Top Korean & Indian Automaker Warranty Expenses:

Kia had an especially expensive year of recalls, but Hyundai didn't emerge unscathed either. Meanwhile, Tata had a great year, and seems to have mastered its warranty accounting years after its acquisition of Jaguar Land Rover.

In our newsletter two weeks ago, we detailed the past five years of warranty expenses for Japan's top three auto manufacturers. This week, we are looking to their neighbors in the continent of Asia, focusing in on the top two automakers based in South Korea and the top automaker based in India.

From South Korea, we have Hyundai Motor Co. and Kia Motors Corp. Hyundai owns 33% of Kia, and thus is technically Kia's parent company. But since the two report all of their annual expenses, including warranty costs, separately, and function fairly independently, we treat them as two separate companies for the purposes of this report. Hyundai also has the Genesis Motor (luxury vehicle) and Ioniq (electric vehicle) brands, which are fully-owned subsidiaries.

During the 1997 Asian financial crisis, Kia declared bankruptcy. Hyundai acquired 51% of the company to keep Kia afloat, outbidding Ford, which had previously partnered with and owned a stake in Kia during the 80's and 90's. Incidentally, Hyundai first began manufacturing cars in partnership with Ford back in the late 60's and 70's. Hyundai has since divested some of its stake in Kia, down to one-third ownership, but remains its largest shareholder.

Our third company in this report is Tata Motors Ltd. Tata, the largest Indian automaker, purchased the Land Rover and Jaguar Cars brands from Ford in 2008, later consolidating them into the U.K.-based subsidiary holding company Jaguar Land Rover. Tata has also owned the South Korean truck manufacturer Daewoo since 2004. Tata additionally makes a variety of buses, under the Tata, Hispano, and Marcopolo brands, and some heavy construction equipment in partnership with Hitachi. The majority of Tata's auto manufacturing plants are located in India, but the company also has factories in Argentina, South Africa, Thailand, and the U.K.

For the purposes of this report, we decided to exclude Tata's compatriot Mahindra. Although Mahindra does make passenger vehicles, it primarily makes medium- and heavy-duty trucks, and a variety of heavy vehicles including agricultural and construction equipment. Mahindra's warranty expenses are also on a much smaller scale than the three companies included in this report, but we do appreciate its reporting. We'll see the company in our upcoming worldwide auto warranty report.

Since Kia and Hyundai report their annual expenses in the South Korean won, and Tata reports its expenses in the Indian rupee, we used the U.S. Internal Revenue Service's Yearly Average Currency Exchange Rates table to convert these totals to U.S. dollars. We should note that we translated Tata's annual expenses from the Indian numbering system, which uses lakhs and crores, to Western numbers, in order to convert from rupees to dollars. For a little more information on that, take a look at our newsletter about these three companies from two years ago.

We'll also note that Tata follows the Japanese convention of having a fiscal year that ends on March 31, so the amounts listed in the 2022 column for them are actually for the months from April 2022 to March 2023. Hyundai and Kia use the calendar year system, from January to December. We don't think Hyundai and Kia grew two years younger last month, but many of their employees did.

From the annual reports of each of the three companies, we extracted three essential warranty metrics: the amount of claims paid, the amount of accruals made, and the amount of warranty reserves held at the end of each year. Additionally, we collected two sales metrics: automotive product sales revenue, and total unit sales.

With the claims, accrual, and revenue figures, we calculate three additional metrics: claims as a percent of sales (the claims rate), accruals as a percent of sales (the accrual rate), and accruals made per vehicle sold.

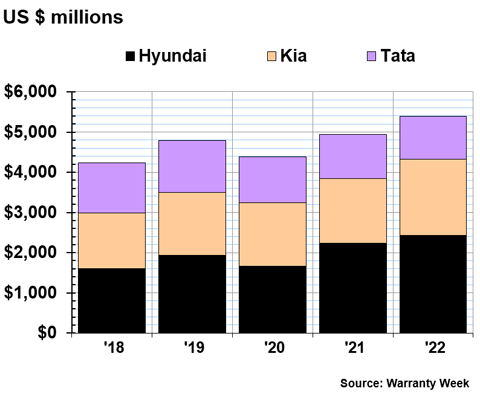

Warranty Claims Totals

In Figure 1, we are looking at the warranty claims totals of Hyundai, Kia, and Tata, converted into U.S. dollars. We should note that from 2021 to 2022, the South Korean won appreciated by an average of about 12.8% compared to the U.S. dollar, and the Indian rupee appreciated by about 6.3%, based on the IRS currency exchange rates. So as we saw with the Japanese automakers, changes in the relative value of these manufacturers' native currencies did affect the the totals they report. So it's doubly useful to standardize these numbers in U.S. dollars, to make them more readily comparable.

