Chinese EV Warranty Expense Rates:

The Chinese electric vehicle market is growing rapidly, and four new companies have come onto the scene in just the last five years. All of them have accrual rates much higher than their claims rates, meaning they're erring on the side of caution, a wise approach to warranty expenses for new manufacturers.

If all goes according to plan, every new vehicle sold twenty years from now will be electric. It will probably take a few more decades for the majority of cars on the road to be electric, and implementation will undoubtedly vary globally. Right now, almost all of the traditional internal combustion engine vehicle (ICE) OEMs have at least one electric vehicle (EV) in its lineup. Though some are further along in this transition than others, much like Bob Dylan in 1965, the automotive world is going electric.

Electric vehicles have already been around for a couple of decades, mainly made by smaller start-ups. Two of the pioneers in that field, Tesla in the United States and BYD in China, have grown into huge, highly successful manufacturers large enough to challenge the traditional OEMs. In the past five years, we've seen dozens of new EV manufacturers come onto the scene, and many of them have begun to report their warranty expenses. So this and next week, we are taking a look at the warranty costs of these relatively new, EV-only manufacturers.

For this report, we identified 20 manufacturers of electric vehicles. Of them, 13 report their warranty expense data in their annual reports and quarterly financial statements. This week, we are focusing in on the five Chinese EV-only manufacturers on the list, and next week, we will highlight the other 15 U.S.-based companies, of which eight report their warranty expense data.

First, we identified four EV-only manufacturers based in China: BYD Company Ltd., Li Auto Inc., Nio Inc., and XPeng Inc..

We also found one Swedish manufacturer, Polestar Automotive Holding UK PLC, which is owned by the Swedish Volvo Cars, which in turn is owned by the Chinese Geely Holding Group. Polestar is headquartered in Sweden, and its cars are manufactured in China; similar to Volvo Cars, Polestar reports its revenue and warranty expenses separately from Geely Auto.

These five companies all report their warranty expenses on an annual basis. The four China-based companies report their annual warranty expenses in Chinese yuan, while Polestar reports in U.S. dollars.

For each of these five manufacturers, we perused their annual financial reports, and extracted three warranty metrics: total claims paid, total accruals made, and the balance of the warranty reserve fund at the end of each year. We also gathered data for each company's total automotive sales revenue, and used those data to calculate our two expense rates: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

Since these companies vary in size, and report in different currencies, we will be focusing on the claims and accrual rates in these newsletters rather than the totals.

Keep in mind that these EV start-ups are nowhere near the same scale of warranty expenses as the traditional ICE vehicle manufacturers. Even Tesla, the largest of the 20 EV manufacturers, has quarterly warranty expenses in the millions, while the traditional OEMs deal in the billions.

BYD

First we're taking a look at BYD, by far China's largest EV-only manufacturer.

BYD, short for "Build Your Dreams," was founded back in 1995, and makes plug-in hybrids as well as fully electric vehicles. It used to make ICE vehicles but seems to have phased them out completely. While the majority is Chinese-owned, note that Berkshire Hathaway owns about 10% of BYD.

The vast majority of BYD's vehicles are sold in China, but it also exports cars to Germany, Norway, and Denmark.

BYD has a larger international presence with its fleets of electric buses, which it has sold in the United States, Canada, Japan, Brazil, and throughout Europe. It seems that BYD supplied the city of Albuquerque, New Mexico with a fleet of electric buses, but the contract was terminated in 2019 after many of the buses malfunctioned. Outside of China, BYD has factories in California, United States and Ontario, Canada, as well as Hungary, France, Brazil, and India.

BYD has also submitted a proposal to build a monorail for the Sepulveda Transit Corridor Project in Los Angeles, California, but it isn't the favored proposal. BYD has built monorails and trams in China, and another is under construction in São Paulo, Brazil. BYD will likely continue to make these forays into U.S. public transit systems, which have government incentives to electrify. Of course, it is extremely difficult for BYD and its compatriots to export passenger cars to the United States.

BYD claims that last year, it surpassed Tesla as the world's top EV-only manufacturer based on passenger car unit sales, but these sales figures included BYD's plug-in hybrids, which are not fully electric. BYD sold about 900,000 EVs and 950,000 plug-in hybrids in 2022.

