U.S. Auto Warranty Annual Reports:

Ford, GM, and Tesla all had a rough and costly year of warranty expenses and recalls. Their 2023 warranty expense data reflects this, as well as inflation and increased repair costs, resulting in the highest collective warranty claims, accrual, and reserve totals we've ever seen from these three manufacturers.

With the release of Ford's 10-K annual report on Wednesday morning, the annual reports are in for the three largest U.S.-based auto manufacturers. Ford, General Motors, and Tesla spent a collective $10 billion in warranty claims during 2023, exceeding 2022's total by just about a billion dollars. The three manufacturers also collectively accrued over $10 billion for future warranty costs, another record, with an additional $4.65 billion added in as adjustments to accruals made during previous periods.

To compile this report, we perused the annual and quarterly reports of Ford, GM, and Tesla, and collected three essential warranty metrics: the amount of claims paid, the amount of accruals made, and the end balance of the warranty reserve fund. In addition, we collected data on quarterly product sales revenue, in order to calculate our two warranty expense rates: claims as a percentage of revenue (the claims rate), and accruals as a percentage of revenue (the accrual rate).

2023: A Year of Recalls

Tesla

Needless to say, 2023 was the costliest year in history for these three major warranty providers. And things aren't exactly looking up, especially for Tesla. Last Friday, February 2nd, the National Highway Traffic Safety Administration (NHTSA) announced the recall of 2.2 million Tesla vehicles, almost every vehicle that the company has ever sold in the United States, because "an incorrect font size is displayed on the instrument panel for the Brake, Park, and Antilock Brake System (ABS) warning lights." The recall will cover the 2012-2023 Model S, 2016-2023 Model X, 2017-2023 Model 3, 2019-2024 Model Y, and 2024 Cybertruck. The only Tesla passenger car not affected is the Roadster, which was the first vehicle the company produced, from 2008 to 2012.

While the issue can be fixed with a software update, the scale of the recall makes this a huge undertaking for Tesla. And it's an especially brutal blow less than two months after the December 2023 recall of over 2 million vehicles due to issues with the company's Autopilot system. That recall affected the 2012-2023 Model S, 2016-2023 Model X, 2017-2023 Model 3, and 2020-2023 Model Y, almost all of the same vehicles subject to the recall announced last week.

When announcing that recall, entitled Autopilot Controls Insufficient to Prevent Misuse, back in December, NHTSA wrote, "In certain circumstances when Autosteer is engaged, and the driver does not maintain responsibility for vehicle operation and is unprepared to intervene as necessary or fails to recognize when Autosteer is canceled or not engaged, there may be an increased risk of a crash."

We first discussed these issues with Tesla's Autopilot system all the way back in January 2023, a few months after a driver using the then-new "Full Self-Driving" feature caused an eight-car pileup on the San Francisco-Oakland Bay Bridge on the Thanksgiving holiday in November 2022. "Full Self-Driving" mode has an expanded set of features atop "Autopilot." More recently, a deadly crash occurred in Virginia in July 2023, in which a speeding Tesla using Autopilot drove underneath a crossing tractor-trailer. In all, NHTSA has investigated at least 35 crashes associated with the use of Autopilot, which resulted in 17 deaths. NHTSA's investigation into Tesla's Autopilot took the agency about two years, culminating in the December 2023 recall. The remedy to the recall is a software update, which will detect hands on the steering wheel and alert drivers to pay attention to the road.

To add insult to injury, Tesla announced in early January that it is recalling more than 1.6 million vehicles sold in China, for problems with automatic assisted steering. China's State Administration for Market Regulation mandated the recall just a month after NHTSA released the results of its investigation. The remedy is the same software update, aimed at getting drivers who are using Autopilot to pay more attention to the road, with increased warnings and alerts when hands are not detected on the steering wheel.

These recalls are far from over, and not just because the approval and installation of the software remedies is ongoing. In December, research conducted by NHTSA, the National Transportation Safety Board (NTSB), and other investigators was released, showing that measuring torque on the steering wheel isn't enough to ensure that drivers are paying sufficient attention. Jennifer Homendy, the chairwoman of the NTSB, stated, "I do have concerns about the solution. [...] The technology, the way it worked, including with steering torque, was not sufficient to keep drivers' attention, and drivers disengaged." NHTSA found that out of 43 crashes it examined, 37 drivers had their hands on the wheel in the final second before the vehicle crashed, showing that hands on the wheel is an insufficient metric for judging drivers' level of attention.

