Nine-Month U.S. Auto Warranty Expenses:

Ford's warranty claims were way up, while Tesla's claims and accrual rates both rose, as increases in warranty costs outpace increases in revenue. Ford and GM both discussed increasing warranty costs in their earnings calls, citing costlier parts and labor for warranty work.

Tesla, General Motors, and Ford all released their 10-Q quarterly reports for the third quarter of 2023 last week. While Tesla perhaps has bigger fish to fry right now (namely, an unpredictable quasi-celebrity CEO and several class action lawsuits), Ford and GM both had discussion of rising warranty costs in their Q3 earnings calls.

But surely, rising warranty costs have been overshadowed by a much bigger news story in the U.S. automotive landscape, the United Auto Workers' strike of assembly plants and parts distribution centers owned by Ford, GM, and Netherlands-based Stellantis (which owns the American Chrysler, but reports all global expenses annually out of Europe, and is thus not included in this report based on quarterly expenses).

According to the UAW, "The Stand Up Strike is a new approach to striking. It is the first time the union has struck all Big Three automakers at the same time. But instead of all 150,000 UAW autoworkers walking out at once, select locals have been called on to "Stand Up" and strike. The strike began on Sept. 15 with a walkout against three assembly plants in Michigan, Missouri, and Ohio. It has since grown to include eight assembly plants and 38 parts distribution centers in 22 states."

The strategy of gradually expanding the strike to more factories over time was a very effective negotiation tactic for the UAW. After six weeks of action, the Big Three all reached tentative contract agreements with their union workers over the past week; Ford on Wednesday the 25th, Stellantis on Saturday the 28th, and General Motors on Monday the 30th. Most recently, this Thursday, November 2, workers at Ford's Michigan Assembly Plant in Wayne, MI, one of the first plants to go on strike back in mid-September, voted 82% in favor of the new contract, which will last a bit less than five years.

Ford's agreement with the UAW came the day before their Q3 earnings call, but GM's Q3 earnings call was held about a week before it reached an agreement with the union. So it's perhaps not so surprising that these two calls had slightly different priorities, with GM having much more UAW discussion than Ford did.

Still, we were surprised by the sheer number of mentions of the word "warranty" in each of these calls — while we and many of our readers talk about warranties all the time, they're not always the hottest topic around. We decided to do a survey of GM, Ford, and Tesla's earnings calls going back to this time last year, looking for the frequency of the use of the word "warranty."

In GM's Q3 2023 earnings call, "warranty" was said three times, and in the Q2 2023 earnings call, it was said six times. It was said zero times in GM's Q1 2023, Q4 2022, and Q3 2022 earnings calls.

In Ford's Q3 2023 earnings call, "warranty" was said eight times, and "warranties" was said another two times. In the Q2 2023 call, "warranty" was said three times, and in the Q1 2023 call, it was said once. It was said zero times in Ford's Q3 and Q4 2022 earnings calls.

Tesla's Q3, Q2, and Q1 2023, as well as Q4 and Q3 2022 earnings calls had no mention of the word "warranty."

Without further ado, let's take a look at the second and third quarter data, and see the warranty trends that Ford and GM executives have been discussing with shareholders this year.

We gathered all of the following data by perusing Ford, GM, and Tesla's quarterly financial statements, and extracting three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end balance of the warranty reserve fund. In addition, we collect data on quarterly product revenue, in order to calculate two additional metrics, the warranty expense rates: claims as a percentage of product revenue (the claims rate) and accruals as a percentage of product revenue (the accrual rate).

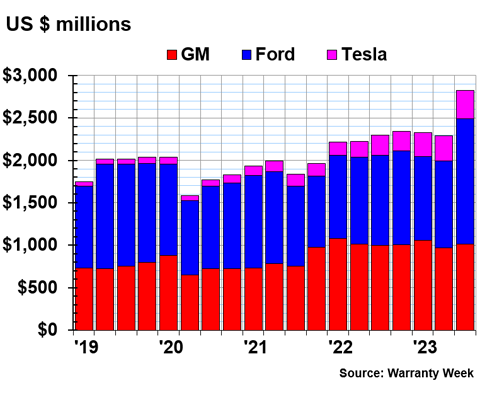

Warranty Claims

Figure 1 shows the quarterly warranty claims costs for Ford, GM, and Tesla.

