U.S. Power Equipment Warranty Report:

Power equipment manufacturers are transitioning to renewable energy, with GE leading the charge. Warranty expense rates have skyrocketed in this industry in recent years, mainly due to challenges with solar and wind power equipment.

Power systems and power generation equipment used to mean turbines and generators. Now, it also encompasses a variety of renewable energy equipment and infrastructure, such as solar panels and battery systems, wind turbines, nuclear power, and even hydrogen.

The transition away from fossil fuels has come with its share of challenges, including mechanical and technical failures that can become very costly. In 2022, General Electric's warranty accruals increased by over 50%, likely due to higher failure rates in its onshore wind turbines. As we saw in our Wind Turbine Warranty Report earlier this year, wind turbine failures are up across the top manufacturers in the industry, mainly because the technology has changed very rapidly; wind turbines have doubled in size in the past few years. GE is the only major wind turbine manufacturer in this report, since the direct competitors of GE Renewable Energy are not based in the United States, such as Vestas, Siemens Gamesa, and several rapidly growing Chinese companies.

Several photovoltaic cell and solar panel manufacturers have expanded their business in recent years. These are especially interesting from a warranty perspective, since solar equipment typically comes with a 10 to 25 year warranty. One manufacturer has even gone as far as offering a 50-year product warranty on its solar cells. We'll note that there are fascinating layers of insurance that come along with these guarantees, since the average lifespan of a solar panel manufacturer is likely shorter than some of the warranties attached to their products.

To create this 20-year report, we began with a list of 52 U.S.-based manufacturers that primarily produce equipment used for power generation, which report their warranty expenses in their financial statements and were active for some period since 2003. We excluded heavy equipment manufacturers that also make generators, such as Caterpillar, Cummins, and Terex, because generators are not their main business and likely not the source of the majority of their sizeable annual warranty claims.

From each manufacturer's annual reports and quarterly financial statements, we collected three warranty metrics: the amount of claims paid, the amount of accruals made, and the balance of the warranty reserve fund at the end of each calendar year. We also collected product sales revenue data, and combined with the claims and accrual totals, we calculated the percentage of sales spent of claims (the claims rate) and the percentage of sales spent on accruals (the accrual rate).

In the past, we categorized these companies as either "green" or "traditional" power equipment makers, but this dichotomy doesn't make sense for this industry anymore. Among the traditional power equipment companies, the majority are somewhere in the process of transitioning to renewable energy. Some are further along than others, but especially since Joe Biden announced plans to switch the United States to 100% renewables by 2035, many are refocusing their business to stay relevant in the industry's changing landscape.

From the list of 52, we ranked them based on their 2022 warranty claims, accrual, and reserve totals, identifying the top 10 companies for each warranty metric. The 11 top companies were: General Electric Co., SolarEdge Technologies Inc., Generac Holdings Inc., SunPower Corp., Power Solutions International Inc., Enphase Energy Inc., First Solar Inc., Babcock & Wilcox Enterprises Inc., Bloom Energy Corp., Valmont Industries Inc., and FTC Solar Inc.

Among these 11 companies, six are solar companies, one makes nuclear power equipment, and four primarily make non-renewable energy equipment, but are transitioning to renewables or say they plan to do so. This includes General Electric, which has announced plans to combine GE Renewable Energy, Power, Digital, and Energy Financial Services under the new name GE Vernova, with the intention to spin off from the parent GE at the beginning of next year. As we will see in the following charts, GE has by far the largest warranty expenses among the U.S.-based manufacturers in this industry. And if the split between GE Vernova and Aerospace really happens next year, we might finally know which sector represents a larger proportion of GE's total warranty expenses.

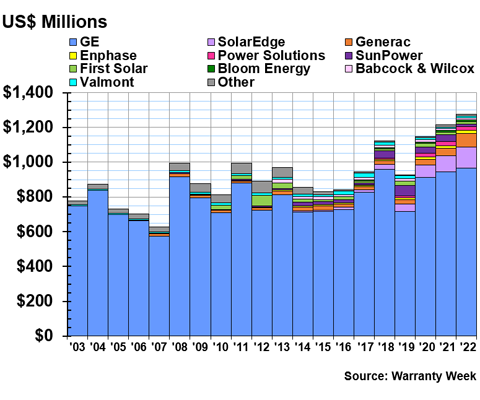

Warranty Claims Totals

Figure 1 shows the past 20 years of warranty claims totals in this industry. As we will see, GE's annual claims costs have risen in recent years, but the company's proportion of the industry's claims has decreased as SolarEdge, Generac, and others have seen claims totals increase as well.

