Smallest Warranty Reserve Capacities:

The manufacturers with the smallest warranty reserve capacities represent several industries, including auto parts, building trade suppliers, manufactured and mobile homes, and semiconductors.

To continue our exploration of the warranty reserves of the top U.S.-based manufacturers that report product warranty expenses, this week we present the smallest warranty reserve capacities. For part one of this series, take a look at last week's newsletter, "Largest Warranty Reserve Capacities."

Simply put, a warranty reserve capacity is the theoretical number of months a manufacturer will be able to pay future warranty claims, based on the amount currently held in its warranty reserve fund. The formula for this metric is:

Reserve Capacity = Reserve Fund Balance / Claims Paid Per Month

This metric, warranty reserve capacity, is a useful way to compare the amount of money a company has set aside in the expectation of spending it on future warranty expenses, the reserve balance, to the amount of money the company is actually spending on those expenses on a monthly basis, the claims cost.

Underpinning the warranty reserve capacity metric is the warranty accrual method, which is designed to protect companies from reliability surprises. By setting aside funds for future warranty costs each time a product is sold, and storing those funds in a dedicated account, a manufacturer has some financial padding when big, unexpected product malfunctions and warranty expenses arise. The whole point is to avoid having to take a huge chunk of money out of available cash, which would otherwise be part of the net profit. Thus the company and its profits are protected from sudden spikes in warranty expenses, because the money is already set aside in a dedicated warranty reserve fund.

However, it's not necessarily a condemnation for a manufacturer to show up in one of the following tables. Some of these companies sell products that come with short warranties, so naturally have smaller warranty reserves. But some are setting aside an inadequate amount of warranty accruals, based on the actual warranty claims spending it's reported.

Methodology

Our sample size for this newsletter is the same top 103 U.S.-based manufacturers that we used for last week's part one. For each company, we collected warranty data for the most recent eight quarters that had been reported by the end of February. Although some companies have published their 2023 annual reports over the past week, we are not including those data in this report in order to keep the data set consistent with that of last week's newsletter.

For each company, we perused their most recent eight quarterly and annual reports and collected three key warranty metrics: total claims paid, total accruals made, and the end-balance of the warranty reserve fund.

To create the following tables, Figures 1 and 4, we first calculated the warranty reserve capacity ratio for all 103 manufacturers, by dividing the quarter-ending warranty reserve fund balance by one-third of the quarterly claims total. We divide the claims total by three before plugging it into the formula in order to extrapolate the quarter's claims payments into three equal months of claims payments.

We calculated eight warranty reserve capacity ratios for each manufacturer, for each one's most recent eight quarters of available data. For the majority of the manufacturers, those most recent eight quarters were the four quarters of 2022, and the four quarters of 2023.

Among those companies named in Figures 1 and 4, this is true for all but Insulet Corp. For Insulet, we used the data from the fourth quarter of 2021, the four quarters of 2022, and the first three quarters of 2023. And of course, for those companies among the 103 that have fiscal years that differ from the calendar year, such as Cisco, we used the eight most recent quarters available, and matched them up to the traditional four quarters of the calendar year.

After we calculated the warranty reserve capacity ratios, we averaged the eight ratios together, to create the measure we call average reserve capacity, as shown in Figures 1 and 4. In those tables, the claims totals presented are the total for the same eight quarters for which the ratios were calculated, and the reserve balance shown is the balance at the end of the fourth quarter of 2023, except for Insulet, for which we show the end-balance of the third quarter of that year.

For the following charts, Figures 2, 3, and 5, we present the quarterly warranty reserve end-balances, and quarterly warranty reserve capacity ratios, starting from the beginning of 2021, and going up to the end of 2023. The additional year of data, 2021, was not used to calculate the average ratios in Figures 1 and 4, but is included in order to provide additional context for those particular companies.

To set a baseline, we'll let you know that the average of all of the average warranty reserve capacities was 29 months. Ford and General Motors both had an average reserve capacity of 26 months. Deere had an average capacity of 25 months. And Tesla had an average capacity of 43 months.

Top 10 Smallest Warranty Reserve Capacities

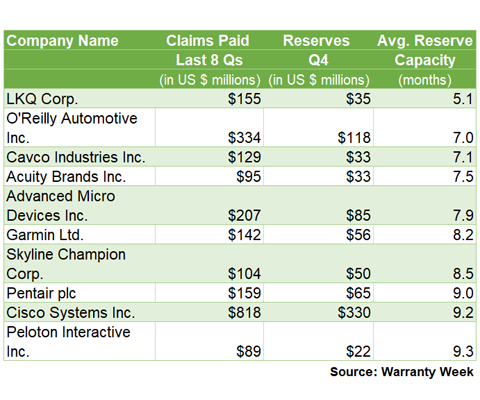

Figure 1 shows the top ten companies with the smallest average warranty reserve capacities over the last eight quarters.

