Nine-Month Top 100 Warranty Providers of 2025:

44 of the top 100 American warranty-issuing manufacturers made at least one appearance in our charts showing the largest increases and reductions in warranty costs. Nvidia, Shoals Technologies, and TPI Composites made three appearances in our nine-month charts.

As 2025 comes to a close, we're taking a look at how the top American issuers of limited warranties fared over the first three quarters of the year. We ranked the top 100 U.S.-based manufacturers by the amount of warranty claims paid during the first nine months of 2025, and identified the largest changes in warranty costs, from the first three quarters of 2024 to the first three quarters of 2025.

While we can't compare companies' warranty expenses to each other, but we can compare them to themselves from a year ago. Generally, manufacturers do not want to see huge fluctuations in their warranty costs; product warranty should be predictable.

Overall, 56 of the top 100 warranty-issuing manufacturers did not land in any of the following top 10 change charts, while 44 did. Of those 44, 31 made just one appearance, 10 made two appearances, and three made three appearances, proving that stable rates are the norm. As such, the largest fluctuations stand out using our methodology.

Methodology

We perused the quarterly financial statements of every U.S.-based manufacturer that issues product warranties and reports its warranty expenses to the SEC. We extracted three key warranty metrics: the amount of claims paid, the amount of accruals made, and the quarterly end-balance of the warranty reserve fund.

We also gathered data on each manufacturer's product sales revenue, and used these to calculate two additional warranty metrics: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

We sorted the list of companies by the amount of warranty claims paid in the first three quarters of 2025, and narrowed the list down to the top 100 manufacturers. We eliminated any companies that reported in 2025, but did not report in 2024.

Based on these criteria, the smallest manufacturer paid $8.77 million in warranty claims during the first three quarters of 2025.

Next, we did some calculations, in order to create the following charts. There are six charts in this report, three showing reductions and three showing increases.

For each of the top 100 manufacturers by warranty expenses, we calculated the percent change of the claims rates, accrual rates, and warranty reserve end-balances, from the first nine months of 2024, to the first nine months of 2025.

For each metric, we ranked the companies by their rates of change. Figures 1, 3, and 5 show the largest reductions in these metrics, and Figures 2, 4, and 6 show the largest increases.

Each manufacturer could appear in a maximum of three charts. Three companies did: GPU manufacturer Nvidia Corp., solar cell component manufacturer Shoals Technologies, and wind turbine blade manufacturer TPI Composites Inc.

Ten companies appeared in two charts: Hyster-Yale Inc., Illumina Inc., Ingersoll Rand Inc., Lucid Group Inc., Owens Corning, Pentair plc, RPM International Inc., SolarEdge Technologies, Vertiv Holdings Co., and Visteon Corp.

31 companies appeared in just one chart.

Claims Rate Reductions

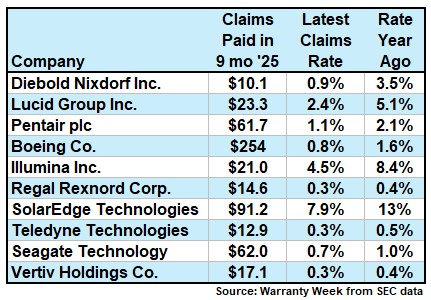

Figure 1 shows the ten U.S.-based manufacturers with the largest reductions in the warranty claims rate, from the first nine months of 2024 to the first nine months of 2025. This is good news for the following companies, meaning they're spending a lower percentage of their total product revenue on warranty claims costs.

Figure 1

Top 100 U.S.-based Warranty Providers:

Top Ten Claims Rate Reductions,

9 Mo. 2024 vs. 9 Mo. 2025

(claims as a % of product sales)

Automated teller machine (ATM) and point-of-sale (POS) manufacturer Diebold Nixdorf Inc. had a claims rate of 3.5% in the first nine months of 2024. This rate was reduced by three-quarters, down to 0.9% in the first nine months of 2025. Diebold Nixdorf paid a total of $10 million in warranty claims in the first nine months of 2025.

