Worldwide Aviation Warranty Expenses:

The global airframe manufacturers paid about $1.13 billion in warranty claims in 2024, with an average claims rate of 0.76%, and set aside about $1.08 billion in warranty accruals, with an average accrual rate of 0.73%. 2024 was the second year in a row in which claims exceeded accruals.

Global civilian aircraft sales still have not quite returned to their pre-pandemic level. According to an August 2025 report by the International Air Transport Association (IATA) on commercial aviation, "the aircraft shortage that began building in 2019 has become the industry's most pressing challenge." Furthermore, commercial aircraft "order backlog continues to build up despite reaching an all-time high," and "normalization is unlikely before 2031-2034."

In order to create this warranty report, we perused the annual reports of each global airframe manufacturer, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the end-balance of the warranty reserve fund.

In addition, we gathered data on each manufacturer's global aircraft sales revenue, and used these to calculate two additional warranty expense rates: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

We identified a total of 21 global airframe manufacturers, which report their warranty expenses in seven different currencies: U.S. and Canadian dollars, Russian rouble, Chinese yuan, British pounds, Euro, and Swiss franc. For consistency and ease of comparison, we converted all data to U.S. dollars using the IRS Yearly Average Currency Exchange Rates table.

Commercial Aircraft

The dynamics of the commercial aviation sector have changed over recent years, though the duopoly between Airbus and Boeing persists. In 2019, Airbus surpassed Boeing, in both commercial aircraft revenue and in aircraft deliveries. In October 2025, Airbus set another huge milestone in the commercial aviation industry, when its A320 family of narrow-body jets surpassed the Boeing 737 to become the most-delivered commercial aircraft in history.

Both manufacturers have seen a lot of value in emphasizing the production and sale of newer, more fuel-efficient narrow-body aircraft in recent years. Both Airbus and Boeing have attempted to acquire narrow-body commercial aircraft programs from smaller global competitors as well.

Airbus acquired the C-Series program from Bombardier in 2020, and renamed the narrow-body aircraft the Airbus A220. This move effectively bought the Canadian airframe maker out of commercial aviation.

In response, Boeing attempted to acquire Embraer's commercial aircraft division in 2019. However, the merger fell through after delays from regulators due to antitrust concerns, ensuing fallout between the two manufacturers. Other contributing factors include the drop in demand for narrow-body aircraft as the pandemic began, and Boeing's concurrently soaring costs related to the 737 MAX groundings.

So three commercial long-haul aircraft manufacturers remain in the game globally, Boeing Co., Airbus SE, and Embraer S.A.

In addition, there is Avions de Transport Régional GIE, or ATR, which is a joint venture between Airbus and Leonardo S.p.A. ATR makes regional turboprop aircraft, mainly the ATR 72 model.

There is also the Chinese state-owned Commercial Aircraft Corporation of China, Ltd., or Comac. Comac makes regional jets, the C909, formerly the ARJ21, used by Chinese airlines. However, Comac has announced plans to rival Boeing and Airbus in both narrow-body and wide-body jetliners. In 2023, Comac delivered its first narrow-body airliner, the C919, intended to rival the 737 MAX and A320neo. In addition, Comac is developing the C929 wide-body to rival the 787 Dreamliner and A330neo; the C939 wide-body to rival the 777 and A350; and has even announced plans for a supersonic airliner, the C949, to rival the Concorde.

Comac's suppliers include the state-owned aerospace and defense conglomerate AVIC, along with several western manufacturers, including Liebherr, Honeywell, Safran, and GE Aerospace. Comac does not report its warranty expenses as of right now.

Business Jets

In addition to the commercial aircraft makers, there are several business jet manufacturers that report their warranty expenses as well.

Canadian manufacturer Bombardier Inc. has been exclusively in the business aviation market since Airbus fully bought out the troubled C-Series program in 2020. Bombardier makes Global and Challenger business jets. Bombardier also owns Learjet, but the subsidiary ceased production in 2021.

French manufacturer Dassault Aviation SA makes Falcon business jets. American manufacturer Textron Inc. makes the Cessna and Beechcraft brands. General Dynamics Corp. owns the Gulfstream brand.

The Swiss manufacturer Pilatus also makes business jets, as do Airbus, Boeing, and Embraer.

Military Aircraft

Military aircraft are a huge aspect of the global aviation industry. Military contracts do include warranty work, but unlike the civilian aviation sector, military aviation warranty costs are not publicly reported. Unlike traditional product warranties that come with civil aircraft, military aircraft typically come with a special type of military service contract.

