Worldwide Heavy Equipment Warranty Report:

In the global heavy equipment industry, warranty claims fell by -8% to $4.89 billion, and that total represented 1.04% of sales; accruals fell by -6% to $5.85 billion, and that total represented 1.24% of sales; and reserves fell by -4% to $10.4 billion.

As the year winds down, all of the annual data from last year has been released by the internationally reporting companies, even those with fiscal years that don't align with the traditional calendar year we use in the United States. So we can finally take a look back to the warranty expense and revenue numbers from the global heavy equipment industry, almost a year after those numbers were recorded.

What we refer to as "the heavy equipment sector" is a bit of a catch-all term. We're talking about the makers of construction equipment such excavators, bulldozers, backhoes, skid-steer loaders, graders, pavers, pipe-layers, compactors, and so on; as well as agricultural equipment such as tractors, rototillers, and earth augers; material handlers, such as cranes and forklifts; and even underground mining equipment. These are huge machines that can cost up to a million dollars, and even beyond, and are essential for so much of the heavy industry that keeps our world functioning.

We are tracking 52 heavy equipment manufacturers worldwide, of which 21 disclose their warranty expense data in their annual reports. We estimate that those 21 companies accounted for about 66% of global heavy equipment revenue, but 83% of the industry's total global warranty expenses in 2022.

Methodology

For each of the 21 companies that did report their warranty expenses in 2022, we examined their annual reports and extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, the amount of reserves held at the end of their fiscal year. We also collected data about each of the 21 companies' product revenue, which the revenue generated only from the sales of products that come with warranties; not the revenue generated from services, parts sales, T-shirt sales, etc.

Using the claims, accrual, and product revenue figures, we calculated two additional warranty metrics: claims as a percent of sales (the claims rate), and accruals as a percent of sales (the accrual rate).

Among those 21 companies, there are manufacturers reporting their expenses in dollars, euro, yen, won, yuan, and Swedish kronor. In order to compare these figures, we converted all of the numbers into U.S. dollars, using the IRS's Yearly Average Currency Exchange Rates table. As with our Worldwide Auto Warranty Report published earlier this year, we use the IRS exchange rates simply because they are reliable and released annually.

For the other 31 manufacturers, we needed to create estimates for their warranty expenses. Most of those companies are either privately-owned, or, in the case of some of the Chinese manufacturers, government-owned, and thus have no obligation to publicly publish their annual reports. For these cases, we gathered their revenue data from International Construction magazine's IC Yellow Table, which it publishes annually. The Yellow Table doesn't focus on warranty costs, but it does compile a list of the top 50 heavy equipment manufacturers worldwide, and rank them based on their revenue, which they call "Construction Equipment Sales (US$ millions)." As that title suggests, IC conveniently converts all of the revenue figures to U.S. dollars, though we do not know which conversion rates they use.

From there, we take a look at each manufacturer's Yellow Table revenue their primary market, and their closest competitors to create estimates for warranty claims, accruals, and reserves. As we mentioned earlier, the 31 companies for which we created estimates accounted for 34% of the total global industry's revenue in 2022. But we estimate that those 31 companies only accounted for 17% of the industry's total warranty expenses.

In Figures 1, 2, and 4 in this report, we present the top 11 manufacturers for each warranty metric, with the other 41 in the "Other" category. Of the top 11, we crafted estimates for three companies: Sany Heavy Industry Co. Ltd., Liebherr Group, and Xuzhou Construction Machinery Group (XCMG). And there are eight for which we have exact data: Deere & Company, more commonly known as John Deere; Caterpillar Inc.; Volvo AB, also known as Volvo Group, which is the parent company of Volvo Truck (no longer owns Volvo Car); Hitachi Ltd.; CNH Industrial N.V., which owns New Holland; Kubota Corp.; Komatsu Ltd.; and Doosan Group, which owns Bobcat. Doosan Bobcat, as it is commonly referred to, is not to be confused with Doosan Infracore, which was recently acquired by Hyundai Heavy Industries Group and renamed HD Hyundai Infracore; all three are on our list of companies, but only Doosan had large enough warranty expenses to be included in the charts.

