U.S. Truck, Bus, & Heavy Equipment Warranty Expenses:

The industry set a new record high for total warranty claims paid in 2024, for the second year in a row, while total accruals made and reserves held both decreased from 2023. Paccar saw claims costs rise by 45%, a year after it nearly doubled its warranty accruals.

Last week, we presented 22-year charts showing the warranty expenses of the passenger vehicle industry, including manufacturers whose primary product lines are up to as large as a pick-up truck or ambulance. This week, we're looking at the warranty expenses of the U.S.-based truck, bus, and heavy equipment industry, which accounted for roughly one-eighth of all reported product warranty costs in the United States in 2024.

The manufacturers in this industry make a variety of large vehicles, including agricultural, mining, and construction equipment, on-highway trucks, recreational vehicles (RVs), coach buses, transit buses, school buses, tactical trucks, firetrucks, and tow trucks.

Keep in mind that this category only includes vehicle frame manufacturers, excluding powertrain manufacturers and tier 1 suppliers, such as Cummins and BorgWarner. This is because commercial vehicle warranties work differently than those for consumer vehicles. Components of on-highway heavy trucks and buses, such as the engine, transmission, or chassis, are typically sold separately, and thus come with discrete warranties attached to each vehicle element. It wouldn't be unusual for each of these components to be made by a different manufacturer, and covered under a different product warranty, within a single vehicle. We'll be taking a look at the warranty expenses of auto parts suppliers in an upcoming newsletter, as well as the relationship between OEMs and suppliers.

There were 21 U.S.-based truck, bus, and heavy equipment manufacturers that reported product warranty expenses in 2024: Deere & Co., Caterpillar Inc., Paccar Inc., Thor Industries Inc., AGCO Corp., Winnebago Industries Inc., Oshkosh Corp., Terex Corp., Rev Group Inc., Astec Industries Inc., Blue Bird Corp., Greenbrier Cos. Inc., Shyft Group Inc., Miller Industries Inc., Manitex International Inc., Workhorse Group Inc., Nikola Corp., Xos Inc., Hyliion Holdings Corp., Phoenix Motor Inc., and Rush Enterprises Inc.

Note that Manitex was acquired by the Japanese crane manufacturer Tadano Ltd. in early January 2025, so 2024 will be its last year of reporting in the United States. Lightning eMotors went into receivership in December 2023, and liquidated its assets in February 2024, but still reported some warranty expenses for 2024.

And Nikola Corp. filed Chapter 11 bankruptcy in February 2025, so 2024 is likely the final year of data for the manufacturer. Nikola's founder, Trevor Milton, was sentenced to four years in prison in December 2023 for defrauding investors, but was pardoned after donating millions to a certain presidential re-election campaign. Saudi Arabian Public Investment Fund-owned electric vehicle maker Lucid Group announced in April that it would be acquiring Nikola's Arizona-based manufacturing facilities. It was announced last week that Paccar would be placing a bid for Nikola's environmental credits. We'll keep an eye on that deal, and the fate of the other aspects of Nikola's business.

In total, we found 36 manufacturers that reported warranty expenses for some period between 2003 and 2024, though only 21 reported in 2024. These include Proterra Inc., which filed for Chapter 11 bankruptcy in mid-2023. Proterra's electric transit bus line was sold to Phoenix Motor, which is part of this newsletter, but its charging system business was acquired by private equity firm Cowen Equity, and its electric bus powertrain business was acquired by Volvo Group.

These data also include Navistar from 2003 until mid-2021, when it was acquired by Volkswagen Group's fully-owned subsidiary Traton SE, formerly known as Volkswagen Truck & Bus. In fact, Navistar has undergone a name change since the acquisition as well, and was officially rebranded as International Motors in October 2024.

This newsletter does not include data from Volkswagen, based in Germany, because our scope is specific to companies based in the United States, which publicly report their warranty expenses on a quarterly basis with the SEC. Similarly, this newsletter does not include data from Volvo Group, based in Sweden, although it has been the parent company of American brand Mack Truck since 2000.