Most of the airframe manufacturers we've mentioned so far, including Boeing, Airbus, Embraer, and Bombardier, are also military contractors. We would go further with Dassault, Textron, General Dynamics, and Pilatus, which are primarily military contractors, with secondary businesses in corporate jets. However, we do not factor in any revenue from defense contracts in the product sales revenue data that form the denominators for our warranty expense rate calculations.

To that point, we've labeled General Dynamics' warranty expenses as "Gulfstream" in several of the following charts, since there are no reported warranty expenses related to military contracts, the dominant business. Again, that's not to say that warranty work does not occur, just that the contracts and reporting standards function differently in the defense sector.

For these reasons, Lockheed Martin and Northrop Grumman are not included in this report. Although Lockheed Martin's F-35 fighters and Northrop Grumman's B-2 bombers (and B-21 under development) are at the cutting-edge of aviation, we do not have any hard data of the global warranty costs associated with these, or any, military aircraft. The small amount of civilian product warranty expenses that these two manufacturers report are included in the "Other" categories in the following charts.

The same can be said of China's state-owned military and defense aerospace manufacturer Aviation Industry Corporation of China, or AVIC, and Russian state-owned PJSC United Aircraft Corporation, or UAC. There are also the Italian Leonardo S.p.A., which is the military contractor that owns 50% of ATR.

We crafted estimates for the warranty expenses of AVIC, UAC, ATR, and Pilatus. However, we did not craft estimates for Leonardo, Lockheed Martin, or Northrop Grumman, nor for the significant defense business of General Dynamics, Textron, Boeing, RTX, etc.

We were able to form estimates for the warranty expenses of ATR and Pilatus based on the data they do report, their annual product sales revenue, along with industry average warranty expense rates. We will use our estimates to enable our charts to better describe the warranty expenses of the global airframe industry, but we will not detail these data in this newsletter.

Warranty Claims Paid

With no further ado, we will present our charts depicting the amount of warranty claims paid by the largest global airframe manufacturers.

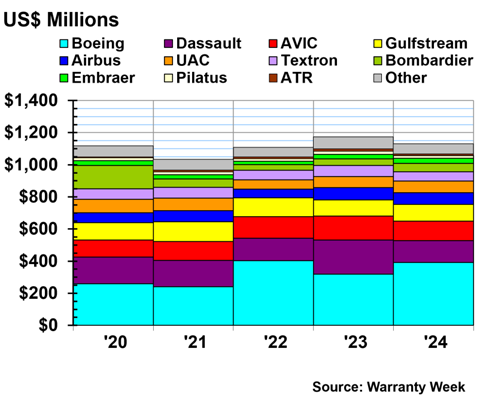

Figure 1 shows the amount of warranty claims paid by the global airframe manufacturers, from 2020 to 2024.

Figure 1

Top Airframe Makers Worldwide

Claims Paid per Year

(in millions of U.S. dollars, 2020-2024)

In total, we estimate that the global airframe manufacturers paid $1.13 billion in warranty claims in 2024, down slightly from 2023.

Boeing paid $392 million in warranty claims in 2024, a 23% increase from 2023. This total was a little lower than the company's recent peak of $403 million in 2022, amidst the aftermath of the 737 MAX groundings.

Airbus paid just $58 million in warranty claims in 2024, a -25% decrease from 2023's total of $77 million.

Dassault paid $136 million in warranty claims in 2024, a -36% decrease from the year prior. General Dynamics (labeled under the Gulfstream label that generates most of its civilian warranty costs) paid $105 million in warranty claims, a 4% increase.

Textron paid $72 million in warranty claims in 2024, a 4% increase. Bombardier paid $52 million, a 27% increase from the year prior. And Embraer paid $33 million, a 22% increase.