Figure 1

Top Korean & Indian Auto Manufacturers

Claims Paid per Year

(in billions of U.S. dollars, 2018-2022)

Hyundai, the largest company of the group, naturally had the highest claims total. The company paid $2.43 billion in claims during 2022.

Hyundai certainly has seen a spike in total claims payments over the past several years. Claims totals have increased every year since 2016, with the exception of a little dip during the pandemic year 2020. Hyundai's claims totals rose by 33.8% from 2020 to 2021, and an additional 8.8% from 2021 to 2022.

In its most recent annual report, Hyundai states, "During the year ended December 31, 2022, the Group updated the measurement of warranty provisions related to the recall of Theta 2 and other engines to reflect of new information and a longer period of historical claim data." If that sounds a little familiar, it's because the company provided an almost identical explanation for dramatically increasing accruals back in 2020. So it seems that the company is still paying out claims for the Theta 2, also stylized as Theta II, engine recall, which was first announced all the way back in September 2015. The recall has been expanded several times, notably in 2017, 2019, and most recently during late 2020. There's been penalties and class-action lawsuits. And it seems that eight years later, Hyundai and Kia are both still paying for Theta II problems and struggling to fully estimate the scope of this recall.

Kia saw the biggest increase in total claims, but it's nothing compared to the rise in accruals we'll see later on in this report. Kia has been paying out claims for Theta II engines, and it additionally issued several voluntary recalls last year, for which it accrued heavily, as we will see in Figure 4. The company's total claims rose by 17.4%, to $1.9 billion.

Tata's claims total decreased. The company paid $1.07 billion in claims during 2022, down -2.4% from the year prior.

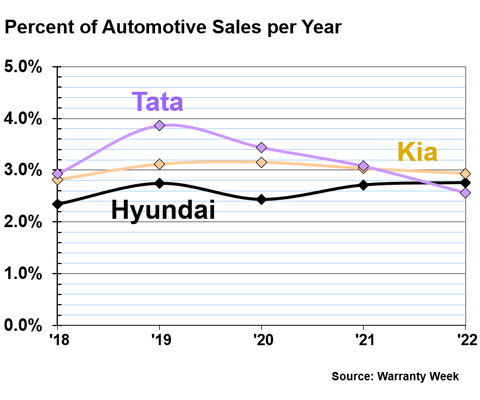

Warranty Claims Rates

Figure 2 shows the claims rates of the three companies, which is the claims totals shown in Figure 1 divided by each company's annual vehicle sales revenue.

Figure 2

Top Korean & Indian Auto Manufacturers

Warranty Claims Rates

(as a percentage of sales, 2018-2022)

Tata started out this five-year window with the highest claims rate of the bunch, and ended fiscal 2022 with the lowest. During 2019, Tata was spending closer to 4% of its product revenue on claims, but that number has dropped down consistently since then.

All three companies have been spending just about the same proportion of their product sales revenue on warranty claims. In 2022, Kia's claims rate was 2.93%, Hyundai's was 2.76%, and Tata's was 2.57%.

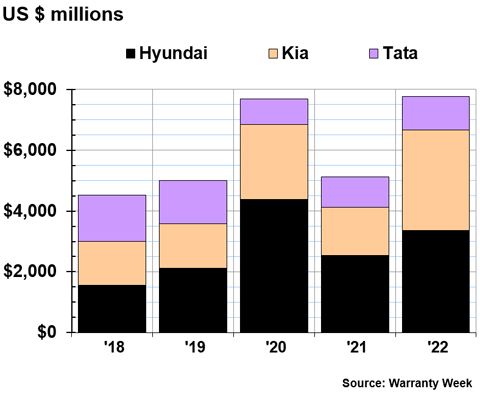

Warranty Accrual Totals

Figure 3 is the tale of two recalls, which were really two waves of the same eight-year trudge. Hyundai had especially high warranty expenses back in 2020, and Kia's jumped as well, due to the U.S. National Highway Traffic Safety Administration (NHTSA)'s extension of the Theta II engine recall. In 2022, Kia was hit hard by several "voluntary" recalls, which totaled 3.28 million vehicles.

Figure 3

Top Korean & Indian Auto Manufacturers

Accruals Made per Year

(in billions of U.S. dollars, 2018-2022)

Hyundai's accruals increased by 32.8%, to a total of $3.37 billion in 2022. This is fairly typical for comparably-sized European and American companies, but represents a huge increase in accruals for Hyundai in just a few years.