Electric vehicle manufacturer Lucid Group saw its claims rate cut in half from the first three quarters of 2024 to the first three quarters of 2025. Lucid paid $23 million in claims in the first nine months of 2025, and the claims rate reduced from 5.1% in the first nine months of 2024, to 2.4% in the first nine months of 2025.

Manufacturer of water treatment plant components Pentair plc also cut its claims rate in half. Pentair had a claims rate of 2.1% in the first three quarters of 2024, which was reduced to 1.1% in the first three quarters of 2025. Pentair paid a total of $62 million in warranty claims in the first three quarters of 2025.

Aerospace manufacturer Boeing Co. paid $254 million in warranty claims in the first nine months of 2025. The claims rate for this period was 0.8%, cut in half from 1.6% in the first nine months of 2024.

Biotechnology company Illumina Inc. paid $21 million in warranty claims in the first nine months of 2025. The claims rate was also cut in half, from 8.4% in the first nine months of 2024, to 4.5% in the first nine months of 2025.

Solar inverter manufacturer SolarEdge Technologies Inc. paid $91 million in warranty claims in the first nine months of 2025. Its claims rate was reduced by about two-thirds, from 13% in the first nine months of 2024, to 7.9% in the first nine months of 2025. This is still quite a high claims rate, even for the solar industry, but it is a reduction nonetheless.

Data center power supply system, thermal management, and infrastructure manufacturer Vertiv Holdings Co. saw its claims rate reduced by about one-third over the same period. Vertiv paid $17 million in warranty claims in the first nine months of 2025, with a claims rate of 0.3% over the same period, reduced from 0.4% in the first nine months of 2024.

Claims Rate Increases

Generally, a significant increase in the warranty claims rate is not good news, and often reflects a recall, a fault product, or a drop in quality. However, an increase in the claims rate can also reflect a decrease in product sales, but claims costs staying the same. Furthermore, in 2025, this can also reflect rising repair costs, because of inflation, parts costs increasing due to tariffs, and labor costs increasing due to shortages.

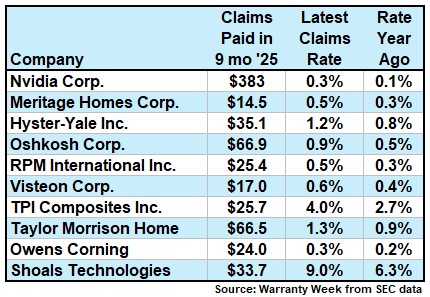

Figure 2 shows the top ten largest claims rate increases, from the first three quarters of 2024 to the first three quarters of 2025.

Figure 2

Top 100 U.S.-based Warranty Providers:

Top Ten Claims Rate Increases,

9 Mo. 2024 vs. 9 Mo. 2025

(accruals as a % of product sales)

Prominent GPU manufacturer Nvidia Corp. paid $383 million in warranty claims in the first nine months of 2025. The claims rate was 0.33%, more than triple the claims rate of 0.09% in the first nine months of 2024.

New home builder Meritage Homes Corp. paid $15 million in warranty claims in the first nine months of 2025. The claims rate increased by two-thirds, from 0.3% in the first nine months of 2024, to 0.5% in the same period of 2025.

Forklift manufacturer Hyster-Yale Inc. paid $35 million in warranty claims in the first nine months of 2025. The claims rate also increased by about two-thirds, from 0.8% in the first nine months of 2024, to 1.2% in the first nine months of 2025.

Automotive, aerospace, and defense manufacturer Oshkosh Corp. paid $67 million in warranty claims in the first nine months of 2025. Oshkosh also saw a two-thirds increase in the claims rate, from 0.5% in the first nine months of 2024, to 0.9% in the first nine months of 2025.

RPM International Inc., maker of building materials, including paint, coatings, adhesives, and sealants, also saw its claims rate increase by about two-thirds. RPM paid $25 million in claims in the first nine months of 2025, and the claims rate increased from 0.3% in the first nine months of 2024, to 0.5% in the first nine months of 2025.

TPI Composites paid $26 million in claims in the first nine months of 2025. The claims rate increased by about one-half, from 2.7% in the first nine months of 2024, to 4.0% in the first nine months of 2025.

Shoals Technologies, which also appeared in three charts, paid $34 million in claims in the first nine months of 2025. The claims rate in the first nine months of 2025 was 9.0%, up from 6.3% in the same period of 2024.

