPMorgan Chase Bank, N.A.

Capital One

Capital One uses the standard MasterCard extended warranty benefit terms for the MasterCard versions of the credit card products that it issues.

Credit Cards with Extended Warranty Benefits: American Express

American Express is a card issuer as well as a card network. As such, it uses the same coverage for almost all of its cards, and offers extended warranty benefits for almost every card it issues. This includes a few $0 annual fee cards, such as the Blue Business Plus and Blue Delta SkyMiles.

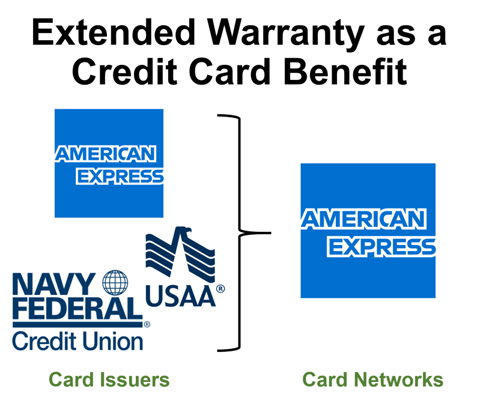

Figure 3 shows the card issuers that offer extended warranties as a credit card benefit, with American Express as the card network.

Figure 3

Credit Cards with Extended Warranty Benefit:

Card Issuers in American Express Network

American Express issues cards for military banks, in addition to its own cards.

Navy Federal Credit Union

Navy Federal issues a few cards using the American Express network, including the Navy Federal More Rewards American Express Card. This card's extended warranty coverage adds one year onto a limited warranty of one year or less, and has maximum coverage of $1,000 per claim, $50,000 per cardholder per year.

The Navy Federal AmEx cards use Virginia Surety Company, Inc., an Assurant company (see Figure 4) as the obligor, and TWG Innovative Solutions, Inc. as the administrator. It was not clear if the policy underwriter was Chubb or American Express.

USAA

USAA also issues cards using the American Express network, including the USAA Preferred Cash Rewards Visa Signature Credit Card. This card adds one year of extended warranty onto a manufacturer's warranty of three years or less, with maximum coverage of $15,000 per claim, $50,000 per account. The administrator is Asurion (see Figure 5), and the underwriter is Indemnity Insurance Company of North America, owned by Chubb Insurance.

American Express

American Express offers extended warranty protection for most of its credit cards, including the Green, Gold, and Platinum, the business versions, Delta co-branded cards, Hilton co-branded cards, Marriott co-branded cards, and more. The terms for the extended warranty is one additional year of coverage for products with a limited warranty of five years or less, with maximum coverage of $10,000 per claim, $50,000 per card.

The only exception to these coverage terms is American Express' ultra-exclusive Centurion card, also known as the Black card. The extended warranty coverage for items purchased with the Black card adds three years onto a limited warranty of up to five years, with maximum coverage of $10,000 per card, $50,000 per card.

American Express is the administrator, obligor, and underwriter of its own extended warranty credit card benefit coverage, through its AMEX Assurance Company (see Figure 7).

Credit Card Extended Warranty by Administrator

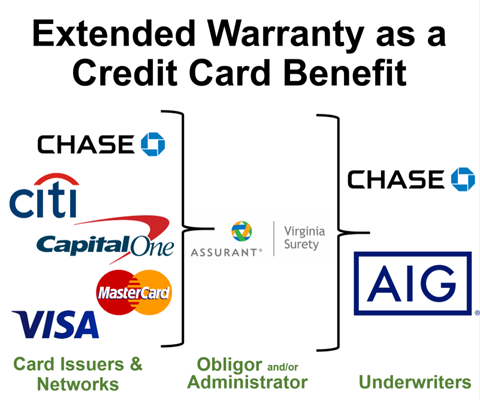

Figures 4 through 7 show the same card networks and issuers, along with which banks use which extended warranty administrators, and who the underwriters for those policies are.

Figure 4 shows which card issuers and networks use Assurant as an extended warranty administrator, and which insurers are the underwriters.

Figure 4

Credit Cards with Extended Warranty Benefit:

Card Issuers using Assurant

as Extended Warranty Administrator

& Benefit Underwriters

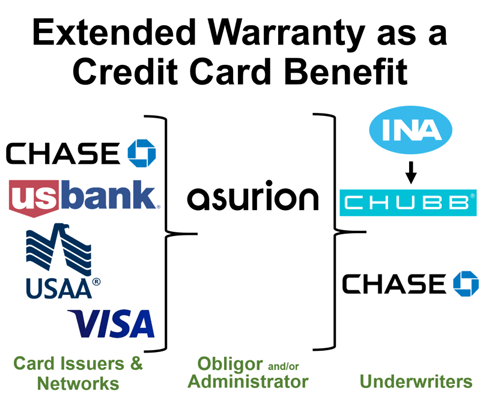

Figure 5 shows the credit card issuers and networks using Asurion as the extended warranty administrator, and which insurers are the underwriters.

Figure 5

Credit Cards with Extended Warranty Benefit:

Card Issuers using Asurion

as Extended Warranty Administrator

& Benefit Underwriters

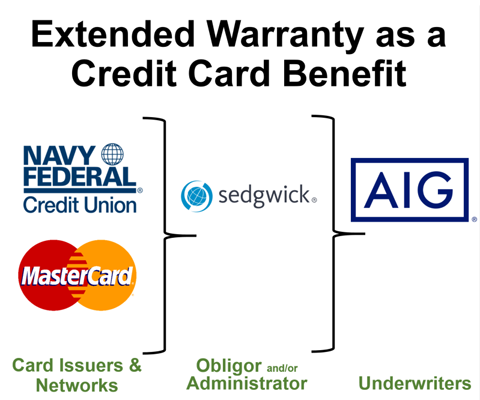

Figure 6 shows which card issuers and networks use Sedgwick as an extended warranty administrator, and which insurers are the underwriters.

Figure 6

Credit Cards with Extended Warranty Benefit:

Card Issuers using Sedgwick

as Extended Warranty Administrator

& Benefit Underwriters

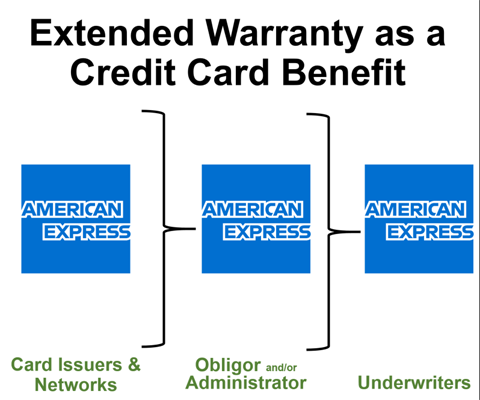

Finally, Figure 7 is a simple one, but it highlights how American Express is unique in this business as the administrator, obligor, and underwriter of its own credit card extended warranty programs.

Figure 7

Credit Cards with Extended Warranty Benefit:

Card Issuers using American Express

as Extended Warranty Administrator

& Benefit Underwriters