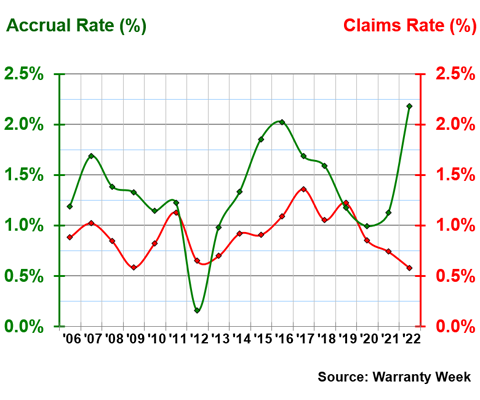

Figure 1 shows BYD's annual warranty claims and accrual rates from 2006 to 2022.

Figure 1

Electric Vehicle Manufacturer Warranties:

BYD, Claims and Accrual Rates,

(as % of product revenue, 2006-2022)

In 2022, BYD had an accrual rate of 2.18%, and a claims rate of 0.58%. BYD's accrual rate nearly doubled from 2021 to 2022, while its claims rate fell by about a fifth.

In all of its years of reporting warranty expenses, BYD has never paid more than 1.5% of its vehicle sales revenue in claims. The company seems to be doing a decent job of accruing for future warranty costs as well, though the accrual rate did fall below the claims rate in 2012, and very slightly again in 2019. It seems to make up for these dips by increasing accruals in these cyclical patterns, then letting them wane as the reserve balance depletes a little bit, then back to accruing more than is spent again.

At the end of 2022, BYD held CN¥7.55 billion Chinese yuan in its warranty reserve fund, equal to about $1.12 billion U.S. dollars based on the IRS's Yearly Average Currency Exchange Rates.

Generally, the global automotive manufacturers have claims and accrual rates between 2% and 3%. BYD is below average, which in this case is great news. This means that BYD is generally spending a smaller-than-typical portion of its sales revenue on warranty expenses. This trend is especially apparent with the claims rate, which has stayed around 1%, though the accrual rate also usually falls at or below 2%.

Nio

Our next company is Nio Inc. Nio was founded in 2014, and currently makes eight luxury EVs, including a sports car, a few sedans, and mid- and full-size SUVs, all sold in China.

Nio is pioneering battery swapping technology, where users can simply drive up to a battery swap station, have the dead electric battery removed from the car, and have a fully charged one installed in above five minutes. This differs from traditional EV charging, where users often have to wait for at least an hour for a full charge, though there are some "superchargers" that are much faster. Not all EV batteries are swappable, and this is unique technology. There are a few small startups in U.S. trying to implement battery swapping, but at nowhere near the same scale as Nio.

Nio has over 1,300 battery swap stations located throughout China, and its first swap station in Europe opened in Norway in May 2022. It also has over 2,000 EV charging stations in China, about half of which are superchargers.

In addition to Norway, the company also currently sells three of its EVs in Germany, the Netherlands, Sweden, and Denmark, with plans to expand into 25 countries by 2025.

Nio sold a total of about 120,000 vehicles in 2022, all fully electric. By comparison, it only sold 11,000 in 2018, its first year of production.

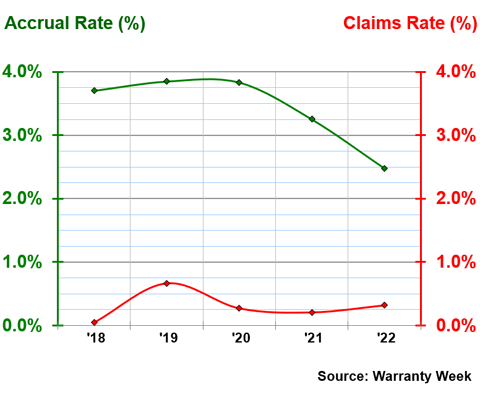

Figure 2 shows Nio's warranty claims and accrual rates from 2018 to 2022. This chart is especially emblematic of the trend that defines this report, with the accrual rate significantly higher than the claims rate, which is well below the automotive industry's average claims rate.

