Korean & Indian Automaker Warranty Expenses:

Warranty claims costs fell a bit for Hyundai and Kia, but their warranty accruals soared, in the wake of the "park outside" recall of 3.3 million vehicles at the end of 2023. Tata's warranty claims, accruals, reserves, and expense rates all increased from 2023 to 2024.

This week, we're taking a look at the warranty expenses of the largest South Korean and Indian automakers. Based in South Korea, we have Hyundai Motor Co. and Kia Corp., and based in India, we have Tata Motors Ltd. and Mahindra & Mahindra Ltd.

In terms of vehicle production, Hyundai is the third-largest global automaker, behind Toyota and Volkswagen. Hyundai owns the Genesis luxury vehicle brand, as well as the Ioniq electric vehicle (EV) line.

In addition, Hyundai owns one-third of Kia, ever since the 1997 Asian financial crisis. While Hyundai acquired a 51% controlling majority of Kia in 1997, it has since divested some of that stake, down to 34% ownership, but remains Kia's largest shareholder. In turn, Kia is a minority holder of Hyundai subsidiaries.

While the two South Korean automakers are in partnership with each other, they still publish separate annual reports, and do their warranty expense accounting separately. However, they share suppliers, which has led to similar recalls from both automakers over the past decade.

Tata Motors Ltd. is the largest Indian automaker. Tata acquired the Jaguar Cars and Land Rover brands from Ford in 2008, and has since consolidated them into the U.K.-based subsidiary holding company Jaguar Land Rover. In 2004, Tata acquired the South Korea-based Daewoo Commercial Vehicles Division, now known as the Tata Daewoo Commercial Vehicle Co. Tata also manufactures buses, under the Tata, Hispano, and Marcopolo brands, and construction equipment in a joint venture with Japanese-based Hitachi Construction Machinery Co.

Although Jaguar Land Rover and Daewoo Commercial Vehicles are technically subsidiaries of Tata, the company reports all of the warranty expenses of all of its global brands collectively. Thus, all of these subsidiaries of Tata are represented in the following data.

In addition, we have included warranty data from another Indian automaker, Mahindra & Mahindra Ltd. Mahindra & Mahindra is a subsidiary of the larger Mahindra Group, but the auto division of the Indian multinational conglomerate publishes a separate annual report. Mahindra & Mahindra makes cars, SUVs, and three-wheel rickshaws, along with commercial trucks, coach buses, and motorcycles. In addition, Mahindra & Mahindra is a prominent global tractor manufacturer, under the Mahindra Tractors subsidiary.

Tata and Mahindra both use the Japanese convention of using a fiscal year that spans from April 1 to March 31, while Hyundai and Kia use the calendar year as their fiscal year, from January 1 to December 31.

Hyundai and Kia both report their annual expenses in South Korean won (₩), while Tata and Mahindra & Mahindra both report in Indian rupees (₹). We used the IRS Yearly average currency exchange rates table to convert these data into U.S. dollars, to enable us to represent these four manufacturers in the same charts.

We should also note that Tata and Mahindra both report using the Indian numbering systems, which uses lakh and crore. So we first converted these data into Western numbers, and then converted from rupees to USD.

For each of the four automakers, we perused their annual reports, and gathered three key warranty metrics: the amount of claims paid, the amount of accruals made, and the balance of the warranty reserve fund at the end of the fiscal year.

In addition, we gathered data on each manufacturer's total vehicle sales revenue, and total vehicle unit sales, and used these to calculate three additional warranty expense rates: claims as a percentage of vehicle sales (the claims rate), accruals as a percentage of vehicle sales (the accrual rate), and accruals made per vehicle sold (in U.S. dollars).

Warranty Claims Totals

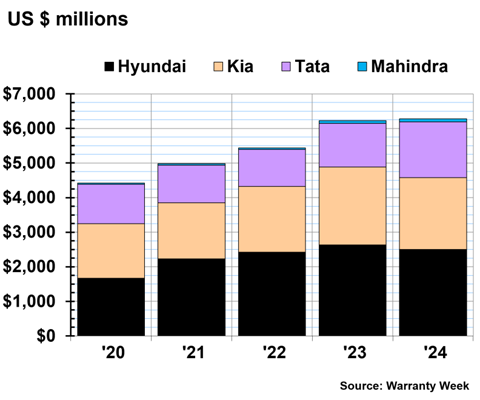

Figure 1 shows the total warranty claims paid by Hyundai, Kia, Tata, and Mahindra, from 2020 to 2024, in U.S. dollars.

