U.S. Computer Industry Warranty Report:

The big headline is that Apple abruptly stopped reporting its warranty expenses in the middle of last year with no explanation. Among the suppliers to the computer OEMs, warranty expenses for the semiconductors are growing, while telecom expenses are shrinking to their lowest recorded levels.

In our Twentieth Annual Product Warranty Report, which kicked off this series of 20-year charts two months ago, we divided U.S.-based manufacturing into three sectors: vehicles, building trades, and electronics. As we reported in that newsletter, vehicles have taken on an increasing share of all product warranty expenses in the United States over the past two decades, while the electronics sector's share of expenses has shrunken considerably. In 2012, the vehicle sector accounted for about 50% of U.S. accruals, while high tech accounted for 40%. Ten years later, in 2022, vehicles represented 60% of U.S. warranty accruals, and high tech just 20%.

To analyze the data, we split the high tech sector into seven industries, of which computers is by far the largest. This week, we are taking a look five of the seven: the U.S.-based computer manufacturers, and the support industries that function as their suppliers. These are semiconductors & printed circuit boards (PCBs), telecommunications equipment, data storage, and other peripherals. The other two industries, consumer electronics and medical & scientific equipment, will be the subjects of future 20-year data summaries.

While we've reported record-breaking high warranty expense totals in other industries, especially in the face of recent U.S. dollar inflation, most of the industries in this report had lower total warranty expenses than ever in 2022. Sounds good on the surface, but manufacturers don't want to see their warranty expenses decrease simply because they're selling fewer units.

We began with a list of 473 U.S.-based manufacturers of high-tech electronics equipment that report their warranty expenses in their financial statements are were active in some period of the past 20 years (not all are still in business or trading publicly). Of those, 24 are manufacturers of desktop computers, laptops, smart phones, tablets, and mainframes. A total of 155 make semiconductors, printed circuit boards (PCBs), or the tools, test equipment, and manufacturing systems used for their production. 44 make data storage systems for computers, and 60 make computer peripherals such as monitors, terminals, printers, scanners, etc. The final 190 companies manufacture telecom hardware.

From each manufacturer's annual reports and quarterly financial statements, we collected three essential warranty metrics: the amount of claims paid, the amount of accruals made, and the balance of the warranty reserve fund at the end of each year. We also collected product sales revenue data, and with that plus the claims and accrual totals, we calculated the percentage of sales spent on claims (the claims rate) and the percentage of sales spent on accruals (the accrual rate).

We should note that our charts presenting the claims, accrual, and reserves totals have one more category, only present in the bars with data from 2022. This category is called "Apple Estimates," and it represents a dilemma we faced in reporting on this industry this year. It seems that Apple Inc., which has led the computer industry in product warranty expenses for the past decade, stopped reporting in the middle of 2022 without any explanation. Warranty claims, accrual, and reserves totals were reported in the second quarter of 2022; in the third and fourth quarters, the tables were simply absent from the documents. We can't find an explanation anywhere, nor can we find the data. We contacted Apple months ago, but they never got back to us to comment. If any of our readers have any information about this, please get in contact with us at Warranty Week, either on or off the record.

To create this report, we fashioned estimates for Apple's 3Q and 4Q of 2022 using the quarterly totals from the corresponding quarters in 2021. Apple's fiscal year ends in September, but we transposed the quarters to match the typical U.S. calendar. While we don't want to speculate on why Apple stopped reporting these numbers, certainly it did not suddenly stop issuing standard product warranties on its products, and the SEC did not suddenly stop requiring all companies to report these data. Perhaps naively, we will continue to hold out hope that Apple will start reporting again in the future.

