U.S. Small Vehicle Warranty Expenses:

For the second year in a row, the car & cycle industry set new record highs in total claims paid, total accruals made, and total reserves held. This time, there isn't one catastrophic event that explains it, such as a major recall; instead, the contributing factors seem to be little things, like small recalls, electrical failures, and price inflation for parts and repairs.

This week begins our weeks-long deep dive into the warranty expenses of the over 1,400 U.S.-based manufacturers that we track. In our "Twenty-Second Annual Product Warranty Report," we divided those companies into 18 industry groups across three sectors, all of which we'll cover in this series.

We're beginning with the sector with the largest product warranty expenses, vehicles, and the largest industry group therein, Cars & Cycles. Alternatively, we can think of this as the "small vehicle" category; generally, the largest vehicles that these companies make are ambulances, and pick-up trucks.

This industry includes the three large U.S.-based automakers, Ford, GM, and Tesla. Take a look at our recent newsletter "U.S. Auto Warranty Annual Reports" for a more in-depth view on the quarterly warranty expenses of these three manufacturers.

In addition to those three, we found 34 more U.S.-based car & cycle manufacturers that reported annual product warranty expenses between 2003 and 2024.

Of those 34, 15 reported warranty expenses in 2024: Rivian Automotive Inc., Polaris Inc., Lucid Group Inc., Toro Co., Harley-Davidson Inc., Hyster-Yale Inc., Malibu Boats Inc., Alamo Group Inc., Federal Signal Corp., MasterCraft Boat Holdings Inc., Marine Products Corp., Art's-Way Mfg. Co. Inc., Twin Vee PowerCats Co., Mullen Automotive Inc., and Faraday Future Intelligent Electric Inc.

These manufacturers make vehicles including: electric cars & vans, motorcycles, boats, all-terrain vehicles (ATVs), snowmobiles, riding lawn mowers, forklifts, and street sweeper vehicles.

To create this newsletter, we perused the annual reports of all U.S.-based car & cycle manufacturers, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund. In addition, we gathered data on each company's segmented product sales revenue, and used these to calculate two warranty expense rates: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

Note that the warranty expenses of American automaker Chrysler are not included in this report. Although Chrysler was founded in the United States, it was owned by Daimler from 1998 to 2007, and was later acquired by Fiat in 2014. Fiat Chrysler Automobiles merged with Peugeot in 2021 to form Stellantis, which is based in the Netherlands. Stellantis, which owns Chrysler, Jeep, and Dodge, reports its warranty expenses in Euro once per year; take a look at last year's newsletter "European Automaker Warranty Expenses" for more details on the warranty expenses of Fiat Chrysler and Stellantis.

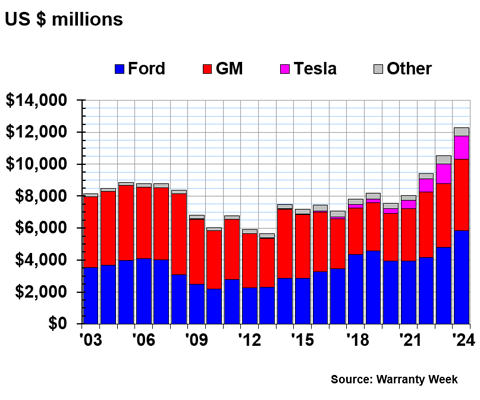

Warranty Claims Totals

We're not going to get too deep into the warranty problems of Ford, Tesla, and GM in this newsletter, since we've done several articles dedicated to that very topic fairly recently, including: February 27, 2025's "U.S. Auto Warranty Annual Reports," August 29, 2024's "Mid-Year U.S. Auto Warranty Report," and February 8, 2024's "U.S. Auto Warranty Annual Reports." We'll mention their numbers, but reference those articles for in-depth explanations of the fluctuations of the three automakers' warranty expenses in recent years.

First, we'll take a look at the total warranty claims paid by the cars & cycles manufacturers, from 2003 to 2024, shown in Figure 1.