Figure 1

Top Korean & Indian Auto Manufacturers

Claims Paid per Year

(in billions of U.S. dollars, 2020-2024)

In 2024, Hyundai paid $2.50 billion in warranty claims, a -5% decrease from 2023. Kia paid $2.08 billion in claims, a -8% decrease.

In 2023, the two South Korean automakers set record highs for the amount they paid in warranty claims in a single fiscal year. 2024 was the first time in four years that Hyundai's total warranty claims costs did not increase, and for Kia, it was the first time in 15 years.

This was largely due to the Theta 2 engine recall, which happened in waves, notably in 2017, 2019, 2020, and 2023. In addition, in 2023, Hyundai recalled 1.6 million vehicles, and Kia recalled 1.7 million vehicles, for an issue with the Anti-Lock Brake System, which could spill brake fluid internally and cause an electrical short, potentially leading to an engine compartment fire, which could occur whether the vehicle is parked and turned off, or while driving. This resulted in the NHTSA issuing a "park outside" recommendation for the vehicles until they were repaired.

According to Consumer Reports, in November 2023, "NHTSA started auditing existing recalls of more than 6.3 million Hyundai and Kia vehicles at risk of fire due to faulty parts in their antilock braking systems." Furthermore, "According to Consumer Reports and the Center for Automotive Safety, over the past 12 years the automakers have sent recall notices for over 10 million cars and SUVs to fix problems that could cause the vehicles to catch fire."

Tata paid $1.61 billion in claims in fiscal 2024, a 27% increase from 2023. And Mahindra paid $88 million in claims, an 11% increase.

Warranty Claims Rates

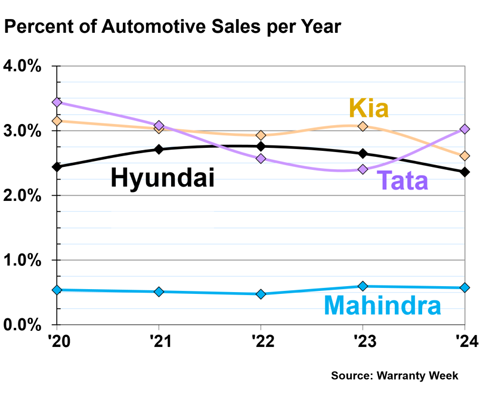

Figure 2 shows each automaker's annual warranty claims rate, from 2020 to 2024.

Figure 2

Top Korean & Indian Auto Manufacturers

Warranty Claims Rates

(as a percentage of sales, 2020-2024)

The claims rate is the percentage of each OEM's vehicle sales revenue they spend on paying warranty claims in a given fiscal year.

Hyundai's claims rate decreased a little bit in 2024, to 2.36%. Kia's claims rate also decreased a bit, to 2.61% in 2024.

On the other hand, Tata's claims rate increased by about one-quarter, up to 3.02% in fiscal 2024.

Mahindra's claims rate decreased very slightly, to 0.57% in fiscal 2024.

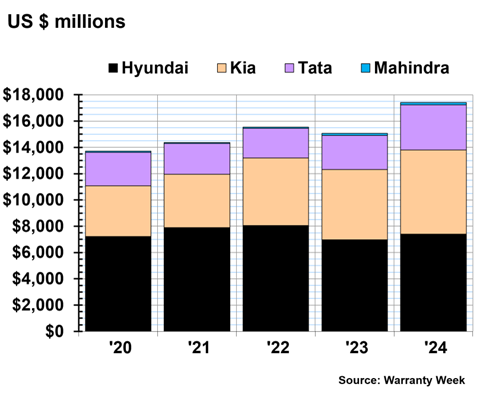

Warranty Accrual Totals

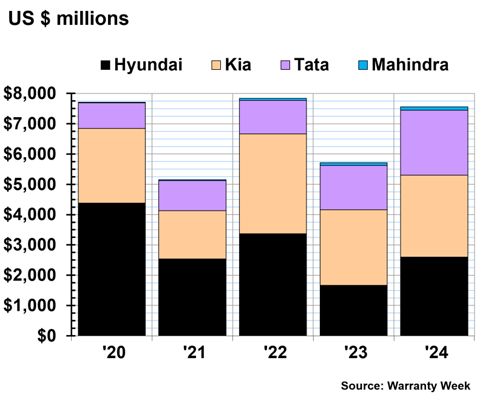

Figure 3 shows the total warranty accruals set aside by the four South Korean and Indian automakers, from 2020 to 2024.

Figure 3

Top Korean & Indian Auto Manufacturers

Accruals Made per Year

(in billions of U.S. dollars, 2020-2024)

All four of the South Korean and Indian automakers increased their total warranty accruals from 2023 to 2024.

In 2024, Hyundai set aside $2.60 billion in warranty accruals, a 56% increase from 2023's total of $1.67 billion.

