U.S. Small Vehicle Warranty Expenses:

Ford, GM, and Tesla are not the only small vehicle manufacturers based in the U.S., though they do account for the lion's share of the industry's warranty expenses. This week, we delve into the warranty expenses of the other manufacturers in the industry, including manufacturers of motorcycles, boats, EVs, riding lawn mowers, street sweepers, and more.

The more astute and attentive readers of Warranty Week will recall that we covered the U.S.-based automotive manufacturers quite recently, in the newsletter "U.S. Auto Warranty Annual Reports," published in February of this year. So why are we covering the industry's annual warranty data again?

We could go for the technical explanation, that this newsletter contains annual data from the past 21 years, while the newsletter in February contained quarterly data from the past five years. Or we could go for the matter-of-fact explanation, that in 2023, the passenger car manufacturers accounted for 40% of product warranty claims costs, 39% of accruals, and 48% of warranty reserves; the largest industry for product warranties deserves extra coverage in our publication. And since we released our "Twenty-first Annual Product Warranty Report" last week, it's natural to begin our deep dive into each industry in that report with the largest one.

But really, what sets this newsletter apart is the inclusion of the small but mighty "other" category, which is not present in our quarterly auto OEM updates, such as our most recent from February. The "other" category consists of 34 auto OEMs that, frankly, have product warranty expenses so low that they wouldn't show up individually on a chart against the huge warranty expenses of Ford, GM, and Tesla (the "new big three," if you will). Many of these companies are new to the U.S. manufacturing landscape, and new to warranty reporting, even compared to relative newcomer Tesla, which started reporting in 2009.

Our use of the phrase "the new big three" nods to Chrysler's departure from the list of U.S.-based auto OEMs back in 2015. While traditionally considered an American automaker, Chrysler was owned by the German-based Daimler from 1998 to 2007, and then acquired by the Italian-based Fiat in 2014, forming Fiat Chrysler Automobiles (FCA). You can take a look at Chrysler's warranty data from the brief five-year window in which it was U.S.-based and reporting its warranty expenses in our 2019 newsletter "American Auto Warranty Expenses." In 2021, FCA merged with Peugeot to form Stellantis; because Stellantis is European-based, it only reports its warranty expenses once a year, in its annual reports. You can take a look at Stellantis' last five years of warranty expenses in our 2023 newsletter "European Automaker Warranty Expenses."

To compile the data used in this newsletter, we perused the annual and quarterly financial reports of all 37 U.S.-based small vehicle manufacturers that have ever reported product warranty expenses. Of those 37, 20 reported warranty costs during 2023. For each company, we extracted three key warranty metrics: claims paid, accruals made, and reserves held. We also gathered figures for total automotive sales revenue, using segmented revenue when possible to obtain a number that represents just product sales, and not services, service contracts, financing, etc. We used the product revenue data to calculate our two ratios: claims as a percentage of sales (the claims rate), and accruals as a percentage of sales (the accrual rate).

The 17 companies in the "other" category that reported warranty expenses during 2023 are, in order of the amount of warranty accruals they made: Polaris Inc., Toro Co., Lucid Group Inc., Harley-Davidson Inc., Hyster-Yale Materials Handling Inc., Malibu Boats Inc., Alamo Group Inc., MasterCraft Boat Holdings Inc., Federal Signal Corp., Mullen Automotive Inc., Marine Products Corp., Volcon Inc., Twin Vee PowerCats Co., Art's-Way Mfg. Co. Inc., Ideanomics Inc., Faraday Future Intelligent Electric Inc., and Rivian Automotive Inc.

In the name of full disclosure, we'll mention here that Lucid Group is 60% owned by Saudi Arabia's Public Investment Fund. And we'll make a larger blanket statement about the new EV manufacturers that have popped up in the last five years or so: if their warranty expenses seem astronomical compared to the amount of sales they're making, just know that they're able to burn money with the hope of profit in the future, thanks to their investors. Tesla did it, and now Lucid is hoping to be the next, with the help of Saudi Arabian investment.

Warranty Claims Totals

Before we get to the data, we'll start by commenting on recent news stories for the three largest OEMs in this report, Ford, GM, and Tesla. We detailed the chronicles of all three manufacturers' recalls, trials, and tribulations in our recent newsletter "U.S. Auto Warranty Annual Reports." Take a look there for more information on some of the forces, beyond just inflation, driving up the three manufacturers' warranty costs.

In addition to the recall of almost every vehicle Tesla's ever sold in both the United States and China, announced in the early part of 2024, Tesla announced last week that it's also recalling all of its new, experimental Cybertrucks, of which it sold about 4,000. As a fun warranty tidbit, we'll mention that Tesla also announced that washing your Cybertruck without first activating "car wash mode" voids the product warranty. The Cybertruck owner's manual states, "Failure to put Cybertruck in Car Wash Mode may result in damage (for example, to the charge port or windshield wipers). Damage caused by car washes is not covered by the warranty."

