Warranty Adjustments:

When a company finds that its actual warranty costs are above or below its predictions, it makes a change of estimate and adds or removes funds from its warranty reserve. We identified the six largest warranty adjustments of recent years, and added them to each company's regular quarterly accruals, to paint a fuller picture that often reflects the hardship and unexpected costs of recalls.

When a company sells a product covered by warranty, it is supposed to estimate that warranty's future cost, and set that amount aside as a warranty accrual. Over time, it is supposed to use its actual claims cost to help adjust those estimates up or down.

These so-called changes of estimate can be found in the financial statements of most manufacturers under a variety of different labels. Distinct from other figures such as claims paid, accruals made, or the beginning and ending balance in the reserve fund, they represent corrections of past predictions that turned out to be too optimistic or too pessimistic, as the case may be.

If you treat them like weather forecasts, then an upward change of estimate, which adds funds to cover unexpected costs, is a bit like predicting a sunny day but finding it rains. A downward change of estimate, in which a manufacturer takes out funds that proved to be unnecessary, is a bit like predicting rain but finding it to be a sunny day.

For this newsletter, we've selected six top U.S.-based manufacturers with significant changes of estimate reported over the past six years. It's not a coincidence that several of these companies have gone through major recalls during the same period.

Methodology

We've received some questions about warranty accruals and our data collection methodology over the past year, from readers ranging from amateur financial enthusiasts new to the world of warranty, all the way to warranty professionals at the United States' largest product warranty providers. At the novice end, we've had people wondering exactly what warranty accruals are. The kernel of that same question is at the core of the much more nuanced inquiries into data collection methodology from warranty professionals who know exactly how complicated the manner in which manufacturers report their warranty expenses is.

Most simply, warranty accruals are the deposits into the warranty reserve fund for future warranty costs. Each company has its own formulas for determining how much to accrue per product sold, per quarter, and per annum.

But a seasoned warranty professional likely knows that every manufacturer has not only its own methodology for estimating future warranty costs, but also its own strategy, structure, and terminology for reporting product warranty liabilities in its quarterly and annual financial statements.

Some manufacturers, such as Cummins and General Motors, report their regular product warranty accruals separately from accruals made during the same period for recall campaigns. In those cases, we always add those two numbers together for each period, in order to present what we call "total accruals."

Changes of estimates, which are adjustments to accruals made during past quarters, are also reported on a separate line in annual reports, as are foreign currency exchange adjustments, and warranty reserves gained through the acquisition of another product warranty-providing manufacturer. Some manufacturers improperly combine all of these figures into one number; e.g., with an accrual of $100 million, and a change in estimate of -$100 million, the company would report $0 accruals. However, this is not the norm.

We don't add adjustments into our total accrual calculations, since these changes affect funds accrued during previous periods, and we'd run the risk of double-counting the same funds twice if we did this categorically. And usually, we're talking about a few million dollars being added or subtracted from a multi-billion dollar warranty reserve. In other words, these changes of estimate are often negligible. But in the cases below, they're significant, and reveal interesting dimensions to the warranty expenses of some of the United States' largest warranty-providing manufacturers.

We do record adjustments in separate lines in our spreadsheets; we just usually don't factor these numbers into the data we present in our charts and newsletters. But this week, we're taking a look at two types of adjustments: changes of estimate, and acquisitions. For each of our six manufacturers, we'll present quarterly changes of estimate separately from total accruals, to highlight some significant additional warranty costs incurred by these manufacturers that were adjustments to previous accruals, rather than new accruals during that period.

The majority of the changes of estimate we'll see in the following charts were extra funds added into the warranty reserves to correct under-estimation of the product's future warranty costs. But we'll also see a few downward changes of estimate, where funds are removed from the warranty reserves, and increase net income. Some companies use the phrase "changes of estimate" for the upward changes, but terms like "removal of excess reserves" or "benefit from prior years" for downward changes.

First, we perused the annual and quarterly financial reports of the top 200 U.S.-based manufacturers, and collected data on total warranty claims paid, accruals made, adjustments made, and reserves held.