Warranty Claims Rates

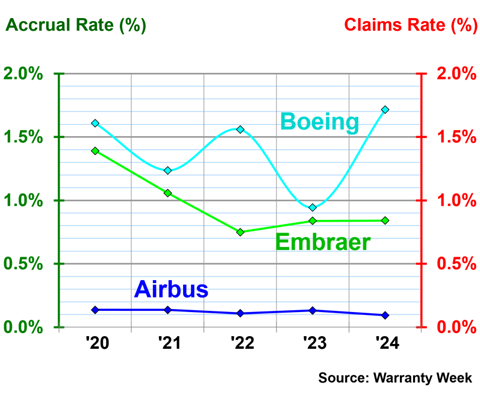

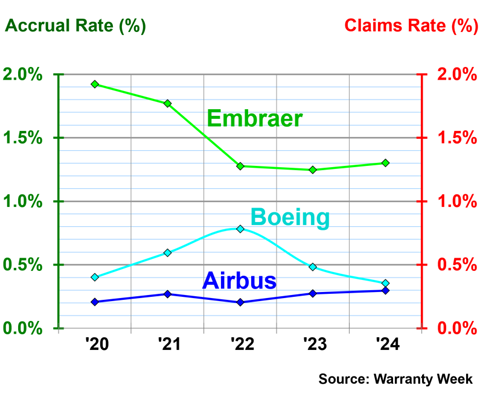

Figures 2 and 3 show the warranty claims rates of seven airframe manufacturers, divided into commercial aircraft and business aircraft manufacturers, respectively. Figure 2 shows the annual warranty claims rates of the three commercial aircraft makers, from 2020 to 2024.

Figure 2

Top Commercial Airframe Makers Worldwide

Warranty Claims Rates

(as a % of product sales, 2020-2024)

Boeing's warranty claims rate increased by about three-quarters, from 0.94% in 2023, to 1.71% in 2024. This was a higher claims rate than we saw even in the pandemic year 2020.

Airbus had a miniscule claims rate of just 0.09% in 2024, down about one-third from 2023. And Embraer had a claims rate of 0.84%, unchanged from the rate we saw in 2023.

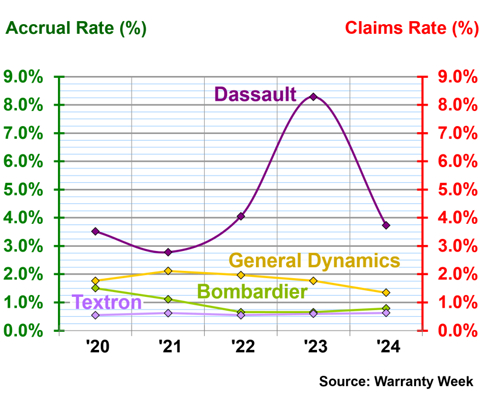

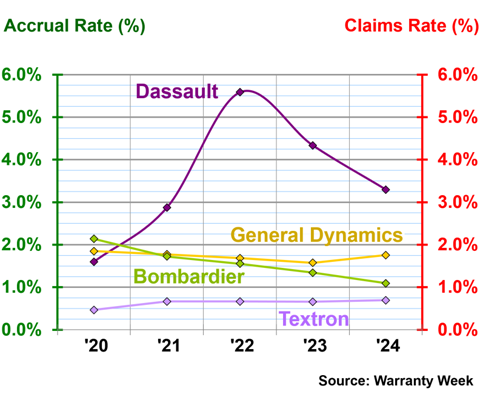

Figure 3 shows the warranty claims rates of the four business jet manufacturers, from 2020 to 2024.

Figure 3

Top Business Airframe Makers Worldwide

Warranty Claims Rates

(as a % of product sales, 2020-2024)

Dassault's warranty claims rate was cut in half from 2023 to 2024. In 2024, Dassault had a claims rate of 3.73%, down from the peak of 8.29% in 2023.

General Dynamics had a claims rate of 1.34% in 2024, down about one-quarter from 2023. Bombardier had a claims rate of 0.79%, up about one-quarter. And Textron had a claims rate of 0.63%, up slightly.

Warranty Accrual Totals

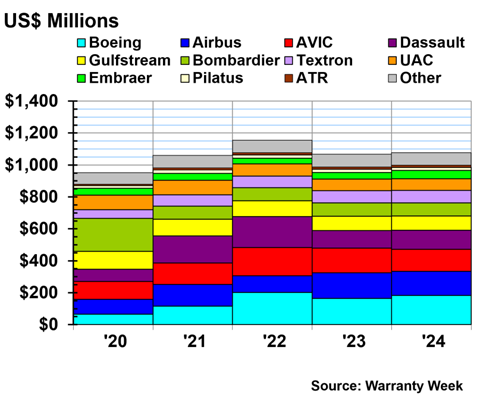

Figure 4 shows the total warranty accruals set aside by the global airframe manufacturers, from 2020 to 2024.

Figure 4

Top Airframe Makers Worldwide

Accruals Made per Year

(in millions of U.S. dollars, 2020-2024)

We estimate that the global airframe manufacturers set aside about $1.08 billion in warranty accruals in 2024, up slightly from 2023.

Airbus set aside $183 million in warranty accruals in 2024, a 14% increase from 2023. In contrast, Boeing set aside just $81 million in warranty accruals in 2024, a -51% decrease from 2023. Boeing's warranty claims costs exceeded its accruals by a ratio of almost 5:1 in 2024.