It's possible, perhaps even likely, that these software remedies are just the tip of the iceberg in these ongoing Tesla recalls.

So Tesla's 2023 was murky, and its 2024 is not looking particularly bright, on the warranty and recall front. But its two major U.S.-based competitors, Ford and GM, had their own share of recall and warranty problems in 2023, and we'd be remiss not to list them here.

GM

In our June 2023 newsletter "U.S. Auto OEM Update," we detailed the chronicle of GM's Chevy Bolt EV battery recall, which was first announced back in the summer of 2021. That recall cost GM about $2 billion in warranty accruals in 2021, of which just about the whole $2 billion was recovered from its electric battery supplier, LG Electronics, in 2022 and 2023. GM has set aside additional funds since then, with a total of $2.6 billion accrued for the recall as of December 31, 2023.

In October 2023, GM announced an early compensation program for some Bolt owners, in anticipation of the settlement of a class action lawsuit. As part of the recall, GM replaced the batteries in almost all 2017-2019 Bolts, but offered a software diagnostic remedy rather than a battery replacement to the owners of 2020-2022 Bolts. The software was designed to detect which batteries in the newer models actually needed replacement, but required 10,000 kilometers of driving in order to detect the problems, during which the battery's charge was limited to 80% capacity.

The compensation program offered 2020-2022 Bolt owners a $1,400 Visa gift card if they brought their vehicle into the dealer for the installation of the "final advanced diagnostic software" by December 31, 2023, and signed a legal release. The diagnostic period for the battery, in which the 10,000 km must be driven, will last until March 31, 2025. If the class action settlement ends up being more than $1,400 per person, the difference will still be paid out to owners who took the early compensation. It's not clear if the funds for the compensation program came out of warranty reserves.

More recently, in our November 2023 newsletter "Nine-Month U.S. Auto Warranty Expenses," we detailed GM's recall of about 1 million SUVs with faulty airbag inflators, announced in May 2023. In the same month, another 650,000 vehicles were recalled for an issue that hindered the proper installation of children's car seats.

Ford

Ford didn't walk away from 2023 unscathed either. We reported in last week's newsletter, "Warranty Adjustments," that Ford had the most NHTSA recalls of any passenger car manufacturer, with 5.7 million vehicles affected by 56 recalls. However, Honda exceeded Ford in the total number of vehicles recalled in the U.S., due to a large Honda recall announced in late December. And the number of Ford vehicles affected by recall was down by -30% compared to 2022.

Ford's largest recall of 2023 was announced in July, and affected about 870,000 2021-2023 F-150 pickup trucks due to faulty parking brakes. In August, the company recalled about 175,000 2020-2023 vehicles with faulty rearview cameras. And in late December 2023, about 140,000 2016-2018 Focus and 2018-2022 EcoSport vehicles were recalled, due to oil pump drive belt or drive belt tensioner failures, which could result in a loss of engine oil pressure, potentially causing an engine stall and a loss of power braking assist.

Most recently, in January 2024, about 1.9 million 2011-2019 Ford Explorers were recalled due to a loose A-pillar trim piece that could become detached. According to David Shepardson at Reuters, "Ford said it was aware of 14,337 warranty reports alleging missing or detached exterior A-pillar trim parts."

This recall, like the Tesla warning light recall, was announced in early 2024, and thus is not yet directly reflected in the data. However, once a manufacturer anticipates warranty expenses, it should accrue for them, so it's possible that fourth quarter accruals anticipate at least some of these costs.