Since these recalls were announced in 2024, they ostensibly shouldn't show up in the following data, which goes up to December 2023, too much. However, GM, Ford, and Tesla all released their first quarter financial statements this week, so we'll take a look at those soon and keep our readers updated about Tesla's unfolding product warranty crisis.

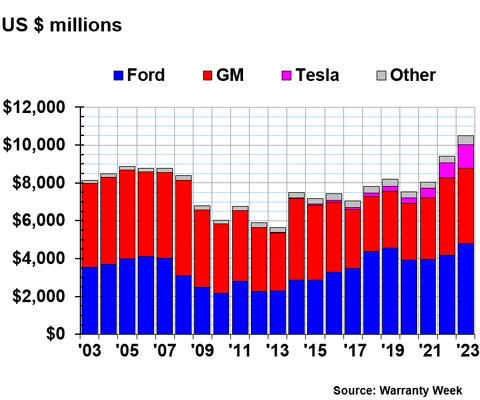

Figure 1 shows the annual warranty claims costs not just of Ford, GM, and Tesla, but also 34 more car & cycle manufacturers, represented in the "other" category, from 2003 to 2023.

Figure 1

U.S.-based Auto Manufacturers

Claims Paid per Year

(in millions of U.S. dollars, 2003-2023)

The car & cycle manufacturers paid a total of $10.508 billion in warranty claims during 2023. That figure was up by 12%, or $1.084 billion, from 2022. We've seen year-over-year increases in total warranty claims costs by over one billion dollars two years in a row, with the increase from 2021 to 2022 being even larger.

Ford paid $4.779 billion in claims during 2023, up 15% from the year prior. GM paid $4.009 billion in claims, down -2%. And Tesla paid $1.225 billion in claims, up 53% from 2022. 2023 was the first year that we've seen Tesla pay over $1 billion in warranty claims.

Snowmobile, ATV, motorcycle, and boat manufacturer Polaris Inc. paid $201 million in claims during 2023, up 40% from 2022. Lawn mower, snow blower, and snow plow manufacturer Toro Co. paid $85 million in claims, up 9%. Motorcycle maker Harley-Davidson paid $67 million in claims, up 76%. Forklift manufacturer Hyster-Yale Materials Handling paid $27 million in claims, down -9%.

Another lawn mower manufacturer, Alamo Group Inc., paid $12 million in claims, up 6% from the year prior. Street sweeper and emergency vehicle manufacturer Federal Signal Corp. paid $8 million in warranty claims, up 7%. Art's-Way Mfg. Co. Inc., which makes farm equipment designed to be hauled by tractors, paid $330,000, down -5%.

Among the boat makers, Malibu Boats paid $25 million during 2023, up 20% from the year prior. MasterCraft Boat Holdings paid $15 million in claims, up 22%. Marine Products Corp. paid $4 million, down -8%. And Twin Vee PowerCats Co. paid $360,000, up 58%.

Next we have our small electric vehicle (EV) manufacturers. These are companies hoping to be the next Tesla (whether that moniker is a good thing in light of the recent recalls is another question), but currently at much lower sales volumes and thus paying a lot less for warranty costs. Lucid Group Inc. spent $51 million on claims during 2023, more than quadrupling from 2022's $12 million. Faraday Future Intelligent Electric Inc. paid just $12,000 in claims, the first time the company has reporting paying any product warranty claims at all.

Fellow EV makers Ideanomics, Mullen, Rivian, and Volcon reported warranty accruals, but not claims.

Warranty Accrual Totals

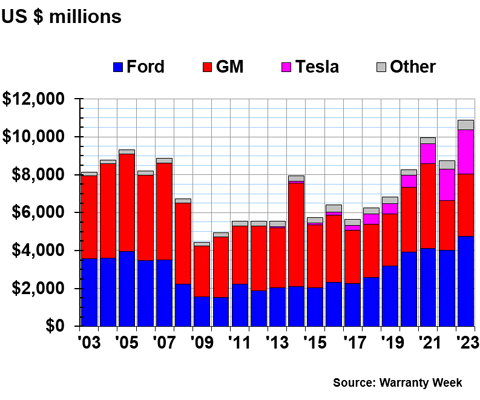

Figure 2 shows the annual warranty accruals of these manufacturers, from 2003 to 2023.

Figure 2

U.S.-based Auto Manufacturers

Accruals Made per Year

(in millions of U.S. dollars, 2003-2023)

The car & cycle manufacturers set aside a total of $10.895 billion in warranty accruals during 2023, up 25%, or $2.153 billion, from 2022.

Ford accrued a total of $4.743 billion during 2023, up 18% from the year prior. GM accrued $3.282 billion, up 27%. And Tesla accrued $2.333 billion, up 38%.