Figure 1

Power Generation Equipment Warranties

Claims Paid by U.S.-based Companies

(in US$ millions, 2003-2022)

In 2022, the U.S.-based power generation equipment industry paid a total of $1.27 billion in warranty claims. General Electric represents just about 75% of these claims, with a total of $967 million in 2022. This was only a 2% increase from the year before for the company.

SolarEdge paid $120 million in warranty claims in 2022, up 32% from the year prior. The company only started reporting its warranty expenses in 2014, and less than a decade later, it had the second-highest warranty expenses in the industry.

Generac saw claims increase by 82%, or $35 million, in 2022, to a total of $77 million. While the company did not directly explain this huge increase in claims in its 2022 annual report, it did mention two unexpected costs:

For the year ended December 31, 2022, [there was] a specific credit loss provision of $17.9 million for a clean energy product customer that filed for bankruptcy, as well as a warranty provision of $37.3 million to address certain clean energy product warranty-related matters.It looks like that $37.3 million got deposited right into the company's warranty reserve fund.

We looked into this a bit and came across some stories from October 2022 about Pink Energy, a bankrupt solar panel installer active in a few states including North Carolina, Pennsylvania, and Ohio. These were all local news stories centering disgruntled homeowners who fell victim to this "solar scam." Hundreds of consumers claimed that Pink Energy installed rooftop solar panels that never worked, and they were left with loan payments due, the company that sold them the panels no longer in business, and no one to fulfill their warranty claims.

When we dug a little deeper, we found statements from Pink Energy's former CEO Jayson Waller blaming Generac for the solar panel failures and Pink Energy's bankruptcy. Note that Generac makes "solar and storage solutions," but doesn't actually make the solar cells or panels. In a statement to Asheville, North Carolina News 13, Waller claimed that Generac installed a firmware update in early 2022 that caused thousands of Pink Energy's solar systems to crash or produce less electricity. Pink Energy filed a lawsuit against Generac in mid-2022, claiming that the company failed to issue a recall on the software or fulfill the warranty claims of Pink Energy's customers. On the other side, Generac claims that Pink Energy's installers failed to follow "product installation guidelines," and that this triggered the rapid shutdown devices in many of these solar systems. In the meantime, it seems that neither has taken steps to do the warranty work to fix these solar panels.

It is not clear if Generac's higher costs are directly related to Pink Energy, since the lawsuit is still ongoing. It is likely that the majority of these claims remain unfulfilled, hence the local news consumer interest stories. But this is certainly an interesting warranty story, with both sides asserting that the other should be the one to pay the warranty claims and repair costs. We'll keep following this to see who ends up paying these claims, which News 13 estimated totaling around $150 million. And if Generac's 80% increase in claims is unrelated to this specific case, it's possible this isn't the only situation to arise from this software update issue.

Enphase Energy had the fourth-highest warranty claims total in 2022. The maker of solar panel micro-inverters and residential electric vehicle charging stations paid $21 million in claims in 2022, up 38%, or $6 million, from 2021. Next on the list was Power Solutions International, which saw claims decrease by -30% to $18 million; however, the company still has not reported its fourth quarter data, so we can presume around 25% of its real annual total is missing from this number. SunPower, which makes solar panels and energy storage systems, saw claims decrease by -60%, or $24 million, to $17 million.

First Solar, which makes solar cells and panels, paid about $13 million in claims, around the same level as in 2021. Bloom Energy, which deals in solid oxide fuel cells and hydrogen power, paid $12 million, up about 30%. Babcock & Wilcox, which makes nuclear power equipment, paid $11 million, down -10%. And rounding out the top 10 claims payers, Valmont Industries paid $11 million, a 64%, or $4 million, increase from 2021.