Until 2016, Hyundai's annual accruals stayed around or below just $1 billion. The company's accruals jumped from $1.55 billion in 2017, to $2.13 billion in 2018, to an unprecedented $4.38 billion in 2020. Totals dropped back down to $2.53 billion in 2021, but shot right back up to above $3 billion in the most recent year.

The company's history of low warranty accruals, and the inconsistency of accrual totals in recent years, indicates to us that Hyundai has long struggled to craft estimates of its warranty expenses, a problem exacerbated since this engine recall started.

Kia's accruals increased by an even more dramatic factor. In fact, the company's total accruals more than doubled from 2021 to 2022. Kia accrued $3.30 billion in 2022, a 107.4% increase from the year prior.

By way of explanation, its annual report just stated, "Kia carried out a voluntary recall of 3.28 million units and obtained ISO 9001 (quality management system) certification for 100% of its facilities, fulfilling its promise to customers that it will not compromise on customer safety and quality."

Kia was burnt by the original Theta II recall as well (pardon the pun; the main issue was engine fires). Kia's accruals increased by around two-thirds back in 2017, in the second wave of the recall. Kia fared even worse in the fourth wave of recalls in 2020, when its accruals rose by 70% to $2.47 billion. Accruals dropped back to $1.59 billion in 2021, and then more than doubled in 2022.

Tata's total accruals increased by 10.5%, to $1.1 billion. As we will see in Figure 4, this increase is explained away by an increase in revenue. In fact, the increase in revenue exceeded the increase in total accruals, since Tata's accrual rate went down. So the company saved money on warranty expenses overall during 2022.

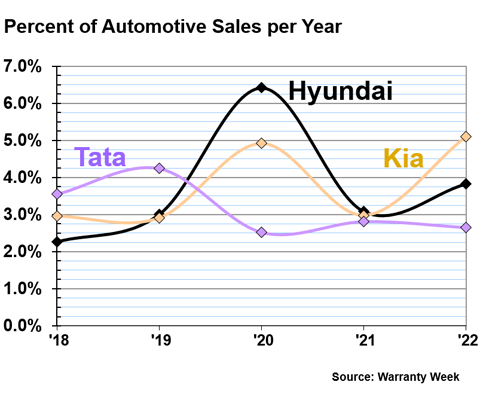

Warranty Accrual Rates

Figure 4 shows the accrual totals in Figure 3 divided by each company's total product sales revenue.

In the case of Hyundai and Kia, 2020 was a terrible year for their accrual rates, because of the double whammy of increased accruals due to the engine recalls, and lower revenue due to the pandemic. Hyundai's accrual rate has recovered since then, but Kia's went up even higher in 2022 due to the additional recall expenses.

Figure 4

Top Korean & Indian Auto Manufacturers

Warranty Accrual Rates

(as a percentage of sales, 2018-2022)

Hyundai's accrual rate increased by about a quarter from 2021 to 2022. In 2022, its accrual rate was 3.82%. Before the recall, Hyundai used to have accrual rates between 1% and 2%, believe it or not. But this rate is still not as bad as it was in 2020, when the combination of heightened accruals and lower revenue drove the accrual rate to 6.42%.

Kia's accrual rate increased by about three-quarters from 2021 to 2022. Kia's accrual rate in 2022 was a whopping 5.10%. The company usually averages around 3%.

Finally, some good news. Tata's accrual rate was 2.64% in 2022, down a little bit from the year prior, and down a lot from its typical rates between 3% and 4%.

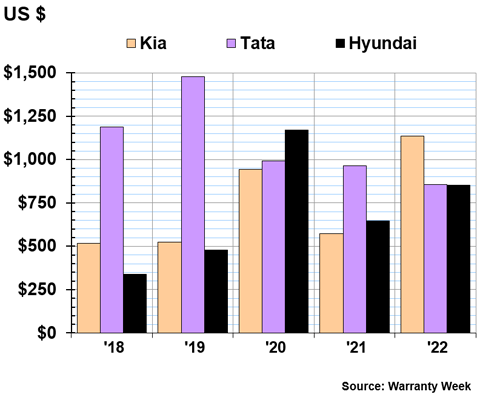

Accruals per Vehicle Sold

Hyundai, Kia, and Tata all conveniently provide statistics on the total number of vehicles they sell in a year. Using these data and the accrual totals shown in Figure 3, we calculated the average amount in U.S. dollars that each company accrued per each vehicle sold.