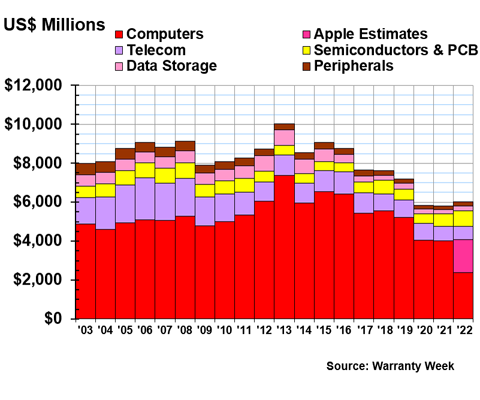

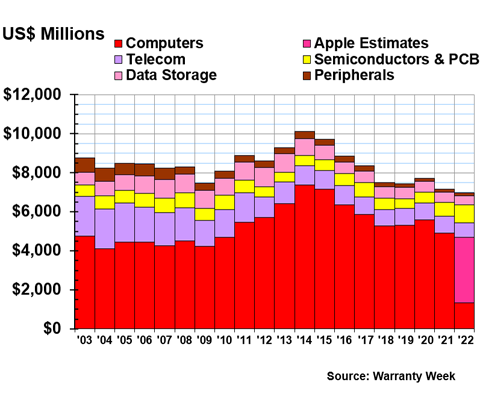

Warranty Claims Totals

In Figure 1, we're looking at the past 20 years of warranty claims paid by all companies in the five industry segments. The computer manufacturers pay the vast majority of the claims, even though they are the fewest in number.

Figure 1

Computer Industry Warranties

Claims Paid by U.S.-based Manufacturers

(in US$ millions, 2003-2022)

The computer industry paid a total of $2.39 billion in warranty claims in 2022, not including our estimates for Apple's third and fourth quarters. Including these estimates, the industry's claims total was $4.06 billion for the year.

Figure 1 helps highlight the crucial role that Apple plays in warranty expenses in this industry. The hot pink Apple Estimates bar is only the estimated total for the third and fourth quarters of 2022; the real 1Q and 2Q totals from Apple's quarterly reports are included in the red Computers bar. In the first two quarters of 2022, Apple paid a total of $1.12 billion in warranty claims. We estimate that the company paid an additional $1.68 billion in the third and fourth quarters of 2022, for an estimated annual total of $2.79 billion.

The first generation iPhone came out in 2007. In that year, Apple paid just $307 million in warranty claims. The highest annual claims total for the company was recorded about a decade later, in 2016, during which Apple paid $4.73 billion. That's more than $1 billion in claims payments per quarter. This does not include repairs done under AppleCare plans, which function as a type of extended warranty, distinct from the product warranties we are discussing here. AppleCare expenses are reported separately, under the label of "deferred revenue," along with gift card sales. Apple's warranty claims expenses have dropped off in the years since that peak was recorded.

As we can see in Figure 1, total computer warranty claims had been trending downward years before this accounting change affected our reporting of Apple's warranty expenses. Claims totals dropped for the industry in 2020, but have barely budged since the pandemic started. Aside from Apple, the other major computer manufacturers in this category include IBM Corp. and the two successors of Hewlett-Packard Co.: HP Inc. and Hewlett Packard Enterprise Co.

HP Inc. paid $988 million in claims in 2022, while Hewlett Packard Enterprise paid $203 million. IBM paid just $81 million. This is the lowest annual claims total we've ever seen IBM report. The company's highest claims total of $870 million was recorded in 2003, the first year these data were reported. Total claims have been trending downward for IBM since then.

We do want to take a moment to acknowledge that Apple has, in a way, joined its international peers. While a handful of international computer manufacturers do report their warranty expenses, most do not. We have no warranty data from Lenovo, Toshiba, Fujitsu, Asus, or Acer, and only company-wide data from consumer electronics giants Sony and Panasonic, which do not segment their computer-only warranty expenses. Furthermore, the American-based Dell Inc. stopped reporting when it went private a decade ago. Therefore, we have no warranty data for well over half the global computer industry, and will not be trying to size the industry's worldwide warranty expense totals.

Of the four other industries that function in part as suppliers to the computer manufacturers, warranty expenses for semiconductors have surpassed telecom in recent years. Warranty claims for the U.S.-based semiconductor & PCB industry totaled $799 million in 2022, while telecom warranty claims totaled $680 million. Data storage warranty claims totaled $253 million, and claims for other peripherals totaled $223 million. Telecom claims were down by -9%, while claims for the other three were up by about 23%.

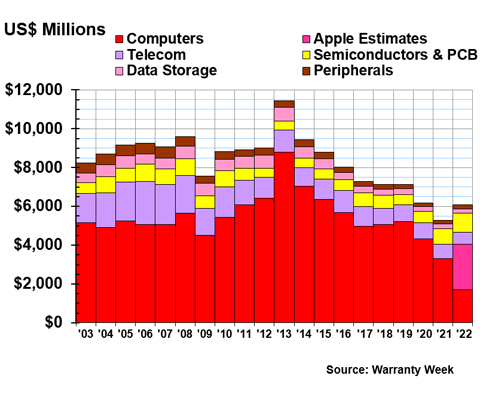

Warranty Accrual Totals

Warranty accrual totals were up slightly in 2022, but only because they hit an all-time low in 2021. Figure 2 shows the past 20 years of warranty accruals in the computer and related industries. As with Figure 1, the hot pink portion of the 2022 bar represents our estimates of Apple's 3Q and 4Q expenses, while the red portion includes the concrete numbers they reported in the first half of the year, along with the accruals of all the other U.S.-based computer manufacturers.