To create this newsletter, we perused the annual reports and quarterly financial statements of the public, U.S.-based truck, bus, and heavy equipment manufacturers. We gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

We also gathered data for each manufacturer's segmented automotive sales revenue, excluding all revenue generated from service, extended warranty, financing, etc. We used these data to calculate our two warranty expense rates: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

Warranty Claims Totals

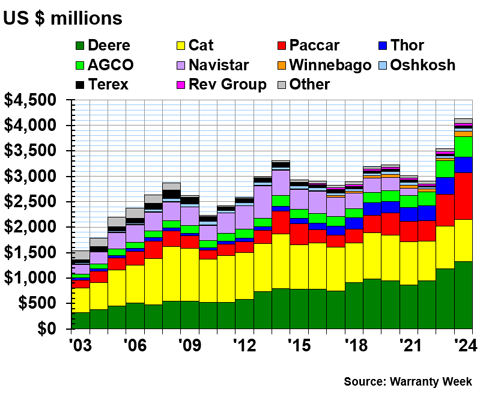

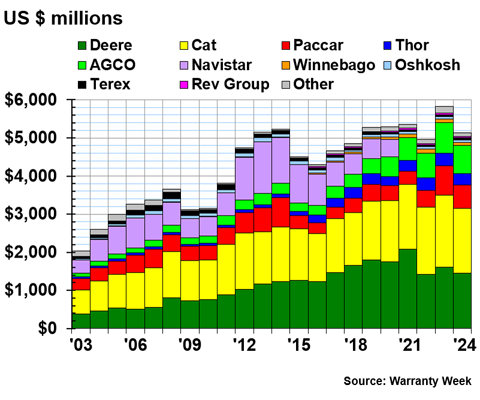

Figure 1 shows the warranty claims paid by the U.S.-based truck, bus, and heavy equipment manufacturers, highlighting the top ten with the largest warranty expenses.

Figure 1

U.S.-based Truck & Heavy Equip. Manufacturers

Claims Paid per Year

(in millions of U.S. dollars, 2003-2024)

In 2024, the truck, bus, and heavy equipment manufacturers paid $4.128 billion in warranty claims, a 15% increase from 2023. Similar to what we saw with the small vehicle manufacturers, the truck, bus, and heavy equipment industry set a new record high for the second year in a row.

In 2024, Deere paid $1.327 billion in claims, a 12% increase from the year prior. Rival heavy equipment manufacturer paid $824 million in claims in 2024, a -1% decrease. AGCO paid $401 million in claims, a 22% increase.

Paccar, on-highway truck manufacturer and owner of the Peterbilt and Kenworth brands, paid $918 million in claims, a rather dramatic 45% increase from 2023's total of $632 million. This was by far the largest amount that Paccar has ever paid in warranty claims in a single year. Paccar didn't provide an explanation in its annual report.

RV manufacturer Thor Industries paid $312 million in claims in 2024, a -5% decrease from the year prior. Winnebago Industries paid $104 million in claims, a 5% increase. And Rev Group paid $41 million in claims, a 22% increase from 2023.

Oshkosh Corp. paid $60 million in claims, a 17% increase from the year prior. Terex paid $49 million, a 12% increase.

In the "Other" category, hydrogen and electric truck manufacturer Nikola Corp. paid $36 million in warranty claims, a 814% increase from 2023's total of $4 million.

Concrete and asphalt paver manufacturer Astec Group paid $19 million in claims in 2024, a 44% increase. Freight railcar manufacturer Greenbrier Cos. paid $12 million in claims in 2024, a 19% increase. School bus manufacturer Blue Bird Corp. paid $9 million in claims, a -4% decrease.