Warranty Claims

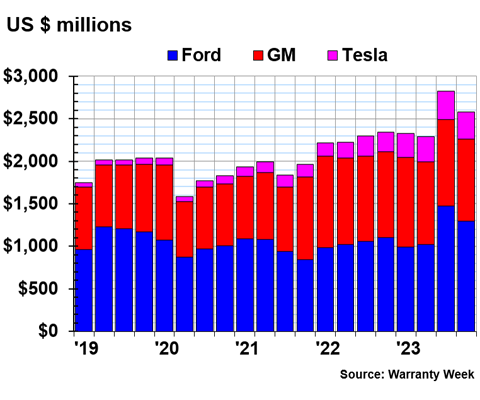

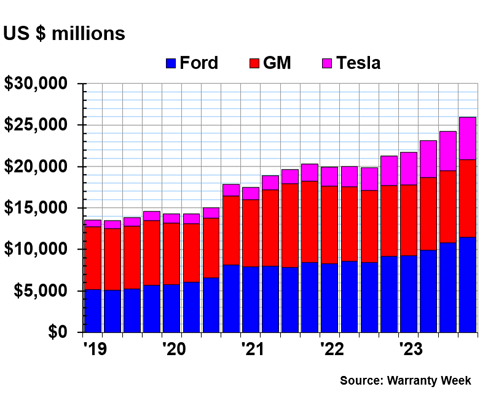

That's a lot of recalls. A lot of warranty woes for our three U.S.-based auto manufacturers in 2023. Without further ado, let's take a look at Figure 1, which shows the three companies' quarterly warranty claims costs over the past five years.

Figure 1

U.S.-based Auto Manufacturers

Claims Paid per Quarter

(in millions of U.S. dollars, 2019-2023)

In 2023 as a whole, Ford paid a total of $4.78 billion in warranty claims, up 15% from the year prior. GM paid $4.01 billion in claims during 2023, down -2% from 2022. Tesla paid $1.23 billion in claims, up 53% from the year prior. 2023 was the first year Tesla exceeded the billion-dollar threshold for total annual warranty claims payments.

During the fourth quarter of 2023, Ford paid $1.30 billion in claims. The company's most expensive period of 2023 for warranty claims was the third quarter, in which it paid $1.47 billion in claims.

During the fourth quarter of 2023, GM paid $965 million in warranty claims. GM's most expensive quarter for warranty claims was the first, in which it paid $1.06 billion.

Tesla paid $314 million in warranty claims during the fourth quarter of 2023. The company's most expensive quarter was the third, in which it paid $335 million in claims.

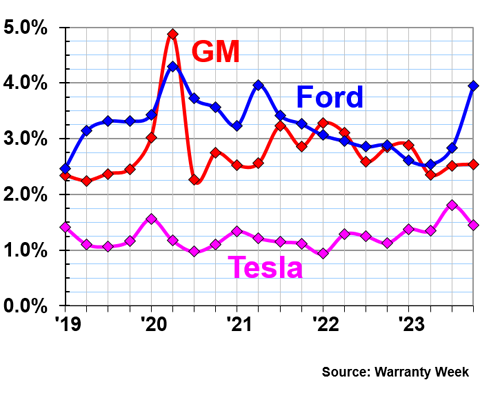

Figure 2 shows the three manufacturers' quarterly warranty claims rates for the past five years.

Figure 2

U.S.-based Auto Manufacturers

Warranty Claims Rates

(as a % of product sales, 2019-2023)

In the fourth quarter of 2023, GM had a claims rate of 2.54%. The company's claims rates have stabilized since the confusion of decreased sales in the early days of the pandemic, the Takata airbag recall resurgence in late 2020, and the 2021 Bolt battery recall. The global passenger vehicle industry average over time is just about 2.5%, so GM is currently right on target.

On the other hand, Ford's claims skyrocketed at the end of 2023. From the third to the fourth quarter, Ford's claims rate increased by about one-third, from 2.84% in the third quarter, to 3.95% in the fourth quarter. The last time we saw Ford's claims rate this high was in the second quarter of 2021. The claims rate had been steadily declining since then, until this upswing in the second half of 2023.

Tesla had a claims rate of 1.45% in the fourth quarter, despite year-over-year total claims payments increasing by about half. This is because product sales revenue has been increasing at pace with warranty claims costs, keeping the two in proportion to each other. This is why the claims rates are so important— while Tesla's total claims increased the most, Ford's claims rate increased the most. Totals without proportionality to sales don't tell the whole story.

Warranty Accruals

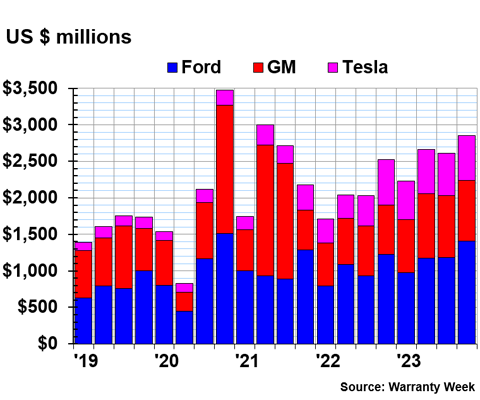

Figure 3 shows the three vehicle manufacturers' total warranty accruals over the past five years.