Figure 2

Computer Industry Warranties

Accruals Made by U.S.-based Manufacturers

(in US$ millions, 2003-2022)

Total accruals for the computer manufacturers totaled $1.70 billion in 2022, not including our estimates for Apple. With the estimates, the accrual total was $4.06 billion for 2022.

Apple reported accruing just $434 million in the first half of 2022, but based on the 2021 figures, we estimated that the company accrued $2.36 billion in the second half of the year, for an estimated annual total of $2.79 billion.

HP Inc. accrued $948 million in 2022, while Hewlett Packard Enterprise Co. accrued $238 million. IBM accrued just $84 million in 2022.

Total accruals for the telecom industry were down by -18% to a total of $611 million in 2022. As with the claims total, this is the lowest total we've ever recorded for the industry.

Cisco Systems Inc., which makes networking hardware such as routers, among other things, is the telecom equipment manufacturer with the largest warranty expenses by far. Cisco's accruals were down by -19% to a total of $398 million in 2022, the lowest accrual total the company has reported since 2009. The company's revenue was up a bit over the same period, showing savings per unit sold.

Other big names among the telecom manufacturers include L3Harris Technologies Inc., which accrued $39 million in 2022, CommScope Holding Co. Inc., which accrued $25 million, and Juniper Networks Inc., which accrued $30 million. These totals were down from 2021 for all three companies.

On the other hand, total accruals for the semiconductor & PCB industry were up by 23% in 2022 to a total of $980 million. This is actually the highest annual industry-wide accrual total we've seen for semiconductors.

The largest semiconductor manufacturer on the list is Lam Research Corp. The company's total accruals were up by 21% in 2022 to a total of $325 million. Lam's revenue was up by a similar amount, indicating overall growth. Next on the list is Applied Materials Inc., which increased its accruals by 14% to $254 million, again mapping to an increase in revenue.

Advanced Micro Devices Inc.'s accruals were up by 8% to $155 million, while its fourth quarter revenue from 2021 to 2022 increased by an amazing 44%. The company's total accruals have increased steeply over the past few years. Unlike telecom, whose warranty expenses fell and then stagnated as landlines fell out of vogue, semiconductors, circuit boards, and computer processors are on the up and up.

One last big name in semiconductors is Nvidia Corp., which makes computer graphics processing units (GPUs). GPUs render images in a computer, and the company is popular among video gamers and graphic designers, among others. The company's total accruals increased by 540% (no, that's not a typo) in 2022, and it was also featured in our report on the Largest Nine-Month Warranty Expense Rate Changes a few months ago. In 2022, Nvidia accrued $161 million; in 2021, it accrued just $25 million. The company's year-over-year revenue was down in the fourth quarter, but it's a burgeoning industry with a lot of movement and growth, so it's not clear what they are anticipating for the future.

Total accruals for the data storage industry were down by -21% to $201 million. Western Digital is the largest company in the category, and accrued $127 million in 2022, down -18% from the year prior. Seagate Technology Holdings plc, the next-largest, accrued $63 million, down -23%. Both companies also saw decreases in revenue.

Finally, we have the peripherals industry, which saw $216 million in total accruals in 2022, up 18% from the year prior. Dover Corp. was the largest in the category, and accrued $61 million in 2022, down -10%. Next on the list is LED scoreboard maker Daktronics Inc., which accrued $64 million in 2022, a 650% increase. Again, not a typo, but an astronomic increase in accruals; Daktronics was featured on the list of the biggest rises in warranty expense rates from 2021 to 2022, along with Nvidia.

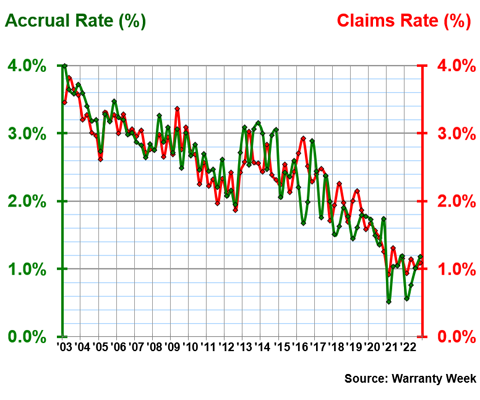

Warranty Expense Rates

Based on the totals we've just reported, our general trends are that computer warranty expenses have been consistent in the short-term, but have been trending down over the years; telecom expenses shrunk considerably when landlines lost popularity; semiconductors & PCBs are taking on an increased share of computer warranty expenses; and data storage and peripherals expenses are shrinking as well.

