European Automaker Warranty Expenses:

In the wake of several major mergers and spin-offs, the European automakers are seeing their annual warranty expenses moderate, although Euro inflation helped drive up costs during 2022 and 2023.

In honor of the American holiday Memorial Day, we're taking a break from our series of twenty-one year product warranty data of U.S.-based manufacturers for the week. We hope our U.S.-based subscribers enjoy their long weekend, as do those subscribers off of work for the Spring Bank Holiday in the U.K. For those of us not replying to this email with an "out of office" message, we've got fresh and hot 2023 warranty data for seven European automakers.

Although SEC regulations only require public manufacturers based in the U.S. to report their product warranty expenses, the practice has spread worldwide, especially among the automakers. The European auto manufacturers report their warranty expenses once a year, in their annual reports.

Every year since 2003, we've gathered the warranty expense data of every global automaker that reports it. This year, we identified nine European-based auto manufacturers that reported warranty expenses during the past five years. Some of those companies are: Volkswagen AG, Stellantis N.V., Mercedes-Benz Group AG, BMW AG, Renault S.A., and Ferrari S.p.A.

In addition, we have data from Volvo Car AB and its subsidiary manufacturer Polestar Automotive Holding UK PLC, both of which are majority owned by the China-based Geely Holding Group, also the parent company of Geely Auto. Volvo Cars is not to be confused with Volvo Truck, also known as AB Volvo or the Volvo Group. Volvo Group sold Volvo Cars to Ford in 1999, and the two Volvos have been separate since then.

Geely entered the automotive industry in 1997, and acquired Volvo Cars from Ford Motor Co. in 2010. Polestar is a relatively new luxury EV-only manufacturer, founded in 2017. Although both Volvo Cars and Polestar are owned by Geely Auto, which does not report its warranty expenses, the two relatively autonomous European subsidiaries still file their own annual reports, in which they summarize their own product warranty expenses. Volvo Cars reports in Swedish kronor, while Polestar oddly reports in U.S. dollars.

In contrast, Jaguar Land Rover is not included in this report. Although it is based in the United Kingdom, Jaguar Land Rover is majority owned by the Indian Tata Motors, and does not file its own separate annual report, or report its own warranty expenses independent from the rest of Tata.

We also included the product warranty data from PSA Peugeot Citroën Group, which ceased reporting after merging with FCA Fiat Chrysler Automobiles N.V. to form Stellantis N.V. in early 2021. PSA owned the Peugeot, Citroën, Opel, DS, and Vauxhall brands, while FCA owned brands including Fiat, Chrysler, Jeep, Dodge, Alfa Romeo, Lancia, Maserati, and Ferrari. In turn, FCA was formed in 2014 through the merger of Fiat and Chrysler. Because FCA was the larger of the two manufacturers that merged to form Stellantis, the data labeled "Stellantis" for 2019 and 2020 in the following charts represent the warranty expenses that FCA reported during those years. PSA's data are also included for those years in the charts.

In anticipation of the merger with PSA, FCA spun off Ferrari in 2016. Ferrari started reporting its warranty expenses in 2019, so it is also included separately in the following charts.

Another European automaker that's undergone some restructuring lately is Mercedes-Benz Group, formerly known as Daimler AG (from 2007 to 2022), and before that known as DaimlerChrysler (from 1998 to 2007), and before that known as Daimler-Benz (from 1926 to 1998). Daimler spun off its commercial vehicle manufacturing business as Daimler Truck Holding AG in 2019, and then renamed itself Mercedes-Benz Group to reflect the name of its passenger car business.

Renault also has a bit of a unique situation. Renault has been in an alliance with Nissan since 1999, and Mitsubishi joined the venture in 2017. While each of the three is an independent company, they each own partial voting stakes in the other two. Nissan owns a 15% stake in Renault, as does the French government.

For each of these nine manufacturers, we perused their annual reports and collected three essential warranty metrics: the amount of claims they paid, the amount of accruals they made, and the amount of reserves they held at the end of each year. In addition, we collected two sales metrics: the amount of automotive product revenue they reported, and the number of vehicles they sold.

Using these data, we calculated three additional metrics: claims as a percentage of sales revenues (the claims rate), accruals as a percentage of sales revenue (the accrual rate), and the amount of accruals per vehicle sold (accruals divided by unit sales).

For Volvo Cars, which reports in Swedish kronor, we first converted the totals to U.S. dollars using the IRS yearly average currency exchange rates. Then we took the U.S. dollar amounts for Volvo Cars and Polestar and converted them to Euro using the same exchange rate table provided by the IRS.

