GPU Warranty Expenses:

GPUs power artificial intelligence and cryptocurrency mining, and manifest the graphics on most consumer electronics. Nvidia and AMD, the two largest GPU manufacturers, both spend less than 1% of their product revenue on warranty expenses. Both have cracked down on warranty claims made by miners in recent years, since it's a commercial usage, and an energy-intensive process that goes well beyond normal use.

In this week's newsletter, we are going to take a look at the warranty expenses of the world's two largest manufacturers of GPUs, Nvidia Corp. and Advanced Micro Devices Inc. (AMD). Along with Intel, which does not report its warranty expense data despite being a publicly trading company, these two produce the vast majority of the world's integrated and discrete GPUs.

Graphics processing units, or GPUs, are a specialized type of semiconductor chip featuring a large number of cores, used for a wide variety of complex computing calculations. GPUs are found in personal computers (PCs), smartphones, video game consoles, and basically any other device that has a screen that displays images. Its basic function is to lighten the load on the central processing unit (CPU), especially when running graphics intensive games or applications. A discrete GPU is simply one that is separate from the CPU chip, as opposed to an integrated GPU, which comes built in to the electronic. Nowadays, it is quite common for video game enthusiasts to purchase all of their computer parts separately, and build their own desktop PC, customizing the elements such as the GPU, CPU, motherboard, hard drive, etc.

Initially, GPUs were invented for image processing and the rendering of graphics for video game consoles, such as the Atari VCS, starting in the late 1970s. But the GPU industry entered a new era at the end of 1999, when Nvidia released the GeForce 256 GPU, the first consumer-level card made for PCs. GPUs began to be a part of a much wider variety of consumer electronics, and started getting much more sophisticated.

Think about the stark improvement of video game graphics since the invention of arcade games; Pong, Pac-Man, Frogger, Donkey Kong, etc. all used early GPUs back in the 70's. In contrast, many modern video games, especially those designed for PC gaming, are extremely complex, with file sizes upward of 150 GB, huge maps, varied and elaborate storylines, and movie-quality graphics. This would not be possible without the competitive development of increasingly sophisticated GPUs over the past two decades.

But modern GPUs are especially interesting not just because of their integrated presence in almost all consumer electronics, but also because of their utility for other, non-graphic calculations. Two of the most interesting uses for discrete GPUs in the last decade have been the mining of cryptocurrency such as Bitcoin, and the training of artificial intelligence.

At first, it seems a far cry from video game graphics to Bitcoin mining. But GPUs basically do millions of simple computations in the same nanosecond, typically in order to render a moving image. Initially, Bitcoin was mined using CPUs, but in 2010, cryptocurrency enthusiasts found that GPUs were better suited to performing the calculations necessary for Bitcoin mining. So the GPU industry underwent another significant transformation, as the value of Bitcoins skyrocketed over the next decade. Subsequently, the industry experienced shortages of discrete GPUs, as many were bought up in bulk for blockchain mining.

For similar reasons, researchers and engineers began to realize the computing power of GPUs for the development of artificial intelligence and accelerating deep neural networks. In his 2016 blog "Accelerating AI with GPUs: A New Computing Model," Nvidia president Jensen Huang stated that by 2011, scientists found that "12 Nvidia GPUs could deliver the deep-learning performance of 2,000 CPUs." This was when AI development really took off and snowballed, culminating in the technological landscape of today.

More recently, the first version of ChatGPT was trained on a supercomputer made of about 10,000 Nvidia GPUs.

After attending the Extended Warranty & Service Contract Innovations conference in Chicago last week, and the MAPConnected Vehicle Service & Warranty Lifecycle Summit in Dearborn this week, we've had AI on our minds, since it's clearly technology that the warranty world is looking to develop and utilize. So this week, we decided to take a look at the product warranty expenses of the world's two largest GPU manufacturers, starting from 2010, when they started being used for cryptocurrency mining and to power deep learning and AI.

