Mid-Year U.S. Truck Industry Warranty Metrics:

During the lockdowns, sales were down and so were accruals for the top truck makers. But warranty claims barely changed, and were actually down more this year than last. And while extended warranty sales fell precipitously in 2020, they're still not back up to the record levels we saw in 2019.

On-highway trucks and the cargo they delivered were an essential part of the world's response to the pandemic. But as important as they were, new sales of trucks suffered along with most other vehicle categories. So the question we set out to answer is, how did the lockdowns affect the product warranty and extended warranty metrics of some of the top manufacturers?

We took a look at the annual reports and quarterly financial statements of four companies deeply involved in the on-highway truck business: Paccar Inc., the parent company of the Kenworth, Peterbilt, Leyland Trucks, and DAF brand names; Navistar International Corp., which became a wholly-owned subsidiary of Traton S.E. on July 1, making it part of the Volkswagen Group; diesel engine manufacturer Cummins Inc.; and Trane Technologies plc, whose Thermo King unit makes refrigeration systems for trucks and HVAC systems for buses and trains.

We looked for two sets of figures: a pair of metrics for product warranties, and a pair of metrics for extended warranties. For product warranties, we looked for the amount of claims paid per quarter and the amount of accruals made per quarter. For extended warranties, we looked for the amount of new contracts sold (for which the revenue is initially deferred), and the amount of service contracts amortized (for which the revenue is being recognized).

We also gathered figures for product sales revenue, which we compared to both the claims and accrual data to calculate the percentage of sales paid in claims (the claims rate) and the percentage of sales set aside as accruals (the accrual rate). The details for these six metrics for the past five-and-a-half years are in the charts that follow.

Warranty Claims

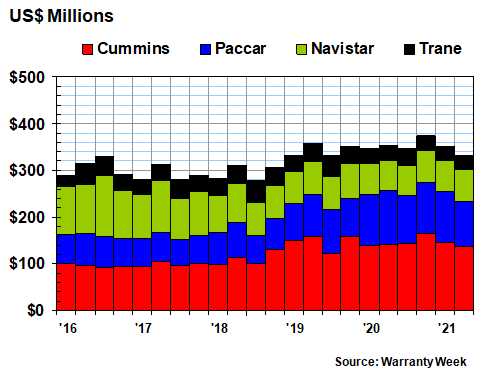

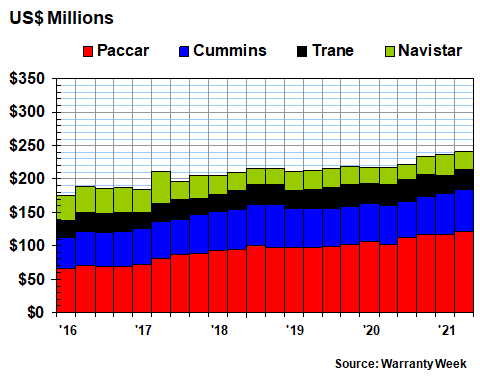

In Figure 1, we are looking at 22 quarters of claims data for the four companies, so we can see four years of the baseline before the pandemic struck, and the six quarters of activity since then. For the group as a whole, claims were up slightly in the first quarter of 2021 and were down slightly in the second quarter of 2021, compared to the same quarters of last year. In the first half of 2021, claims were down by about -2.4% to $683 million, compared to $700 million in the first half of 2020.

Figure 1

Truck Product Warranty Metrics

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2016-2021)

Paccar reported a steep drop in its second-quarter claims total (-15%) while Trane reported a steep drop in its first-quarter total (-10%). All the other changes were smaller. For the first half of this year, Cummins and Navistar reported slight increases in claims payments, while Paccar and Trane reported slight decreases.

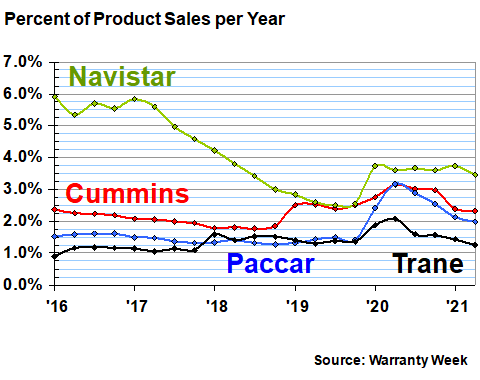

Claims Rates

In Figure 2, we can see that all four companies are now seeing their claims rates drop. In fact, all four claims rates in both the first and second quarters of 2021 were down from the same period the year before. Paccar and Cummins fell the most, while Trane and Navistar fell the least.