Please note that Polestar has yet to file its 2023 annual report, so its data are included just for 2020, 2021, and 2022, the only years currently available.

Warranty Claims Totals

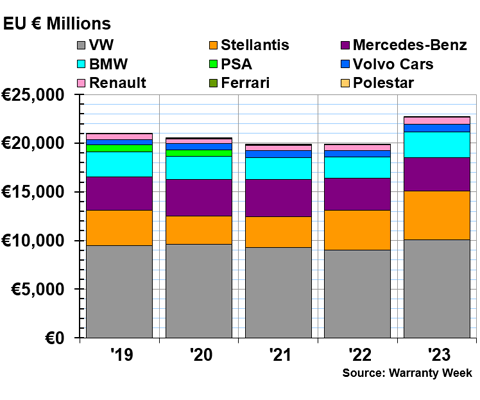

Figure 1 shows the warranty claims costs of the nine European auto manufacturers in this report, from 2019 to 2023.

Figure 1

Warranty Claims Paid by

Nine European Manufacturers

(in EU € millions, 2019-2023)

The seven European automakers currently active (excluding Polestar) spent a collective total of €22.716 billion during calendar 2023. It's the highest total out of the five years depicted in Figure 1, but still shy of 2017's total of €26.960 billion, thanks to Volkswagen's emissions scandal.

Volkswagen paid €10.047 billion in product warranty claims during 2023, up 12% from 2022's total. It's the most the manufacturer has spent on claims annually during the last five years, but less than the company spent in 2017 or 2018.

Stellantis paid €5.066 billion in claims during 2023, up 24% from the year prior. In the final year of data from before the merger, 2020, FCA spent €2.897 billion on claims, while PSA spent €624 million. So the new Stellantis is now spending more on warranty claims than what its two predecessors used to spend combined.

Mercedes-Benz spent €3.377 billion on warranty claims in 2023, up 2% from 2022. BMW spent €2.674 billion on claims during 2023, up 23%. And Renault spent €709 million on claims, up 20%.

Volvo Cars, owned by Geely Group but reporting separately from Geely Auto, spent €793 million on claims during 2023, up 22% from 2022. Geely's other, much smaller European auto brand, Polestar, has yet to file its 2023 annual report, if it's coming at all. Polestar paid just €24 million in claims during 2022, too little to even show up in Figure 1 beyond a sliver of color above Renault.

Along with Polestar, Ferrari is also included in Figure 1, but paid so little in claims that its totals are not visible next to those of Renault. Ferrari paid €51 million in claims during 2023, up 27% from €40 million during 2022.

Warranty Claims Rates

While those totals are intriguing, it's hard to compare the expenses of one company to those of another, considering how diverse they are in size and product lines. Ferrari and Polestar are selling luxury vehicles at high price points, and selling a few vehicles to select consumers. Volkswagen and Stellantis, on the other hand, are two of the largest automakers in the world, and sell several million vehicles each year. And then Mercedes-Benz, BMW, and Renault are just about in the middle, having sold about two million vehicles each during 2023.

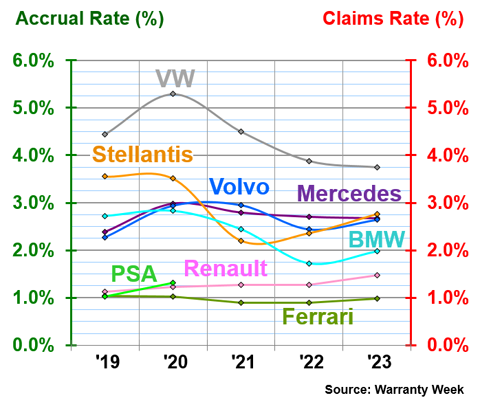

This is where our warranty expense rates especially come in handy. Figure 2 depicts the claims totals of Figure 1 in proportion to each manufacturer's own vehicle sales total. Figure 2 shows the warranty claims rates of eight of the European automakers from 2019 to 2023, excluding Polestar since the 2023 data are missing.

Figure 2

Warranty Claims Rates of

Eight European Manufacturers

(as a % of product revenue, 2019-2023)

Volkswagen has the highest sales volume among the group, but still maintains the highest warranty expense rates among the group as well. In 2023, Volkswagen had a claims rate of 3.75%. This is actually the lowest we've seen Volkswagen's claims rate in a decade, and the first time the company's claims rate has dipped below 4% since 2014.

Stellantis had the next-highest claims rate during 2023, at 2.76%. Also in the middle of the pack were Mercedes-Benz with a 2.67% claims rate, and Volvo Cars with a 2.64% claims rate.