Yes, we know that Tata also makes buses and trucks. But Tata is a special case, because it also makes luxury vehicles under the Jaguar and Land Rover models, which are much more expensive than its other passenger car offerings. So we won't compare Tata's accruals per vehicle sold to Hyundai's and Kia's, but it is certainly a metric worth analyzing compared to Tata's own past data.

Figure 5

Top Korean & Indian Auto Manufacturers

Accruals Made per Vehicle Sold

(in U.S. dollars, 2018-2022)

The good news is that Figure 5 confirms that Tata has made great strides in mastering its warranty expenses in recent years. The company accrued just $856 per vehicle in 2022. In comparison, it was accruing over $1,000 per vehicle from 2016 to 2019, and still above $950 per vehicle in 2020 and 2021.

Tata also saw a decrease in its total claims, claims rate, and accrual rate in 2022. So overall, it was a great year for the company's warranty department.

From the acquisition of Jaguar Land Rover back in 2008 until 2019, Tata accrued exceedingly more money per vehicle than either Hyundai or Kia. In 2022, it was at the middle of the pack. That, unfortunately, is not just due to good news for Tata. It's also the result of Kia and Hyundai's accruals per vehicle soaring in the past five years.

In 2018, at the beginning of our five-year frame, Hyundai accrued just $337 per vehicle. Until 2016, that number was even lower, staying below $250 per vehicle. In 2020, the metric peaked at $1,171 per vehicle. In 2022, Hyundai was still accruing $853 per vehicle.

Kia has a similar story. Kia's accruals per vehicle stayed below $400 until 2017. Kia's accruals per vehicle peaked in 2022, when the company accrued $1,137 per vehicle.

So overall, it's safe to say that the early days of this engine recall hit Hyundai harder, but Kia has had more issues recently, especially in 2022.

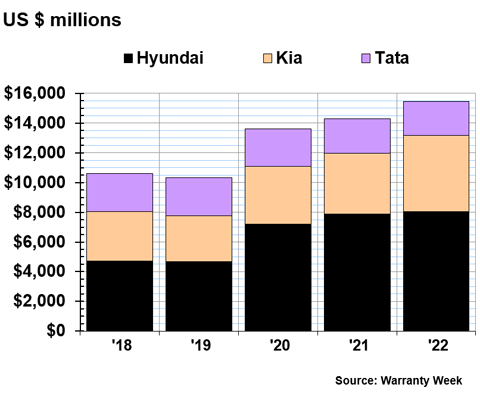

Warranty Reserve Balances

Our final metric is the balance in the warranty reserve fund reported at the end of each company's past five fiscal years.

Figure 6

Top Korean & Indian Auto Manufacturers

Reserves Held at Year's End

(in billions of U.S. dollars, 2018-2022)

Hyundai still accounts for the largest share of the reserves between the three companies. Hyundai held $8.05 billion in its reserve fund at the end of 2022.

Kia added almost $1 billion to its reserve fund in 2022, an increase of 27%. Its year-end balance was $5.14 billion.

Tata's reserve balance has been shrinking a bit over the past five years. At the end of fiscal 2022, the company held $2.25 billion in warranty reserves.

Announcing the all-new agenda covering all the topics you have asked for! This year The 14th Annual Extended Warranty & Service Contract Innovations National Forum is moving to Chicago on October 17-18, 2023, at the Palmer House Hilton. This highly acclaimed, cross-industry event covers innovations in customer service, new product development, data & technology, operations, marketing & sales, legal & regulatory, finance & insurance.

Register today at: www.warrantyinnovations.com. Use Our Special Discount Code WW300 for $300 off!

This conference is proclaimed to be the ONLY conference to meet who's who decision makers in the extended warranty and service contract industry. Plus, it is consistently rated as the number one conference for quality content and expert speakers.

Join us for in-depth case study solutions, vibrant panel discussions, industry-specific roundtables, and the ever popular news flash sessions including:

Exclusive Conference Bonus Features:

Industry News Flashes: Auto, Mobile/Electronic, Home/Appliance

- Eric Arnum, Publisher, Warranty Week

Talent Management and Recruiting: Strategies to Overcome Labor Shortages & Diversity Challenges and the Impact of an Aging Workforce

- Angie Breedlove, Executive Director, Women of Warranty; Co-Founder and CRO, Xcelerator Group

Exclusive Research Results: Product Protection -- Predictions and Analysis

- Scott Sherrod, Founder, Warranty Design

Find the full agenda here. See you there!