Accrual Rate Reductions

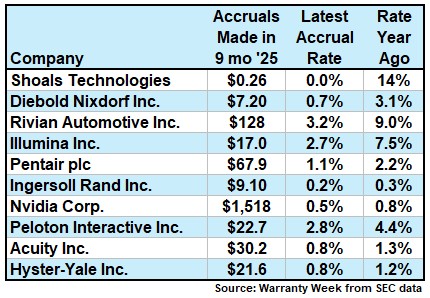

Appearing in Figure 3 is the best possible news for these manufacturers, because it means that the warranty accrual rate was reduced from the first nine months of 2024, to the first nine months of 2025.

Figure 3

Top 100 U.S.-based Warranty Providers:

Top Ten Accrual Rate Reductions,

9 Mo. 2024 vs. 9 Mo. 2025

(accruals as a % of product sales)

Interestingly, two of the three companies that make three appearances in this newsletter are in Figure 3, though they were also in Figure 2 with claims rate increases. This means that over the same period, the claims rate increased, but the accrual rate decreased.

Shoals Technologies dramatically decreased its warranty accruals to just $0.26 million in the first three quarters of 2025. This means that the accrual rate was 0% in the first nine months of 2025, a huge decrease from 14% in the first nine months of 2024. Again, keep in mind that Shoals had a claims rate of 9.0% over the same nine-month period.

Nvidia also saw its accrual rate decrease at the same time that its claims rate increased. Nvidia set aside $1.52 billion in warranty accruals in the first three quarters of 2025. The accrual rate was reduced by about one-third, from 0.8% in the first three quarters of 2024, to 0.5% in the first three quarters of 2025.

Diebold Nixdorf saw its accrual rate reduced by three-quarters, from 3.1% in the first nine months of 2024, to 0.7% in the first nine months of 2025. Diebold Nixdorf set aside $7 million in warranty accruals in the first nine months of 2025.

Electric vehicle manufacturer Rivian Automotive Inc. reduced its warranty accrual rate by about two-thirds, from 9.0% in the first nine months of 2024, to 3.2% in the first nine months of 2025. Rivian set aside $128 million in warranty accruals in the first three quarters of 2025.

Illumina also saw its accrual rate reduced by two-thirds, from 7.5% in the first nine months of 2024, to 2.7% in the first nine months of 2025.

Accrual Rate Increases

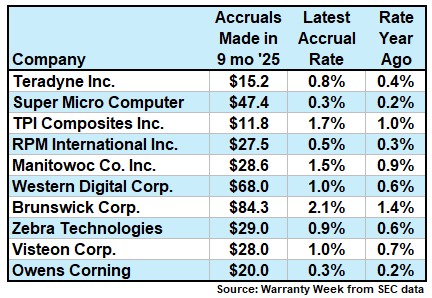

Figure 4 is what we have previously called "the pain chart." Companies have direct control over the amount of warranty accruals they set aside, so increasing the proportion of revenue that is going to warranty, rather than net profit, is typically not good news.

Figure 4 shows the ten largest warranty accrual rate increases, from the first three quarters of 2024, to the first three quarters of 2025.

Figure 4

Top 100 U.S.-based Warranty Providers:

Top Ten Accrual Rate Increases,

9 Mo. 2024 vs. 9 Mo. 2025

(accruals as a % of product sales)

Teradyne Inc. makes automatic test equipment for semiconductors, with clients including Samsung, Intel, and IBM. Its warranty accrual rate more than doubled from 0.35% in the first three quarters of 2024, to 0.8% in the first three quarters of 2025. Teradyne set aside $15 million in warranty accruals in the first nine months of 2025.

Server and data storage company Super Micro Computer Inc. set aside $47 million in warranty accruals in the first nine months of 2025. The accrual rate increased by three-quarters, from 0.2% in the first nine months of 2024, to 0.3% in the first nine months of 2025.

TPI Composites made its second of three appearances in Figure 4. TPI Composites set aside $12 million in warranty accruals in the first nine months of 2025. The accrual rate increased by three-quarters, from 1.0% in the first nine months of 2024, to 1.7% in the first nine months of 2025.