Figure 1

Top U.S.-based Product Warranty Providers:

Smallest Warranty Reserve Capacities

2022 to 2023

Figure 1 is topped by two auto parts suppliers, LKQ Corp. and O'Reilly Automotive Inc. LKQ owns Keystone Automotive Industries, which is the United States' largest aftermarket auto parts supplier. LKQ also makes salvaged, recycled, and remanufactured auto parts, and had an average warranty reserve capacity of 5.1 months.

O'Reilly is an auto parts retailer, which offers limited product warranties on car batteries and other parts. As a retailer, O'Reilly isn't manufacturing much of its product line, but it does provide product warranties on many of the parts it sells. O'Reilly had an average capacity of 7.0 months.

It's not surprising to find these two with the smallest average warranty reserve capacities among 103 manufacturers. LKQ sells parts mainly to retailers and mechanics, some of whom tend to engage in the somewhat shady business practice of using warranty returns as a form of inventory control. For many of the parts returned to LKQ under warranty, its defect is simply that it didn't sell. So LKQ's warranty costs are likely higher than they really should be.

On the other side of the coin, O'Reilly is likely passing its warranty claims costs onto its suppliers, who reimburse O'Reilly for the claims payment made to the customer. As a retailer, O'Reilly doesn't need to be holding too many extra months' worth of claims payments, because it will recover claims costs from suppliers a few months after the payout to the consumer that returned the part.

In third in Figure 1 is Cavco Industries Inc., a prefabricated homebuilder with an average reserve capacity of 7.1 months. Cavco builds manufactured homes, modular homes, vacation cabins, and park model RVs. Park model RVs are essentially mobile homes, but re-branded (much like the "tiny house" craze of a few years ago). It's a trailer set on a chassis, but like a traditional mobile home, need a special permit and equipment to be moved. Similarly, we have Skyline Champion in the seventh spot in Figure 1, with an average reserve capacity of 8.5 months. Skyline Champion also makes manufactured, modular, and mobile homes, along with park model RVs.

Also in the building trades, we have Acuity Brands Inc. in the fourth spot, with an average capacity of 7.5 months, and Pentair plc in the eighth spot, with an average capacity of 9.0 months. Acuity Brands makes lighting, lighting controls, building system controls, and other power supply systems for both commercial and residential buildings. And Pentair makes water treatment systems for homes, including pool and spa pumps and filtration systems, water softening and filtration systems, and residential water supply and disposal pumps.

It's certainly interesting to see so many businesses engaged in homebuilding on this side of the spectrum of average warranty reserve capacities, since we saw five homebuilders and building trade suppliers in the table of the Largest Warranty Reserve Capacities. However, we can draw some contrasts between the types of homebuilders on each list. In Figure 1 above, Cavco and Skyline Champion build pre-fabricated manufactured homes and trailer homes, which come at a different price point than the luxury McMansion homebuilders such as Landsea and Hovnanian, both of which were on the list of the top ten largest reserve capacities. But even manufactured homes do come with warranty protections, so while we might expect smaller accruals per home sold for Cavco and Skyline Champion, what we're seeing here may be too small.

The final four companies in Figure 1 are all manufacturers in the tech industry. In the fifth spot, Advanced Micro Devices Inc., or AMD, makes semiconductors and computer processors, such as GPUs and CPUs. AMD had an average reserve capacity of 7.9 months. In the sixth spot, Garmin Ltd., with an average capacity of 8.2 months, makes global positioning system (GPS) receivers, including avionics, automotive and marine GPS systems, handheld devices, and wearable technology such as smartwatches. In ninth, Cisco Systems Inc., with an average capacity of 9.2 months, makes telecom equipment and other networking hardware, including routers.

These three companies all make small pieces of tech equipment that have a lot of impact. They all also sell their products to consumers, other manufacturers, and commercial entities. As we noted for the building trades, being a supplier to another manufacturer, or selling products for commercial use, can significantly cut down on a company's product warranty costs, so they can get away with holding less money in warranty reserves.