Figure 1

U.S.-based Auto Manufacturers

Claims Paid per Quarter

(in millions of U.S. dollars, 2019-2023)

Ford's warranty claims costs were up rather significantly from the second to the third quarter of this year. Claims were up 44% from the second quarter to the third quarter, to a total of $1.47 billion, which is actually the highest quarterly claims total Ford has ever reported, since manufacturers' warranty expenses began to be disclosed in 2003. Year-over-year, this was still a 39% increase from Ford's quarterly claims total from the third quarter of 2022.

We took a look at Ford's most recent quarterly report for explanation, but there wasn't one particular defect or recall that was pointed out. Instead, the company reported that its earnings for all three of its divisions, Ford Blue, Model e, and Pro, were "offset partially by higher warranty costs (reflecting an increase for field service actions and inflationary cost pressures) and higher material costs for new products." So earnings were up, despite rising warranty costs.

Along the same lines, Ford's CFO John Lawler stated,

"Adjusted EBIT [earnings before interest and taxes] in the quarter was 2.2 billion with a margin of 5%. Both improved year over year. However, costs increased, underscoring the fact that we still have more work to do, especially on warranty expense and material cost."Lawler continued, "The higher warranty was driven by recalls and higher per unit repair costs due to inflation."

Later in the call, answering a question about high warranty costs, Lawler said,

"One of the things we're seeing is that it's not just the quality issues, which are an important piece of this [...] But we're also seeing tremendous inflation from the dealers on the repair costs. And that's driving quite a bit of it. If you look at the increase that we had in the quarter for the warranty on a year over year, the 1.2 billion, and say that about 300 million of that was inflationary costs and roughly 900 million was the issue with warranties. So, that's what we're seeing there."

That 1.2 billion figure refers to Ford's total quarterly warranty accruals, which are shown in Figure 3.

So in short, Ford's warranty costs are rising due to a confluence of higher labor costs, more expensive parts, and lower-quality parts breaking more frequently (and occasionally being recalled by the NHTSA).

GM's warranty claims totals rose by just 5% from the third quarter of 2022 to the same quarter of 2023, to a total of $1.02 billion. Remember that in GM's 2021 and 2022 Chevy Bolt EV battery recall, the company did not report those claims as warranty costs, but rather, as separate recall costs, which is why they do not show up in this chart.

Tesla spent $335 million on warranty claims, up 42% from the same quarter of last year. This is a rather steep rise for Tesla, which saw its rising revenues falter in the most recent quarter. But since Tesla's market share keeps growing, it's more useful to talk about its warranty expenses as a ratio to product revenue, as shown in Figure 2.

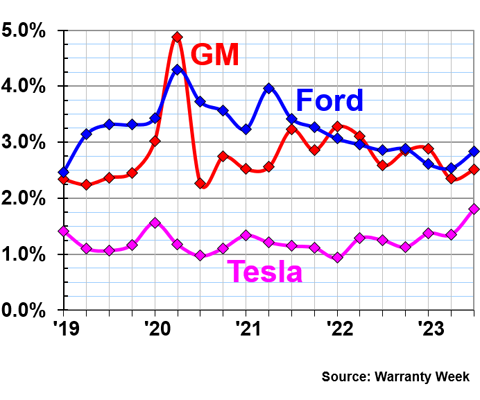

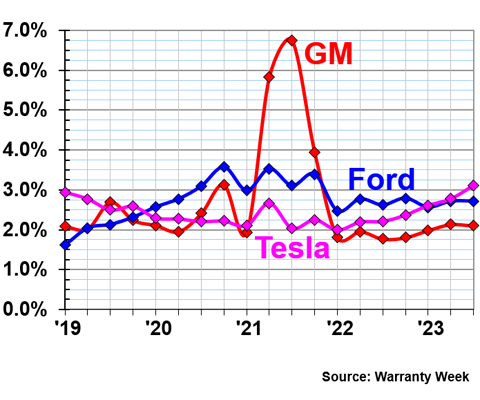

Figure 2

U.S.-based Auto Manufacturers

Warranty Claims Rates

(as a % of product sales, 2019-2023)