We perused Nvidia and AMD's quarterly and annual financial statements, and gathered data on three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance in the warranty reserve fund. In addition, we gathered data on each company's total revenue from product sales, in order to calculate two additional metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

Nvidia and AMD are indisputably the world's two largest GPU manufacturers, but they are not the only ones. Intel also makes integrated GPUs, and they just started creating discrete GPUs within the last three years. Beyond those three, there are dozens of Taiwanese GPU manufacturers, including MSI, Gigabyte, and ASUS, as well as Chinese GPU manufacturers such as Sapphire Technology and Zotac, and American manufacturers such as EVGA (which recently announced it will stop making GPUs after disputes with Nvidia). However, none of them report their warranty expenses. So we're presenting the data for Nvidia and AMD separately, since the two companies combined do not represent the size of the warranty expenses of the entire GPU industry, though they have cornered a very significant portion of it.

Nvidia

Nvidia makes about 80% of all discrete GPUs sold around the world, though it only makes about 20% of all GPUs sold worldwide. So Nvidia has really specialized and focused on making discrete GPUs to power artificial intelligence and machine learning, as well as for PC gaming.

Interestingly, Nvidia has stated that cryptocurrency mining voids the three-year manufacturer's warranty on its GPUs, since that is a commercial usage of the product, and it is extremely intensive well beyond normal wear and tear. In addition, in March, the company's chief technology officer said that cryptocurrencies do not "bring anything useful for society."

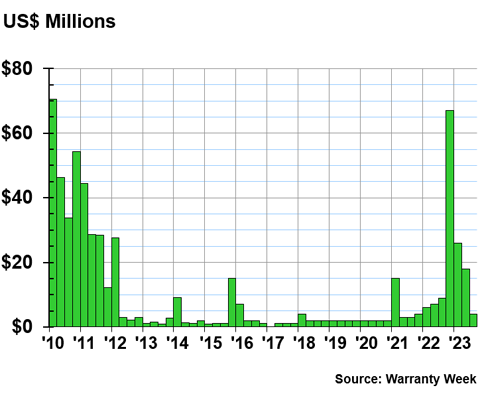

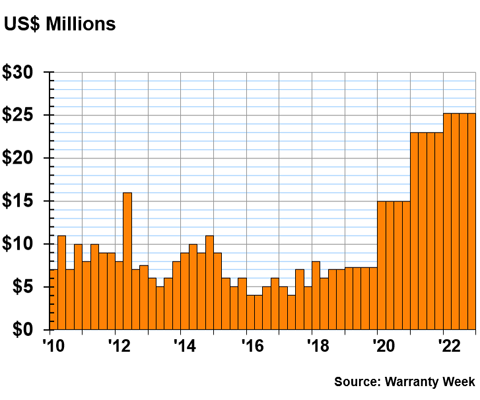

Figure 1

Nvidia Corp.

Claims Paid per Quarter

(in millions of U.S. dollars, 2010-2023)

We began our data frame for all of these charts in 2010 mainly because that was the year that discrete GPUs started being used for both Bitcoin mining and machine learning. However, we also wanted to highlight more recent warranty trends, without focusing too much on Nvidia's recall troubles. Nvidia experienced a rather significant recall in late 2008, when it found that all of its GPUs in Apple MacBook Pros produced between May 2007 and September 2008, as well as several HP and Dell laptop models, had a defect and needed to be replaced. This caused the company's warranty claims totals to jump significantly from 2008 to 2009, and even higher in 2010.

So keep in mind that the high claims totals at the beginning of Figure 1 are not exclusively the result of the popularization of using GPUs for mining Bitcoin. However, it is very possible that consumers who used their discrete GPUs for blockchain mining were able to slip through the cracks in the following years, since Nvidia's warranty department was likely focused on these multi-million dollar recalls and settlements with OEMs to which it supplied GPUs.

It wasn't until 2016 and 2017 that GPU shortages really started to affect the marketplace, driving up prices and creating a huge resell market. It was around the same time that Nvidia officially stated that cryptocurrency mining voided the product warranty, clarifying beyond the boilerplate language about "normal use."