Worldwide Claims Totals

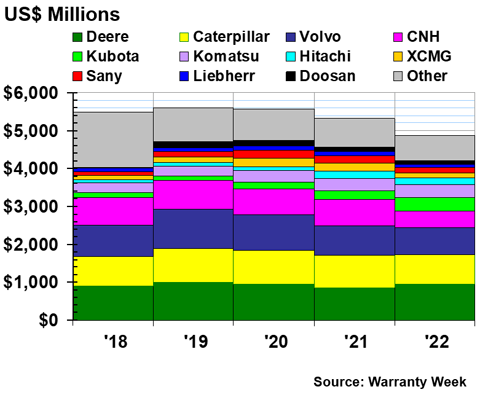

Our first warranty metric is the total amount of warranty claims payments the global heavy equipment industry made in 2022. Figure 1 shows the past five years of claims data, highlighting the top 11 manufacturers in the industry.

Figure 1

Top Heavy Equipment Makers Worldwide

Claims Paid per Year

(in US$ millions, 2018-2022)

Total claims fell in 2022, down -8% to $4.89 billion. Of that total, 83%, or $4.08 billion, are exact numbers taken from annual reports, and another $806 million comes from our estimates. This was the lowest claims total in five years, and the first time the total dipped below $5 billion since 2017.

Among these leaders in the industry, Deere was once again the largest claims payer, surpassing Caterpillar in the second position by a larger margin than we've seen in recent years. This is because Deere's total claims rose by 10%, to $951 million, while Caterpillar's claims fell by -9%, to $778 million.

In the third slot is Volvo AB (also known as Volvo Group), the parent company of Volvo Truck — as many of us are aware by now, Volvo Truck and Volvo Car have totally different parent companies, with Volvo Group retaining its heavy equipment divisions after selling Volvo Car to Ford back in 1999. Ford later sold Volvo Car to the Chinese Geely Group in 2010. More recently, in 2017, Geely also acquired an 8% stake in Volvo Group, becoming its largest shareholder by number of shares. Volvo Group spent $714 million on warranty claims in 2022, down -6% from the year prior. This is Volvo Group's lowest claims total in five years; the metric peaked for the company at $1.04 billion in 2019.

Next, we have CNH, the parent company of New Holland and Case IH. CNH's claims fell by -38% in just a year, to a total of $440 million. Kubota, in fifth, had an even larger move in the other direction; its claims rose by 51%, to a total of $347 million.

In sixth, we have Komatsu, which saw claims rise by 8% to $342 million. And in seventh is Hitachi, which saw claims fall by -7% to $179 million.

The next three companies, XCMG, Sany, and Liebherr, are those for which we crafted estimates for this report. We won't dwell on the numbers, but we estimate that claims fell for all three, following the larger industry-wide trend of claims totals falling in 2022. Of our top 11, only Deere, Kubota, and Komatsu saw their claims totals rise.

In the eleventh slot is Doosan Bobcat, which saw its claims total fall by -37% to $76 million.

We estimate that another $692 million in claims lives in the "Other" category, down by -9%. This is a combination of exact numbers and estimates.

Warranty Accrual Totals

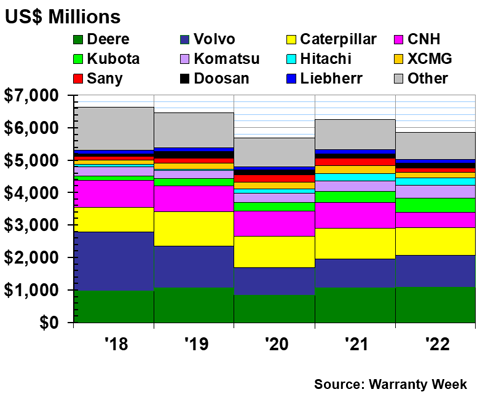

Our next metric is the total amount of warranty accruals each heavy equipment manufacturer made. Figure 2 shows the past five years of accrual data, highlighting the accruals of the 11 largest companies in the industry, in terms of their warranty expenses.