Now, we are going to take a look at the industry-wide average warranty claims and accrual rates for each of the five categories. These are the claims and accrual totals normalized by product sales revenue, showing what percentage of sales goes back to warranty expenses.

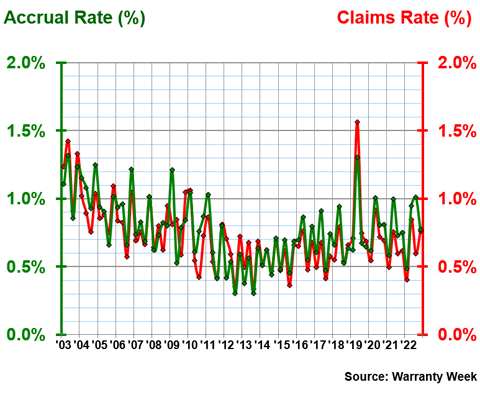

First, we are looking at the 20-year data for the 24 U.S.-based computer manufacturers.

Figure 3

U.S.-based Computer Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2022)

Clearly, warranty expenses have been decreasing consistently. That means that the computer OEMs are spending a smaller portion of product sales revenue on warranties, showing savings per unit over the years. Of course, the look, size, components, and presentation of computers have changed so much over the past two decades.

In the fourth quarter of 2022, the claims rate was 1.1%, and the accrual rate was 1.2%. Both rates have even dipped below 1% twice, in the first quarters of 2021 and 2022.

Over 20 years, the average claims rate for the computer OEMs was 2.42%, with a standard deviation of 0.69%, and the average accrual rate was 2.43%, with a standard deviation of 0.79%.

The averages and standard deviations actually don't do much to tell the current story of the industry, but paired with Figure 3, tell a compelling story about significant change over the past two decades. This is a fairly rare example where both rates keep decreasing, and the current rates are thus much lower than the averages. Overall this is great news for the efficiency of the warranty departments of these manufacturers, and probably the cost of computer components and repairs overall.

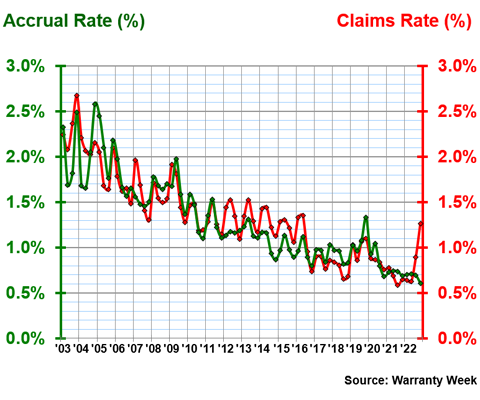

Next, we're taking a look at the average expense rates for the telecom industry.

Figure 4

U.S.-based Telecom Equipment Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2022)

The expense rates for the telecom equipment manufacturers have also trended downward, especially in recent years, though less dramatically. In the fourth quarter of 2022, the telecom industry had an average claims rate of 0.6% and an average accrual rate of 0.5%.

Over 20 years, the average claims rate was 1.33%, with a standard deviation of 0.28%, and the average accrual rate was also 1.33%, with a standard deviation of 0.29%.

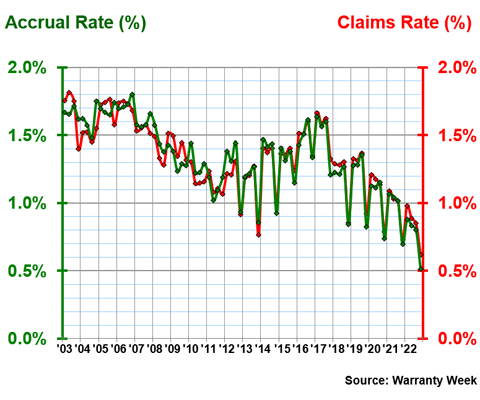

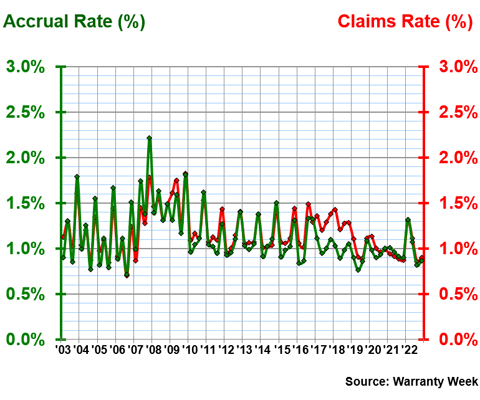

Next, we're looking at semiconductors & PCBs.