Next, we used these data to identify six top companies with intriguing and revealing changes of estimate: Ford Motor Co., General Motors Co., Boeing Co., Cummins Inc., Tesla Inc., and Paccar Inc. For each manufacturer, we created a chart detailing the total quarterly accruals, as well as changes of estimate and warranty reserve acquisitions during the same period.

Our first two companies are the two largest U.S.-based vehicle manufacturers, Ford and GM. Indeed, all of the companies featured in this report make vehicles of some type, from cars to trucks to airplanes, which isn't surprising considering the industry accounts for the majority of product warranty expenses both in the United States and worldwide.

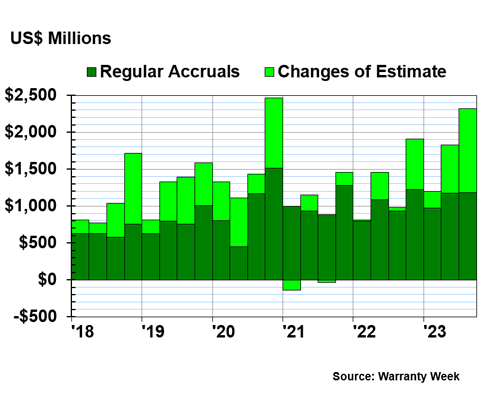

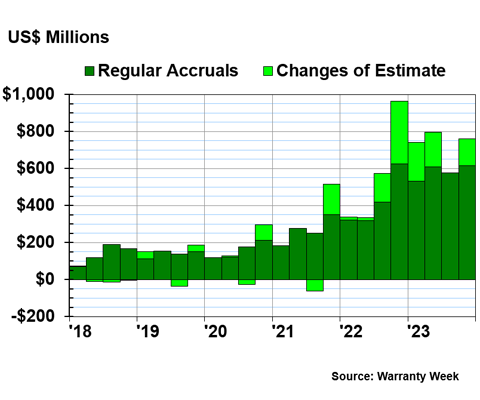

Ford

Ford has been prone to rather large changes of estimate for years, as we can see in this newsletter from 2014. However, these adjustments have gotten larger and more frequent in the last six years, as we can see in Figure 1.

Figure 1

Ford Motor Co.

Accruals Made per Quarter

(in US$ millions, 2018-2023)

In the fourth quarter of 2018 and second quarter of 2020, changes of estimate actually exceeded the total quarterly accruals. And in the most recent quarter for which we currently have data, the third quarter of 2023, changes of estimate came very close to the same level as total accruals: $1.185 billion in accruals for new product warranties, and an additional $1.134 billion accrued for changes of estimate.

The higher-than-usual accruals in the fourth quarter of 2020, as well as the large changes of estimate, are associated with the Takata airbag recall.

What is Ford's formula for calculating future warranty costs?

In the quarterly report for the third quarter of 2023, Ford states,

We accrue the estimated cost of both base warranty coverages and field service actions at the time of sale. We establish our estimate of base warranty obligations using a patterned estimation model, using historical information regarding the nature, frequency, and average cost of claims for each vehicle line by model year. We establish our estimates of field service action obligations using a patterned estimation model, using historical information regarding the nature, frequency, severity, and average cost of claims for each model year. [...] Changes to our estimated costs are reported as changes in accrual related to pre-existing warranties in the table above. Our estimate of reasonably possible costs in excess of our accruals for material field service actions and customer satisfaction actions is a range of up to about $1.5 billion in the aggregate.

So Ford acknowledges that its estimated warranty accruals could be off by as much as $1.5 billion. But Ford's changes of estimate in the first nine months of 2023 alone totaled $2.016 billion, exceeding the generous padding of that caveat.

We can't say for sure what caused the $2 billion discrepancy between previous accruals and the updated estimates, since Ford doesn't explicitly tell us in its financial statements.

However, we did find a few rather large recalls that Ford and the NHTSA announced during 2023, which could be associated. Ford's largest of 2023 was the recall of about 870,000 2021-2023 F-150s in July 2023, due to faulty parking brakes that engage unexpectedly. And in August, the company recalled about 175,000 2020-2023 vehicles due to faulty rearview cameras.

