U.S. Truck & Heavy Equipment Warranties:

Warranty claims, accruals, and reserves all hit new collective record highs in the truck & heavy equipment industry during 2023. Warranty costs increased for most due to inflation, but for a few, costs rose significantly higher than even the most pessimistic U.S. dollar inflation rates. Paccar almost doubled its accruals from 2022 to 2023, indicating that perhaps warranty-related strife is in its near future.

This week continues our odyssey through the details of the industry totals presented in our "Twenty-first Annual Product Warranty Report." We're continuing this series with an exploration of the product warranty costs of the U.S.-based truck, bus, and heavy equipment manufacturers.

Trucks and heavy equipment manufacturers generate the second-largest amount of product warranty expenses in the United States, after the passenger car industry, which we assessed in our last newsletter, "U.S. Small Vehicle Warranty Expenses." In 2023, the truck, bus, and heavy equipment manufacturers accounted for 13% of all product warranty claims costs of U.S.-based companies, 15% of warranty accruals, and 11% of warranty reserves.

We keep this category name a little broad, in order to encompass the diverse product lines of the top companies that fall into this industry grouping. These manufacturers make large commercial vehicles, including on-highway trucks, buses, and recreational vehicles (RVs), along with heavy equipment used for agriculture, construction, mining, and adjacent heavy industries.

However, while the category is broad, it does not include manufacturers that produce only powertrain or drivetrain components, such as Cummins. This is because commercial vehicle warranties work differently than those for consumer vehicles; components of heavy trucks, for example, are often sold separately, and come with discrete warranties. So one truck could theoretically have a vehicle shell, chassis, engine, transmission, axles, and other major components, all covered under different product warranties. We'll be exploring the relationship between powertrain suppliers and manufacturers of commercial vehicle end-products over the next few weeks, because those manufacturers that deal directly with end-users tend to have much higher product warranty expense rates than those that primarily supply components to other manufacturers.

To compile the data for this newsletter, we perused the annual and quarterly financial reports of all 36 U.S.-based truck, bus, and heavy equipment manufacturers that have ever reported product warranty expenses. Of those 36, 23 reported warranty costs during 2023.

We extracted three key warranty metrics from each manufacturer's financial statements: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund. We also gathered data for total automotive sales revenue, using segmented revenue when possible to obtain a number that represents just product sales, and not service, extended warranties, financing, apparel, etc. We used these product revenue data to calculate our two warranty expense rates: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

The three largest manufacturers among the list of 23 are Deere & Co., Caterpillar Inc., and Paccar Inc.; the former two are makers of heavy agricultural and construction equipment, while the latter produces on-highway trucks under brands including Peterbilt and Kenworth.

Readers in this industry likely notice that a key player in this industry, Navistar Inc., is missing from that list. Traton SE, formerly known as Volkswagen Truck & Bus, acquired Navistar back in 2021. Since Traton is based in Germany, it only reports its warranty costs on an annual basis, rather than quarterly, and does not meet the criteria of being based in the United States and reporting according to the guidelines of the U.S. Securities and Exchange Commission (SEC). Navistar's historical data, up to mid-2021 when it was acquired, are included in this report, but Navistar disappears from the data in the third quarter of that year.

The next six manufacturers, with product warranty expenses in 2023 large enough to be named in Figures 1, 2, and 4, are: Thor Industries Inc., AGCO Corp., Winnebago Industries Inc., Oshkosh Corp., Terex Corp., and Rev Group Inc. Each of these manufacturers spent more than $20 million on warranty claims during calendar 2023.

14 manufacturers round out the list of U.S.-based manufacturers that reported product warranty expenses during 2023, comprising the "Other" category in the following charts. Many of these manufacturers are electric truck and bus companies new to actually manufacturing products, not just designing and conceptualizing them, and new to warranty expense reporting as well. They are: Astec Industries Inc., Blue Bird Corp., Greenbrier Cos. Inc., Proterra Inc., Shyft Group Inc., Miller Industries Inc., Manitex International Inc., Workhorse Group Inc., Lightning eMotors Inc., Nikola Corp., Xos Inc., Hyliion Holdings Corp., Phoenix Motor Inc., and Rush Enterprises Inc.

As we noted in last year's newsletter "U.S. EV-Only Warranty Expense Rates," Proterra filed for Chapter 11 bankruptcy in August 2023, and the third quarter of 2023 was the final quarter in which the manufacturer reported its warranty expenses. In November 2023, Proterra was split into three divisions and sold; its main electric powertrain business was sold to Volvo Group, its transit bus business was sold to Phoenix Motor, and its charger business was sold to a private equity firm.