Even if the high claims totals from 2010 to 2012 were mainly associated with the large-scale recalls, rather than with cryptocurrency mining, the data from mid-2012 to mid-2016 are intriguing. For most of those quarters, the company paid about $2 million in warranty claims. But we can see some deviations: $9 million in the first quarter of 2014, $15 million in the fourth quarter of 2015, $7 million in the first quarter of 2016. After Nvidia cracked down on warranty claims made by blockchain miners, their claims totals stayed consistently low for the following four years, back to about $2 million per quarter.

In the past three years, Nvidia's product revenues have increased significantly, as have its warranty claims costs. The company still sells GPUs to gamers, but its newer products are increasingly expensive, and seem more catered to machine learning and artificial intelligence applications. With the boom in AI in the past few years, the company has seen a huge amount of growth, though we did find that it's also had some big and costly issues with defective "third-party component[s] embedded in certain Data Center products," as it stated in its 2022 annual report.

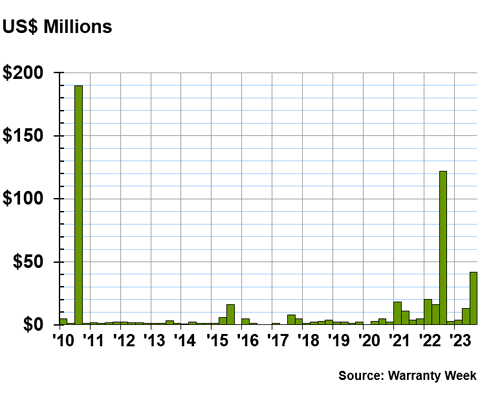

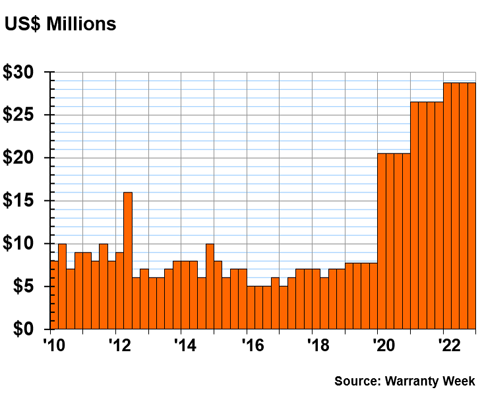

Figure 2 shows Nvidia's total quarterly warranty accruals since the beginning of 2010.

Figure 2

Nvidia Corp.

Accruals Made per Quarter

(in millions of U.S. dollars, 2010-2023)

Figure 2 helps flesh out the story that Figure 1 is telling. When it came to the recalls in 2009, the company made huge accruals in the third quarters of 2008, 2009, and 2010, the third of which is shown on the left side of Figure 2. Similarly, the company increased its accruals to $16 million in the third quarter of 2015, coinciding the jump in claims in the next quarter. These are the increases in claims that Nvidia expected, and for which it made extra accruals in advance.

So we could extrapolate that the other two jumps in claims totals between 2010 and 2015, at the beginning of 2014 and 2016, were perhaps unexpected, since we don't see changes in accruals that coincide with the increases in claims.

Accruals have increased in the last three years, just as claims have. Nvidia's accruals jumped up from $16 million in the second quarter of 2022 to $122 million in the third quarter, and then back down to just $3 million in the fourth quarter of last year. In the most recent quarter, Nvidia accrued $42 million.

However, we need to take a look at these totals proportional to total product revenue, since the company has seen its revenues and stock prices skyrocket since 2021. Figure 3 shows Nvidia's claims and accrual rates since 2010, which are the totals in Figures 1 and 2 as a percentage of product sales revenue.