More recently, but after the frame of the data in Figure 1 ends, Ford recalled about 140,000 2016-2022 vehicles due to oil pump drive belt failures, which will be a more costly replacement campaign. And in January 2024, about 1.9 million 2011-2019 Ford Explorers were recalled due to a loose trim piece that could become detaches; a less expensive repair but a huge amount of vehicles.

In total, Ford had 56 recalls during 2023, according to Christopher Smith in his article "Ford Is The Most Recalled Brand In America For 2023 And It's Not Even Close," published in Motor 1. Smith totals the number of recall-affected Ford vehicles at 5.7 million for 2023. Smith notes that while Ford had the most recalls, Honda exceeded Ford in terms of number of vehicles affected, since Honda announced a huge recall of 2.6 million vehicles in the final weeks of 2023. Smith also notes that while Ford was the leader in number of NHTSA recalls in 2023, the number of recalls and the amount of vehicles affected were down from 2022, when 68 recalls affected 8.5 million vehicles for the manufacturer.

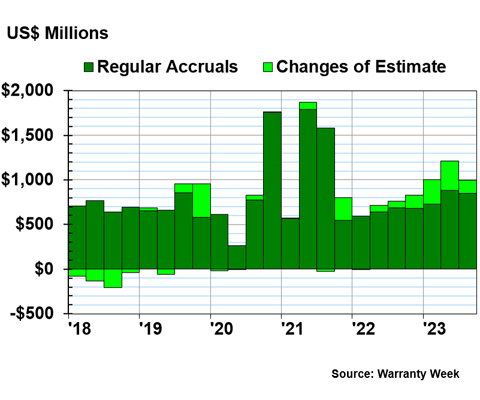

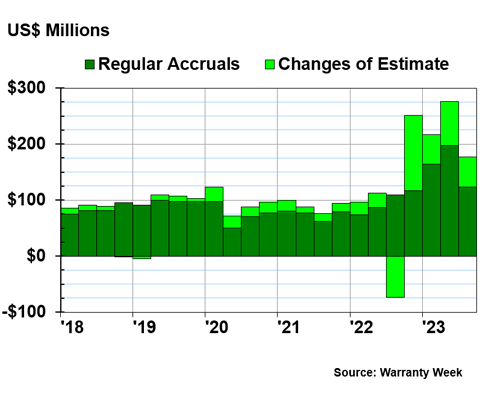

General Motors

We can't speak about recalls for U.S.-based car manufacturers without discussing General Motors. General Motors had a huge, expensive, and highly publicized recall of all Chevrolet Bolt electric batteries. We detailed the story of this recall in the June 2023 newsletter "U.S. Auto OEM Update." The recall cost GM about $2 billion, accrued during the second and third quarters of 2021. Note that the company has since recovered at least $1.9 billion of those accrual costs from its battery supplier.

Along with Ford, GM had higher-than-usual accruals in the fourth quarter of 2020, related to the Takata airbag recall. It was especially unfortunate timing that another even costlier recall hit the company so soon after.

Figure 2 shows GM's accruals and changes of estimate from 2018 to the third quarter of 2023.

Figure 2

General Motors Co.

Accruals Made per Quarter

(in US$ millions, 2018-2023)

GM has had a few rather large changes of estimate: in the fourth quarter of 2019, fourth quarter of 2021, and again more recently, especially in the first two quarters of 2023.

It's possible that the company has modified its formula since the Bolt recall in 2021. Or it could be more recent, smaller recalls requiring the extra funds to be deposited as changes of estimate. The company did not offer an explanation in its quarterly reports for its high changes of estimate during the first three quarters of 2023.

We found two rather large recalls for GM during 2023. In May, the company recalled about 1 million SUVs with faulty air bag inflators. Also in May, GM announced a recall of about 650,000 vehicles with an issue that could prevent child car seats from being installed properly.