While warranty claims are something that happen to a company, accruals are something that the company chooses to do, typically based on a formula that calculates the warranty risk of each product sold. So these numbers in Figure 2 give us a better sense of each company's accounting and machinations, while Figure 1 gives us a sense of external factors happening to each manufacturer.

Figure 2

Top Heavy Equipment Makers Worldwide

Accruals Made per Year

(in US$ millions, 2018-2022)

Total accruals for the industry fell by -6% in 2022, to an estimated total of $5.85 billion. Of that total, 83%, or $4.89 billion, are estimates, while the remaining 17%, or $966 million, comes from our estimates.

As with claims, Deere made the largest amount of warranty accruals among the global heavy equipment manufacturers in 2022. Deere's accruals were up by just 2%, to a total of $1.09 billion.

In a twist, the second place slot for warranty accruals is occupied by Volvo Group, which rose its accruals by 10% to $973 million. On the other hand, Caterpillar's accruals fell by -9%, to $850 million, causing the two companies to switch positions compared to their rankings in 2021. While Caterpillar's accruals surpassed those of Volvo in 2020 and 2021, Volvo's accruals far exceeded those of Caterpillar in the several years prior.

Next, in the fourth slot is CNH, which dropped its accruals in a similar fashion to its drop in claims. CNH's warranty accruals fell by -41%, to a new total of $475 million. This is significantly lower than the company's average of about $800 million, which we observed in the rest of the five-year period of Figure 2.

Kubota, Komatsu, and Hitachi, and fifth, sixth, and seventh, respectively, all increased their warranty accruals in 2022. Kubota's accruals increased by 27% to $442 million; Komatsu's accruals increased by 20% to $388 million; and Hitachi increased its accruals by a mere 2%, to $225 million. Doosan, ranked tenth, decreased its accruals by -4% to a total of $136 million.

The numbers for XCMG, Sany, and Liebherr, in eighth, ninth, and eleventh, respectively, are our estimates. We estimate that accruals fell for all three companies, following larger industry-wide trends. As such, the total accruals in the "Other" category of Figure 2, which is a mix of hard numbers and estimates, also fell by -9%, to a total of $833 million.

Warranty Expense Rates

According to the IC Yellow Table, construction equipment revenue decreased by about -1% to $230.6 billion last year. By our estimates, warranty claims were down by -8%, and warranty accruals were down by -6% in 2022.

With revenue figures, we diverge a bit from the IC Yellow Table, because we count each company's total heavy equipment revenue — not just for construction equipment, but also for agricultural equipment, mining equipment, and in the case of a few companies such as Volvo Group, even for some on-highway trucks. This is because no manufacturers segment their warranty expense data in the same way that they segment revenue data, and we need to keep the scope wider to ensure all the numbers are describing the same thing.

On that basis, the pool of product revenue we're looking at is twice as large: $470.9 billion, which was up 5% from the 2021 total. This is the base number that we used in the denominator to calculate the claims and accrual rates for the industry as a whole. Anything else, such as an attempt to product a number just for construction equipment from our data (with warranty expenses not segmented by type of equipment), would involve high levels of conjecture on our part.

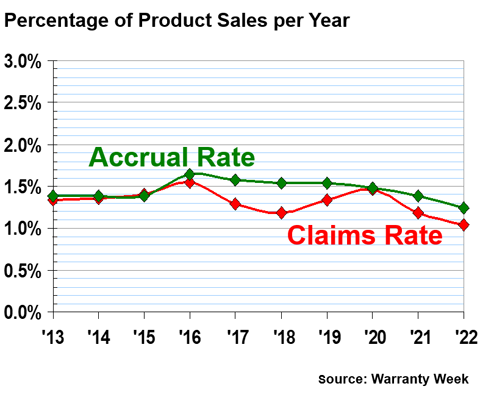

So what we see in Figure 3 is the an attempt to take the total claims from Figure 1, and the total accruals from Figure 2, and divide them by the total product revenue figures for the 52 heavy equipment manufacturers we're tracking worldwide.