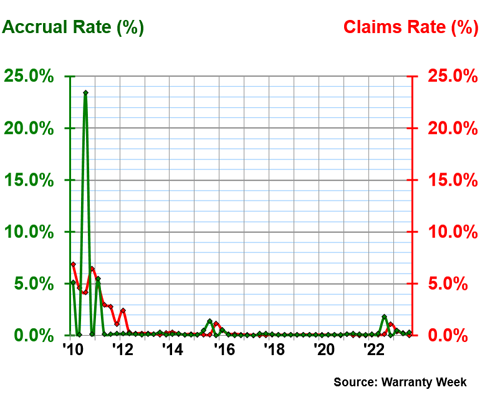

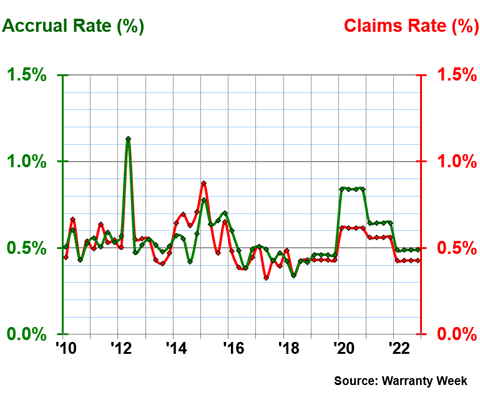

Figure 3

Nvidia Corp.

Claims and Accrual Rates

(as a % of product sales, 2010-2023)

The product revenue figures used to calculate the warranty expense rates give more context, especially to the accrual totals in Figure 2. In the third quarter of 2010, accruals totaled $190 million, which was a whopping 23.4% of product revenue for that quarter. By contrast, the more recent spike in accruals, in the third quarter of 2022, totaled $122 million, but that was only 1.8% of total product revenue.

The warranty expense rates for the semiconductor industry average to about 0.75%. Nvidia is below that average, especially recently, since the company hasn't increased its total accruals much despite increased revenue. To be fair, it also hasn't seen much increase in claims yet, despite booming business in the last two years. In a typical quarter, Nvidia's warranty expense rates don't exceed 0.5%, and that's been the trend since 2010.

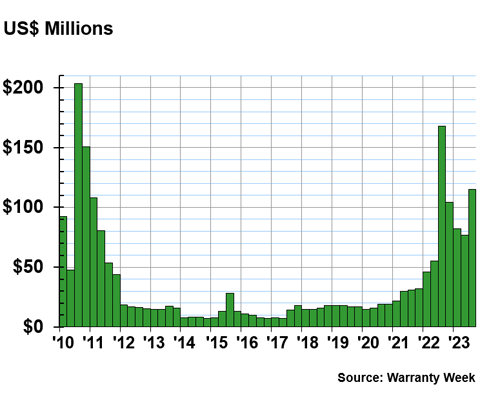

Our final metric for Nvidia is the balance in the warranty reserve fund at the end of each quarter, shown in Figure 4.

Figure 4

Nvidia Corp.

Reserves Held per Quarter

(in millions of U.S. dollars, 2010-2023)

We can see that the company has been increasing the size of its warranty reserve fund in recent years, after depleting the balance in the wake of the 2009 recalls. While claims have been up since the beginning of 2021, accruals have been up more, so reserves are growing as well.

One interesting question for Nvidia is whether using its GPUs for powering artificial intelligence also invalidates the product warranty. The company hasn't made any explicit statements about this like it has with cryptocurrency mining. Something as large as ChatGPT is clearly a commercial use and thus not covered by the manufacturer's warranty, but if homegrown machine learning applications begin to emerge in coming years, there are some interesting questions there about the future of Nvidia's product warranties, and the usage of its increasingly large, complex, and expensive GPUs.

Advanced Micro Devices

Next, we are going to take a look at the same five warranty metrics for one of Nvidia's primary competitors, Advanced Micro Devices Inc., or AMD for short.

AMD competes more directly with Intel, since it makes a lot of integrated GPUs, meaning they come with the computers, mobile phones, and other electronics, rather than being sold separately as a part. AMD also accounts for somewhere between 10% and 20% of the discrete GPU market, a far second to Nvidia. AMD's discrete GPUs tend to be more affordable than Nvidia's. And unlike Nvidia, AMD approves of its GPUs being used for blockchain mining.

Figure 5 shows AMD's total warranty claims costs from 2010 to 2022. While AMD is based in the U.S. and puts out quarterly reports, it has only detailed its warranty costs in its annual reports since 2019, hence the four bars in a row at the same level.