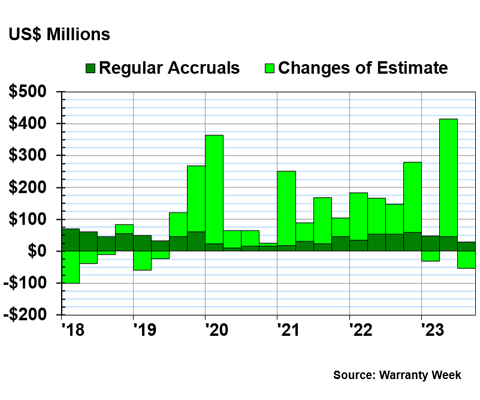

Boeing

Boeing was embroiled in a difficult recall from March 2019 to November 2020, with all of its 737 MAX airplanes grounded by mandate of over 80 world governments due to safety concerns. Two fatal plane crashes took hundreds of lives, a direct result of a malfunction of the aircraft's MCAS flight stabilizing software. The grounding, fines, and legal fees cost Boeing tens of billions of dollars, of which only a small fraction were warranty costs.

However, as we'll see in Figure 3, Boeing is a very interesting warranty story right now, because what it lacks in regular accruals, it more than delivers in huge changes of estimate.

Figure 3

Boeing Co.

Accruals Made per Quarter

(in US$ millions, 2018-2023)

In the third quarter of 2019, Boeing's changes of estimate were more than double its regular accruals. In the fourth quarter of 2019, changes of estimate were more than quadruple the regular accrual total. And in the first quarter of 2020, changes of estimate exceeded regular accruals fifteen-fold; the company put aside $23 million in product warranty accruals, but added an additional $341 into the warranty reserve as an adjustment to previous estimates.

But the end of the first 737 MAX grounding was not the end of Boeing's warranty struggles. In the first quarter of 2021, Boeing's changes of estimate exceeded regular accruals fourteen-fold; regular accruals were just $17 million, but adjustments totaled $234 million.

More recently, in the second quarter of 2023, Boeing's adjustments exceeded regular accruals nine-fold; just in that quarter, the company accrued $45 million, but added an additional $369 million in changes of estimate. The company didn't offer any explanation for these changes of estimate.

We all saw the viral video of the missing door panel of the Alaska Airlines flight that came in early January 2024. That plane was also a 737 MAX. As Whizy Kim details in this article in Vox, this is just one of the many issues Boeing has had with the 737 MAX between its first groundings and now. In the article, entitled "How Boeing Put Profits Over Planes," Kim alleges that Boeing has allowed a culture of corporate greed to overshadow safety and engineering concerns in favor of cost-cutting by any means necessary.

We won't comment on Boeing's future, nor its corporate culture. However, the warranty data never lies, and Figure 3 looks like the warranty accruals of a company in crisis, that believes that warranty claims won't cost more than $100 million per quarter, but huge changes of estimate keep arising as the company uncovers more defects, with repairs costlier and more frequent than they predicted. What's especially surprising is that Boeing's formula for calculating its accruals still hasn't changed, despite these huge adjustments revealing flaws in warranty accounting strategy.

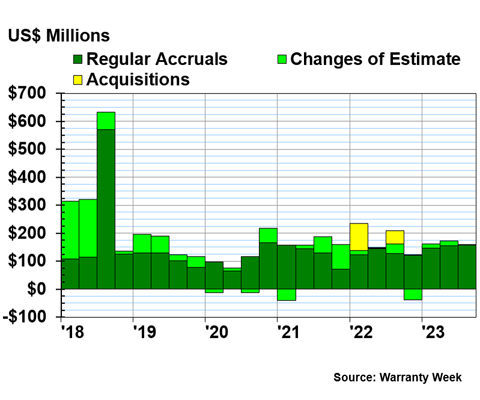

Cummins

In contrast, Cummins' data in Figure 4 looks like a model for recovery from a recall. This recall was the result of Cummins' failure to comply with EPA and California Air Resources Board (CARB) emissions standards for its model year 2010 to 2015 diesel truck engines.