Truck manufacturer Shyft Group, formerly known as Spartan Motors until June 2020, paid $4 million in claims in 2024, a -0.3% decrease from the year prior. Tow truck manufacturer Miller Industries paid $4 million in claims, a 19% increase. Commercial truck and bus retailer and dealership network Rush Enterprises paid $3 million in claims in 2024, in its first year of warranty reporting. Truck crane manufacturer Manitex International paid $2 million in claims in 2024, a -3% decrease.

Electric step van manufacturer Xos Inc., which makes delivery vehicles for UPS and FedEx, paid $2 million in claims in 2024, a 24% increase from the year prior. Medium-duty electric vehicle manufacturer Phoenix Motor paid $1 million in claims, a dramatic increase from 2023's total of just $36,000. Electric truck and drone manufacturer Workhorse Group paid $300,000 in claims in 2024, a -72% decrease. And electric vehicle manufacturer Hyliion paid $300,000 in claims as well, a 65% increase from 2023.

Warranty Accrual Totals

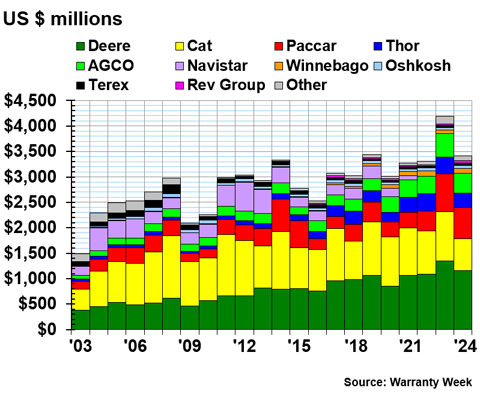

Figure 2 shows the warranty accruals made by each U.S.-based truck, bus, and heavy equipment manufacturer, from 2003 to 2024.

Figure 2

U.S.-based Truck, Bus, & Heavy Equip. Manufacturers

Accruals Made per Year

(in millions of U.S. dollars, 2003-2024)

The industry's accruals decreased in 2024, after a dramatic spike in 2023. In 2024, the truck, bus, and heavy equipment manufacturers set aside $3.412 billion in warranty accruals, a -19% decrease from the year prior.

Deere accrued $1.157 billion in 2024, a -14% decrease from the year prior. Caterpillar accrued $630 million, a -35% decrease. AGCO paid $396 million in claims, a -15% decrease.

Paccar accrued $616 million in 2024, a -17% decrease from 2023. Thor accrued $278 million, a -16% decrease. Winnebago accrued $85 million, a 26% increase. Rev Group accrued $45 million, a 35% increase.

Oshkosh Corp. accrued $67 million, a 29% increase. Nikola Corp. accrued $45 million, a -42% decrease. Terex accrued $39 million, a -3% decrease. Astec Industries accrued $19 million, a 6% increase. Greenbrier accrued $12 million, a 29% increase. Blue Bird accrued $10 million, an 8% increase.

Warranty Expense Rates

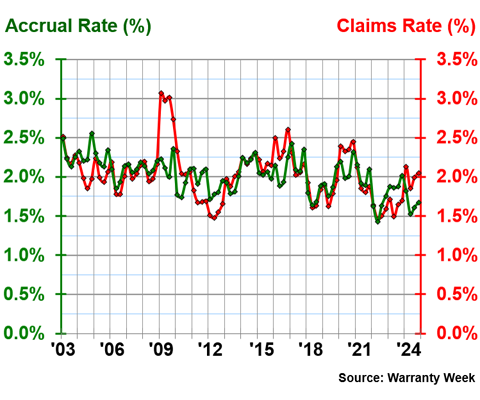

Figure 3 shows the industry-wide average warranty claims and accrual rates, from 2003 to 2024.

Figure 3

U.S.-based Truck, Bus, & Heavy Equip. Manufacturers

Average Claims and Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the average warranty claims rate for the truck, bus, and heavy equipment industry was 2.03%, with a standard deviation of 0.33%. and the average warranty accrual rate was 2.02%, with a standard deviation of 0.22%.