RPM International set aside $28 million in warranty accruals in the first nine months of 2025. The accrual rate increased by two-thirds, from 0.3% in the first nine months of 2024, to 0.5% in the first nine months of 2025.

Automotive electronics supplier Visteon Corp., which makes vehicle dashboard and cockpit electronics, appeared in Figures 2 and 4. Visteon set aside $28 million in warranty accruals in the first nine months of 2025. The accrual rate increased by about one-third, from 0.7% in the first nine months of 2024, to 1.0% in the first nine months of 2025.

Building materials manufacturer Owens Corning, which makes insulation, roofing, and fiberglass composites, also appeared in Figures 2 and 4. Owens Corning set aside $20 million in warranty accruals in the first nine months of 2025. The accrual rate increased by one-third, from 0.2% in the first nine months of 2024, to 0.3% in the first nine months of 2025.

Warranty Reserve Reductions

Figure 5 shows the ten largest warranty reserve reductions, from the first nine months of 2024, to the first nine months of 2025.

Figure 5

Top 100 U.S.-based Warranty Providers:

Top Ten Warranty Reserve Reductions,

9 Mo. 2024 vs. 9 Mo. 2025

(accruals as a % of product sales)

Shoals Technologies makes its third appearance in Figure 5. So this company had the tenth largest claims rate increase, paired with the largest accrual rate decrease, and the largest warranty reserve decrease.

Shoals Technologies held $55 million in its warranty reserve fund at the end of the third quarter of 2025, a -86% decrease, from $8 million at the end of the third quarter of 2024.

Drivetrain and electrified propulsion system manufacturer Dana Inc. held $113 million in warranty reserves at the end of the third quarter of 2025, a -29% reduction compared to the end of the third quarter of 2024.

SolarEdge held $479 million in warranty reserves at the end of the third quarter of 2025, a -18% reduction from the end of the third quarter of 2024.

Ingersoll Rand Inc., after the spin-off of Trane Technologies and merger with Gardner Denver in 2020, made two appearances in this newsletter, in Figures 3 and 5. Ingersoll Rand held $71 million in warranty reserves at the end of the third quarter of 2025, a -16% reduction from the end of the third quarter of 2024.

Warranty Reserve Increases

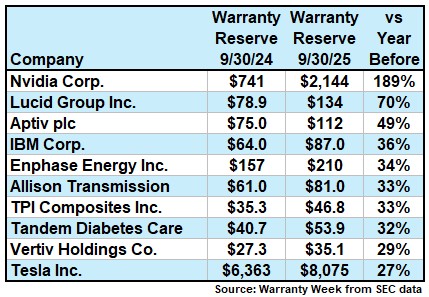

Figure 6 shows the ten largest warranty reserve increases, from the end of the third quarter of 2024, to the end of the third quarter of 2025.

Figure 6

Top 100 U.S.-based Warranty Providers:

Top Ten Warranty Reserve Increases,

9 Mo. 2024 vs. 9 Mo. 2025

(accruals as a % of product sales)

Nvidia had the largest claims rate increase (Figure 2), seventh-largest accrual rate reduction (Figure 3), and largest warranty reserve increase, from the first nine months of 2024 to the first nine months of 2025. Nvidia held $2.14 billion in warranty reserves at the end of the third quarter of 2025, a 189% increase from the end of the third quarter of 2024.

TPI Composites also made its third appearance in Figure 6. TPI Composites held $47 million of warranty reserves at the end of the third quarter of 2025, a 33% increase from the end of the third quarter of 2024.

Lucid Group held $134 million in warranty reserves at the end of the third quarter of 2025, a 70% increase from the end of the third quarter of 2024.

Fellow electric vehicle manufacturer Tesla had the tenth-largest nine-month warranty reserve increase. Tesla's reserve balance increased by 27% to $8.08 billion at the end of the third quarter of 2025.

Automotive electronics and components supplier Aptiv plc increased its warranty reserve balance by 49% to $112 million at the end of the third quarter of 2025.

Vertiv Holdings made its second appearance in this chart. Vertiv's warranty reserve balance increased by 29% to $35 million at the end of the third quarter of 2025.