Polaris accrued $209 million during 2023, up 14% from 2022. Toro accrued $90 million, up 5%. Harley-Davidson accrued $45 million, up 15%. Hyster-Yale Materials Handling accrued $45 million, up 57%.

Malibu Boats accrued $25 million, an increase of just 0.4%. MasterCraft Boat Holdings accrued $12 million, down -22%. Marine Products accrued $6 million, up 2%. Twin Vee PowerCats accrued $460,000, up 88%.

Alamo Group accrued $14 million, up 22%. Federal Signal Corp. accrued $8 million, up 16%. Art's-Way accrued $430,000, up 27%.

And now for the EV manufacturers, aside from Tesla. Many of these OEMs reported 2023 warranty accruals that really exceeded those of 2022. We can chalk this up to increasing sales driving up total accruals. For instance, Lucid Group delivered 4,400 vehicles in 2022, and 6,000 vehicles during 2023.

Lucid set aside $74 million in warranty accruals, up 123% from 2022. Ideanomics Inc. accrued $430,000, up 333%. And Rivian Automotive accrued $120,000, up 19%. We're excited to welcome Rivian to Warranty Week; 2023 was the first time the company reported its warranty expenses, but it helpfully provided historical data for 2022 as well.

We have three more EV manufacturers in their first year of reporting. Mullen Automotive accrued $6.6 million during 2023. Faraday Future Intelligent Electric Inc. accrued $260,000. And Volcon Inc., which makes electric off-road power sports vehicles, accrued $560,000 during 2023.

Warranty Expense Rates

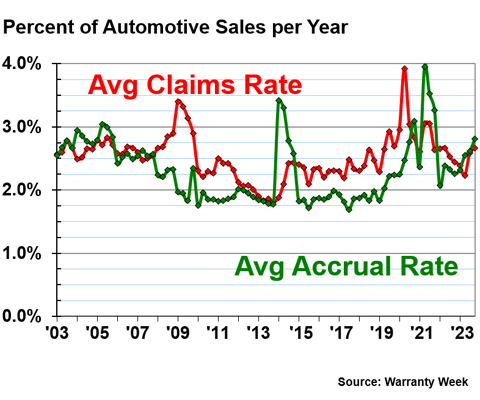

Figures 3-5 detail these manufacturers' warranty expense rates. Figure 3 shows the industry average warranty expense rates, accounting for all the manufacturers in this report, as well as those that previously reported over the past two decades, but no longer do.

Figure 3

U.S.-based Auto Manufacturers

Average Claims and Accrual Rates

(as a % of product sales, 2003-2023)

Over 21 years, the car & cycle manufacturers had an average claims rate of 2.52%, with a standard deviation of 0.36%, and an average accrual rate of 2.31%, with a standard deviation of 0.49%. So on average, there's more volatility in the accrual rate than there is in the claims rate, which makes sense considering manufacturers have a more direct influence on the amount they accrue each year.

In 2023, the industry average claims rate was 2.47%, and the average accrual rate was 2.57%. However, we see much more volatility on a quarter-by-quarter basis, even among the industry average rates. In 2023 alone, the minimum average claims rate was 2.23%, recorded in the second quarter, and the maximum was 2.67%, recorded in the fourth quarter. So in one year, we see a range that exceeds even the standard deviation for this rate over 21 years. That's an astounding amount of volatility, especially compared to the very stable period we saw from 2015 to 2021.

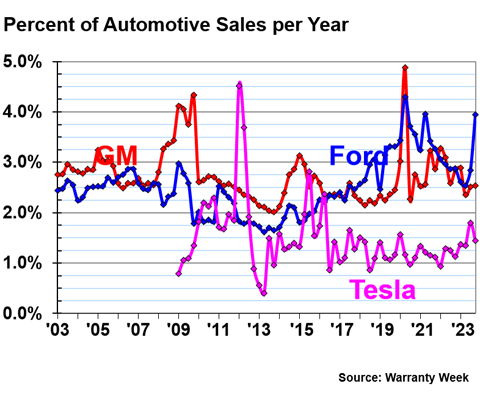

Figure 4 details the quarterly warranty claims rates for the three largest OEMs in this report, Ford, GM, and Tesla, from 2003 to 2023.

Figure 4

U.S.-based Auto Manufacturers

Warranty Claims Rates

(as a % of product sales, 2003-2023)

It's fair to say that GM's quarterly claims rates were all over the place a few years ago, especially when the company was embroiled in the Bolt battery recall. Recently, we've seen a lot of volatility in this metric from Ford.

Ford had a claims rate of 4.0% in the fourth quarter of 2023, shooting up over a percentage point from 2.8% in the third quarter.

In the fourth quarter, GM had a claims rate of 2.5%, and Tesla had a claims rate of 1.4%.