In 2024, the quarterly industry average claims rates ranged from 1.85% in the second quarter, to 2.13% in the first quarter. The average quarterly accrual rates ranged from 1.53% in the second quarter, to 1.82% in the first quarter.

Warranty Expense Rates of Individual Manufacturers

Figures 4 through 8 show the quarterly warranty claims and accrual rates of the largest manufacturers in the truck, bus, and heavy equipment industry, from 2003 to 2024.

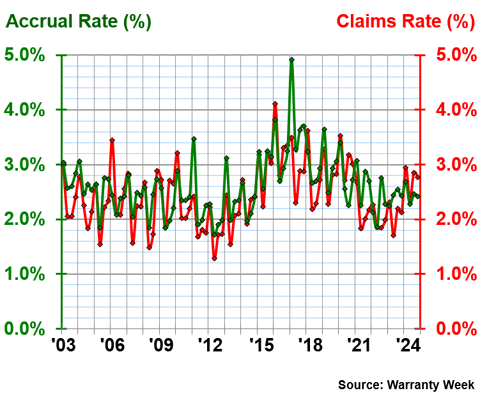

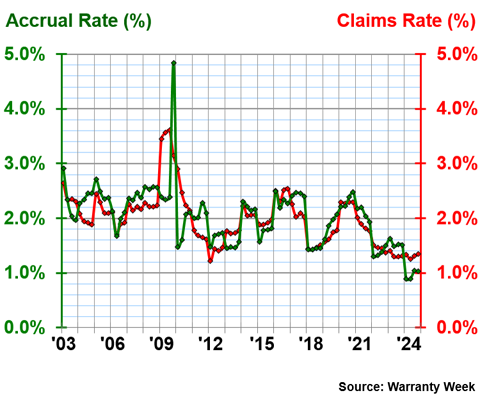

Figure 4 shows the warranty expense rates of Deere & Co.

Figure 4

Deere & Co.

Warranty Claims and Accrual Rates

(as a % of product sales, 2003-2024)

In 2024, Deere had an average warranty claims rate of 2.74%, and an average warranty accrual rate of 2.46%.

The company's claims rate peaked at 4.11%, in the first quarter of 2016, and its accrual rate peaked at 4.92%, in the first quarter of 2017.

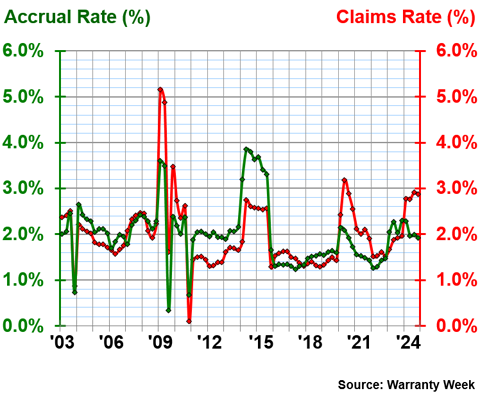

Figure 5 shows the quarterly warranty expense rates of Caterpillar.

Figure 5

Caterpillar Inc.

Warranty Claims and Accrual Rates

(as a % of product sales, 2003-2024)

In 2024, Caterpillar had a claims rate of 1.31%, and an accrual rate of 0.96%.

The company's claims rate peaked at 3.61%, in the third quarter of 2009, and its accrual rate peaked at 4.84%, in the fourth quarter of 2009.

Figure 6 shows the warranty expense rates of Paccar, from 2003 to 2024.

Figure 6

Paccar Inc.

Warranty Claims and Accrual Rates

(as a % of product sales, 2003-2024)

In 2024, Paccar had a warranty claims rate of 2.83%, and an accrual rate of 2.04%.

Paccar's claims rate peaked at 5.15% in the first quarter of 2009, and its accrual rate peaked at 3.86%, in the second quarter of 2014.