Figure 2

Truck Product Warranty Metrics

Average Warranty Claims Rates

(as a % of product sales, 2016-2021)

Navistar, which saw its claims rate fall steadily through 2017, 2018, and 2019, saw it turn upwards again in 2020. But by the end of April (its fiscal year runs from November 1 to October 31), its claims rate was down to 3.5% -- the highest of the group this year.

Cummins had a big upturn in its warranty expense rates in 2018, but by July 4, 2021 its claims rate was back down to 2.3% -- not quite back to normal but lower than it's been at any time in either 2019 or 2020.

Paccar's claims rate briefly rose above 3.0% in early 2020 but it's back down to 2.0% now. And Trane, nearly always the lowest of the cohort, is back down to 1.3% after a bump in the road in early 2020.

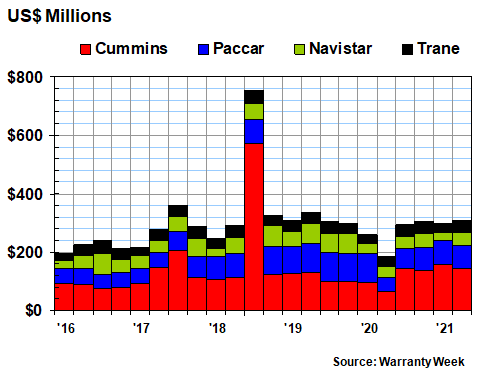

Warranty Accruals

In Figure 3, the most obvious feature is the incredible spike that Cummins' accrual total underwent for the months of July, August, and September 2018, when its accruals soared to $571 million, after some of its model years 2010-15 engines failed their emissions tests.

However, there's also a noticeable notch in the data for the second quarter of 2020, which of course is the start of the pandemic and the lockdowns that followed. During that quarter, Paccar, Navistar and Cummins each cut their accruals by -40% to -50%, while Trane cut its by a mere -17%. Accruals for the group declined to $186 million, from $337 in the second quarter of 2019.

Figure 3

Truck Product Warranty Metrics

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2016-2021)

Of course, accruals soon recovered, and by the second quarter of this year, were back up to $309 million -- not quite normal, but close to it. Cummins boosted its accruals the most: from $64 million in the second quarter of 2020 to $145 million in the second quarter of 2021. Paccar went from $50 million to $77 million. Navistar went from $38 million to $47 million. And Trane, which cut the least in 2020, added the least in 2021 -- $34 million to $40 million.

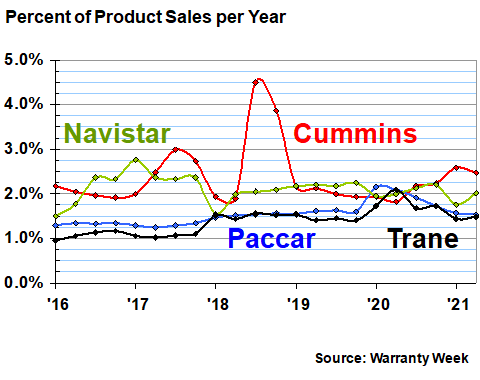

Accrual Rates

The spike in Figure 3 produces the hump in Figure 4 -- the result of Cummins setting aside all that extra money to deal with the emissions problems. What you don't see in Figure 4 is a notch in the second-quarter 2020 data, because accruals fell more or less just as fast as sales, so the rates didn't really change.

Figure 4

Truck Product Warranty Metrics

Average Warranty Accrual Rates

(as a % of product sales, 2016-2021)

Since that awful quarter, when the pandemic was raging and new truck purchases were the last thing on the minds of many companies, sales have recovered. But accruals have not remained proportional. As a result, two companies' accrual rates are up, and two are down.

Cummins has seen its accrual rate climb back up to 2.5%, from 1.8% in the heart of the lockdowns. But it's down from 2.6% at the end of the first quarter of 2021. Navistar's accrual rate is up just barely -- from 1.99% to 2.01%. And then Paccar and Trane are each down by 0.6% to 1.5%.