Commercial use invalidates the warranty, so for instance, AMD's GPUs used for Bitcoin mining are not covered under warranty. Furthermore, the GPUs and CPUs that AMD manufactures and sells to HP, for instance, are more sheltered from warranty claims costs. If a consumer files a warranty claim on their laptop's GPU, HP will replace the part, and then engage the supplier recovery process to be reimbursed by AMD. The more steps away from the consumer you are, the less likely you are to actually pay the warranty claims cost, simply due to bureaucratic inefficiency.

The final company in Figure 1 is Peloton Interactive Inc., in the tenth spot with an average reserve capacity of 9.3 months. While kind of a tech company, Peloton is distinct from AMD, Cisco, and Garmin, because Peloton makes luxury exercise equipment, including stationary bicycles, treadmills, and rowing machines. The Peloton craze took off a few years ago, offering exclusive exercise classes on the screen attached to the equipment. The classes require an additional $13 per month streaming service subscription, on top of the price of the equipment. Peloton is new to reporting its warranty expenses, so this may explain the disparity between its reserve capacity of 9.3 months, and the length of its warranties. The touchscreen and certain components of the equipment come with a 12 month warranty, while the frame comes with a five year warranty.

LKQ Corp.

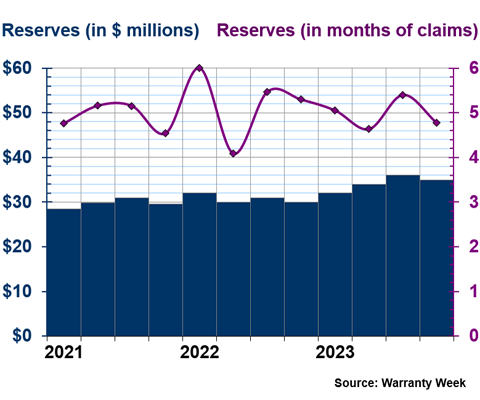

The next two charts focus in on the two companies with the smallest warranty reserve capacities, LKQ and O'Reilly. Figure 2 shows LKQ's warranty reserves and reserve capacity from 2021 to 2023.

Figure 2

LKQ Corp.

Warranty Reserve Capacity

2021 to 2023

(in US$ millions & months)

As we noted in our discussion of Figure 1, LKQ is an aftermarket auto parts manufacturer. As such, LKQ can often see retailers returning parts under warranty, not because they are defective, but simply because they did not sell.

As we saw in Figure 1, LKQ paid $155 million in warranty claims over the past two years, but only held $35 million in its warranty reserve fund at the end of the fourth quarter of 2023. The company's average reserve capacity across eight quarters was 5.1 months, so based on what it actually pays in claims, the company has less than half-a-year of claims payments currently set aside.

However, we can assume that many of the parts returned could be re-sold, so it's quite likely that the true reserve capacity for just those parts that really are broken would be higher.

With that said, we can see in Figure 2 that LKQ grew its warranty reserves a bit over the course of 2023. LKQ's warranty reserve capacity has fluctuated from as much as six months in the first quarter of 2022, to as low as four months in the second quarter of 2022.

O'Reilly

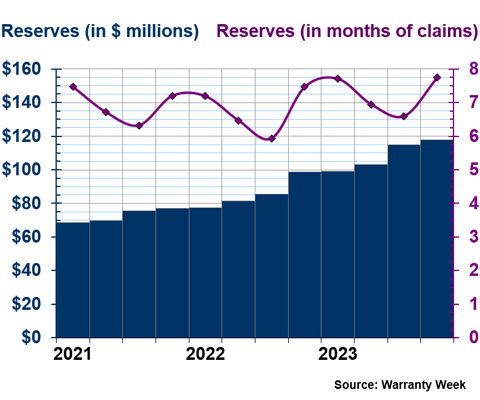

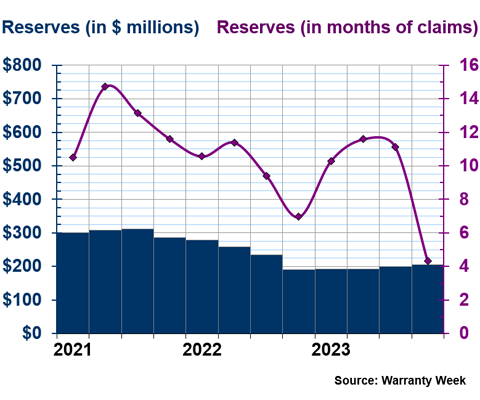

Figure 3 shows O'Reilly's warranty reserve capacity from 2021 to 2023.