Figure 1

U.S.-based Auto Manufacturers

Claims Paid per Year

(in millions of U.S. dollars, 2003-2024)

In 2024, Ford paid $5.831 billion in warranty claims, a 22% increase from 2023. This was a new record high for annual claims paid for Ford, firmly breaking the previous record (2023) by over $1 billion.

In 2024, General Motors paid $4.474 billion in claims, a 12% increase from 2023. Tesla paid $1.453 billion, a 19% increase from the year prior.

Polaris Inc., manufacturer of ATVs, snowmobiles, motorcycles, quadricycles, and military off-road vehicles, paid $151 million in warranty claims in 2024, a -25% decrease from 2023. Toro Co., maker of lawn mowers, utility vehicles, snow blowers, and irrigation systems, paid $88 million in claims in 2024, a 4% increase from the year prior. Motorcycle manufacturer Harley-Davidson paid $64 million in claims, a -5% decrease.

Electric vehicle manufacturer Rivian Automotive Inc. paid $68 million in warranty claims, in the company's second year of reporting its warranty expenses. That's an 89% increase from 2023's total of $36 million. Fellow EV manufacturer Lucid Group Inc. paid $54 million in claims, a 6% increase from the year prior. 2024 was Lucid's third year of reporting warranty expenses.

Forklift manufacturer Hyster-Yale Inc. paid $34 million in claims, a 26% increase. Malibu Boats Inc. paid $27 million in claims, an 8% increase. Rival boat maker MasterCraft Boat Holdings Inc. paid $12 million in claims, a -22% decrease from the year prior.

Alamo Group Inc., maker of lawn mowers, vacuum trucks, compact utility loaders, and equipment used for industrial landscaping, forestry, roadside maintenance, and highway safety, paid $16 million in warranty claims in 2024, a 30% increase from the year prior. Street sweeper, emergency vehicle equipment, vacuum excavator, and power washer manufacturer Federal Signal Corp. paid $8 million in claims, a 6% increase. And boat manufacturer Marine Products Corp. paid $4 million in claims, a 0.4% increase from the year prior.

Art's-Way Mfg. Co. Inc., Twin Vee PowerCats Co. and Faraday Future Intelligent Electric Inc. each paid less than half a million dollars in warranty claims in 2024.

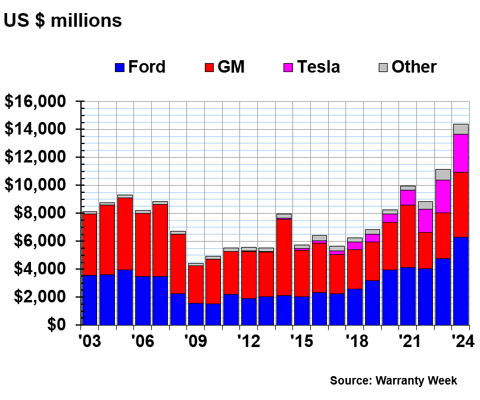

Warranty Accrual Totals

Figure 2 shows the total warranty accruals made by the car & cycle manufacturers, from 2003 to 2024.

Figure 2

U.S.-based Auto Manufacturers

Accruals Made per Year

(in millions of U.S. dollars, 2003-2024)

In 2024, Ford set aside $6.294 billion in warranty accruals, a 33% increase. This is by far a new record high, $1.55 billion above the previous record holder (2023). Two record-breakingly expensive years of warranty costs in a row, with no major recall, definitely spells trouble for the automaker.

In 2024, GM accrued $4.618 billion, a 41% increase from the year prior. Tesla accrued $3.730 billion, a 17% increase from 2023.