Despite Ford's claims costs rising enough that it was a discussion point in its most recent earnings call, the claims rate rose by a smaller margin, being normalized by product revenue. The claims rate rose from 2.54% in the second quarter of this year to 2.84% in the third quarter.

On the other hand, Tesla saw a larger jump in its claims rate, from 1.35% in the second quarter to 1.80% in the third quarter. This was Tesla's highest claims rate since the second quarter of 2016, back when the company's revenue was significantly lower, and warranty claims only cost them $25 million. Usually, we see Tesla's claims and accrual totals rise exponentially, but the expense rates stay the same, because revenue is rising concurrently. In this quarter, it seems that the rise in warranty costs has begun to exceed the rise in revenue, driving up these expense rates.

GM's claims rate was 2.51% in the third quarter, up a bit from the previous quarter, but down a bit from the same quarter in 2022.

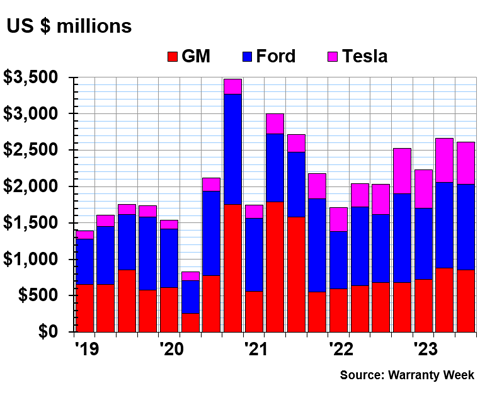

Warranty Accruals

Next, we will take a look at all three companies' total quarterly warranty accruals, shown in Figure 3. These are the numbers over which each OEM has more direct control: the money they accrue for future warranty costs.

Figure 3

U.S.-based Auto Manufacturers

Accruals Made per Quarter

(in millions of U.S. dollars, 2019-2023)

We can see that Tesla's accruals are still roughly twice its claims, though the gap between the two metrics is closing. Tesla accrued $577 million in the third quarter of 2022, up 38% from the same quarter in 2022, but down -5% from the second quarter of this year.

Ford accrued $1.19 billion, up 28% from the third quarter of 2022, but at just about the same level as the second quarter of this year.

GM accrued $850 million in the third quarter, up 24% from the same quarter the year prior, but down slightly from the second quarter of this year. It seems that GM is also experiencing the same conditions that have driven up warranty costs for Ford. GM's CFO, Paul Jacobson, stated in the Q3 earnings call, "We have experienced an increase in the cost of repairing vehicles due to inflationary factors. We are committed to reducing the number of claims and finding efficiencies to minimize costs and are optimistic that year over year warranty headwinds will begin moderating in Q4."

GM had yet another win for supplier recovery: "In the nine months ended September 30, 2023, we recorded a charge to supplier recoveries of $792 million related to a settlement for Chevrolet Bolt recall costs." That's in addition to the $1.9 billion the company had already recovered from its battery supplier. The accruals for that recall, back in the second and third quarters of 2021, can be seen in Figure 3. It's amazing that all of that money got paid back to GM after the fact.

There's also two developing recall stories at GM that we'll keep an eye on for the coming quarters. In the Q3 report, GM stated,

"In May 2023, we initiated a voluntary recall covering nearly one million 2014-2017 model year Buick Enclave, Chevrolet Traverse and GMC Acadia SUVs equipped with driver front airbag inflators manufactured by ARC Automotive, Inc. (ARC), and accrued an insignificant amount for the expected costs of the recall. As part of its ongoing investigation into ARC airbag inflators, on September 5, 2023, NHTSA issued an initial decision that approximately 52 million frontal driver and passenger airbag inflators manufactured by ARC and Delphi Automotive Systems LLC over a roughly 20-year period contain a safety-related defect and must be recalled."It seems like a rather large recall for which to accrue an "insignificant amount." We'll see how this one unfolds.