Speaking of Volvo Group, also known as Volvo Truck, we'll mention that they've owned Mack Truck since 2000, so that's another "American" manufacturer that's actually European-owned, and thus not present in this report.

Without further ado, let's dig in to the data, which represents the past 21 years of product warranty expenses for these U.S.-based truck, bus, and heavy equipment manufacturers.

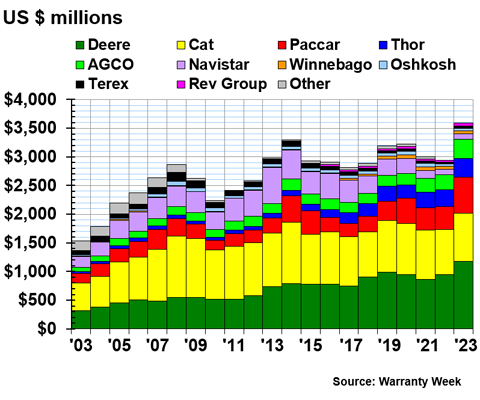

Warranty Claims Totals

Our first warranty metric is the total amount of warranty claims each manufacturer paid annually, from 2003 to 2023, shown in Figure 1.

Figure 1

U.S.-based Truck & Heavy Equip. Manufacturers

Claims Paid per Year

(in millions of U.S. dollars, 2003-2023)

The U.S.-based truck & heavy equipment manufacturers paid a total of $3.586 billion in warranty claims during calendar 2023, up 21% from the 2022 total. As we can see in Figure 1, this is the most that the manufacturers in this industry have ever paid in claims during a single year.

A large contributor to this rise was Paccar, which saw its warranty claims costs rise by a shocking 59% from 2022 to 2023. In 2023, Paccar spent a total of $632 million on warranty claims, compared to 2022's $399 million. The company did not offer its investors an explanation in its 2023 annual report as to why its warranty costs increased so significantly in just a year, except to vaguely allude to "increased warranty costs."

Inflation is definitely a factor driving warranty expense totals up to record highs across the board in a number of industries, especially in the vehicle sector. We saw a similar phenomenon in the passenger car industry, where warranty costs increased rather steeply without an obvious explanation, such as a singular large recall. Yet these increases we're seeing for Paccar exceed the realm of what we might consider normal increases due to U.S. dollar inflation. This is certainly a story we'll keep an eye on.

With that said, among the top nine manufacturers active in 2023 (thus excluding Navistar), all but Oshkosh saw their warranty claims costs rise from 2022 to 2023. Deere saw claims costs rise by 24% to $1.18 billion. Caterpillar's total claims rose to $835 million, an increase of 7%. Thor's claims rose by 9% to $328 million. AGCO paid $329 million in claims, an increase of 26%. Winnebago paid $99 million, up 8% from 2022. Terex paid $44 million, up 25% from the year prior. And Rev Group paid $34 million in claims, up 7%.

Oshkosh alone saw its claims costs fall. Oshkosh paid $51 million in claims during 2023, down -11% from 2022.

Joining Oshkosh are a few manufacturers in the "Other" category that saw claims costs fall from 2022 to 2023. Tow truck manufacturer Miller Industries Inc. saw claims costs fall by -21% to a total of $3.3 million in 2023. Workhorse Group paid $1.1 million in claims, down -23% from 2022. Lightning eMotors paid $640,000 in claims, down -44% from 2022. And Phoenix Motor paid $30,000 in claims, down -14% from 2022. The latter three manufacturers all make electric trucks and buses, but it may be more appropriate to say that they strive to manufacture electric heavy duty vehicles, and so far have sold a few prototypes.

A few manufacturers among the "Other" category saw their warranty claims costs increase, going with the overall industry-wide trend. Astec Industries, which makes heavy equipment for road building, paid $13.1 million in product warranty claims during 2023, up 18% from 2022. The Greenbrier Companies, which makes freight railcars, paid $9.8 million, up 15% from 2022. And Manitex International, which makes construction cranes, paid $2.36 million in claims, up 29%.

We also have a few more electric truck companies that reported some rather strange statistics. Nikola Corp. paid $3.9 million in claims during 2023, which is a 1,235% increase from 2022's claims cost of $290,000. Xos Inc. paid $1.3 million in claims during 2023, a 493% increase from 2022's total of $220,000. And Hyliion Holdings paid $180,000 in claims, up 18% from 2022.