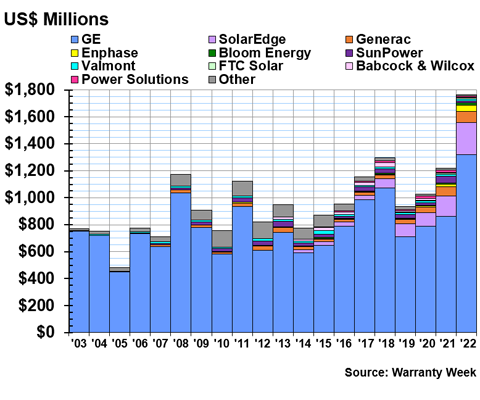

Warranty Accrual Totals

Figure 2 shows warranty accrual totals for the power generation equipment industry over the past 20 years.

Figure 2

Power Generation Equipment Warranties

Accruals Made by U.S.-based Companies

(in US$ millions, 2003-2022)

Accruals skyrocketed in this industry during 2022, especially due to GE's boost to its accruals by over 50%. Industry warranty accruals totaled $1.76 billion in 2022, up 45% from 2021.

GE's accruals increased by 53%, or $457 million, in 2022, to a record high accrual total of $1.32 billion. The company's product revenue also decreased over this period; GE stated that these segment losses are "primarily attributable to Onshore Wind's lower U.S. volume." Beyond just lower volume, we've come across several news stories that report higher failure rates for GE's wind turbines, with some asserting that these machines got too big, too fast, and that the newer, larger models are more prone to failure and collapse. This is anecdotal, and it's not clear if the warranty numbers are reflecting this perceived increase in broken wind turbines. Again, we'll remind you that claims only increased by 2% during the same year that GE increased its accruals by over 50%. The company must be anticipating something huge and costly for 2023.

SolarEdge increased its accruals by 60%, or $89 million, to a total of $239 million. The company stated that this increase is "associated primarily with an increased number of products in [their] install base, as well as an increase in costs related to the different elements of [their] warranty expenses, which include the cost of the products, shipment and other related expenses." So warranty work has become a little more expensive per product, but sales increased around the same amount as accruals did.

Generac increased its accruals by 16%, or $11 million, to $80 million. This was proportional to an increase in product sales revenue, and although the company's claims total almost doubled, accruals still exceeded claims in 2022. Enphase Energy increased its accruals by 150%, or $28 million, to $46 million. The company stated that this was partly due to changes in estimates based on diagnostic data, increased shipping costs, and increased labor costs. Enphase's fourth quarter product sales revenue increased by 70% from 2021 to 2022, explaining the rest of this more than doubling of accruals. Bloom Energy increased accruals by 60%, or $7 million, to $18 million, again tracking to an increase in revenue.

SunPower, ranked sixth, decreased its accruals by -70%, or $33 million, to $15 million. This is a recovery back to more typical levels, after accruing an extra $20 million lump sum during 2021 "in connection with a cracked connectors issue." Valmont also managed to decrease accruals while increasing revenue. Valmont's accruals decreased by just -5%, less than $1 million, to a total of $13 million.

FTC Solar, which ranked eighth in warranty accruals but did not place among the top 10 in claims, accrued $8 million in 2022. Babcock & Wilcox accrued $7 million. Power Solutions International accrued just $6 million, down $12 million from the year prior. This is a -65% decrease, but we are currently missing the fourth quarter data for this company, which could shrink this percentage.

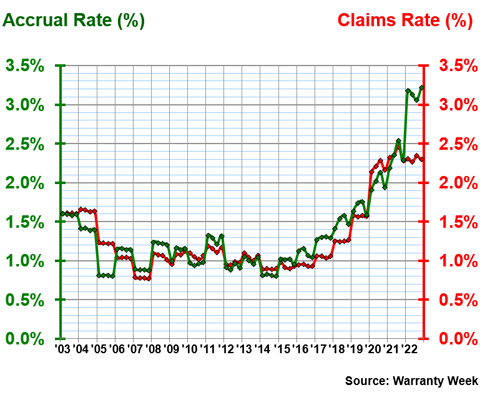

Warranty Expense Rates

Figure 3 shows the industry average warranty claims and accrual rates for all 80 quarters over the past 20 years.