Please take a look at last week's newsletter, "Warranty Adjustments," for a fuller picture of these warranty accruals. Accruals are made based on sales during that period, while adjustments, specifically changes of estimate, are made to previous accruals when the company gains new information about how much warranty costs will be. During 2023, Ford, GM, and Tesla all made significant adjustments to previous warranty accruals made before 2023. Last week's newsletter details Tesla's adjustments for all four quarters of 2023, but only the first three quarters for Ford and GM, so we'll briefly tally the annual changes of estimate here. But take a look at the charts in that newsletter for a visual depiction and discussion of those adjustments by quarter, as changes of estimate are not shown in Figure 3.

Figure 3

U.S.-based Auto Manufacturers

Accruals Made per Quarter

(in millions of U.S. dollars, 2019-2023)

Ford accrued a total of $4.74 billion during 2023, up 18% from the year prior. In addition, Ford added another $2.65 billion into the warranty reserves as adjustments to previous accruals.

GM accrued $3.28 billion during 2023, up 27% from the year prior. GM deposited an additional $1.46 billion into the warranty reserves as adjustments to previous accruals.

Tesla accrued $2.33 billion during 2023, up 38% from the year prior. The company deposited an additional $539 million into the warranty reserves as adjustments to previous accruals.

During the fourth quarter of 2023, Ford accrued $1.41 billion for future warranty costs. This was the company's highest accrual total of the four quarters of 2023.

GM accrued $827 million during the fourth quarter of 2023. The company accrued the most funds during the second quarter, when it set aside $879 million.

Tesla accrued $616 million during the fourth quarter of 2023. This was Tesla's largest quarterly accrual total during 2023.

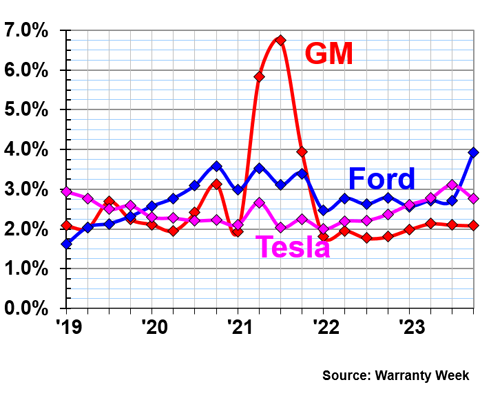

Figure 4 shows these quarterly accrual figures in proportion to total product sales revenue, with five years of accrual rates for each manufacturer.

Figure 4

U.S.-based Auto Manufacturers

Warranty Accrual Rates

(as a % of product sales, 2019-2023)

GM's accruals for the Bolt battery recall during the middle of 2021 still set the scale for this chart. Ford's recent increase in its accrual rate looks small in comparison.

However, Ford's accrual rate increased almost by half from the third to the fourth quarter of 2023. The accrual rate was 2.72% during the third quarter, and shot up to 3.92% during the fourth quarter.

In the fourth quarter, GM had an accrual rate of 2.08%, a little higher than the accrual rates we saw in 2022, but much lower than those of 2021.

Tesla had an accrual rate of 2.76% during the fourth quarter of 2023. The company's accrual rate has been on the rise since the beginning of 2022, but remains reasonable compared to the global industry average of about 2.5%.

Warranty Reserves

Our final metric is the end-balance of the warranty reserve fund of each company. The quarterly figures in Figure 5 reflect the reserve balance at the end of each quarter, but we'll simply detail the year-end balance on December 31, 2023.

Figure 5

U.S.-based Auto Manufacturers

Reserves Held per Quarter

(in millions of U.S. dollars, 2019-2023)

The warranty reserves of these three companies exceeded $25 billion for the first time at the end of 2023. We can see that Tesla has been steadily growing its warranty reserves for the past few years, as it's been ramping up global vehicle unit sales.

At the end of 2023, Ford held $11.50 billion in its warranty reserve fund, up 25% from the end of 2022.

GM held $9.30 billion in its warranty reserves at the end of 2023, up 9% from the end of 2022.

And Tesla held $5.15 billion in its warranty reserves at the end of 2023, up 47% from the end of 2022.