Normally, a thirteen-fold increase in warranty claims costs in a single year would be cause to ring alarm bells from the hilltops. But since Nikola is so new to manufacturing, this really just shows a company selling its first units, and performing its first warranty work on those units. So these increases aren't necessarily cause for concern, instead showing a burgeoning aspect of this industry establishing itself and getting its footing in the world of product warranty.

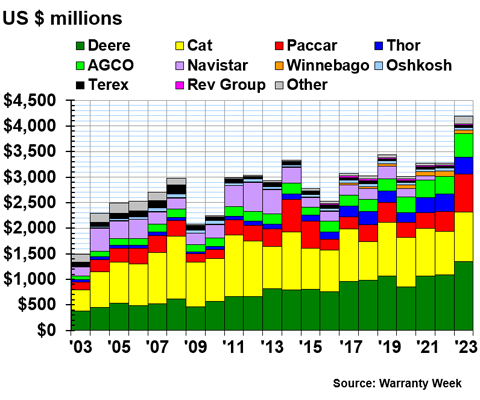

Warranty Accrual Totals

Figure 2 shows the total warranty accruals of the U.S.-based truck & heavy equipment industry from 2003 to 2023.

Figure 2

U.S.-based Truck & Heavy Equip. Manufacturers

Accruals Made per Year

(in millions of U.S. dollars, 2003-2023)

We can see in Figure 2 that the industry set a new record high for product warranty accruals by a longshot. The industry set aside a total of $4.196 billion in warranty accruals during calendar 2023, up 27% from the year prior.

Once again, Paccar was a huge contributor to this significant increase. Paccar nearly doubled its warranty accruals from 2022 to 2023. Namely, Paccar set aside $739 million in warranty accruals, a 91% increase from 2022's total of $386 million. In addition, we found in Paccar's 2023 annual report that the manufacturer set aside an additional $212 million in "changes in estimates for pre-existing warranties." We delve further into these adjustments to previous warranty accruals in Figure 6 our February 2024 newsletter "Warranty Adjustments."

The only manufacturers with warranty accruals that exceeded those of Paccar during 2023 are Deere and Caterpillar. Deere set aside a total of $1.35 billion in warranty accruals during 2023, up 24% from 2022. And Caterpillar set aside $968 million during 2023, up 14% from the year prior.

Among the top nine manufacturers, seven increased their warranty accruals from 2022 to 2023. AGCO increased its accruals by 37%, to a total of $465 million. Rev Group increased its accruals by 29% to a total of $33 million. Oshkosh increased accruals by 6%, to a total of $52 million. And Terex increased accruals by 1% to a total of $40 million.

Winnebago decreased its warranty accruals by -39%, down to a new total of $67 million. And fellow RV manufacturer Thor Industries decreased its accruals by -3%, to a total of $333 million.

Among the "Other" category, Nikola Corp. increased its warranty accruals by the largest factor. Nikola set aside $78 million in warranty accruals, an increase of 1,390% from 2022's accruals of just $5 million. Fellow EV manufacturer Workhorse Group increased its accruals by 57%, to a total of $770,000. And Xos Inc. increased its accruals by 32% to $1.5 million.

Rush Enterprises increased its accruals by 121% to a total of $8 million; Rush didn't report paying any warranty claims during 2023, but did report making warranty accruals. Rush doesn't seem to make electric trucks, and is primarily a dealership conglomerate.

Astec Industries increased accruals by 40% to $18 million. School bus manufacturer Blue Bird Corp. increased accruals by 15% to $9 million. Shyft Group, formerly known as Spartan Motors, increased its accruals by 20% to $6 million. Miller Industries increased accruals by 25% to $4 million. And Manitex increased accruals by 12% to $2.4 million.

Only three manufacturers in the "Other" category decreased their accruals from 2022 to 2023. The Greenbrier Companies decreased accruals by -6% to $9 million. Lightning eMotors decreased accruals by -21% to $1.1 million. And Hyliion decreased its accruals by -66% to just $220,000 set aside during 2023.