Extended Warranties

In two charts, we aim to provide readers with a snapshot of conditions in this corner of the commercial extended warranty market. In previous newsletters we've already shown how the lockdowns affected the home warranty and consumer retail protection plan sectors of the industry; now we're looking at the plans sold by four manufacturers in the commercial truck industry.

With extended warranties, the way companies account for them is to sell the service contract and immediately defer the recognition of the revenue on its books. And then gradually over the life of the contract, they gradually recognize the revenue as time passes. For instance, if it's a three-year service contract sold for $3,600, then as each month passes a sum of $100 will be recognized, or amortized, until the entire $3,600 has been amortized at the end of the 36th month.

It's a little confusing, but basically, Figure 6 below measures the rate at which new contracts are being sold, while Figure 5 measures the rate at which the old revenue is being recognized.

Revenue Recognition

As is immediately obvious, the revenue recognition rate in Figure 5 is gradually rising over time, with only the tiniest interruption during the first half of 2020, and only a few bumps in the road before that. This year, service contract revenue recognition was up +9% in the first quarter and +11% in the second quarter, compared to the same quarters a year before. In terms of annual decreases, you really have to have a good eye to find them, but there were slight annual decreases in the third quarter of 2019 and the second quarter of 2018.

Figure 5

Truck Extended Warranty Metrics

Revenue Recognized/Amortized by U.S.-based Manufacturers

(in US$ millions, 2016-2021)

Among the individual companies, Navistar and Paccar have seen their revenue recognition totals rise swiftly in the first and second quarters of 2021, respectively. Cummins reported modest gains, while Trane reported modest declines. All in all, the totals changed slowly, and over the long term in the positive direction.

Extended Warranty Sales

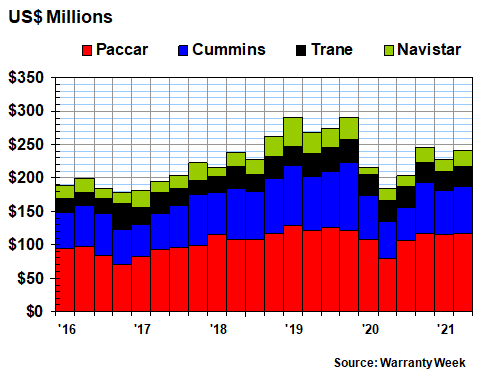

Compare and contrast that to the pattern seen in Figure 6. Here, as with warranty accruals, we see the notch in the second-quarter 2020 data. The difference is, while accruals are determined by the predictive skills of the company's financial experts, sales of extended warranties are determined by the actions of customers. And to finish the analogy, while revenue recognition is determined by the calendar, claims totals are determined by the usage of products.

Note that new contract sales dove during the first quarter of 2020, then again in the second quarter, before rising back into the normal range by the fourth quarter of 2020. Granted, Navistar is two months ahead of everyone else by virtue of its fiscal year ending on October 31, but still, it does appear that sales were falling even before the lockdowns began in mid-March 2020.

Figure 6

Truck Extended Warranty Metrics

New Service Contracts Sold per Quarter by U.S.-based Manufacturers

(in US$ millions, 2016-2021)

During the second quarter of 2020, new service contract sales for the group were down -32% from the same period in 2019. But in the second quarter of 2021, sales were up by +31%. It's not quite a rebound, however, because of the way the changes are calculated (using the old total in the denominator). New contract sales for this group were $269 million in 2Q19; $184 million in 2Q20; and $241 million in 2Q21.

In the first half of 2021, Navistar's extended warranty sales were up a steep +50%. Paccar's contract sales climbed +24%. And Cummins saw a +12% gain, compared to the first half of 2020. Only Trane saw a decline, and only a slight -7.0% slippage at that.

However, the main point is that while the pandemic left its clear mark on the data in Figures 3 and 6, there was little to no damage seen in Figures 1, 4 and 5, and only minor impacts seen in Figure 2. Therefore, in at least this corner of the commercial warranty industry, with on-highway trucks, we can conclude that when the pandemic first hit, manufacturers radically cut their accruals while customers radically cut their purchases of both products and service contracts. And in the quarters since, things have nearly returned to normal.