Figure 3

Top Heavy Equipment Makers Worldwide

Average Warranty Claims & Accrual Rates

(as a % of product sales, 2018-2022)

In 2022, the worldwide heavy equipment manufacturers spent and average of 1.04% of their product revenue on warranty claims, and set aside an average of 1.24% of their product revenue for warranty accruals. Both of these percentages were down from the year prior.

So long as the industry continues to accrue more than it spends on claims, these numbers will remain healthy. And it's impressive that both metrics fell so low last year, meaning that the drops in claims and accrual totals weren't just the results of dips in business. Note that these metrics are much lower than they are for the passenger car industry, which has much more direct-to-consumer interaction; in that industry, both warranty expense rates average around 2.5% in the long term.

Of course, accruals exceeding claims leads to a surplus of money being set aside for potential future warranty claims costs. As such, the balances of warranty reserve funds have been gradually growing over time, as we will see in Figure 4 below.

Warranty Reserve Balances

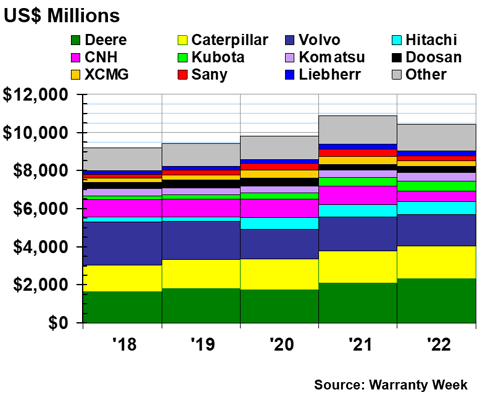

Our final warranty metric is the balance of each manufacturer's warranty reserve fund at the end of their fiscal year. We show the last five years of warranty reserve fund end balances for the heavy equipment industry in Figure 4.

We should note that some companies, such as Oshkosh Corp., end their fiscal year on September 30, while others, especially the Japanese companies such as Komatsu and Hitachi, end their fiscal years on March 31. In all cases, we simply time-shift their data to line up with the majority, who end their fiscal years on December 31. So the calendar year in which the majority of the fiscal year takes place is the one to which it is categorized (e.g., Hitachi's fiscal year with dates April 1, 2022 - March 31, 2023, is categorized as 2022).

Figure 4

Top Heavy Equipment Makers Worldwide

Reserves Held per Year

(in US$ millions, 2018-2022)

At the end of 2022, we estimate that the 52 manufacturers held $10.4 billion in their warranty reserve funds, down -4% from the year prior. Of that total, 83%, or $8.71 billion, is exact figures, while the remaining 17%, or $1.72 billion, is from our estimates. 2021 was the first year that this total exceeded $10 billion, and the total remained above that threshold in 2022. 2022 was the first year since 2015 that the industry-wide reserve balance fell.

Deere's reserves grew by 10% in 2022, to a year-end balance of $2.29 billion. Caterpillar, back to second rank for this metric, grew its warranty reserves by 4% to a total of $1.76 billion at the end of 2022.

Volvo, Hitachi, and CNH were the only three of the top eight to decrease the balance of their warranty reserve funds. Volvo decreased its reserve balance by -6%, to a total of $1.66 billion, and Hitachi's reserves decreased by just 0.5%, to $650 million. CNH had a much larger drop, but comparable to the drops in claims and accruals we saw in Figures 1 and 2. CNH's reserve balance fell by -45%, to a total of $544 million.

Kubota, Komatsu, and Doosan, all saw increases in their warranty reserve balances. Kubota increased its reserves by 19% to $544 million, Komatsu increased by 13% to $438 million, and Doosan increased by 12% to $330 million.

Based on industry trends — all of our warranty metrics decreased in 2022 — we estimate that XCMG, Sany, and Liebherr all decreased their warranty reserve balances.