Figure 5

U.S.-based Semiconductor & Printed Circuit Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2022)

At first glance, we see that the semiconductor industry has much more frequent oscillation in its expense rates, even from quarter to quarter in the same year. This EKG-like pattern shows there's a little more volatility in warranty accounting in the industry, with claims and accruals taking anywhere from 1.5% of revenue to 0.5% of revenue.

In the fourth quarter of 2022, the average claims and accrual rates for the industry were both 0.8%. Over 20 years, the average claims rate was 0.73%, with a standard deviation of 0.24%, and the average accrual rate was 0.77%, with a standard deviation of 0.24% as well. So unlike the other two industries we've just looked at, the current expense rates for semiconductors are just around the average level over the past two decades.

Next, we're looking at the average expense rates of the data storage manufacturers.

Figure 6

U.S.-based Data Storage Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2022)

This is another industry where the average warranty expense rates have been consistently trending downward over the past two decades. In the fourth quarter of 2022, the industry-wide average claims rate was 1.3%, and the average accrual rate was 0.6%.

Over 20 years, the average claims rate was 1.33%, with a standard deviation of 0.47%, and the average accrual rate was 1.30%, with a standard deviation of 0.47%.

Note that in all of our five industries, the average claims and accrual rates over 20 years end up very close to each other, showing consistency between the two metrics. So these industries are generally accruing the correct amount of money to pay its claims, without putting aside too large a portion of revenue, but having enough money to pay all warranty claims that may arise.

Our final expense rate chart depicts the average warranty expense rates for the peripherals industry.

Figure 7

U.S.-based Computer Peripherals Manufacturers

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2003-2022)

The peripherals industry has stayed fairly consistent with its warranty expense rates over the past 20 years, with a little blip upward during the Great Recession. Interestingly, if we look back to Figures 3-6, we don't really see much impact from the recession overall, unlike our observations in the building trades and vehicle sectors.

In the fourth quarter of 2022, the average claims and accrual rates were 0.9% for the peripherals industry. Over 20 years, the average claims rate was 1.18%, with a standard deviation of 0.24%, and the average accrual rate was 1.13%, with a standard deviation of 0.29%.

Warranty Reserve Totals

Our final warranty metric of the computers industry is the year-ending balance in the warranty reserve funds of all 473 former or current manufacturers we're tracking this week. This is the calendar year-ending balance we are examining, not the balance at the end of their fiscal years.

Total reserves between all five industries totaled $6.98 billion in 2022. This is the lowest we've ever seen this total, and the first time in 20 years this number has dropped below $7 billion.

Figure 8

Computer Industry Warranties

Reserves Held by U.S.-based Manufacturers

(in US$ millions, 2003-2022)

Of course, one big issue here is that based on recent data, we estimate that Apple's warranty reserves alone totaled $3.36 billion at the end of 2022. This might sound high, but combined with the rest of the computer manufacturers for which we have hard data for 2022, we estimate that reserves for the computer OEMs totaled $4.69 billion at the end of 2022. This is actually a -4% decrease from ending warranty reserve balance for the computer OEMs the year prior.

Total reserves for the telecom equipment manufacturers fell by -13% to $744 million. The data storage manufacturers' reserve balance decreased by -11% to $469 million, and the other peripherals manufacturers' reserves fell by -7% to $162 million.

In fact, the only industry of the five for which total reserves grew was semiconductors & PCBs. The warranty reserves of the semiconductor industry grew by 30% from 2021 to 2022, to a total of $923 million. This is the largest reserve balance the industry has seen so far.

Needless to say, it will be interesting to see whether Apple resumes reporting its warranty expenses in the future, or if this is a change in accounting or other decision that's here to stay. If it is, this report will look wildly different in the future. Warranty reserves across the five industries in this report would be at least halved without the presence of Apple. The face of the U.S. computer industry is certainly changing, and we also expect to see an increasing presence from the semiconductor and circuit board manufacturers in coming years.