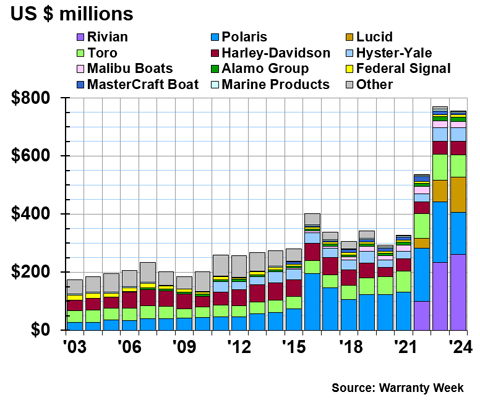

Since we're attempting to highlight the smaller U.S.-based car & cycle manufacturers in this newsletter, Figure 3 zooms in on the "Other" category in Figure 2. Figure 3 shows the warranty accruals of the U.S.-based car & cycle manufacturers from 2003 to 2024, excluding Ford, GM, and Tesla.

Figure 3

U.S.-based Auto Manufacturers: Excluding Top Three

Accruals Made per Year

(in millions of U.S. dollars, 2003-2023)

Rivian set aside $261 million in warranty accruals in 2024, a 12% increase from 2023. Polaris accrued $145 million in 2024, a -31% decrease. Lucid accrued $120 million, a 63% increase. And Toro accrued $77 million, a -15% decrease.

Harley-Davidson accrued $47 million, a 4% increase. Hyster-Yale accrued $47 million, a 3% increase. Malibu Boats accrued $22 million, a -12% decrease. Alamo Group accrued $15 million, an 8% increase. Federal Signal Corp. accrued $8 million, a 6% increase. MasterCraft Boat accrued $7 million, a decrease of -46%. And Marine Products Corp. accrued $4 million, a -37% decrease.

Warranty Expense Rates

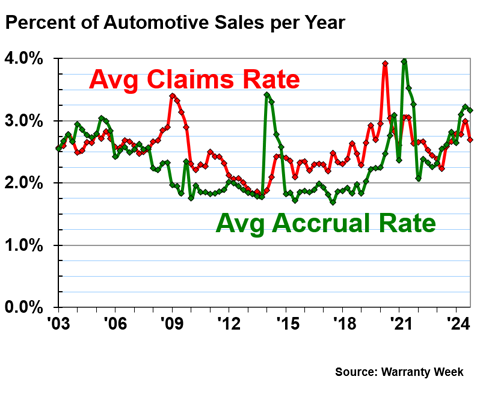

Figure 3 shows the average warranty claims and accrual rates across the car & cycle industry group, on a quarterly basis from 2003 to 2024.

Figure 4

U.S.-based Auto Manufacturers

Average Claims and Accrual Rates

(as a % of product sales, 2003-2024)

Over 22 years, the average warranty claims rate for the U.S.-based car & cycle industry was 2.54%, with a standard deviation of 0.35%, and the average accrual rate was 2.34%, with a standard deviation of 0.50%. Those standard deviations are on the higher side, meaning that these values fluctuate more drastically in the car & cycle industry than they do in many of the other industry groups we track.

In the first quarter of 2024, the average claims rate was 2.79%, and the average accrual rate was 2.64%. In the second quarter, the average accrual rate rose drastically, to 3.10%, while the claims rate stayed about the same, at 2.78%.

In the third quarter, the average claims rate rose to 2.99%, and the average accrual rate rose to 3.22%. And in the fourth quarter, both expense rates fell slightly, with the average claims rate at 2.70%, and the average accrual rate at 3.17%.

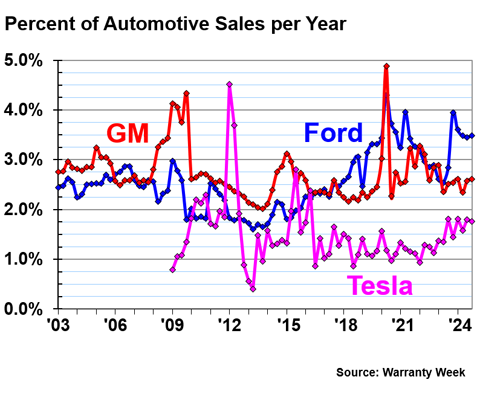

Figure 5 shows the quarterly warranty claims rates of the three largest companies in this report, Ford, GM, and Tesla, from 2003 to 2024.