There's one more GM story that we picked up from the news, but didn't see mentioned in the quarterly report. In response to pending class action lawsuits filed by Chevy Bolt owners, a GM spokesperson announced:

"GM is announcing a compensation program for 2020-22 Bolt EV/EUV owners upon installation of the final advanced diagnostic software as part of the original battery recall. Owners are eligible to receive a $1,400 Visa eReward card upon installation."

But here's the catch: to get your $1,400, you need to bring your Bolt in by December 31, 2023, and you need to sign a legal release stating that you will not participate in any current or future class action lawsuits against GM in relation to the Bolt battery fires or recall. The software, by the way, temporarily reduces maximum charging levels to 80% of the battery's capacity, until the vehicle drives its first 6,200 miles, because the batteries in the '20-'22 Bolts only set fire when fully or near-fully charged.

Next, we're going to take a look at the quarterly accrual totals in Figure 3 in proportion to each company's product revenue. This gives us our accrual rates, shown in Figure 4.

Figure 4

U.S.-based Auto Manufacturers

Warranty Accrual Rates

(as a % of product sales, 2019-2023)

The GM Bolt battery recall is much more visible in Figure 4; this perhaps helps visualize its severity and high cost. In the third quarter of 2023, GM's accrual rate was 2.10%, down a little bit from the prior quarter. Ford's accrual rate in the third quarter was 2.72%, staying consistent.

Tesla had an accrual rate of 3.11% in the third quarter. In the second quarter, Tesla's accrual rate was 2.77%; in that quarter, Tesla's accrual rate surpassed that of both Ford and GM for the first time. Back a year ago, the accrual rate in the third quarter of 2022 was just 2.21%. So this rate has been on the rise, meaning that Tesla is accruing an increasing percentage of its product revenue for future warranty costs.

Although Tesla's claims rate, shown in Figure 2, is on the rise, it's still much lower than those of Ford and GM; on the other hand, as seen in Figure 4, Tesla is now accruing a larger percentage of its product revenue than either of its large U.S.-based competitors.

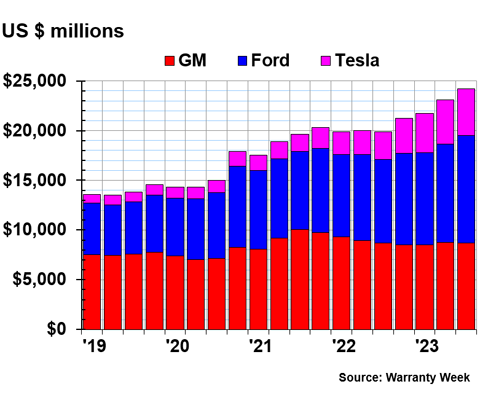

Warranty Reserve Balances

Our final metric is the balance of each of the three OEMs' warranty reserve funds at the end of each quarter. We can see in Figure 5 that Tesla and Ford have been growing their reserves lately.

Figure 5

U.S.-based Auto Manufacturers

Reserves Held per Quarter

(in millions of U.S. dollars, 2019-2023)

On September 30, 2023, GM held $8.70 billion in its warranty reserve fund. The company's warranty reserves have stayed at a rather consistent total since early 2022.

Ford held $10.79 billion in its reserves at the end of the quarter, up 9% from the prior quarter, and up 28% year-over-year from the third quarter of 2022. The company's reserve balance has been increasing since mid-2022.

Tesla held $4.72 billion in its reserve fund, up only 6% from the second quarter, but up 70% from the third quarter of 2022. The company's warranty reserve balance doubled from March 31, 2022 to September 30, 2023, over just six quarters.