BMW's claims rate was a little lower, at 1.97%. This is lower than is typical for BMW, but higher its annual claims rate during 2022.

Renault's claims rate has been on the rise over the past five years. In 2023, Renault had a claims rate of 1.47%.

It used to be that Renault had the lowest warranty claims rates among the European automakers, along with PSA Group. But Ferrari, new kid on the block to warranty reporting, takes the title of lowest warranty claims and accrual rates of 2023. Ferrari had a claims rate of 0.99% in 2023, up a bit from 2021 and 2022.

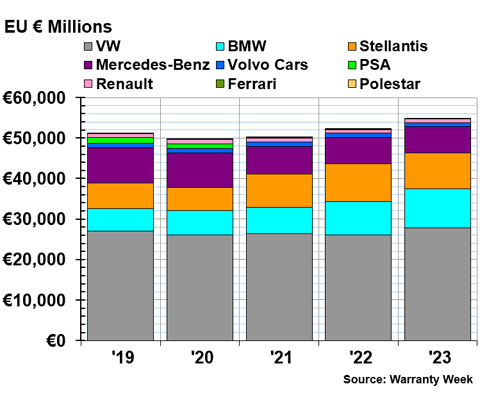

Warranty Accrual Totals

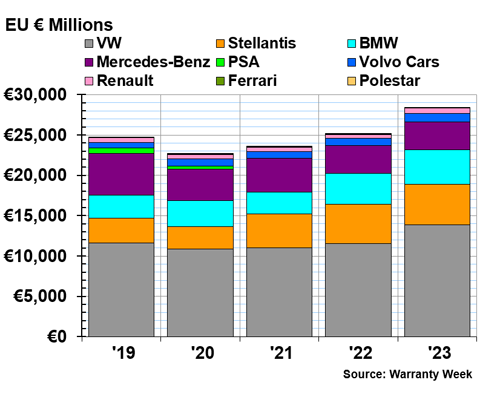

Figure 3 shows the total warranty accruals made by each of the nine manufacturers from 2019 to 2023.

Figure 3

Warranty Accruals Made by

Nine European Manufacturers

(in EU € millions, 2019-2023)

2023 saw the largest collective warranty accrual total from these European automakers since 2015, when the Volkswagen diesel emissions scandal dropped. During 2023, the seven automakers in this report set aside €28.418 billion for future warranty costs.

Volkswagen accrued €13.833 billion during 2023, up 20% from 2022. It's the most Volkswagen accrued in a single year since 2017.

Stellantis accrued €5.064 billion during 2023, up 4% from the year prior. It's the most the company has ever accrued in a single year, but that doesn't really mean much, because Stellantis has only existed in its current form since January 2021. Still, we note that the manufacturer has had its warranty accruals on the rise since it was formed.

BMW accrued €4.243 billion during 2023, up 11% from 2022. Speaking of records, this is the most money we've ever recorded BMW setting aside in warranty accruals during a single year.

Mercedes-Benz accrued €3.483 billion during 2023, a lateral move from 2022. It's impressive that the manufacturer managed to get 2023's total within €1 million of 2022's total, considering the scale of these numbers.

Volvo cars accrued €1.007 billion during 2023, up 14% from 2022. Renault accrued €724 million, up 54% from 2022. It looks like Renault's warranty costs were slightly more than usual during 2023, driving up the warranty expense rates as well. And Ferrari accrued €63 million during 2023, up 4% from 2022.

Warranty Accrual Rates

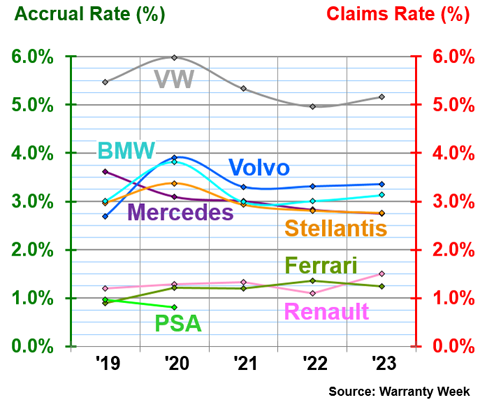

Figure 4 shows the warranty accrual data in proportion to each manufacturer's product sales totals. The accrual rates are shown over a five year period, from 2019 to 2023.

Figure 4

Warranty Accrual Rates of

Eight European Manufacturers

as a % of product revenue, 2019-2023)

Volkswagen had an accrual rate of 5.16% during 2023. We've seen Volkswagen range from 5% to 6% for this metric over the last five years.