Figure 5

U.S.-based Auto Manufacturers

Warranty Claims Rates

(as a % of product sales, 2003-2024)

Ford's quarterly claims rates in 2024 ranged from 2.45% in the third quarter, to 3.60% in the first quarter.

GM's claims rates in 2024 ranged from 2.34% in the second quarter, to 2.61% in the first quarter.

Tesla's claims rates in 2024 ranged from 1.58% in the second quarter, to 1.81% in the first quarter

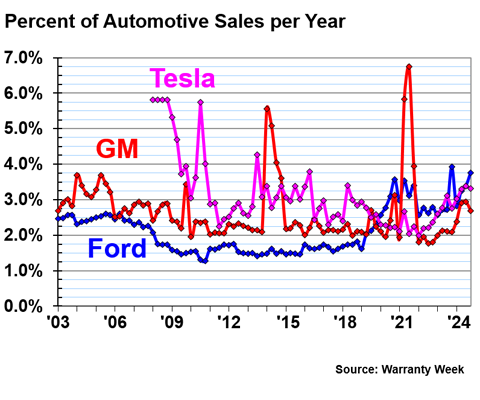

Figure 6 shows the three automakers' quarterly warranty accrual rates, from 2003 to 2024.

Figure 6

U.S.-based Auto Manufacturers

Warranty Accrual Rates

(as a % of product sales, 2003-2024)

Ford's accrual rates in 2024 ranged from 2.82% in the first quarter, to 3.76% in the fourth quarter. That's quite a wide range to span in less than a year.

GM's accrual rates ranged from 2.38% in the first quarter, to 2.94% in the third quarter.

Tesla's accrual rates in 2024 ranged from 3.02% in the first quarter, to 3.38% in the third quarter.

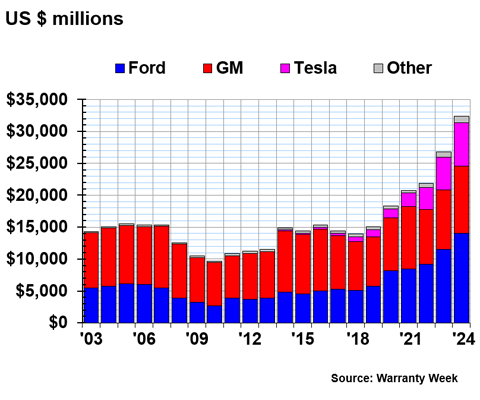

Warranty Reserve Balances

Figure 7 shows the year-end-balances of the warranty reserve funds of all of the U.S.-based car & cycle manufacturers, from 2003 to 2024.

Figure 7

U.S.-based Auto Manufacturers

Reserves Held per Year

(in millions of U.S. dollars, 2003-2024)

Similar to what we saw with claims in Figure 1, and accruals in Figure 2, Figure 7 shows that the car & cycle set a new collective record high for total warranty reserves held at the end of 2024. It's been two record-breaking years in a row for this industry; warranty spending keeps increasing for the small vehicle manufacturers.

At the end of 2024, Ford held $14.032 billion in warranty reserves, a 22%, or $2.5 billion, increase from the year prior. GM held $10.571 billion, a 14%, or $1.3 billion, increase. And Tesla held $6.716 billion, a 30%, or $1.6 billion, increase from the end of the year prior.

Rivian held $473 million at the end of 2024, a 72% increase from the year prior. Lucid held $112 million, a 144% increase from 2023's year-end total of $46 million.

At the end of 2024, Toro held $150 million in warranty reserves, a 4% increase from the end of the year prior. Polaris held $111 million in reserves, a -39% decrease. Hyster-Yale held $87 million, a 28% increase. Harley-Davidson held $72 million, a 12% increase.

Malibu Boats held $36 million in reserves at the end of 2024, a -12% decrease. MasterCraft Boat held $25 million, a -19% decrease. Alamo Group held $10 million, a -12% decrease. Federal Signal Corp. held $10 million, a 2% increase. And Marine Products Corp. held $6 million, a -12% decrease.