Figure 3

O'Reilly Automotive Inc.

Warranty Reserve Capacity

2021 to 2023

(in US$ millions & months)

We can see in Figure 3 that O'Reilly's reserves have been steadily growing from the beginning of 2021 up until the end of 2023. The reserve capacity ratio seems to fluctuate according to a seasonal pattern, highest in the first quarter, falling until the third quarter, and then rising again in the fourth quarter. It's possible that car battery failures in cold weather are a factor here.

As we saw in Figure 1, O'Reilly paid a total of $334 million in claims during 2022 and 2023, but only held $118 million in reserves at the end of 2023. O'Reilly had an average reserve capacity of 7.0 months over the eight-quarter period. We can see in Figure 2 that the maximum has been about 7.75 months, in the fourth quarter of 2023, and the minimum has been 5.9 months, in the third quarter of 2022.

Next 10 Smallest Warranty Reserve Capacities

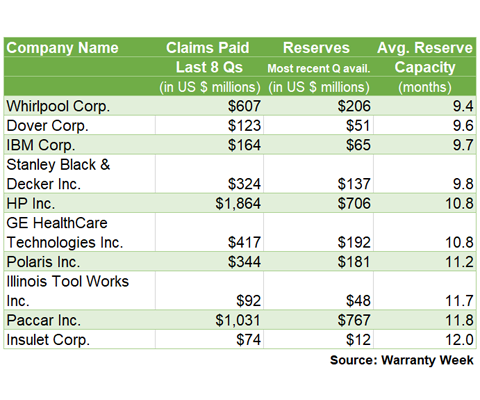

While looking at our data for this newsletter, we noticed many familiar names in the 11th-20th slots for the smallest warranty reserve capacity ratios. So we thought we'd provide the table for the next ten smallest reserve capacities, though we won't go into as much detail for Figure 4 as we did for Figure 1.

Remember that the average of all of the averages, among all 103 companies, was 28.8 months. So the following ten companies still had much smaller reserve capacities than is typical.

Figure 4

Top U.S.-based Product Warranty Providers:

Next 10 Smallest Warranty Reserve Capacities

2021 to 2023

In the first slot of Figure 4, which is eleventh overall among our sample of 103 companies, is famed appliance manufacturer Whirlpool. Whirlpool had an average reserve capacity of 9.4 months.

In second place is Dover Corp., a conglomerate that manufactures all sorts of things, including accessories for various heavy industries. Dover's average reserve capacity was 9.6 months. In the eighth slot is Illinois Tool Works Inc. (ITW), a direct competitor of Dover, which similarly makes a wide variety of industrial products and equipment. ITW had an average reserve capacity of 11.7 months.

In third is IBM, with an average capacity of 9.7 months. IBM has seen its warranty claims costs and reserve balance fall over the years, as the company continues to transition away from producing hardware that comes with warranties, and towards providing software and services. So it's not surprising that the average warranty reserve capacity is on the low side as well.

In fifth in HP Inc., which has a similar story, with accruals, claims, and reserves all reducing in tandem with a shift towards software and consulting services. However, HP still makes hardware, including computers, printers, scanners, and beyond, all of which come with warranties that are definitely longer than the average reserve capacity of 10.8 months.

Another famous name our readers will recognize is Paccar Inc., with an average reserve capacity of 11.8 months.

In fourth, we have Stanley Black & Decker Inc., the power tool manufacturer, with an average capacity of 9.8 months. In sixth we have GE HealthCare Technologies Inc., which is the relatively new spin-off from the parent GE, with a capacity of 10.8 months. In seventh is Polaris Inc., maker of motorcycles, snowmobiles, ATVs, and boats, with a capacity of 11.2 months. And in ninth is Insulet Corp., which makes high-tech insulin pumps, with an average reserve capacity of 12.0 months.

Whirlpool

Figure 5 shows Whirlpool's warranty reserve capacity from 2021 to 2023.

Figure 5

Whirlpool Corp.

Warranty Reserve Capacity

2021 to 2023

(in US$ millions & months)

We can see in Figure 5 that Whirlpool's average warranty reserve capacity fell significantly in the fourth quarter of 2023, due to abnormally high claims costs, almost triple what they were in the third quarter. Whirlpool's reserve capacity similarly fell in the fourth quarter of 2022, when claims rose and the reserve balance subsequently fell, but the capacity rose again in the beginning of 2023.