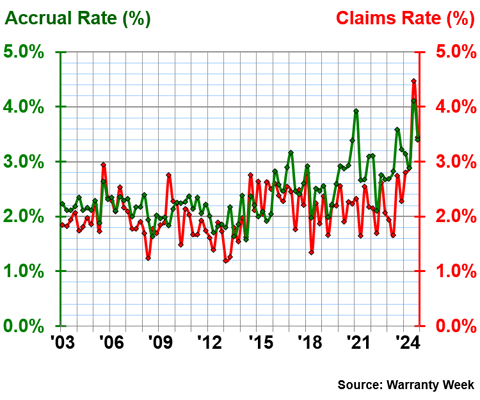

Figure 7 shows the warranty expense rates of AGCO, from 2003 to 2024.

Figure 7

AGCO Corp.

Warranty Claims and Accrual Rates

(as a % of product sales, 2003-2024)

In 2024, AGCO had a warranty claims rate of 3.40%, and a warranty accrual rate of 3.39%.

AGCO's claims rate peaked at 4.47% in the third quarter of 2024, and its accrual rate peaked at 4.11% in the same quarter. Clearly, AGCO spent a larger proportion of its product sales revenue on warranty in 2024, compared to previous years.

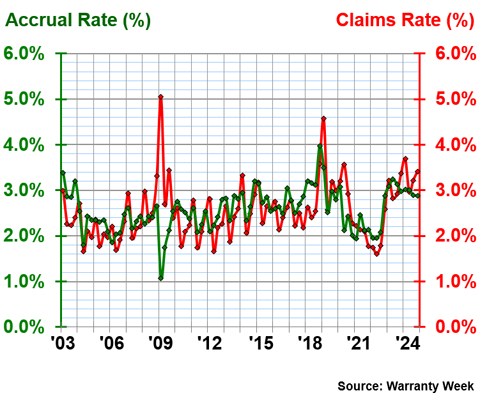

Figure 8 shows the warranty expense rates of Thor Industries, from 2003 to 2024.

Figure 8

Thor Industries Inc.

Warranty Claims and Accrual Rates

(as a % of product sales, 2003-2024)

In 2024, Thor had a claims rate of 3.32%, and an accrual rate of 2.95%.

Thor's claims rate peaked at 5.05%, in the first quarter of 2009, and its accrual rate peaked at 3.97%, in the fourth quarter of 2018.

Warranty Reserve Balances

Our final warranty metric is the year-end-balance of each manufacturer's warranty reserve fund. Figure 9 shows the total warranty reserves held by the U.S.-based truck, bus, and heavy equipment manufacturers, from 2003 to 2024.

Figure 9

U.S.-based Truck, Bus, & Heavy Equip. Manufacturers

Reserves Held per Year

(in millions of U.S. dollars, 2003-2024)

At the end of 2024, the truck, bus, and heavy equipment manufacturers held $5.133 billion in warranty reserves.

At the end of 2024, Deere held $1.454 billion in warranty reserves, a -10% decrease from the end of 2023. Caterpillar held $1.700 billion, a -10% decrease from the end of the year prior. AGCO held $743 million, a -7% decrease.

Paccar held $606 million, a -21% decrease. Thor held $301 million, a -10% decrease.

Winnebago held $73 million, a -21% decrease. Oshkosh Corp. held $73 million, a 13% increase. Terex held $54 million, a 13% increase. Rev Group held $42 million, an 8% increase.

Greenbrier held $24 million, a -1% decrease. Rush Enterprises held $19 million, a -13% decrease. Astec held $16 million, a -2% decrease. And Blue Bird held $16 million, a 6% increase.

Catch the rest of our series of 22-year charts:

- "Twenty-Second Annual Product Warranty Report"

- "New Home Builder Warranty Report"

- "U.S. Small Vehicle Warranty Expenses"