Figure 3

U.S.-based Power Generation Equipment Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2022)

Over 20 years, the industry's average claims rate was 1.31%, with a standard deviation of 0.47%, and the average accrual rate was 1.36%, with a standard deviation of 0.57%. These averages are closer to the industry averages from 2003 to 2017. Since 2017, these percentages have been driven upward steadily, taking an especially big jump when revenues dropped during the pandemic.

In the fourth quarter of 2022, the industry average claims rate was 2.3%, and the industry average accrual rate was 3.2%. The industry's average accrual rate jumped by about a full percentage point from the fourth quarter of 2021 to the first quarter of 2022. Unsurprisingly, this was largely influenced by a change in General Electric's accrual rate. The company releases its warranty expense data annually, not quarterly, hence the steep increase from the end of 2021 to the beginning of 2022.

In 2022, GE's claims rate was 3.0%, and its accrual rate was 4.1%. For comparison, in 2021, the claims rate was 2.8%, and the accrual rate was 2.5%. The company's 50% increase in accruals in 2021 heavily affected the accrual rate of the entire industry. It's a little strange that the company didn't explain why accruals increased so much in its most recent annual report. For comparison, a decade ago, in 2012, GE's claims rate was 1.0%, and its accrual rate was 0.8%.

SolarEdge has even higher warranty expense rates. In the fourth quarter of 2022, its claims rate was 3.8%, and its accrual rate was a whopping 7.7%. This means that almost 8% of product revenue goes right back to warranty accruals. These rates are much higher than is typical.

Generac, ranked third in the industry in terms of warranty expenses, has expense rates closer to the 20-year industry average. In the fourth quarter of 2022, Generac's claims rate was 1.7%, and its accrual rate was 1.8%. But it seems that the renewable energy companies, or those heavily emphasizing their renewable transition, are spending more per product sold than others. This makes sense, since the technology is newer and usually changes much more rapidly with new advances.

Hopefully, higher warranty expense rates (and perhaps failure rates, though we don't measure this) will not hinder the renewable energy transition. Certainly, a mastery of warranty repairs and costs could help generate a lot more profit in this industry in the future, as will standardization of the technologies.

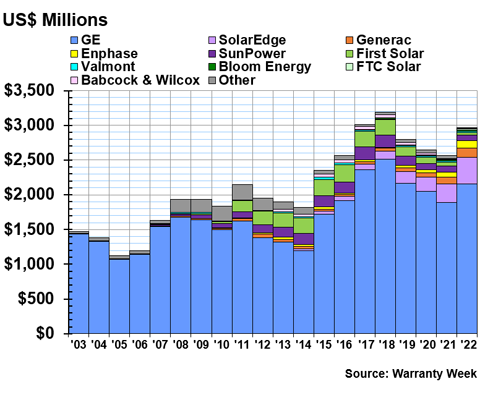

Warranty Reserve Balances

Our final metric is the balance in the warranty reserve fund for each company at the end of the calendar year. Figure 4 shows warranty reserve totals in the power generation equipment industry over the past 20 years.

Figure 4

Power Generation Equipment Warranties

Reserves Held by U.S.-based Companies

(in US$ millions, 2003-2022)

Warranty reserves totaled $2.97 billion at the end of 2022. This is not the industry's highest reserve balance; this total actually exceeded $3 billion in 2017 and 2018. However, this is a 16% increase from 2021's industry-wide total reserve balance.

GE increased its warranty reserves by 15%, or $262 million, to a total of $2.15 billion. SolarEdge increased its reserves by 45%, or $120 million, to a total of $385 million. And Generac increased its reserves by 45%, or $44 million, to a total of $138 million.

Enphase has more than doubled its warranty reserve balance since 2020. In 2022, the company increased its reserves by 45%, or $33 million, to a total of $106 million. In 2020, the company held just $46 million in the warranty reserve account. SunPower's reserves shrunk by -12%, or $11 million, to a total of $79 million.

First Solar's reserves have shrunk significantly over the past few years. The company's warranty reserve fund balance peaked at $252 million in 2016; in 2022, the company held just $34 million in that fund. Reserves were reduced by -35%, or $19 million, from 2021 to 2022. From 2018 to 2019, the company almost halved its reserve balance, from $221 million in 2018 to $130 million in 2019.