Figure 2

Electric Vehicle Manufacturer Warranties:

Nio, Claims and Accrual Rates,

(as % of product revenue, 2018-2022)

In 2022, Nio had a claims rate of 0.32%, and an accrual rate of 2.48%. This was actually a fairly significant decrease in accruals, which peaked at 3.85% of total vehicle sales revenue in 2019.

Since 2018, Nio has not spent more than 0.7% of its unit revenue on paying claims, but the company is clearly erring on the side of caution here, and continues to accrue a much higher proportion of its income for possible future warranty costs.

With a company this young, this is probably wise, especially because a major issue with EV batteries can be charging capacity drop-off after the first two years of use. However, Nio's battery swap model likely combats much of that issue, and time has not revealed any major issues with its batteries or vehicles thus far.

Li Auto

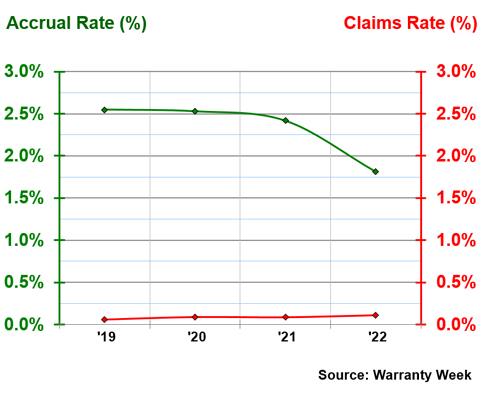

We see the same phenomenon in Figure 3 with Li Auto, which has accrual rates that, while a bit lower than Nio's, are still much higher than its claims rates.

Figure 3

Electric Vehicle Manufacturer Warranties:

Li Auto, Claims and Accrual Rates,

(as % of product revenue, 2019-2022)

Li Auto was founded in 2015, and makes about four luxury electric SUVs. It began auto sales in 2019, when it sold just 1,000 vehicles. In 2022, Li Auto sold about 130,000 vehicles, around the same annual market share in China as Nio.

In 2022, Li Auto had its highest-ever claims rate, a laughably low 0.11%. This means that Li Auto paid a microscopic fraction of its vehicle sales revenue on warranty claims. By contrast, Li Auto had an accrual rate of 1.82% in 2022.

Though there isn't as dramatic of a gap between the claims and accrual rates, the trend is clear, with accruals a much higher proportion of product revenue than claims. Despite low claims, the companies are still accruing money per vehicle, seemingly just in case something goes wrong.

XPeng

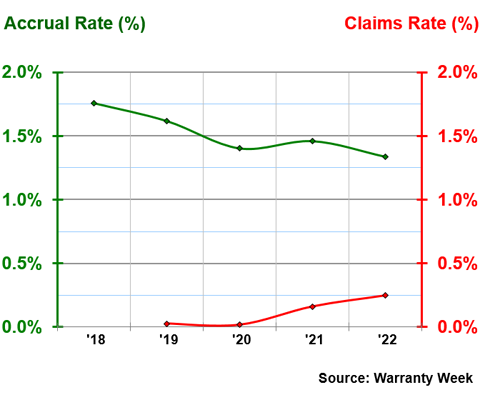

Our next company is XPeng Inc., which is also accruing much more than it is paying in claims.

XPeng, short for Guangzhou Xiaopeng Motors Technology Co. Ltd., is named for the Chinese entrepreneur He Xiaopeng. XPeng makes five EVs, which are luxury sedans and SUVs. It sold about 120,000 vehicles in 2022.

In addition to China, XPeng sells some of its electric SUVs in Norway, though it doesn't seem to be as far along into entering the European market as its compatriots in this report.

Figure 4

Electric Vehicle Manufacturer Warranties:

XPeng, Claims and Accrual Rates,

(as % of product revenue, 2018-2022)

In 2022, XPeng had a claims rate of 0.25%, and an accrual rate of 1.33%. This is a smaller difference between the two expense rates, but the trend still holds that the accrual rate soars above the claims rate on this chart.

XPeng only reported its accrual total in 2018, its first year of reporting. The next year, it did report paying some claims, but those totals were so low that its claims rate was 0.03%. Its accruals have also been lower-than-average for the industry, staying below 2%. This rate has been falling recently, so it seems that XPeng isn't being quite as cautious as Nio or Li Auto. Yes, XPeng is still accruing much more than it's paying in claims, but the gap isn't quite as wide as it is for its competitors.