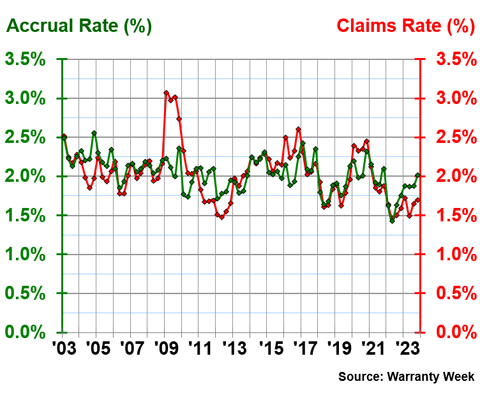

Average Warranty Expense Rates

Figure 3 shows the industry-wide average claims and accrual rates from 2003 to 2023. This shows us total claims and accruals compared to total product revenue for the entire U.S.-based truck & heavy equipment industry, from 2003 to 2023.

Figure 3

U.S.-based Truck & Heavy Equip. Manufacturers

Average Claims and Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the average claims rate for the industry was 2.03%, with a standard deviation of 0.34%, and the average accrual rate was 2.04%, with a standard deviation of 0.21%. This shows that claims is the more volatile of the two metrics, which makes sense because manufacturers directly dictate the amount of accruals they make, but have less control over the amount of claims they pay.

In 2023, the industry average claims rate was 1.64%, and the average accrual rate was 1.91%. On a quarterly basis, the claims rates during 2023 ranged from 1.49% in the second quarter, to 1.72% in the first quarter. The accrual rates ranged from 1.86% in the second quarter, to 2.01% in the fourth quarter.

So in 2023, the average claims rates were much lower than the 21-year average, while the accrual rates were on par with the 21-year average. In other words, in 2023, manufacturers in this industry were accruing about 2% of their product sales for future warranty expenses, just as they have been doing for the past two decades, although they only paid about 1.6% of product revenue in warranty claims during the same year.

Following this, we would expect to see excess funds sitting in the warranty reserve funds of these manufacturers. And as we'll find in Figure 4, the amount of warranty reserves collectively held by this industry at the end of 2023 set yet another new record high.

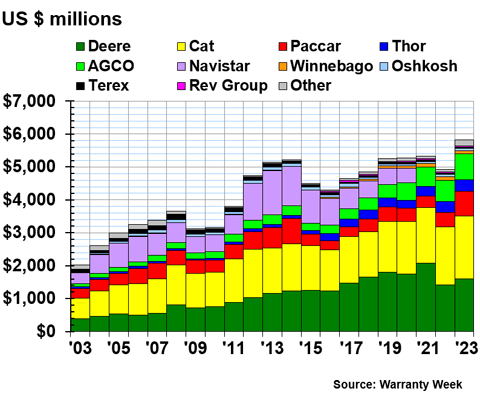

Warranty Reserve Totals

Figure 4 shows the total warranty reserves held by this industry on December 31 of each year.

Figure 4

U.S.-based Truck & Heavy Equip. Manufacturers

Reserves Held per Year

(in millions of U.S. dollars, 2003-2023)

At the end of calendar 2023, the truck & heavy equipment industry held a collective $5.820 billion in its warranty reserve funds. This is once again a record high, meaning that the industry set new annual record highs for total claims, accruals, and reserves during 2023.

At the end of 2023, Deere held a total of $1.6 billion in its warranty reserve fund, up 13% from the end of 2022. Caterpillar held $1.9 billion in its reserves, up 8% from the year prior.

Paccar significantly grew its warranty reserve fund in 2023. The manufacturer grew its reserves by 75%, to a total of $767 million at the end of 2023. Since a large portion of the company's doubled accruals were deposited right into the warranty reserves, it seems that Paccar is expecting a significant rise in its warranty claims costs in the near future.

AGCO grew its reserves by 25% to a total of $801 million. Rev Group grew its reserves by 23% to a total of $39 million.

On the other hand, Winnebago shrunk its reserves by -25%, to a total of $92 million. Hyliion decreased its reserves by -22% to $410,000. And Workhorse Group decreased its reserves by -14% to $1.9 million.

Most manufacturers in this industry grew their warranty reserves during 2023, but the majority did so by 15% or less, simply an attempt to grow the fund to match rising inflation. Among the "Other" category, a few manufacturers grew their reserves by a larger factor. Astec Industries increased its reserves by 39% to $17 million. Miller Industries increased its reserves by 34% to $2.8 million. Nikola Corp. grew its reserves quite significantly, by 865%, to $79 million. Xos grew its reserves by 19% to $1.3 million. And Rush Enterprises grew its warranty reserve fund by 64%, to a total of $21 million at the end of 2023.