Volvo Cars had the next-highest accrual rate of 3.36% during 2023. Joining Volvo Cars in the middle of the pack are BMW, Stellantis, and Mercedes-Benz. During 2023, BMW had an accrual rate of 3.13%, Stellantis had an accrual rate of 2.76%, and Mercedes-Benz had an accrual rate of 2.75%.

The manufacturer that saw the most fluctuation in its annual accrual rate from 2022 to 2023 was Renault. Renault's accrual rate increased by two-fifths in just a year. In 2023, Renault had an accrual rate of 1.50%.

During 2023, Ferrari had an accrual rate of 1.24%, lowest among the group of seven.

Accruals per Vehicle Sold

For this report, we have one more warranty metric calculated using the data from each manufacturer's annual report, accruals per vehicle sold. When we can, we used the segmented product sales figures for just passenger cars, excluding sales of trucks, buses, motorcycles, etc. However, none of these manufacturers provides segmented warranty data for each product type. So these accrual rates are an average across all product lines, not just passenger cars.

However, each manufacturer's individual product mix doesn't change much from year to year, so therefore their accruals per vehicle sold also shouldn't change too much.

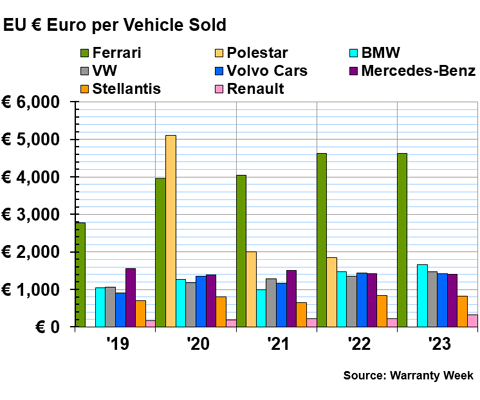

Figure 5 shows the accruals per vehicle sold for eight European manufacturers, from 2019 to 2023.

Figure 5

Warranty Accruals Made per Vehicle Sold by

Eight European Manufacturers

(in EU € euro, 2019-2023)

We expect that the luxury vehicle manufacturers sell fewer vehicles, but each vehicle costs more than a typical sedan. Repairs are also more expensive for luxury vehicles. So it's no surprise that Ferrari and Polestar have the highest accruals per vehicle sold in Figure 5.

What's a little surprising is that Polestar's accruals per vehicle sold more than halved from 2020 to 2021. However, it's not totally unreasonable, since it's such a new company and 2020 was its first year reporting its warranty expenses. Of course, Polestar hasn't filed its 2023 annual report yet, so we don't know if this metric continued to drop.

In 2023, Ferrari accrued an average of €4,635 for every vehicle it sold. The metric has risen for Ferrari each year since 2019, when it first started reporting.

The next-highest is a far cry from Ferrari's high average. BMW accrued an average of €1,661 for every vehicle it sold in 2023.

Volkswagen joins its German compatriots in the middle of the pack for this warranty metric. In 2023, Volkswagen accrued an average of €1,478 for each vehicle it sold. And Mercedes-Benz accrued an average of €1,398 for each vehicle it sold.

Volvo Cars accrued an average of €1,421 for each vehicle it sold.

Surprisingly at the low end of the curve for this warranty metric, Stellantis accrued an average of just €820 for each vehicle it sold. And rounding out the group is Renault, which accrued an average of €332 per vehicle sold.

Warranty Reserve Totals

Our final warranty metric is the year-end balance of each European automaker's warranty reserve fund.

Figure 6

Warranty Reserves Held by

Nine European Manufacturers

(in EU € millions, 2019-2023)

At the end of 2023, the seven European automakers held a collective €54.783 billion in warranty reserves, the highest since 2016.

At the end of 2023, Volkswagen held €27.764 billion in reserves, up 7%, and the highest since 2017.

BMW had the second-largest warranty reserve fund of the group, after doubling its reserve balance from 2017 to 2023. In fact, it's perfectly double: at the end of 2017, BMW held €4.825 billion in reserves, and at the end of 2023, BMW held €9.650 billion. BMW grew its reserve balance by 17% from the end of 2022 to the end of 2023.

Stellantis held €8.984 billion in its reserve fund at the end of 2023, down -3% from 2022. Mercedes-Benz held €6.399 billion in its reserve fund, also down -3% from 2022.

With much smaller warranty reserve fund balances, we have our final three manufacturers. At the end of 2023, Volvo Cars held €968 million in reserves, down -10% from the end of 2022. Renault held €887 million, up 1% from the end of 2022. And Ferrari held €130 million, up 4% from the end of 2022, but still not quite enough to show up in our chart.