These data will likely be a model for Cummins itself in the coming year, since it is once again in hot water for failing emissions tests, as we reported in last week's newsletter, "Nine-Month Large Vehicle & Powertrain Warranty Trends." At the end of December, the U.S. Department of Justice announced that Cummins will be fined $1.67 billion for violation of the Clear Air Act, the largest fine ever secured under the bill, plus an additional $352 million for pollution remedies. The recall affects 2013 to 2023 Dodge Ram 2500 and 3500 diesel pickup trucks, an estimated 900,000 vehicles, on which "defeat devices" were installed in order to bypass or disable emissions controls.

Figure 4

Cummins Inc.

Accruals Made per Quarter

(in US$ millions, 2018-2023)

We can see the large amount of accruals made in relation to the first emissions compliance scandal, in changes of estimate in the first two quarters of 2018, and then a regular accrual in the third quarter of that year. For more information and discussion of that scandal, take a look at our newsletter "World's Largest Warranty Problems," from 2021.

Cummins acquired Westport Fuel System Inc.'s stake in Cummins Westport, Inc. in early 2022, so Cummins is the only example of acquired warranty reserves we see in this newsletter.

In the first nine months of 2023, Cummins put aside $458 million in regular accruals, and added an additional $36 million in changes of estimates.

Tesla

Tesla's another company that's been experiencing a lot of issues with design flaws recently, most publicly with its Cybertruck. But there's also been issues with finding service technicians that can work on electric vehicles, which could be driving up the cost of repairs. Figure 5 shows Tesla's accruals and changes of estimate from 2018 to 2023.

Figure 5

Tesla Inc.

Accruals Made per Quarter

(in US$ millions, 2018-2023)

In its 2023 annual report, Tesla states,

We accrue a warranty reserve for the products sold by us, which includes our best estimate of the projected costs to repair or replace items under warranties and recalls if identified. These estimates are based on actual claims incurred to date and an estimate of the nature, frequency and costs of future claims. These estimates are inherently uncertain and changes to our historical or projected warranty experience may cause material changes to the warranty reserve in the future.

Unlike Ford and GM, Tesla hasn't been a popular car company for very long. It's possible that the company truly is struggling to successfully anticipate future warranty costs, since it's selling vehicles at a scale it's never experienced before, and keeps ramping up. The expansion of total accruals since 2020 already paints a picture of a company expanding rapidly, since sales are growing at similar rates as claims and accrual totals. The additional changes of estimate show that warranty claims are coming in from older models, and at higher volumes, and the company is making adjustments because it didn't really know what to expect. The interesting and revealing part will be how the formula changes in response to these data.

Paccar

Our final manufacturer in this report is Paccar. We won't dwell too long on the company, since we also reported its quarterly warranty expenses in last week's newsletter. Figure 6 shows Paccar's total accruals and changes of estimate from 2018 to 2023.

Figure 6

Paccar Inc.

Accruals Made per Quarter

(in US$ millions, 2018-2023)

Much like Tesla, Paccar's changes of estimate have increased dramatically in the past year. Unlike Tesla, though, Paccar has been manufacturing its vehicles for decades.

In the fourth quarter of 2022, Paccar's adjustments even exceeded regular accruals; the company put aside $117 million in regular accruals, and an additional $135 million in changes of estimate.

Paccar accrued $484 million in the first nine months of 2023, and put aside an additional $186 million in changes of estimate. In its report from the third quarter of 2023, the company stated,

Warranty expenses and reserves are estimated and recorded at the time products or contracts are sold based on historical and current data and reasonable expectations for the future regarding the frequency and cost of warranty claims, net of recoveries. The Company periodically assesses the adequacy of its recorded liabilities and adjusts them as appropriate to reflect actual experience.

It's possible that these extra adjustments are associated with the late 2022 recall of over 76,000 Kenworth and Peterbilt vehicles due to a software issue affecting a digital display. However, only about 1% of the affected vehicles were estimated to have the defect, so it couldn't have been an especially costly recall. The company had a couple of smaller recalls of a few thousand vehicles in 2023, but again, it seems unlikely that these were costly enough to necessitate these large changes of estimate in the past few quarters.