General Dynamics (Gulfstream) set aside $137 million in warranty accruals in 2024, a 52% increase from 2023. Dassault set aside $120 million in accruals, a 9% increase.

Textron set aside $79 million in warranty accruals in 2024, a 4% increase. Bombardier set aside $72 million in accruals, a -14% decrease. And Embraer set aside $52 million in accruals, a 27% increase.

Warranty Accrual Rates

Figures 5 and 6 show the warranty accrual rates of these airframe manufacturers. Figure 5 shows the accrual rates of the commercial aircraft makers, from 2020 to 2024.

Figure 5

Top Commercial Airframe Makers Worldwide

Warranty Accrual Rates

(as a % of product sales, 2020-2024)

Embraer had a warranty accrual rate of 1.30% in 2024, about the same level we've seen since 2022. Airbus' accrual rate also stayed about the same, at 0.30%.

Boeing's accrual rate decreased by about one-quarter, to 0.35% in 2024.

Figure 6 shows the warranty accrual rates of the business aircraft makers, from 2020 to 2024.

Figure 6

Top Business Airframe Makers Worldwide

Warranty Accrual Rates

(as a % of product sales, 2020-2024)

Dassault's accrual rate fell by about one-quarter from 2023 to 2024, to 3.30%.

General Dynamics had a warranty accrual rate of 1.75% in 2024, up slightly from 2023. Bombardier had an accrual rate of 1.09%, down a bit from the year prior. And Textron had an accrual rate of 0.69% in 2024, up slightly.

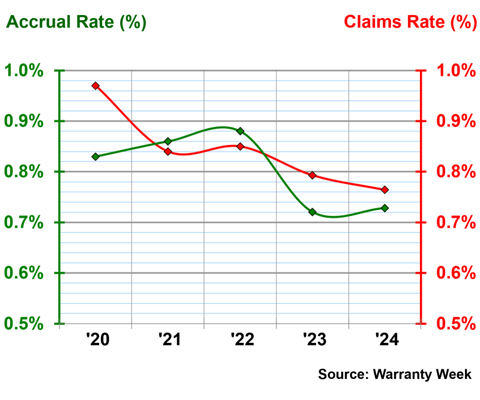

Average Warranty Expense Rates

Figure 7 shows the average warranty expense rates of the global airframe manufacturers, from 2020 to 2024.

Figure 7

Top Airframe Makers Worldwide

Average Claims & Accrual Rates

(as a % of product sales, 2020-2024)

The average warranty expense rates were largely unchanged from 2023 to 2024. The average warranty claims rate was 0.76% in 2024, and the average warranty accrual rate was 0.73%.

2023 was the second year in a row that the industry average claims rate exceeded the accrual rate. However, the gap between the two percentages closed a bit between 2023 and 2024.

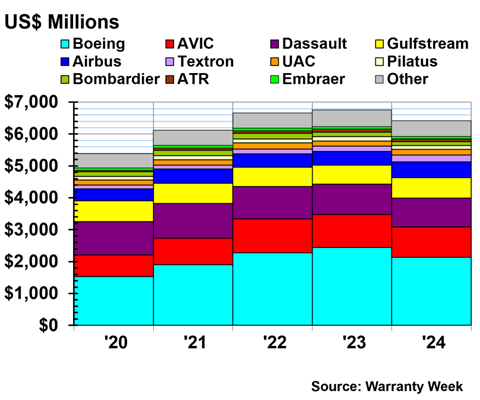

Warranty Reserve Balances

Our final warranty metric is the year-end-balance of each airframe manufacturer's warranty reserve fund. Figure 8 shows the total warranty reserves held by the global airframe makers, from 2020 to 2024.

Figure 8

Top Airframe Makers Worldwide

Reserves Held per Year

(in millions of U.S. dollars, 2020-2024)

At the end of 2024, Boeing held $2.13 billion in its warranty reserve fund, a decrease of -13% from the end of 2023. Airbus held $491 million in reserves at the end of 2024, a 15% increase.

Dassault held $910 million in warranty reserves at the end of 2024, a -4% decrease from the end of 2023. General Dynamics held $642 million in reserves, an 8% increase.

Textron held $173 million in reserves at the end of 2024, a 1% increase from the end of 2023. Bombardier held $120 million at the end of 2024, a -14% decrease. And Embraer held $79 million in warranty reserves at the end of 2024, an 8% increase from the end of 2023.