Figure 5

Advanced Micro Devices Inc.

Claims Paid per Quarter

(in millions of U.S. dollars, 2010-2022)

AMD spent $101 million on claims in 2022, shown in Figure 5 as four consecutive quarters of $25.25 million. This was way up for the company, which has also seen a steep increase since 2020, similar to Nvidia. However, much like its competitor, AMD's claims totals have been rising in proportion to product revenues, as we will see in Figure 7.

AMD has slightly higher quarterly claims costs than Nvidia, but it's also more consistent, rather than being prone to fluctuations caused by parts malfunctions and recalls.

As shown in Figure 6, total accruals have also been on the rise, staying a little higher than claims totals.

Figure 6

Advanced Micro Devices Inc.

Accruals Made per Quarter

(in millions of U.S. dollars, 2010-2022)

Accruals totaled $115 million in 2022, or $28.75 million per quarter, up a bit from the year prior.

It seems that AMD has garnered more favor among cryptocurrency miners in recent years, especially since Nvidia changed its software to make its GPUs worse at mining. AMD has embraced the use of its products for blockchain mining, likely picking up some of Nvidia's former customers. However, we don't see much evidence of mining causing increased warranty costs from 2010 to 2016, in either Figure 5 or Figure 6.

As we will see in Figure 7, AMD's total claims and accruals have also stayed relatively proportional to product sales revenue, with much less volatility than we saw from Nvidia.

Figure 7

Advanced Micro Devices Inc.

Claims and Accrual Rates

(as a % of product sales, 2010-2022)

Figure 7 shows the claims totals from Figure 5 and the accrual totals from Figure 6 in proportion to total product revenue for each quarter, or annually after 2019. With the exception of the second quarter of 2012, the company's warranty expense rates have stayed between 0.3% and 0.9% for over a decade. This is about average for the industry.

However, it is a little strange that AMD's expense rates tend to be a little higher than Nvidia's, since Nvidia is doing more direct-to-consumer sales, while AMD is supplying more GPUs to computer and consumer electronics OEMs. One would expect the opposite, where Nvidia has higher expense rates since it deals directly with its consumers, while AMD has lower ones, since it is more often a supplier. Instead, Nvidia's volatility in Figure 3 was mainly due to large-scale defects in GPUs they supplied to OEMs such as Apple, HP, and Dell.

It's possible that Nvidia's higher prices for individual GPUs are another reason why its warranty expense rates are a little lower. We don't know the failure rates of either of these two companies' products, just what proportion of product sales the claims total represents. It's also possible that the usage of tens of thousands of Nvidia GPUs to power AI supercomputers helps to drive down its expense rates, because those sales count toward product revenue, but since it's a commercial use of the product, they can't have warranty claims made on them.

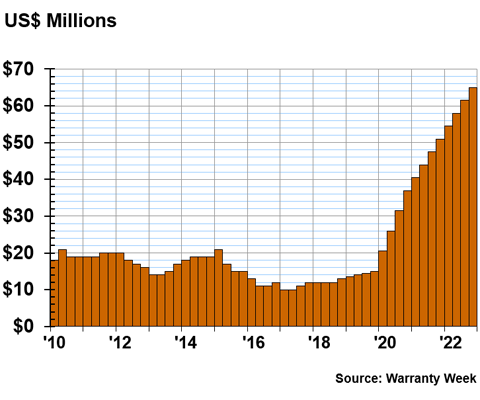

Our final warranty metric is the ending balance of AMD's warranty reserve fund, shown in Figure 8.

Figure 8

Advanced Micro Devices Inc.

Reserves Held per Quarter

(in millions of U.S. dollars, 2010-2022)

AMD has been steadily growing its warranty reserves since the begining of 2020, but its fund is still smaller than that of Nvidia. At the end of 2022, AMD held $65 million in its warranty reserves, about half the size of Nvidia's reserves. This is despite AMD typically paying more in claims per quarter than Nvidia does.

However, AMD usually accrues just a little more than it spends on claims, so it's not putting aside much excess money to sit in the dedicated warranty reserve account, just enough to pay the claims that come in each year.