In the short-term that money is going to net revenue, rather than being put aside into the warranty reserve fund. Only time will tell which strategy was most effective, though they are all following a similar philosophy of accruing twice what you spend.

XPeng, Nio, and Li Auto all released their vehicle delivery numbers for July 2023 this Tuesday, August 1st. Li Auto led the pack with 34,000 vehicles, followed by Nio with 20,000, and then XPeng with 11,000. By comparison, BYD delivered 260,000 vehicles during the month, though that includes plug-in hybrids along with regular EVs. Apparently, a price war has been stoked in the Chinese EV market in order to compete with Tesla. Lower prices are likely driving sales, though the Chinese market has been relatively slow to grow since COVID lockdowns were lifted last year.

It remains to be seen how these increased sales volumes will affect these companies' warranty claims rates. But even BYD, the only one of the four in business for over a decade, has never seen its claims rate drop below 1.5%. Li Auto's 0.11% claims rate just seems impossibly low, but so does does Nio's 0.32% and XPeng's 0.25%.

Polestar

The final company of this first part of our EV warranty report is technically Chinese-owned, but headquartered in Sweden, and reporting separately from its parent company. Polestar was founded in 1996 as a Swedish car racing team. Volvo began working with Polestar in the late 2000s, and eventually acquired the company in 2015. By then, Volvo Cars was already owned by the Geely Group, also the owner of the Chinese Geely Auto.

In 2017, Geely announced that Polestar would be a stand-alone brand separate from Volvo, focused specifically on electric cars. So far, Polestar has only released two EVs, one of which has been discontinued.

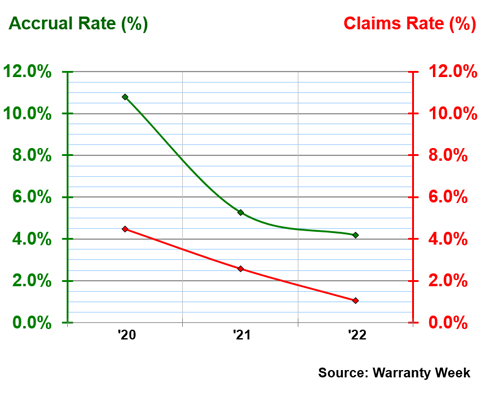

As such, we only have three years of data available for Polestar. While we see that the claims rate still falls well below the accrual rate, both rates are in a much higher range than we have seen from the Chinese EV manufacturers.

Figure 5

Electric Vehicle Manufacturer Warranties:

Polestar, Claims and Accrual Rates,

(as % of product revenue, 2020-2022)

In 2022, Polestar had a claims rate of 1.05%, and an accrual rate of 4.18%. These rates are more in line with what is typical for a European auto OEM, though the trend of the accrual rate much higher than the claims rate persists.

Polestar had its highest claims and accrual rates in 2020, but this was due to low revenue during the pandemic, rather than high warranty costs. Claims totals have remained fairly consistent, but the company has still been gradually increasing accruals over the three years. Still, these accruals are a smaller proportion of revenue due to higher sales, so the accrual rate has been falling.

Overall, Polestar was the only one of the five Chinese companies to have its claims rate exceed 1% in 2022. By contrast, we usually see claims rates around 2.5% for the automotive industry as a whole, including ICE vehicles.

Of the five, BYD was the only one to have its claims and accrual rate lines cross. BYD is also the most well-established of these five. But its claims rates haven't varied too much, compared to the accrual rates.

For the four companies not even a decade old, it makes sense to keep accruals so much higher than claims, because the technology and vehicles are still new. It doesn't hurt to accrue some extra money just in case of a rainy day. Or rather, it hurts a lot more to be hit with a failure or recall for which there's no money put aside.

So while these five are perhaps still mastering the art of accruing funds for future warranty expenses, their claims rates have stayed consistently low. Is it possible that electric vehicles have lower rates of failure? Certainly, the issues that arise are different, and the lack of an engine eliminates a lot of parts that could possibly malfunction. Next week, we are going to take a look at these companies' U.S.-based counterparts, explore these trends further.