We'll provide some brief highlights of the claims rates of the other OEMs in this report. In the fourth quarter of 2023, Lucid Group had a claims rate of 8.6%, MasterCraft Boat had a claims rate of 3.9%, and Malibu Boats had a claims rate of 3.7%. On the low side of the spectrum, Federal Signal had a claims rate of 0.4%, Alamo Group had a claims rate of 0.7%, and Hyster-Yale had a claims rate of 0.7% as well.

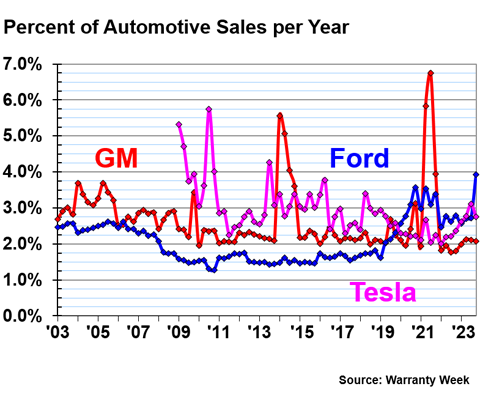

Figure 5 shows the same three OEMs' quarterly warranty accrual rates from 2003 to 2023.

Figure 5

U.S.-based Auto Manufacturers

Warranty Accrual Rates

(as a % of product sales, 2003-2023)

We can see that Ford's accrual rate shot up at the end of 2023 too, just like the claims rate did. Ford's accrual rate was 2.7% during the third quarter of 2023, and increased to 3.9% in the fourth quarter of the year.

During the fourth quarter of 2023, GM had an accrual rate of 2.1%, and Tesla had an accrual rate of 2.8%. Notice that Tesla's accruals, and accrual rate, are almost double its claims and claims rate. It remains to be seen if this reflects the company's growing sales and projections of growth, or if this reflects the anticipated recalls and higher-than-usual warranty costs per vehicle.

We'll again provide the highest and lowest accrual rates among the other OEMs, from the fourth quarter of 2023. Lucid Group had an accrual rate of 12%, a figure we might even call shockingly high. The next-highest is Malibu Boats with an accrual rate of 3.2%. Federal Signal had the lowest accrual rate in the group, at 0.5%, followed by Alamo Group at 0.8%, and Harley-Davidson at 1.0%.

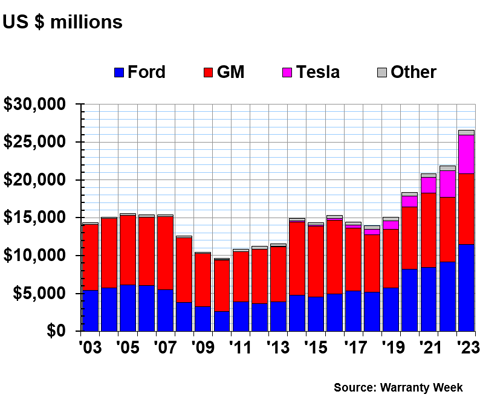

Warranty Reserve Balances

Our final warranty metric is the end-balance of each manufacturer's warranty reserve fund at the end of each calendar year from 2003 to 2023, shown in Figure 6.

Figure 6

U.S.-based Auto Manufacturers

Reserves Held per Year

(in millions of U.S. dollars, 2003-2023)

It's amazing to think that the car & cycle manufacturers' collective warranty reserves have grown by $10 billion in just five years. Warranty reserve balances are growing at an unprecedented rate in this industry, and it seems that every year, almost every quarter, sets a new industry record high for this metric.

At the end of 2023, Ford held $11.504 billion in its warranty reserves, growing this balance by 25% in just a year. It's a new record high warranty reserve balance for Ford.

GM held $9.295 billion in its warranty reserves at the end of 2023, up 9%.

Tesla held $5.152 billion in its reserves at the end of 2023, up an amazing 47%, to a new record high by a longshot.

At the end of 2023, Polaris held $181 million in its warranty reserves, up 5%. Toro held $144 million, up 7%. Harley-Davidson held $64 million, down -16%; Harley-Davidson was the only manufacturer in this report to shrink its warranty reserves from 2022 to 2023. Hyster-Yale Materials Handling held $68 million, up 20%.

Among the boat manufacturers, Malibu Boats held $41 million, narrowly up just 0.2%. MasterCraft Boat Holdings held $31 million, up 5%. Marine Products held $7 million, up 24%. And Twin Vee PowerCats held $193,000, an increase of 109%.

Alamo Group held $11 million, up 19%. Federal Signal held $10 million, up 3%. And Art's-Way held $295,000, up 53%.

Lucid Group is the only one of our newer EV manufacturers that reported its warranty reserve balance at the end of 2023. Lucid held $46 million in its reserve fund at the end of 2023, doubling 2022's end-balance of $23 million.