Kia set aside $2.71 billion in warranty accruals in 2024, an 8% increase from 2023.

Tata set aside $2.15 billion in warranty accruals in fiscal 2024, a 47% increase from fiscal 2023's total of $1.46 billion.

Mahindra set aside $113 million in warranty accruals in fiscal 2024, a 20% increase.

Warranty Accrual Rates

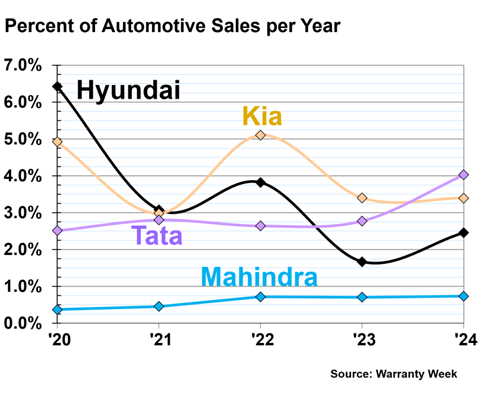

Figure 4 shows the annual warranty accrual rates of the four automakers, from 2020 to 2024.

Figure 4

Top Korean & Indian Auto Manufacturers

Warranty Accrual Rates

(as a percentage of sales, 2020-2024)

In 2024, Hyundai had a warranty accrual rate of 2.46%, an increase from 2023, but still lower the rates from the three earlier years shown in Figure 4.

Kia's accrual rate stayed the same from 2023 to 2024, at 3.40%.

Tata's accrual rate increased to a new high in 2024, at 4.03%.

Mahindra's accrual rate stayed just about the same, at 0.73% in 2024.

Accruals per Vehicle Sold

Each of these automakers conveniently report the total number of vehicles they sell in a year, along with the total amount they set aside in warranty accruals. We used these two figures to calculate the amount of warranty accruals set aside per vehicle sold.

Of course, Tata also makes buses and trucks. Mahindra also makes tractors, rickshaws, motorcycles, trucks, and buses. So we'll refrain from comparing the automakers to each other; however, we can compare each automaker to itself in previous years.

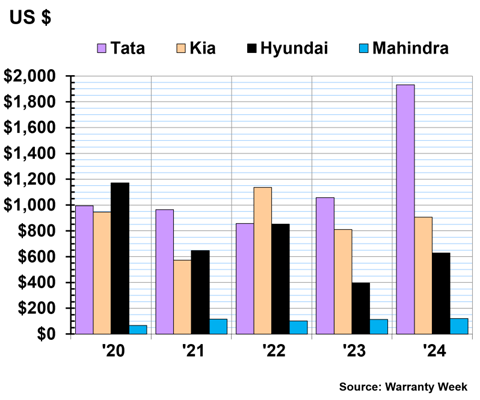

Figure 5 shows the average amount of warranty accruals set aside per vehicle sold by each of the four automakers, from 2020 to 2024.

Figure 5

Top Korean & Indian Auto Manufacturers

Accruals Made per Vehicle Sold

(in U.S. dollars, 2020-2024)

Amazingly, the average amount of warranty accruals set aside by Tata per vehicle sold almost doubled from fiscal 2023 to fiscal 2024. In 2023, Tata set aside an average of $1,057 per vehicle sold, while in 2024, Tata set aside an average of $1,932 in warranty accruals per vehicle sold.

Kia set aside an average of $905 in warranty accruals per vehicle sold in 2024, a 12% increase from 2023.

Hyundai set aside an average of $628 in warranty accruals per vehicle sold in 2024, a 59% increase from 2023.

Mahindra set aside an average of $120 per vehicle sold in fiscal 2024, a 5% increase.

Warranty Reserve Balances

Our final metric is the balance of each automaker's warranty reserve fund at the end of the fiscal year. Figure 5 shows the warranty reserve end-balances, from 2020 to 2024.

Figure 6

Top Korean & Indian Auto Manufacturers

Reserves Held at Year's End

(in billions of U.S. dollars, 2020-2024)

At the end of 2024, Hyundai held $7.41 billion in warranty reserves, a 6% increase from the end of 2023. Kia held $6.40 billion in reserves at the end of 2024, a 20% increase.

Tata held $3.42 billion in warranty reserves at the end of fiscal 2024, a 32% increase from the end of fiscal 2023. And Mahindra held $179 million in warranty reserves at the end of fiscal 2024, a 15% increase.

Check out these newsletters on 2024 international auto warranty expenses:

- "U.S. Auto Warranty Annual Reports"

- "European Automaker Warranty Expenses"

- "Japanese Automaker Warranty Expenses"